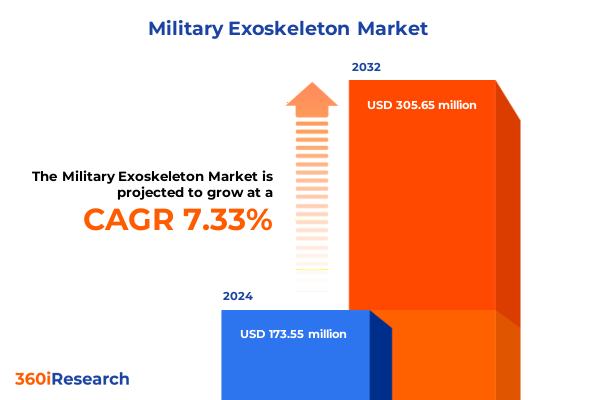

The Military Exoskeleton Market size was estimated at USD 186.06 million in 2025 and expected to reach USD 204.96 million in 2026, at a CAGR of 7.34% to reach USD 305.65 million by 2032.

Setting the Stage for the Military Exoskeleton Revolution with Strategic Insights into Technological Innovation and Operational Synergies

The evolution of military exoskeletons marks a pivotal shift in the way armed forces envision human augmentation on the battlefield. From rudimentary mechanical supports to cutting-edge powered suits, this transformation has been driven by the imperative to enhance soldier endurance, reduce injury, and multiply combat effectiveness. In recent years, accelerated advancements in battery technology, lightweight composites, and artificial intelligence have converged to bring exoskeleton capabilities from experimental prototypes to operational readiness. As a result, defense stakeholders are reassessing traditional mobility paradigms and integrating robotic assistance into mission planning.

This executive summary serves as an authoritative overview of the latest trends, challenges, and strategic considerations shaping the military exoskeleton landscape. It establishes the foundational context by examining generational improvements in ergonomics and power efficiency, while also highlighting the operational synergies that arise from networked systems and predictive analytics. Through this lens, decision-makers will gain clarity on the technological drivers that influence procurement, training, and sustainment. By setting the stage with key definitions and historical milestones, this introduction ensures that readers are equipped to navigate the nuanced insights that follow, from policy impacts to segmentation analysis and regional variations.

Exploring Pivotal Technological and Tactical Shifts Reshaping Military Exoskeleton Development and Deployment in Modern Armed Forces

The military exoskeleton ecosystem is undergoing transformative shifts that extend well beyond incremental improvements in hardware. Today’s systems integrate advanced sensors that continuously monitor biomechanical performance, feeding data into machine learning algorithms that adapt assistance in real time. This convergence of smart materials and cognitive computing has redefined the interface between human and machine, enabling adaptive support that anticipates user intent rather than merely reacting to it.

In parallel, modular architectures are streamlining customization for diverse mission profiles, whether it’s load carriage in mountainous terrain or assisted mobility during medical evacuation. The integration of modular power units and interchangeable joint modules has accelerated the pace of innovation, while open-source software frameworks are fostering collaboration across defense contractors, research institutions, and academic laboratories. Consequently, the landscape is characterized by a dynamic interplay of proprietary advancements and shared development initiatives.

Operational doctrine is also evolving in response to these technological strides. Training programs now incorporate virtual reality simulations that replicate exoskeleton-supported maneuvers, while maintenance protocols are shifting toward predictive maintenance models powered by remote diagnostics. These developments underscore a broader trend: the militarization of robotics is no longer confined to standalone unmanned systems but is increasingly embodied in the very equipment soldiers wear, heralding a new era of human augmentation on the modern battlefield.

Assessing the Far Reaching Effects of 2025 United States Tariffs on Supply Chains Production Dynamics and Strategic Sourcing for Exoskeleton Innovations

The 2025 United States tariffs on imported exoskeleton components have exerted a pronounced influence on supply chains, compelling defense primes and subsystem suppliers to reassess sourcing strategies. By imposing duties on foreign-manufactured actuators, sensor arrays, and advanced textiles, the policy has effectively elevated the cost of key assembly inputs. As a result, manufacturers have faced increased production overhead, necessitating a reevaluation of design-for-cost principles and spurring renewed interest in domestic fabrication capabilities.

In response, several leading technology firms have forged strategic partnerships with U.S.-based manufacturing specialists to localize critical subassembly lines. These alliances not only mitigate tariff exposure but also enhance supply chain resilience by reducing lead times and exposure to geopolitical disruptions. Concurrently, smaller innovators are exploring contract manufacturing options in tariff-exempt regions such as domestic free trade zones, leveraging bonded warehouses to optimize inventory turnover. Despite these adaptive measures, the cumulative cost impact has prompted increased emphasis on component standardization and volume purchase agreements.

Beyond direct procurement implications, the tariff environment has influenced research and development trajectories. Companies are redirecting R&D budgets toward alternative actuator technologies and novel materials that bypass tariff classifications, such as bio-inspired elastomers and magnetorheological fluids. This shift underscores a longer-term strategic calculus: balancing near-term cost pressures against the imperative to maintain technological leadership and ensure uninterrupted support for deployed forces.

Revealing Critical Wear Type Technology Type and Application Based Segmentation Insights Driving Differentiation across Military Exoskeleton Market Segments

A nuanced understanding of military exoskeleton market segmentation reveals how design, functionality, and end use converge to shape competitive positioning. When examining wear type, Lower Limb systems that provide targeted support at the ankle, hip, and knee joints are identifying unique performance and ergonomic trade-offs compared to Upper Limb assemblies focused on elbow, shoulder, and wrist assistance. Lower Limb exoskeletons optimized for load carriage in dismounted operations emphasize torque augmentation at the hip and knee, while Upper Limb devices tailored for precision tasks concentrate on reducing fatigue in shoulder and elbow articulation.

Turning to technology type, the dichotomy between active and passive exoskeletons defines divergent engineering pathways and user experiences. Active systems deploy either rigid actuators or soft robotic muscles to actively propel movement, demanding onboard power supplies and sophisticated control algorithms. In contrast, passive solutions rely on rigid springs or soft composite elements to store and release energy, offering a lower-maintenance and energy-agnostic approach. Within each category, material selection and actuation mechanism introduce further variability, influencing factors such as durability, weight distribution, and tactile responsiveness.

Application-based segmentation underscores the multifaceted roles of exoskeletons across load augmentation, medical rehabilitation, and performance enhancement contexts. Load augmentation platforms emphasize endurance and strength enhancement to enable sustained operations under heavy protective gear. In the medical rehabilitation domain, full body, lower limb, and upper limb rehabilitation suits integrate data analytics and telehealth connectivity to support injury recovery workflows. Performance enhancement systems focused on endurance and strength enhancement appeal not only to special operations forces but also to logistic and expeditionary units seeking to elevate operational tempo.

This comprehensive research report categorizes the Military Exoskeleton market into clearly defined segments, providing a detailed analysis of emerging trends and precise revenue forecasts to support strategic decision-making.

- Wear Type

- Technology Type

- Application

Uncovering Regional Variations in Exoskeleton Adoption Procurement Strategies and Operational Integration across Americas EMEA and Asia Pacific Theaters

Regional analysis illuminates how procurement frameworks, regulatory environments, and combat doctrines shape exoskeleton adoption across the Americas, Europe Middle East & Africa, and Asia Pacific theaters. In the Americas, the United States department of defense has accelerated investment in powered exoskeleton prototypes through major defense acquisition programs. This initiative has catalyzed domestic industrial growth and nurtured a vibrant ecosystem of primes, subcontractors, and academic partners focused on performance, reliability, and sustainment.

Meanwhile, the Europe Middle East & Africa region demonstrates a mosaic of adoption strategies driven by both national armies and multinational defense alliances. European Union member states often coordinate joint R&D initiatives under cooperative procurement frameworks to share development costs and align capability requirements. In the Middle East, sovereign wealth-backed defense budgets are enabling rapid procurement cycles for turnkey exoskeleton systems, whereas several African militaries remain in the evaluation phase, constrained by budgetary limitations and infrastructure challenges.

In the Asia Pacific region, rapid modernization efforts by major powers are underpinning aggressive exoskeleton development and domestic production. Strategic partnerships between local technology firms and established global manufacturers are driving knowledge transfer, and several countries are prioritizing soft exoskeleton variants to support humanitarian assistance and disaster relief operations. Across all theaters, regional priorities and budgetary cycles continue to dictate the pace of fielding exoskeleton capabilities in live deployments.

This comprehensive research report examines key regions that drive the evolution of the Military Exoskeleton market, offering deep insights into regional trends, growth factors, and industry developments that are influencing market performance.

- Americas

- Europe, Middle East & Africa

- Asia-Pacific

Highlighting Leading Organizations Driving Innovation Partnerships and Commercialization in Military Exoskeleton Technology across Global Defense Supply Chains

Leading defense and technology organizations are charting the course for next-generation military exoskeletons through a blend of internal research programs, strategic collaborations, and selective acquisitions. Some established primes leverage decades of experience in armored vehicle power systems to adapt hydraulic and electric drive units for wearable platforms, while smaller specialist firms focus on niche subsystems such as haptic feedback controls or adaptive joint modules. Collaboration between major defense contractors and university research labs has produced breakthroughs in human-machine interfaces, translating neuromuscular signals into precision movement commands.

Commercialization pathways vary across companies, with some adopting direct government contracting models and others pursuing dual-use strategies that tap into commercial rehabilitation and industrial markets. Cross-sector partnerships are particularly influential, as civilian wearable robotics research in sectors like medical rehabilitation and logistics informs defense applications. These alliances facilitate shared prototyping facilities and testing ranges, accelerating iterative design cycles and enhancing interoperability.

Competitive differentiation also emerges through intellectual property portfolios and standardization initiatives. Firms that secure patents for lightweight composite structures or closed-loop control algorithms gain a distinct edge, while participation in emerging exoskeleton interoperability standards helps ensure compatibility with existing soldier systems. Together, these approaches reflect a strategic mosaic in which technology leadership, supply chain integration, and collaborative networks define the competitive landscape.

This comprehensive research report delivers an in-depth overview of the principal market players in the Military Exoskeleton market, evaluating their market share, strategic initiatives, and competitive positioning to illuminate the factors shaping the competitive landscape.

- BAE Systems plc

- CYBERDYNE, Inc.

- Ekso Bionics Holdings, Inc.

- German Bionic Systems GmbH

- Hyundai Rotem Company Limited

- Israel Aerospace Industries Ltd.

- Lockheed Martin Corporation

- Northrop Grumman Corporation

- Panasonic Holdings Corporation

- Raytheon Technologies Corporation

- ReWalk Robotics Ltd.

- Rheinmetall AG

- Sarcos Technology and Robotics Corporation

- Thales S.A.

- Yaskawa Electric Corporation

Empowering Industry Stakeholders with Practical Strategies to Enhance Scalability Responsiveness and Interoperability within the Military Exoskeleton Ecosystem

Industry leaders can capitalize on current market dynamics by implementing targeted strategies that elevate system performance, streamline procurement, and foster innovation ecosystems. Companies should focus on enhancing interoperability among wearable robotics, communications systems, and soldier health monitoring platforms to deliver cohesive operational solutions. By prioritizing open architecture designs, stakeholders can facilitate third-party integration and reduce time to field, ultimately driving faster adoption in tactical units.

In parallel, diversifying supply chains through a blend of domestic production hubs and international free trade zones will mitigate tariff volatility and geopolitical risks. Establishing flexible manufacturing agreements with multiple suppliers of actuators, sensors, and advanced textiles ensures that production disruptions can be rapidly addressed. Concurrently, investing in workforce training programs for maintenance technicians and system integrators will bolster sustainment capabilities, reducing lifecycle costs and minimizing downtime in deployed environments.

To maintain a pipeline of breakthrough technologies, defense primes and innovators must deepen partnerships with academic institutions and start-up incubators. Structured accelerators and sponsored research agreements enable small-scale experimentation with novel materials and control paradigms, while phased pilot programs allow for rapid concept validation under real-world conditions. By combining strategic procurement with collaborative R&D, industry leaders can position themselves to respond swiftly to evolving mission requirements and secure long-term competitive advantage.

Outlining Robust Qualitative and Quantitative Research Methodology That Ensures Integrity Validity and Actionable Market Insights for Exoskeleton Developments

Our research methodology combines comprehensive analysis of secondary publications with an extensive program of primary data collection to ensure robust and actionable findings. We conducted a systematic review of defense white papers, patent filings, technical journals, and open source intelligence to map the technological trajectory of exoskeleton systems. These insights were supplemented by a targeted series of expert interviews, encompassing defense acquisition officers, systems engineers, and field operators, to validate technical assumptions and capture real-world operational considerations.

Quantitative assessments were grounded in supplier benchmarking exercises and cost modeling of key subsystems, while qualitative themes emerged through scenario planning workshops and usability trials. These activities provided granular understanding of performance benchmarks, integration challenges, and sustainment conditions across diverse operational contexts. Stress testing of competing powertrain configurations and iterative human factors evaluations informed our segmentation and competitive landscape analysis.

Throughout the project, stringent quality controls were applied to ensure data integrity and analytical rigor. All findings underwent cross-validation through triangulation with independent third-party scenarios, and our advisory board of subject matter experts reviewed draft insights to confirm objectivity and relevance. This disciplined approach guarantees that stakeholders can confidently leverage our conclusions to inform strategic planning, procurement decisions, and technology roadmaps.

This section provides a structured overview of the report, outlining key chapters and topics covered for easy reference in our Military Exoskeleton market comprehensive research report.

- Preface

- Research Methodology

- Executive Summary

- Market Overview

- Market Insights

- Cumulative Impact of United States Tariffs 2025

- Cumulative Impact of Artificial Intelligence 2025

- Military Exoskeleton Market, by Wear Type

- Military Exoskeleton Market, by Technology Type

- Military Exoskeleton Market, by Application

- Military Exoskeleton Market, by Region

- Military Exoskeleton Market, by Group

- Military Exoskeleton Market, by Country

- United States Military Exoskeleton Market

- China Military Exoskeleton Market

- Competitive Landscape

- List of Figures [Total: 15]

- List of Tables [Total: 1590 ]

Summarizing Key Insights and Strategic Imperatives Shaping the Future of Military Exoskeleton Adoption and Technological Evolution in Defense Operations

This analysis has illuminated the confluence of technological innovation, policy drivers, and strategic imperatives shaping the military exoskeleton domain. From the integration of smart sensor arrays and adaptive control systems to the ripple effects of 2025 tariff policies, defense stakeholders are navigating an increasingly complex ecosystem. Segmentation insights reveal that distinctions in wear type, actuation mechanisms, and application end-uses will continue to define competitive differentiation and procurement priorities.

Regional variations further underscore the importance of tailoring acquisition strategies to local fiscal environments and combat doctrines, whether in the Americas, EMEA, or Asia Pacific theaters. Meanwhile, leading organizations are forging partnerships and advancing intellectual property portfolios to secure cleaner, more efficient, and more interoperable exoskeleton solutions. By aligning R&D investments with pragmatic supply chain diversification and workforce training initiatives, industry leaders can accelerate adoption and ensure sustained operational readiness.

Moving forward, the imperative for cohesive frameworks that integrate exoskeletons into broader soldier systems will only intensify. As military forces worldwide seek to enhance soldier performance, reduce attrition, and optimize mission outcomes, exoskeletons will transition from experimental prototypes to indispensable assets. This report serves as a strategic compass, guiding decision-makers through the evolving terrain and equipping them to harness the full promise of human augmentation technologies.

Engage with Ketan Rohom to Access Exclusive Military Exoskeleton Market Intelligence and Propel Your Strategic Initiatives toward Operational Excellence

To gain immediate access to the full depth of market intelligence on military exoskeleton developments and to chart a path toward operational excellence, engage with Ketan Rohom, Associate Director of Sales & Marketing. His expertise in translating complex research into actionable strategies ensures that your team will benefit from the latest insights on technological innovations, supply chain dynamics, and regulatory trends. By partnering with Ketan, you will secure a customized briefing that aligns with your strategic priorities, unlock priority access to analyst support, and position your organization at the forefront of exoskeleton adoption. Reach out today to transform uncertainty into opportunity and to secure the comprehensive report that will power your next phase of growth

- How big is the Military Exoskeleton Market?

- What is the Military Exoskeleton Market growth?

- When do I get the report?

- In what format does this report get delivered to me?

- How long has 360iResearch been around?

- What if I have a question about your reports?

- Can I share this report with my team?

- Can I use your research in my presentation?