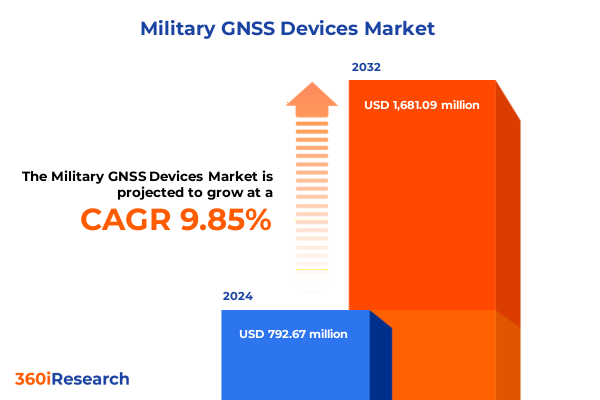

The Military GNSS Devices Market size was estimated at USD 865.04 million in 2025 and expected to reach USD 945.92 million in 2026, at a CAGR of 9.95% to reach USD 1,681.09 million by 2032.

Exploring the Evolving Strategic Value and Operational Capabilities of Military GNSS Devices in the Face of Emerging Electronic Warfare Threats and Innovation

Military GNSS devices have become indispensable tools that underpin the precision and reliability of modern defense operations worldwide. From advanced warfighter equipment to strategic weapon systems, these components ensure accurate positioning, navigation, and timing (PNT) in environments where electromagnetic threats and adversarial interference are constantly evolving. As anti-jamming and anti-spoofing tactics become more sophisticated, defense organizations are prioritizing resilient GNSS architectures that support mission-critical decision-making and real-time situational awareness. Building on the lessons of recent conflicts, military planners recognize that uninterrupted access to authenticated GNSS signals can mean the difference between operational success and critical failure.

This executive summary provides a structured overview of the transformative forces shaping the military GNSS device market. It outlines how technology innovations, trade policies, and geopolitical dynamics intersect with product, platform, and application segments to influence procurement and R&D strategies. By synthesizing industry trends, regional dynamics, and competitive landscapes, this introduction establishes the context for in-depth discussions on market segmentation, tariff impacts, and best practices. Decision-makers will gain a foundational understanding of the key drivers and risks that define the current PNT environment, setting the stage for actionable recommendations and strategic planning.

Charting the Paradigm Shifts Driving Military GNSS Landscape Through Advanced PNT Architectures, Multi-GNSS Integration, and Resilient Anti-Jamming Technologies

Over the past two years, the military GNSS landscape has undergone a paradigm shift fueled by the increasing sophistication of electronic warfare tactics. Adversaries have deployed high-power jammers and precision spoofing platforms in conflict zones, prompting defense agencies to accelerate efforts to harden PNT capabilities. In response, leading manufacturers and research institutions have introduced adaptive antennas, multi-frequency receivers, and software-defined architectures designed to detect and mitigate jamming signals in real time. Experts underscore the importance of layered PNT systems that incorporate fiber-optic timing networks, ground-based backups like eLoran, and alternate satellite constellations to ensure continuity when GPS signals are contested.

Simultaneously, the adoption of M-code user equipment has gained momentum within the U.S. Army’s Military GPS User Equipment (MGUE) program. Flight tests on manned and unmanned platforms have validated Increment 1 variants for battlefield deployment, with certification expected in July 2025. The forthcoming Increment 2 design will blend signals from multiple GNSS constellations-GPS, Galileo, BeiDou, and QZSS-to enhance resilience and reduce single-system dependencies, marking a decisive move toward true multi-GNSS integration.

In parallel, artificial intelligence and machine learning are being woven into receiver firmware, enabling dynamic threat detection and automated waveform adaptation. Pilot projects exploring quantum sensors and magnetic navigation aim to provide non-satellite PNT alternatives for high-value assets, laying the groundwork for a future where GNSS sits within a network of redundant, interoperable PNT sources. This multi-pronged innovation agenda illustrates a broad consensus: military operations of tomorrow will rely on heterogenous architectures that marry advanced signal processing with diversified PNT infrastructures.

Assessing How 2025 U.S. Tariff Measures on Defense Electronics are Reconfiguring Military GNSS Device Supply Chains and Cost Structures

In 2025, the U.S. government’s tariff regime has introduced new cost dynamics for defense electronics, directly impacting the production and procurement of military GNSS devices. A 10–15% import duty on advanced electronics-including microchips, RF front ends, and precision guidance components-has elevated manufacturing costs across the GNSS value chain. Defense contractors face mounting pressure to reassess sourcing strategies, as tariffs on Chinese and select European materials inflate prices for antennas, receivers, and signal-processing modules.

Beyond direct cost inflation, these tariffs have contributed to delayed deliveries and extended project timelines. Manufacturers encountering higher tariff surcharges have been forced to renegotiate supplier agreements or relocate assembly lines to non-tariffed jurisdictions. In some cases, major defense primes have publicly acknowledged margin compression linked to these policies, with one leading contractor projecting an $850 million profit reduction in 2025 due to increased supply chain expenses and trade tensions.

While the immediate financial impact has been mitigated for sovereign-funded defense programs, the indirect effects are evident in tighter budget allocations for R&D and modernization. Programs leveraging cost-shared R&D with commercial partners report heightened uncertainty in capital planning, prompting a strategic pivot toward modular, software-centric solutions that can be updated in the field without replacement of full hardware assemblies. Looking ahead, tariff-induced volatility is spurring stakeholders to invest in regional manufacturing hubs and dual-sourcing arrangements to buffer against future trade disruptions.

Revealing Key Segmentation Insights by Product, Platform, and Application to Illuminate the Nuances of the Military GNSS Device Market

The military GNSS device market spans a diverse range of products, beginning with core components such as antennas, where active elements with built-in amplifiers cater to long-range reconnaissance needs while passive variants offer rugged, low-power solutions for dismounted forces. Receivers form the analytical heart of these systems, split between active designs that directly process encrypted M-code signals and passive units optimized for cost-sensitive applications. Complementing these are synchronized clocks that maintain temporal precision across distributed networks, data links that enable real-time PNT dissemination, and simulation platforms that replicate contested electromagnetic environments for training and system validation.

On the battlefield platform spectrum, airborne applications encompass both manned aircraft and a rising fleet of unmanned aerial vehicles, each demanding SWaP-optimized GNSS modules with hardened anti-jamming capabilities. Handheld units equip individual soldiers with authenticated PNT data, while maritime installations integrate GNSS antennas into ships and submarines for secure navigation. Vehicle-mounted systems extend precision PNT to ground convoys and armored platforms, anchoring networked operations with continuous time and location stamps.

Application requirements further refine the landscape. High-accuracy mapping solutions leverage differential corrections and real-time kinematic updates to support topographical surveys and infrastructure planning. Strategic navigation systems prioritize clandestine, high-integrity positioning for long-range strike and aerial refueling, whereas tactical navigation devices emphasize rapid reacquisition and spoof-resistant tracking in proximity to adversarial jamming sources. In the targeting domain, sub-meter GNSS precision underpins guided munitions and sensor-to-shooter links, driving demand for receivers with integrated anti-spoof authentication.

This comprehensive research report categorizes the Military GNSS Devices market into clearly defined segments, providing a detailed analysis of emerging trends and precise revenue forecasts to support strategic decision-making.

- Product

- Platform

- Application

Unpacking Regional Dynamics Impacting Military GNSS Device Adoption Across the Americas, Europe Middle East and Africa, and Asia-Pacific Markets

In the Americas, defense procurement is heavily influenced by domestic content thresholds and incentives to localize manufacturing. U.S. and Canadian armed forces are investing in bolstering onshore production of antennas, receiver modules, and control electronics, aiming to reduce exposure to foreign tariffs and secure sovereign PNT supply chains. Collaborative R&D programs between government labs and industry have accelerated development of field-upgradeable architectures that can adapt to evolving electronic warfare tactics.

Across Europe, the Middle East and Africa, alliances and regional security agreements drive multilateral PNT initiatives. NATO’s PNT task groups and joint eLoran pilot programs reflect a shared desire to augment satellite GNSS with terrestrial backups, ensuring continuity during GPS outages. Gulf Cooperation Council nations are likewise incorporating multi-constellation receivers into naval and air defense platforms, often integrating European Galileo authentication to diversify their reliance beyond a single satellite network.

In Asia-Pacific, rapid military modernization programs in Japan, Australia, India and South Korea are propelling the deployment of advanced GNSS technologies. Japan’s expansion of its QZSS quasi-zenith constellation signifies a move toward national PNT autonomy, while allied efforts under the U.S. Space Force’s bilateral hosted payload initiatives are fostering interoperable satellite architectures. Regional defense planners prioritize multi-GNSS anti-spoof solutions and seek to co-develop resilient receivers that can operate seamlessly across multiple frequency bands, anticipating future spectrum contestation in contested maritime corridors.

This comprehensive research report examines key regions that drive the evolution of the Military GNSS Devices market, offering deep insights into regional trends, growth factors, and industry developments that are influencing market performance.

- Americas

- Europe, Middle East & Africa

- Asia-Pacific

Profiling Pioneering Industry Players Shaping Military GNSS Device Innovation and Competitive Positioning on the Global Stage

Industry leaders have responded to the escalating demands for resilient GNSS devices by differentiating their technology portfolios and forging strategic partnerships. BAE Systems launched its NavStorm-M gun-hardened anti-jamming receiver in June 2024, combining beamforming and software assurance to protect artillery and unmanned systems from sophisticated interference. L3Harris Technologies introduced its Anti-jam Resilient Radio Objective Waveform (ARROW) in March 2024, delivering secure Position-Location Information for coalition operations without relying solely on GPS satellites. RTX’s Landshield system marked its 1,000th unit sold to the UK Ministry of Defence in mid-2023, underscoring its market leadership in compact, lightweight anti-jamming solutions. NovAtel further supports armored vehicle fleets with its GPS Anti-Jam Technology antennas, enhancing CEMA resilience for the Canadian Army’s armoured combat support vehicles since May 2023.

Meanwhile, Thales is expanding its engineering footprint in India to accelerate development of next-generation GNSS receivers, and independent firms such as Septentrio and Swarm Technologies are leveraging modular software-defined platforms to introduce rapid feature updates. This competitive tapestry reflects a broader shift toward partnerships that bridge prime contractors, start-ups, and sovereign research entities, ensuring that military GNSS portfolios remain agile, interoperable, and prepared for emergent PNT threats.

This comprehensive research report delivers an in-depth overview of the principal market players in the Military GNSS Devices market, evaluating their market share, strategic initiatives, and competitive positioning to illuminate the factors shaping the competitive landscape.

- Accord Software & Systems Pvt Ltd.

- Avidyne Corporation

- BAE Systems plc

- Elbit Systems Ltd.

- General Dynamics Mission Systems, Inc.

- Gladiator Technologies

- Hertz Systems Ltd Sp. z o.o.

- Hexagon AB

- Honeywell Aerospace Technologies

- JAVAD GNSS Inc.

- Juniper Systems Inc.

- L3Harris Technologies, Inc.

- Leonardo DRS

- Lockheed Martin Corporation

- LOCOSYS Technology Inc.

- Northrop Grumman Corporation

- RTX Corporation

- Safran Group

- Seiko Epson Corporation

- Septentrio N.V.

- Thales Group

- Topcon Positioning Systems Inc.

- Trimble Inc.

- Trimble Navigation Ltd

- V3 Novus

Actionable Strategies for Defense Industry Leaders to Navigate Technological Disruption, Supply Chain Risks, and Competitive Pressures in GNSS Markets

Defense industry leaders should prioritize dual-sourcing of critical components alongside investments in local manufacturing capabilities to mitigate the impact of tariff volatility and supply chain disruptions. By qualifying alternative suppliers in allied regions, organizations can maintain production continuity and leverage cost advantages while ensuring compliance with sovereign content requirements.

Innovation roadmaps must emphasize modular, software-centric GNSS architectures that allow for in-field updates of anti-jamming and authentication algorithms without full hardware replacement. Engaging in co-development agreements with prime contractors and leveraging open architecture standards will accelerate integration of AI-driven threat detection and adaptive signal processing into next-generation receivers.

Strategic collaboration with defense alliances and industry consortia will enable pooled investment in complementary PNT technologies such as eLoran, terrestrial timing networks, and low Earth orbit augmentation payloads. By participating in these multilateral efforts, companies can influence interoperability standards and ensure their devices meet coalition requirements, opening new export opportunities while strengthening collective resilience.

Outlining a Rigorous Mixed Methodology Integrating Primary Interviews, Secondary Data and Quantitative Analysis to Ensure Robust Market Insights

This research leverages a mixed-methodology framework, combining primary interviews with defense procurement officers, system integrators, and technology OEMs, alongside secondary analysis of government policy documents, patent filings, and industry publications. Quantitative data was triangulated from customs databases, tariff schedules, and financial disclosures to assess the economic impact of 2025 trade policy shifts on device manufacturing costs.

Product, platform, and application segmentation was informed by cross-referencing technical specifications with procurement contract awards and field deployment records. Regional insights were validated through collaboration with international security think tanks and PNT working groups. The methodological rigor of this study ensures that conclusions rest on robust, multi-source evidence rather than single-channel market estimates.

This section provides a structured overview of the report, outlining key chapters and topics covered for easy reference in our Military GNSS Devices market comprehensive research report.

- Preface

- Research Methodology

- Executive Summary

- Market Overview

- Market Insights

- Cumulative Impact of United States Tariffs 2025

- Cumulative Impact of Artificial Intelligence 2025

- Military GNSS Devices Market, by Product

- Military GNSS Devices Market, by Platform

- Military GNSS Devices Market, by Application

- Military GNSS Devices Market, by Region

- Military GNSS Devices Market, by Group

- Military GNSS Devices Market, by Country

- United States Military GNSS Devices Market

- China Military GNSS Devices Market

- Competitive Landscape

- List of Figures [Total: 15]

- List of Tables [Total: 1272 ]

Synthesizing Core Findings and Strategic Implications to Guide Decision-Makers in the Evolving Military GNSS Device Landscape

The military GNSS device market is undergoing rapid transformation driven by escalating electronic warfare threats, tariff-induced supply chain pressures, and the strategic imperative for multi-layered PNT resilience. Technological innovations-ranging from software-defined receivers and AI-driven anti-jamming algorithms to expanding multi-GNSS constellations-are reshaping product roadmaps and procurement priorities alike.

Regional procurement dynamics underscore the need for localized manufacturing and cooperative PNT initiatives, while leading companies are capitalizing on modular design and interoperability standards to secure defense contracts worldwide. Looking forward, organizations that blend strategic sourcing, agile development processes, and active involvement in multilateral PNT collaborations will be best positioned to maintain operational superiority in contested electromagnetic environments. These findings provide a blueprint for defense stakeholders seeking to navigate the complexities of the evolving military GNSS device landscape.

Engage Directly with Ketan Rohom to Acquire Strategic Market Intelligence and Secure Your Competitive Edge in Military GNSS Devices

Are you ready to secure unparalleled insights into the rapidly evolving military GNSS device market and equip your organization with strategic foresight? Ketan Rohom, Associate Director of Sales & Marketing, stands ready to guide you through our comprehensive market research report. Reach out today to unlock tailored data, deep-dive analyses, and exclusive advisory services that will empower your decision-making. Your path to actionable intelligence and competitive advantage in the military PNT landscape begins with a single conversation.

- How big is the Military GNSS Devices Market?

- What is the Military GNSS Devices Market growth?

- When do I get the report?

- In what format does this report get delivered to me?

- How long has 360iResearch been around?

- What if I have a question about your reports?

- Can I share this report with my team?

- Can I use your research in my presentation?