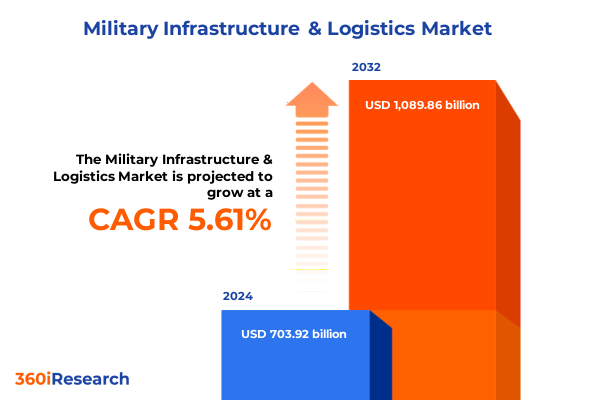

The Military Infrastructure & Logistics Market size was estimated at USD 742.78 billion in 2025 and expected to reach USD 783.80 billion in 2026, at a CAGR of 6.96% to reach USD 1,189.86 billion by 2032.

Laying the Groundwork for Understanding Military Infrastructure and Logistics Dynamics in an Era of Geopolitical Tensions and Technological Evolution

In today’s complex security environment, the backbone of operational readiness lies in robust military infrastructure and logistics capabilities that seamlessly integrate physical assets, technological platforms, and strategic processes. As global defense priorities shift in response to emerging threats and geopolitical realignments, decision-makers require a clear framework to comprehend how supply chain dynamics, facility requirements, and transportation networks coalesce to underpin mission success. This report initiates its narrative by illuminating the multifaceted dimensions of defense logistics, establishing the groundwork for a deeper exploration of the forces reshaping the landscape.

By providing an analytical scaffold, the introductory overview clarifies the interplay between hard infrastructure-such as bases, depots, and transport hubs-and soft capabilities, including digital planning tools, predictive analytics, and collaborative supply chain ecosystems. Through this foundational lens, readers will gain insight into the strategic levers that influence readiness, responsiveness, and resilience. With rising demands for rapid deployment and sustained support, understanding these critical interconnections forms the essential first step toward leveraging cutting-edge innovations and policy developments to bolster global defense logistics.

Exploring the Pivotal Transformative Shifts Reshaping Military Infrastructure and Logistics through Emerging Technologies and Strategic Realignments

The defense logistics landscape is currently undergoing a seismic transformation driven by next-generation technologies and shifting strategic doctrines. Autonomous systems and unmanned platforms are redefining traditional freight forwarding protocols, reducing the reliance on human operators in contested zones. In parallel, digital twins and advanced simulation models enable planners to conduct high-fidelity scenario analyses, pinpointing vulnerabilities in material handling and distribution networks before systems are fielded.

Moreover, new strategic alignments among allied nations have elevated the importance of interoperable infrastructure. Joint logistics hubs are emerging as focal points for multinational exercises, signifying a departure from siloed national supply chains toward integrated frameworks. In addition, blockchain-enabled tracking and IoT-based sensor networks are enhancing transparency across sea, air, rail, and road modes, ensuring end-to-end visibility even in austere environments. These transformative shifts are collectively redefining how militaries organize, deploy, and sustain critical assets.

Assessing the Cumulative Impact of United States Tariffs in 2025 on Military Infrastructure Supply Chains and Operational Readiness

Throughout 2025, a series of tariff adjustments by the United States government have exerted considerable pressure on the global defense logistics supply chain, particularly in areas with a high concentration of cross-border freight activity. As steel and aluminum levies rose, material handling equipment manufacturers experienced increased input costs, prompting some to shift production closer to demand epicenters. Concurrently, higher duties on electronic components have complicated the procurement timeline for advanced sensor arrays and communication modules critical to unmanned aerial systems that support logistical operations.

These elevated trade barriers have had a cascading effect on warehouse operations and transportation service providers. As import costs climb, private contractors and defense agencies have been compelled to revisit inventory management strategies, emphasizing just-in-time replenishment models to mitigate holding costs. Furthermore, the acceleration of regionalization initiatives in Europe, the Americas, and Asia-Pacific reflects a strategic pivot toward supply chain resilience, as stakeholders seek to circumvent tariff-induced volatility. Consequently, tariff policy dynamics in 2025 have become a defining factor in operational planning and strategic procurement for military infrastructure and logistics professionals worldwide.

Unveiling Critical Segmentation Insights Illuminating Diverse Service Types Transportation Modes End Users and Application Use Cases in Defense Logistics

Delving into market segmentation reveals nuanced insights across service type, transportation mode, end user, application, and deployment typologies. By service type, the interplay between freight forwarding, inventory management, material handling, packaging and distribution, transportation, and warehousing underscores how each domain demands tailored technological and process innovations. Within transportation, variations among air, rail, road, and sea operations highlight distinct cost structures and risk profiles, while the differentiation of warehousing into cold, dry, and secure storage demonstrates how environmental control and security protocols shape facility design.

Transportation mode segmentation further underscores the expanding importance of aerial logistics, particularly through cargo airlines, specialized military airlift operators, and emerging unmanned aerial systems. These capabilities are complemented by multimodal connectors that synchronize rail, road, and sea movements to address geographical and infrastructural constraints. End users present an equally complex matrix, where the Air Force, Army, defense agencies, marines, navy, and private contractors each impose unique procedural and technical requirements, with the Army’s combat and support units necessitating divergent logistical footprints. When examined through an application lens-encompassing ammunition logistics, equipment transport, fuel transportation, medical logistics, personnel movement, and supply distribution-the contrast between heavy and light equipment handling further illuminates investment priorities and risk mitigation strategies. Finally, deployment type segmentation across cross-border, offshore, and onshore scenarios, including base-to-base and base-to-field transits, sheds light on the operational planning frameworks that ensure mission continuity regardless of terrain or jurisdiction.

This comprehensive research report categorizes the Military Infrastructure & Logistics market into clearly defined segments, providing a detailed analysis of emerging trends and precise revenue forecasts to support strategic decision-making.

- Service Type

- Transportation Mode

- Deployment Type

- Application

- End User

Forging Ahead with Regional Insights Highlighting Strategic Imperatives across Americas Europe Middle East Africa and Asia Pacific Theaters

Regional considerations play a pivotal role in shaping military infrastructure and logistics strategies, reflecting the confluence of geopolitical risk, regulatory environments, and evolving alliance structures. In the Americas, defense planners are grappling with the dual imperatives of modernizing deep-water port facilities to support naval deployments and upgrading continental rail and road corridors to accommodate high-mobility armored units. Collaborative frameworks among North American partners have fostered integrated supply hubs, enabling rapid cross-border reinforcement during multinational exercises and contingency operations.

Across Europe, the Middle East, and Africa, strategic imperatives diverge from port-centric supply chain models to include expeditionary base constructs and forward arming and refueling points. The region’s dynamic security landscape demands versatile logistics platforms, from cold storage depots for precision munitions to secure storage vaults for critical components. Meanwhile, in the Asia-Pacific theater, the emphasis on sea-lift capacity and maritime prepositioning agreements underscores the importance of interoperable seaports and allied staging bases. Here, complex archipelagic geographies and extended lines of communication require innovative multimodal integration, balancing cost efficiency with the imperative of readiness in contested maritime domains.

This comprehensive research report examines key regions that drive the evolution of the Military Infrastructure & Logistics market, offering deep insights into regional trends, growth factors, and industry developments that are influencing market performance.

- Americas

- Europe, Middle East & Africa

- Asia-Pacific

Examining Key Company Strategies and Collaborations Shaping the Competitive Landscape of Military Infrastructure and Logistics Providers

Leading providers in the military infrastructure and logistics sector are pursuing diverse strategies to strengthen their competitive positions through strategic alliances, technology partnerships, and comprehensive service offerings. Major global logistics integrators have expanded their portfolios by embedding predictive analytics and AI-driven planning tools into existing transportation networks, enhancing transparency and responsiveness. Concurrently, specialized contractors are differentiating themselves through niche capabilities such as rapid-deployment warehousing solutions, tactical port operations, and secure vaulting for high-value military-grade materials.

Collaborative ventures between defense agencies and commercial firms have also introduced co-development programs for unmanned logistics platforms, merging aerospace expertise with supply chain management proficiency. As industry incumbents integrate blockchain-based traceability systems, joint consortiums are emerging to establish standardized data-sharing protocols across allied supply chains. Moreover, innovation centers backed by key stakeholders are accelerating the validation of additive manufacturing facilities at forward operating bases, addressing the demand for on-site component fabrication and reducing lead times for critical repair parts. These concerted efforts reflect a competitive landscape that prizes agility, technological convergence, and a holistic approach to end-to-end logistics.

This comprehensive research report delivers an in-depth overview of the principal market players in the Military Infrastructure & Logistics market, evaluating their market share, strategic initiatives, and competitive positioning to illuminate the factors shaping the competitive landscape.

- AAR Corp.

- Alaska Structures of AKS Industries, Inc.

- Big Top Manufacturing

- Burns & McDonnell

- Claxton Logistics Services, LLC

- Fluor Corporation

- General Dynamics

- Gillard Shelters

- HDT Global

- HTS TENTIQ GmbH

- IRD Engineering

- KBR Inc.

- Kratos Defense & Security Solutions, Inc.

- ManTech International Corporation

- Marshall Land Systems Ltd.

- MSS Defence

- Munters

- Nokia Corporation

- Nordic Shelter

- One Network Enterprises

- Samsung Electronics Co., Ltd.

- Thales Group

- The Lockheed Martin Corporation

- Utilis S.A.S.

- Weatherhaven

Driving Operational Excellence with Actionable Recommendations for Industry Leaders to Navigate Complex Military Infrastructure Logistics Challenges

Industry leaders seeking to elevate their logistical capabilities must prioritize strategic investments in digital infrastructure and workforce upskilling. Establishing integrated command-and-control overlays that aggregate data from material handling systems, transportation vehicles, and warehousing nodes will yield actionable insights for predictive maintenance and route optimization. Furthermore, fostering partnerships with technology innovators-especially those specializing in artificial intelligence, robotics, and advanced materials-can catalyze the deployment of autonomous handling equipment and modular facility designs.

In parallel, organizations should undertake comprehensive supply chain risk assessments to identify single points of failure in cross-border and offshore deployments, implementing redundancy measures through dual-sourcing and regional warehouse networks. Leadership teams must also champion a culture of continuous improvement by launching training programs that instill systems thinking and Lean Six Sigma methodologies across logistics units. Finally, embracing pilot programs for unmanned aerial resupply and mobile additive manufacturing nodes will demonstrate proof of concept and accelerate broader adoption, enabling commanders to maintain logistical superiority in rapidly evolving operational theaters.

Illuminating Rigorous Research Methodology and Analytical Frameworks Underpinning the Military Infrastructure and Logistics Industry Study

This study’s methodology blends qualitative and quantitative research techniques underpinned by a robust analytical framework to ensure rigor and validity. Initially, secondary data sources-including defense white papers, governmental policy documents, and industry technical reports-were systematically reviewed to establish a baseline understanding of supply chain structures, infrastructure typologies, and emerging technology adoption trends. In tandem, financial disclosures and corporate filings from leading logistics providers were analyzed to identify strategic investments and capability gaps.

Primary research was conducted through structured interviews with senior logisticians, facility managers, and technology architects from allied defense agencies and private contractors. These engagements provided firsthand perspectives on operational challenges, procurement decision criteria, and future capability road maps. Data triangulation techniques were applied by cross-referencing interview insights with field observations and trade publication findings to validate trends and resolve discrepancies. Finally, a multi-layer analytical model was developed to synthesize segmentation analyses, regional dynamics, and tariff impact assessments, culminating in an integrated view of the military infrastructure and logistics landscape.

This section provides a structured overview of the report, outlining key chapters and topics covered for easy reference in our Military Infrastructure & Logistics market comprehensive research report.

- Preface

- Research Methodology

- Executive Summary

- Market Overview

- Market Insights

- Cumulative Impact of United States Tariffs 2025

- Cumulative Impact of Artificial Intelligence 2025

- Military Infrastructure & Logistics Market, by Service Type

- Military Infrastructure & Logistics Market, by Transportation Mode

- Military Infrastructure & Logistics Market, by Deployment Type

- Military Infrastructure & Logistics Market, by Application

- Military Infrastructure & Logistics Market, by End User

- Military Infrastructure & Logistics Market, by Region

- Military Infrastructure & Logistics Market, by Group

- Military Infrastructure & Logistics Market, by Country

- United States Military Infrastructure & Logistics Market

- China Military Infrastructure & Logistics Market

- Competitive Landscape

- List of Figures [Total: 17]

- List of Tables [Total: 1908 ]

Synthesis of Insights and Strategic Perspectives Offering a Cohesive Overview of Future-Proof Military Infrastructure and Logistics Trends

By synthesizing insights across technological innovations, geopolitical developments, segmentation analyses, and competitive strategies, this executive summary offers a cohesive perspective on the future trajectory of military infrastructure and logistics. It underscores the imperative for adaptable frameworks that can rapidly integrate autonomous systems, data-driven decision support tools, and resilient supply chain networks. The interplay between policy shifts-such as tariff adjustments-and regional strategic imperatives highlights the complexity of sustaining operational readiness in a multipolar world.

Ultimately, success in defense logistics will hinge on the ability of organizations to blend digital transformation initiatives with pragmatic risk management practices. As stakeholders forge new alliances and pilot next-generation solutions, the industry stands at the cusp of unprecedented efficiency gains and strategic agility. The collective insights presented herein form a strategic compass for decision-makers, guiding the allocation of resources, the formulation of partnerships, and the design of future-proof logistics architectures.

Connect with Associate Director for Personalized Insights and Secure Your Comprehensive Military Infrastructure and Logistics Market Research Report Today

To embark on a transformative partnership and secure decisive market intelligence, connect with Associate Director Ketan Rohom for personalized strategic guidance and obtain the definitive market research report tailored to your military infrastructure and logistics requirements. Engage today to unlock deep analytical insights, gain exclusive access to comprehensive data sets, and benefit from expert consultation that will empower your organization to navigate evolving challenges in supply chain resilience, geopolitical risk mitigation, and technology-driven operational efficiency. Reach out now to catalyze informed decision-making, fortify stakeholder confidence, and accelerate your competitive advantage in global defense logistics.

- How big is the Military Infrastructure & Logistics Market?

- What is the Military Infrastructure & Logistics Market growth?

- When do I get the report?

- In what format does this report get delivered to me?

- How long has 360iResearch been around?

- What if I have a question about your reports?

- Can I share this report with my team?

- Can I use your research in my presentation?