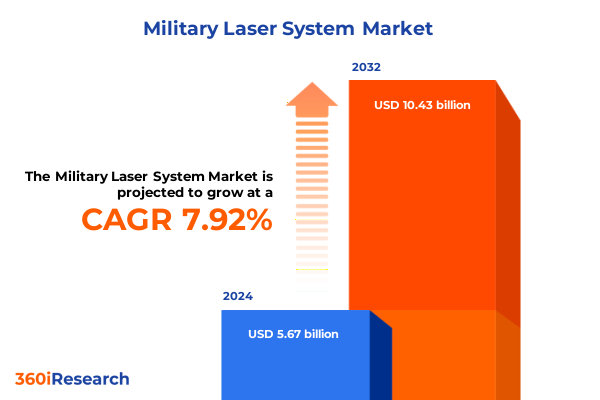

The Military Laser System Market size was estimated at USD 6.11 billion in 2025 and expected to reach USD 6.54 billion in 2026, at a CAGR of 7.94% to reach USD 10.43 billion by 2032.

Exploring the Cutting-Edge Evolution of Military Laser Systems and Their Strategic Significance in Modern Defense Operations

Military laser systems have emerged as a transformative force in defense technology, delivering unparalleled precision, speed, and operational flexibility in a variety of missions. These directed energy weapons harness concentrated beams of light to disable, degrade, or destroy targets with minimal collateral damage. By removing the logistical constraints of conventional munitions and offering virtually unlimited magazine depth, laser systems are reshaping strategic doctrines across air, land, sea, and space domains.

Driven by technological breakthroughs in beam control, power scaling, and thermal management, the latest generation of lasers combines higher output with improved beam quality and platform compatibility. Advances in fiber amplification, solid-state gain media, and semiconductor diode technology have reduced size, weight, and power consumption, enabling more agile integration into manned aircraft, unmanned vehicles, naval vessels, and ground installations. Consequently, defense organizations worldwide are accelerating deployment plans to enhance precision engagement, counter emerging threats, and achieve cost efficiencies over lifecycle operations.

This executive summary outlines the pivotal shifts transforming the military laser landscape, examines the cumulative impact of new U.S. tariffs on procurement and supply chains, highlights critical segmentation insights, and presents regional and competitive analyses. It aims to inform decision makers on strategic imperatives, provide actionable recommendations, and detail the rigorous research methodology underpinning the full market report.

Unveiling the Transformative Technological and Strategic Shifts Redefining Military Laser Systems Across Global Defense Arenas

In recent years, military laser systems have experienced a paradigm shift as innovations in free electron lasers, diode pumped solid state architectures, and high-power chemical lasers bridge the gap between laboratory prototypes and battlefield readiness. This wave of progress has been fueled by breakthroughs in beam combination techniques and adaptive optics, which have dramatically enhanced beam coherence and combat range. At the same time, software-defined beam steering and advanced fire control systems are enabling more reliable target tracking and engagement under contested electronic warfare conditions.

Simultaneously, strategic priorities have evolved as defense planners seek cost-effective, low-collateral precision effects against an array of threats including drones, cruise missiles, and asymmetric ground targets. The growing emphasis on anti-drone and counter-UAS missions has driven deployment of pulsed and continuous-wave solutions capable of disabling sensor payloads or structural components at standoff distances. Moreover, the integration of directed energy weapons into layered air and missile defense architectures marks a transformative step toward persistent denial capabilities that complement kinetic interceptors.

Looking forward, the fusion of artificial intelligence for rapid target discrimination, modular power sources for scalable effects, and hybrid chemical-semiconductor approaches promises to accelerate adoption. As these transformative shifts continue to redefine laser performance metrics and operational doctrines, stakeholders must stay informed on evolving technical benchmarks and emerging tactical concepts.

Assessing the Far-Reaching Cumulative Impact of New United States Tariffs on Military Laser System Procurement and Supply Chains

In 2025, the United States introduced a series of tariffs targeting key components and raw materials used in military laser production, including specialty optical fibers, high-purity semiconductor diodes, and gas mixing assemblies for chemical lasers. Initially intended to protect domestic industries and encourage local manufacturing, these measures have had the unintended consequence of driving up costs for integrators and system developers. The increased price of multi mode fiber strands and diode pump modules has extended procurement timelines and placed added pressure on defense budgets already stretched by modernization programs.

Beyond immediate cost hikes, the tariffs have disrupted established supply chains, compelling manufacturers to seek alternative sources for CO2 and excimer gas mixtures as well as rare earth elements used in solid state gain media. Defense agencies have responded by renegotiating long-term contracts with domestic suppliers while incentivizing joint ventures that localize production of Nd:YAG and Nd:YLF crystals. Although these efforts mitigate some supply risks, they also introduce challenges in quality assurance and certification. Consequently, system integrators are balancing the trade-offs between material availability and performance consistency as they adapt their procurement strategies to a more protectionist trade environment.

Uncovering Critical Segmentation Insights That Illuminate Technology, Platform, Application, Operation Mode, Power Output, Mobility, and End User Dynamics

A nuanced understanding of market segmentation provides clarity on which technology paths and deployment scenarios will drive future investments in military laser systems. When viewed through the lens of core technologies, distinctions emerge between chemical lasers such as deuterium fluoride and hydrogen fluoride, free electron lasers that capitalize on tunable wavelengths, and various solid state platforms including diode pumped solid state, Nd:YAG, and Nd:YLF. Fiber lasers, subdivided into multi mode and single mode categories, continue to gain traction for their beam quality and compact form factors, while semiconductor diode arrays present scalable, low-maintenance alternatives for lower-power applications.

Equally important are the platform-specific considerations that influence system design and integration. Airborne solutions span both manned aircraft and UAV configurations, requiring stringent weight and vibration tolerances. Ground deployments range from fixed installations at strategic bases to vehicle mounted units on mobile command platforms. Naval implementations must accommodate submarine pressure hull constraints and surface ship power systems, whereas emerging space-based lasers on satellites and space stations focus on resilient thermal management and radiation-hardened components. Application-driven segmentation further refines the market narrative, with communication variants leveraging free space optics or lasercomm channels, countermeasure systems offering blinding or dazzler effects, and directed energy weapons tailored to anti-drone, anti-materiel, and anti-missile missions. Range finding and target designation solutions employ both ladar and non-ladar techniques, while surveillance offerings include hyperspectral and Lidar imaging modalities.

Beyond technology, platform, and application, operational and user-driven dimensions shape investment priorities. Continuous wave systems, whether multi frequency or single frequency, balance power draw and cooling demands differently than pulsed mode lock or Q switch architectures. Power output tiers span below 10 kW units optimized for portable defense to above 100 kW installations designed for strategic area denial. Mobility options-from man portable packs to heavy vehicle mounted setups-affect deployment agility, and end users such as Air Force, Army, Marine Corps, Navy, and various defense agencies each impose unique requirements on performance, certification, and support lifecycles.

This comprehensive research report categorizes the Military Laser System market into clearly defined segments, providing a detailed analysis of emerging trends and precise revenue forecasts to support strategic decision-making.

- Technology

- Platform

- Operation Mode

- Power Output

- Mobility

- Application

- End User

Delineating Key Regional Perspectives on Military Laser Systems Adoption and Advancement Trends Across Major Global Territories

Regional dynamics profoundly influence the trajectory of military laser system adoption, starting with the Americas where established defense budgets and advanced R&D infrastructures drive early integration. The United States, in particular, benefits from decades of government-funded innovation in beam combining and power conditioning technologies, creating a robust ecosystem of primes and academic partners. Canada and select Latin American nations are exploring niche collaborations in counter-UAS and border surveillance deployments, laying the groundwork for scalable cross-border initiatives.

Meanwhile, Europe, the Middle East, and Africa present a diverse landscape of opportunities and challenges. NATO members prioritize interoperability and shared development frameworks, fostering collaborative prototypes among multinational consortia. Gulf states and select North African governments are channeling sovereign wealth into directed energy programs aimed at air defense and critical infrastructure protection. Defense agencies across the region balance procurement of off-the-shelf U.S. and European solutions with investments in local manufacturing capabilities to reduce dependency on external suppliers.

In the Asia-Pacific corridor, rapid military modernization is reshaping demand for laser-based weapons and sensors. East Asian powers are investing heavily in high-energy solid state lasers for maritime security and anti-drone patrols, while Southeast Asian nations consider small-scale, mobile point defenses to safeguard ports and critical facilities. Australia’s defense research agencies focus on modular designs capable of integration with existing air and naval platforms. Across all regions, the interplay of geopolitical tensions, industrial policies, and strategic partnerships is creating a competitive yet collaborative environment for the next generation of military laser technologies.

This comprehensive research report examines key regions that drive the evolution of the Military Laser System market, offering deep insights into regional trends, growth factors, and industry developments that are influencing market performance.

- Americas

- Europe, Middle East & Africa

- Asia-Pacific

Identifying Leading Company Strategies and Competitive Landscapes Driving Innovation in Military Laser System Development Worldwide

A cadre of leading defense contractors and specialized technology firms is driving innovation and shaping competitive dynamics in the military laser space. Established primes leverage integrated supply chains and deep domain expertise to advance full-spectrum directed energy solutions, often collaborating with university labs and national research facilities to accelerate prototype maturation. Meanwhile, agile midsize innovators focus on breakthrough components such as high-power fiber amplifiers and advanced beam control subsystems, securing strategic partnerships with larger firms to scale production.

In addition to organic R&D investments, strategic mergers and acquisitions play a critical role in consolidating capabilities and expanding market reach. Alliances forged between platform integrators and optics manufacturers are streamlining system bundling for airborne, naval, and ground-based configurations. Joint ventures between defense agencies and private-sector specialists are also emerging, particularly in regions seeking to localize production of Nd:YAG crystals and semiconductor diode arrays. These collaborative models underscore a competitive landscape that is both dynamic and interdependent, with continuous innovation cycles shaping procurement roadmaps and long-term strategic planning.

This comprehensive research report delivers an in-depth overview of the principal market players in the Military Laser System market, evaluating their market share, strategic initiatives, and competitive positioning to illuminate the factors shaping the competitive landscape.

- AeroVironment, Inc.

- BAE Systems plc

- Boeing Company

- Coherent, Inc.

- Elbit Systems Ltd

- General Dynamics Corporation

- Hua’n Laser Technology Industry Group Co., Ltd

- Israel Aerospace Industries Ltd

- Kratos Defense & Security Solutions, Inc.

- L3Harris Technologies, Inc.

- Leidos Holdings, Inc.

- Lockheed Martin Corporation

- MBDA

- Northrop Grumman Corporation

- Rafael Advanced Defense Systems Ltd

- Rheinmetall AG

- RTX Corporation

- Textron Inc.

- Thales Group

- Trumpf GmbH + Co. KG

Presenting Actionable Strategic Recommendations to Empower Industry Leaders in Capitalizing on Evolving Military Laser System Opportunities

To maintain a competitive edge, industry leaders should prioritize investment in scalable, modular laser architectures that can be adapted across multiple platforms and mission sets. By focusing on interoperable subsystems and open standards, manufacturers will facilitate faster integration cycles and reduce total cost of ownership. Concurrently, cultivating partnerships with academic institutions and national laboratories will ensure early access to emerging breakthroughs in beam quality enhancement and thermal management.

Supply chain diversification must also be a strategic imperative. Companies should establish secondary sourcing agreements for critical materials such as specialty optical fibers and rare earth-doped crystal substrates, while also exploring in-house manufacturing capabilities through joint ventures. Furthermore, engagement with government bodies to anticipate regulatory shifts-particularly regarding export controls and tariff policies-will enable more resilient procurement planning. Lastly, investing in advanced modeling and simulation platforms can accelerate iterative design processes, allowing for rapid validation of new laser configurations under realistic operational scenarios.

Detailing Rigorous Research Methodologies and Analytical Frameworks Underpinning the Comprehensive Study of Military Laser System Markets

This study employs a rigorous mixed-methodology framework that blends primary research with comprehensive secondary analysis. In-depth interviews were conducted with senior defense procurement officers, system integrators, engineering leads, and R&D directors across multiple defense organizations to capture qualitative insights on unmet needs and emerging capabilities. These conversations were supplemented by detailed workshops and technology demonstrations to validate performance parameters and operational metrics.

Secondary sources include government white papers, open-source patent databases, peer-reviewed journals on photonics and directed energy, and publicly available supplier catalogs. A structured patent analysis was undertaken to identify innovation hotspots and technology maturation curves, while comparative assessments of technical specifications were performed to benchmark key offerings. Data triangulation techniques ensure consistency between market narratives, technological feasibility, and strategic defense requirements, providing a robust foundation for the full market report’s conclusions.

This section provides a structured overview of the report, outlining key chapters and topics covered for easy reference in our Military Laser System market comprehensive research report.

- Preface

- Research Methodology

- Executive Summary

- Market Overview

- Market Insights

- Cumulative Impact of United States Tariffs 2025

- Cumulative Impact of Artificial Intelligence 2025

- Military Laser System Market, by Technology

- Military Laser System Market, by Platform

- Military Laser System Market, by Operation Mode

- Military Laser System Market, by Power Output

- Military Laser System Market, by Mobility

- Military Laser System Market, by Application

- Military Laser System Market, by End User

- Military Laser System Market, by Region

- Military Laser System Market, by Group

- Military Laser System Market, by Country

- United States Military Laser System Market

- China Military Laser System Market

- Competitive Landscape

- List of Figures [Total: 19]

- List of Tables [Total: 3816 ]

Summarizing Critical Insights and Concluding Thoughts on the Future Trajectory of Military Laser Systems in Defense Ecosystems

The convergence of advanced beam delivery mechanisms, scalable power architectures, and evolving deployment concepts signals a new era for military laser systems. Stakeholders who stay abreast of technology maturation and supply chain dynamics will gain significant operational advantages. It is clear that flexible, modular designs and diversified sourcing strategies will shape procurement and development roadmaps in the coming years.

Looking ahead, the integration of autonomous targeting algorithms, high-bandwidth laser communications, and next-generation beam control will further enhance mission effectiveness. Defense organizations that embrace collaborative models-linking primes, innovators, and research institutions-will lead the way in deploying resilient, cost-effective solutions. As the landscape continues to evolve, ongoing vigilance and adaptive strategies will be essential to harness the full potential of directed energy capabilities in defense ecosystems.

Engage with Associate Director Sales and Marketing to Secure Exclusive Access to the Comprehensive Military Laser System Market Research Report

For organizations seeking an in-depth, authoritative analysis of military laser systems, engaging directly with Ketan Rohom, Associate Director, Sales & Marketing, offers the fastest path to actionable insights. His expertise ensures tailored guidance on how the report’s findings align with your strategic objectives and operational requirements. Reach out to Ketan to explore customized licensing options, volume discounts, and bundled services that meet the unique demands of your projects. By partnering with him, you gain priority access to expert briefings, supplementary data packages, and ongoing updates that keep your teams at the forefront of defense laser technology developments. Take the next step toward securing comprehensive intelligence on market dynamics, supplier strategies, and growth opportunities by contacting Ketan today.

- How big is the Military Laser System Market?

- What is the Military Laser System Market growth?

- When do I get the report?

- In what format does this report get delivered to me?

- How long has 360iResearch been around?

- What if I have a question about your reports?

- Can I share this report with my team?

- Can I use your research in my presentation?