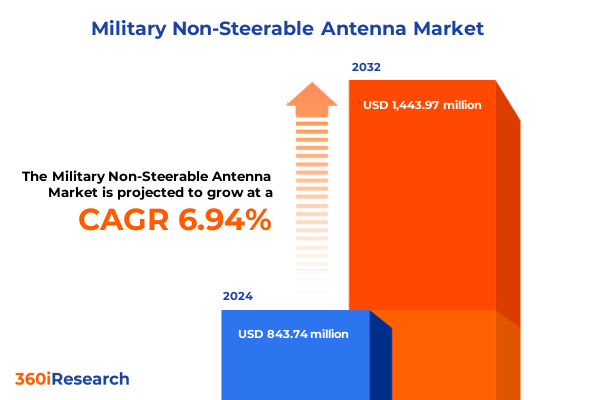

The Military Non-Steerable Antenna Market size was estimated at USD 903.07 million in 2025 and expected to reach USD 957.71 million in 2026, at a CAGR of 6.93% to reach USD 1,443.97 million by 2032.

Strategic Context and Operational Drivers Shaping the Adoption of Military Non-Steerable Antennas in Contemporary Defense Networks

Military non-steerable antennas form the backbone of defense communication infrastructure, delivering steadfast connectivity across complex operational theaters. These fixed-position systems are meticulously engineered to ensure uninterrupted voice, data, and satellite communication, while simultaneously supporting navigation, surveillance, and electronic warfare applications. By eliminating the mechanical complexity inherent in steerable solutions, non-steerable antennas enhance reliability and ease of maintenance, enabling defense forces to focus on mission objectives without the burden of frequent hardware adjustments or extended downtimes.

As modern conflicts evolve, defense organizations face escalating requirements for secure, high-throughput communication channels that can operate across diverse terrains and contested electromagnetic environments. Non-steerable antennas, with their rugged form factors and simplified deployment, address these needs by offering rapid integration into ground stations, naval vessels, airborne platforms, and fixed installations. Moreover, advancements in materials science and signal processing have fueled a wave of innovation in antenna performance and miniaturization, further broadening the scope of applications. Consequently, stakeholders are prioritizing these solutions to achieve both cost efficiencies and tactical superiority, setting the stage for sustained growth and continuous technological refinement.

Transformational Shifts in Threat Dynamics and Technological Innovations Redefining Military Non-Steerable Antenna Capabilities

Over the past decade, the threat landscape has undergone seismic shifts, compelling defense forces to reimagine their communication architectures at both strategic and tactical levels. The proliferation of sophisticated electronic warfare capabilities, unmanned platforms, and distributed operations has elevated the demand for antennas that can withstand jamming, interception, and harsh environmental conditions. Against this backdrop, non-steerable antennas have emerged as vital components, offering a degree of frequency agility and broadband coverage that was once reserved for more complex systems. Consequently, technology developers have redirected R&D efforts toward enhancing polarization diversity, wideband performance, and low-profile form factors to meet these evolving battlefield requirements.

Furthermore, the integration of non-steerable antennas with next-generation network frameworks has unlocked new operational paradigms. By leveraging modular designs and software-defined radio interfaces, modern fixed-position antennas can seamlessly interoperate with satellite constellations, tactical mesh networks, and over-the-horizon communication links. This convergence of hardware robustness and digital adaptability marks a transformative shift in how defense entities conceptualize resilient architectures. In addition, the rising emphasis on expeditionary operations demands solutions that can be rapidly deployed and configured, prompting manufacturers to develop quick-attach mounting mechanisms and streamlined calibration protocols. As a result, the industry is witnessing accelerated innovation cycles, with new entrants and established players alike competing to deliver solutions that strike the optimal balance between performance, cost, and operational agility.

Assessing the Widespread Implications of United States 2025 Tariff Policies on Military Non-Steerable Antenna Supply Chains and Procurement Costs

In response to geopolitical uncertainties and trade policy shifts, the United States implemented a new wave of tariffs in 2025 that directly affects electronic components critical to military antenna manufacturing. These measures encompass a broad spectrum of raw materials, semiconductors, and precision alloys used in antenna elements and housing. Consequently, defense contractors have faced upward pressure on procurement costs, particularly for components sourced from regions subject to elevated duties. However, the impact has not been uniform across the supply chain; some manufacturers operating domestic production facilities or with vertically integrated operations have mitigated cost increases through internal sourcing strategies and long-term contracts.

Moreover, the tariff environment has catalyzed a strategic pivot toward supplier diversification and near-shoring initiatives. By expanding partnerships with North American and allied vendors, defense program managers have sought to reduce dependency on tariff-impacted imports while bolstering supply chain resilience. In parallel, research institutions and industrial consortia have intensified efforts to identify alternative materials and additive manufacturing techniques that can replace tariff-sensitive inputs. These combined responses have fostered a wave of collaboration across public and private sectors, ultimately accelerating the development of domestically manufactured non-steerable antenna solutions. While cost structures continue to adjust to the 2025 tariff landscape, these adaptive strategies underscore the industry’s commitment to maintaining uninterrupted defense readiness.

Deep Dive into Critical Market Segmentation Insights Illuminating Application End User Frequency Type and Mounting Dynamics

A nuanced examination of market segmentation reveals divergent growth trajectories and technology priorities across key categories. When evaluated across application types such as communication, data link, electronic warfare, navigation, and surveillance, it becomes evident that each use case imposes unique performance and reliability criteria. Within communication, subsegments encompassing data, satellite, and voice transmission demand antennas capable of handling varying bandwidth and latency requirements. Conversely, data link applications bifurcate into satellite and tactical domains, where throughput and mobility considerations shape design choices. Simultaneously, surveillance use cases, ranging from aerial to ground and maritime monitoring, necessitate antennas with specific beamwidth and coverage characteristics.

End-user diversification further illuminates market dynamics. Air Force and Navy entities exhibit strong demand for platform-optimized installations, whereas Army and Homeland Security operators prioritize portable and vehicle-mounted solutions for expeditionary deployments. Frequency allocation also drives distinct engineering approaches, with antennas operating at EHF, SHF, UHF, VHF, and HF bands each requiring tailored element designs to satisfy propagation and size constraints. Additionally, antenna type differentiation-spanning dipole, horn, omnidirectional, patch, and Yagi-Uda configurations-influences both manufacturing complexity and field performance. Lastly, mounting modalities, including airborne platform, naval vessel, stationary, portable, and vehicle-mounted installations, impose environmental and mechanical robustness requirements that shape product roadmaps. Collectively, these segmentation insights guide developers and procurement officers in aligning technical capabilities with mission-specific criteria.

This comprehensive research report categorizes the Military Non-Steerable Antenna market into clearly defined segments, providing a detailed analysis of emerging trends and precise revenue forecasts to support strategic decision-making.

- Application

- End User

- Frequency

- Antenna Type

- Mounting

Comprehensive Regional Analysis Revealing Distinct Trends and Competitive Landscapes Across the Americas EMEA and Asia-Pacific Zones

Regional market dynamics exhibit pronounced variations driven by defense spending priorities, alliance structures, and technological ecosystems. In the Americas, robust investment from both national defense budgets and allied partnerships has fueled demand for non-steerable antennas that support networked operations across terrestrial and maritime domains. North American defense integrators leverage mature industrial bases to drive iterative enhancements in antenna materials and electronic subsystems, facilitating rapid field upgrades and legacy system interoperability.

Moving to Europe, the Middle East, and Africa, strategic modernization programs within NATO members and Gulf Cooperation Council states have prioritized communication resilience in contested environments. Collaborative R&D initiatives across these regions have accelerated the deployment of wideband fixed antennas for satellite and tactical mesh networks, while localized manufacturing hubs address region-specific climatic and logistical challenges. Conversely, in Asia-Pacific, the confluence of rising maritime tensions and diversified technological partnerships has created a competitive landscape where local defense contractors and government agencies swiftly adopt non-steerable antennas for coastal surveillance, unmanned platform integration, and secure broadband connectivity. Transitioning across these zones, it becomes clear that regional distinctiveness shapes procurement strategies, partnership models, and technology roadmaps for non-steerable antenna solutions.

This comprehensive research report examines key regions that drive the evolution of the Military Non-Steerable Antenna market, offering deep insights into regional trends, growth factors, and industry developments that are influencing market performance.

- Americas

- Europe, Middle East & Africa

- Asia-Pacific

Profiling Leading Industry Players Driving Innovation Collaboration and Competitive Positioning in the Military Non-Steerable Antenna Sector

Leading industry players are accelerating innovation through strategic partnerships, mergers, and targeted R&D investments to sustain competitive differentiation. Established defense primes have expanded portfolios by integrating next-generation materials, miniaturized electronics, and open architecture interfaces into their non-steerable antenna offerings. At the same time, specialized firms with deep expertise in RF engineering have secured critical contracts by demonstrating rapid prototyping capabilities and tailored solutions for niche applications such as electronic warfare jamming and satellite uplink redundancy.

In addition, synergistic collaborations between technology providers and defense integrators have become increasingly prevalent. Through cooperative test programs and shared simulation platforms, companies are refining antenna designs to achieve greater bandwidth efficiency and resilience against electronic attacks. Meanwhile, new market entrants harness the capabilities of additive manufacturing and advanced composites to reduce lead times and improve form-factor adaptability. Together, these strategic maneuvers are reshaping the competitive landscape, compelling all stakeholders to continuously elevate performance benchmarks and deliver modular, scalable solutions that address the multifaceted demands of modern defense communications.

This comprehensive research report delivers an in-depth overview of the principal market players in the Military Non-Steerable Antenna market, evaluating their market share, strategic initiatives, and competitive positioning to illuminate the factors shaping the competitive landscape.

- Alaris Holdings Limited

- Antcom Corporation

- Antenna Products Corporation

- BAE Systems plc

- Cobham Advanced Electronic Solutions, Inc.

- Comrod Communication Group AS

- Eylex Pty Ltd

- General Dynamics Corporation

- Hascall-Denke Corporation

- L3Harris Technologies, Inc.

- Leonardo S.p.A.

- Lockheed Martin Corporation

- MTI Wireless Edge Ltd.

- Northrop Grumman Corporation

- R.A. Miller Industries, Inc.

- Rohde & Schwarz GmbH & Co. KG

- RTX Corporation

- Saab AB

- Southwest Antennas, Inc.

- Thales Group

Actionable Strategies for Defense Contractors and Technology Providers to Capitalize on Evolving Military Non-Steerable Antenna Market Opportunities

To capitalize on emergent opportunities, defense contractors and technology providers should prioritize integrated solution development that couples high-performance antenna hardware with advanced signal processing and network management software. By adopting a systems-level perspective, organizations can deliver turnkey communication suites that simplify procurement cycles and enhance interoperability across allied forces. Furthermore, investing in modular product architectures will allow rapid reconfiguration to meet evolving mission profiles, reducing lifecycle costs and accelerating field deployment.

Equally important is cultivating strategic alliances with semiconductor and composite material suppliers to secure access to cutting-edge components and sustain long-term production agility. Such partnerships can mitigate supply chain disruptions and support co-development of novel antenna elements optimized for emerging frequencies. Additionally, engaging in cross-sector collaborations with telecommunications and aerospace entities can foster technology transfer and broaden market reach. By aligning R&D roadmaps with defense modernization priorities and sustaining iterative feedback loops with end users, industry leaders will be well positioned to deliver resilient, future-proof non-steerable antenna solutions that drive mission success.

Methodological Framework Detailing Rigorous Research Approaches Data Validation Techniques and Analytical Processes Employed in This Report

This analysis synthesizes insights derived through a rigorous research framework combining both qualitative and quantitative methodologies. Primary research encompassed in-depth interviews with senior defense procurement officers, engineering leads, and technical experts across allied nations to garner firsthand perspectives on operational requirements and emerging trends. Supplementing these interviews, surveys and structured questionnaires were administered to a wide array of antenna system end users, ensuring a representative cross-section of military branches and security agencies.

Secondary research involved comprehensive reviews of defense white papers, patent filings, academic publications, and open-source intelligence repositories to map technology trajectories and supply chain dynamics. Data validation processes included triangulation techniques, where findings from primary sources were cross-checked against industry reports, trade publications, and regulatory filings. Analytical procedures employed both descriptive statistics and scenario modeling to identify growth drivers, risk factors, and strategic imperatives. Collectively, this methodological approach ensures the robustness, reliability, and relevance of the insights presented throughout the report.

This section provides a structured overview of the report, outlining key chapters and topics covered for easy reference in our Military Non-Steerable Antenna market comprehensive research report.

- Preface

- Research Methodology

- Executive Summary

- Market Overview

- Market Insights

- Cumulative Impact of United States Tariffs 2025

- Cumulative Impact of Artificial Intelligence 2025

- Military Non-Steerable Antenna Market, by Application

- Military Non-Steerable Antenna Market, by End User

- Military Non-Steerable Antenna Market, by Frequency

- Military Non-Steerable Antenna Market, by Antenna Type

- Military Non-Steerable Antenna Market, by Mounting

- Military Non-Steerable Antenna Market, by Region

- Military Non-Steerable Antenna Market, by Group

- Military Non-Steerable Antenna Market, by Country

- United States Military Non-Steerable Antenna Market

- China Military Non-Steerable Antenna Market

- Competitive Landscape

- List of Figures [Total: 17]

- List of Tables [Total: 1431 ]

Conclusive Perspectives Synthesizing Key Findings and Underlining Strategic Imperatives for Stakeholders in Military Non-Steerable Antenna Domain

In conclusion, military non-steerable antennas have emerged as indispensable assets within contemporary defense communication architectures, offering a blend of reliability, adaptability, and cost-effectiveness across a spectrum of applications. The confluence of evolving threat dynamics, tariff-driven supply chain recalibrations, and regional procurement nuances has catalyzed both technological innovation and strategic realignment among defense contractors.

As shown by the segmentation analysis, stakeholder requirements vary significantly across application domains, user groups, frequency bands, antenna types, and mounting modalities, underscoring the necessity for tailored product offerings. Moreover, regional insights highlight the importance of aligning manufacturing capabilities and partnership models with local defense modernization agendas. Finally, actionable recommendations emphasize the need for holistic system integration, supplier collaboration, and modular design philosophies to navigate market complexities. By embracing these strategic imperatives, defense industry leaders can not only mitigate risk but also unlock the full potential of non-steerable antenna technologies to achieve operational superiority.

Engage Directly with Our Associate Director to Unlock Tailored Military Non-Steerable Antenna Market Intelligence and Drive Strategic Decisions Today

If you are ready to gain an unparalleled competitive advantage in military non-steerable antenna technologies, reach out directly to Ketan Rohom, Associate Director of Sales & Marketing. You can engage in a personalized consultation to discuss tailored insights, customized data breakdowns, and strategic advisory services. By partnering with Ketan Rohom, you will receive a comprehensive understanding of how fixed-position antenna systems are reshaping defense communications, and, more importantly, how to leverage this knowledge to maximize operational efficiency and technology adoption. Secure your copy of the full market research report today and empower your decision-making with actionable intelligence designed for defense industry leaders.

- How big is the Military Non-Steerable Antenna Market?

- What is the Military Non-Steerable Antenna Market growth?

- When do I get the report?

- In what format does this report get delivered to me?

- How long has 360iResearch been around?

- What if I have a question about your reports?

- Can I share this report with my team?

- Can I use your research in my presentation?