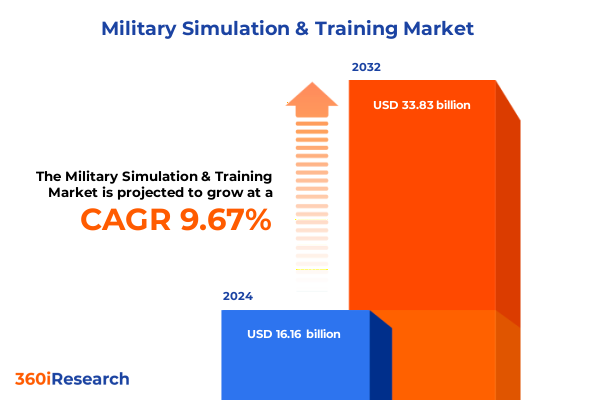

The Military Simulation & Training Market size was estimated at USD 17.64 billion in 2025 and expected to reach USD 19.29 billion in 2026, at a CAGR of 9.74% to reach USD 33.83 billion by 2032.

Setting a Comprehensive Context for Advanced Military Simulation and Training Amid Rapid Technological Innovation and Strategic Security Challenges

The modern security environment demands advanced capabilities and heightened readiness across all armed forces, driving the imperative for sophisticated simulation and training solutions. These solutions extend well beyond traditional live exercises, encompassing constructive, virtual, and live simulation approaches that collectively enhance operational efficacy while minimizing risk and cost. As geopolitical tensions escalate and technological innovations proliferate, defense organizations worldwide are prioritizing investments in immersive training environments that replicate complex battlefield scenarios with high fidelity.

This executive summary outlines the critical factors shaping the military simulation and training landscape, synthesizing the latest strategic insights, regulatory influences, and technological advancements. We begin by contextualizing the market drivers and challenges that underpin procurement decisions, before delving into segmentation frameworks, regional dynamics, and competitive positioning. By mapping transformative shifts and policy impacts-such as evolving tariff regimes and supply chain realignments-this summary equips decision-makers with the knowledge required to navigate an increasingly complex ecosystem. Ultimately, our analysis underscores the strategic importance of simulation and training capabilities in fortifying force readiness and maintaining technological superiority.

Uncovering the Fundamental Transformations Reshaping Global Military Simulation and Training Paradigms Across Technology, Doctrine, and Operational Practice

The military simulation and training sector is undergoing a profound metamorphosis, driven by the convergence of cutting-edge technologies and shifting doctrinal requirements. Artificial intelligence is augmenting scenario generation and after-action reviews, enabling more adaptive, intelligent learning loops. Concurrently, digital twin architectures are facilitating real-time replication of platforms and environments, granting operators unprecedented situational awareness and predictive analytics capabilities. These innovations, coupled with the maturation of augmented and virtual reality, are elevating immersion levels and strengthening cognitive transfer between simulated exercises and real-world operations.

Beyond technical advancement, interoperability frameworks and data standards are gaining traction, fostering seamless integration across joint and coalition exercises. Cloud computing and master data management strategies are centralizing training artifacts, reducing lifecycle costs, and accelerating deployment timelines. The integration of robotic process automation and Internet of Things sensors is streamlining logistics and maintenance training, while blockchain applications are enhancing data integrity and secure content distribution. These transformative shifts are rewriting the playbook for modern defense training, compelling stakeholders to reassess long-held approaches and invest in holistic, connected simulation ecosystems.

Analyzing the Far-Reaching Cumulative Effects of Recent United States Tariff Policies on Military Simulation Hardware and Training Ecosystems Through 2025

In early 2025, the United States government instituted significant tariff policy adjustments that have reverberated across the military simulation and training supply chain. Under Section 232, steel and aluminum tariffs were elevated from 25 percent to 50 percent ad valorem as of June 4, 2025, heightening the cost of critical hardware components such as head-mounted displays and simulation consoles. Meanwhile, Section 301 tariffs targeting semiconductors and other electronic inputs were raised to 50 percent on January 1, 2025, directly affecting high-precision display systems and sensors vital to immersive simulation platforms.

These combined measures have precipitated increased production costs for hardware manufacturers, incentivizing some defense contractors to onshore manufacturing or diversify supplier networks to mitigate tariff exposure. In certain cases, long-term contracts and value-added services have shielded OEMs from immediate price fluctuations, although downstream integrators have faced margin pressure. Moreover, unpredictable tariff adjustments have fostered supply chain uncertainty, prompting organizations to adopt just-in-case inventory strategies and accelerated digital procurement systems. Looking ahead, strategic alignment between procurement policies and workforce capabilities will be essential to absorb residual cost impacts and sustain innovation trajectories within the simulation and training domain.

Revealing Strategic Insights from Multifaceted Market Segmentation Dimensions That Illuminate the Diverse Military Simulation and Training Landscape

Discerning meaningful opportunities within the military simulation and training market requires a layered appreciation of distinct segmentation dimensions. The first dimension, Type, spans constructive simulation, where automated models generate strategic scenarios; live simulation, which blends physical instruments and human operators; and virtual simulation, offering computer-based immersive environments. Each form of simulation underscores different training imperatives, from strategic decision-making to tactical skills and platform familiarization.

Component analysis further refines market understanding by slicing through hardware, services, and software categories. Hardware constituents encompass head-mounted displays, motion platforms, projectors and display systems, and simulation consoles-each serving as tangible conduits for immersive experiences. Services range from consulting and integration to ongoing maintenance and support, reflecting the lifecycle management demands of simulation programs. Software modules, including command and control systems, modeling and simulation engines, and training management applications, orchestrate scenario execution and performance tracking.

Technological segmentation captures the ascendancy of 3D printing, augmented and virtual reality, artificial intelligence, big data analytics, blockchain, cloud computing combined with master data management, digital twin frameworks, Internet of Things integrations, and robotic process automation. These innovations drive efficiency gains and fidelity improvements across both indoor and outdoor training environments, accommodating air force, land, and naval applications. Use cases span combat training-encompassing combined arms and infantry tactics-maintenance training focused on repair, overhaul, and technical equipment instruction, and mission planning that addresses strategic and tactical planning requirements. Together, these segmentation insights reveal the interdependencies and growth vectors that define today’s simulation and training market landscape.

This comprehensive research report categorizes the Military Simulation & Training market into clearly defined segments, providing a detailed analysis of emerging trends and precise revenue forecasts to support strategic decision-making.

- Type

- Component

- Technology

- Training Environment

- Application

- Use Case

Examining Regional Dynamics and Strategic Drivers Across the Americas, Europe, Middle East & Africa, and Asia-Pacific Military Simulation Markets

Regional market trajectories vary considerably, shaped by defense budgets, strategic priorities, and local industrial capabilities. In the Americas, the United States remains the largest consumer, driven by modernization initiatives and the push to integrate multi-domain operations. Latin American nations are incrementally adopting virtual training platforms to optimize limited resources and bolster readiness against asymmetric threats.

Europe, the Middle East, and Africa exhibit a mosaic of adoption patterns. NATO members are prioritizing joint interoperability exercises, leveraging constructive simulations for coalition command training. Middle Eastern governments, flush with energy revenues, are investing in live flight and naval simulators to accelerate force synthesis. Meanwhile, emerging African states are exploring cost-effective virtual and cloud-based solutions to strengthen peacekeeping and border security competencies.

Asia-Pacific dynamics are propelled by an intensifying regional security competition. Indo-Pacific nations are accelerating acquisition of augmented reality and digital twin solutions to simulate complex maritime and aerial scenarios. At the same time, domestic industry players in China, India, Japan, and South Korea are expanding R&D investments, fostering indigenous capabilities, and pursuing export opportunities. Across all regions, strategic alliances and defense cooperation agreements continue to shape procurement strategies, driving cross-border knowledge transfer and collaborative program development.

This comprehensive research report examines key regions that drive the evolution of the Military Simulation & Training market, offering deep insights into regional trends, growth factors, and industry developments that are influencing market performance.

- Americas

- Europe, Middle East & Africa

- Asia-Pacific

Highlighting Leading Industry Participants and Their Strategic Positioning Within the Competitive Military Simulation and Training Ecosystem

Leading industry participants are deploying differentiated strategies to capture growth in the competitive military simulation and training arena. Some firms emphasize comprehensive solution suites that blend hardware, software, and services, allowing them to offer end-to-end lifecycle support. Others concentrate on niche capabilities, such as high-fidelity flight motion platforms or advanced data analytics engines, to establish technological leadership.

Strategic partnerships and joint ventures are on the rise, as companies align with defense primes and specialist integrators to secure large-scale contracts. A few market players have pursued targeted acquisitions to bolster their portfolios, integrating boutique software developers or robotics innovators into broader organizational structures. Concurrently, these companies are investing heavily in R&D, focusing on AI-driven scenario generation, digital twin environments, and immersive XR experiences. This competitive landscape underscores the criticality of agility and the capacity to swiftly translate emerging technologies into operationally relevant solutions.

This comprehensive research report delivers an in-depth overview of the principal market players in the Military Simulation & Training market, evaluating their market share, strategic initiatives, and competitive positioning to illuminate the factors shaping the competitive landscape.

- ACME Worldwide Enterprises, Inc.

- Arotech Corporation

- BAE Systems PLC

- CAE Inc.

- Calian Group Ltd.

- Cubic Corporation

- CymSTAR LLC

- Elbit Systems Ltd.

- Exail Holding

- Fidelity Technologies Corporation

- General Dynamics Corporation

- Guardiaris d.o.o.

- Hanwha Systems Co., Ltd.

- Indra Sistemas, S.A.

- InVeris Training Solutions, Inc.

- Israel Aerospace Industries Ltd.

- Kongsberg Gruppen ASA

- Kratos Defense & Security Solutions, Inc.

- Leonardo S.p.A.

- Lockheed Martin Corporation

- Metrea LLC

- Northrop Grumman Corporation

- Phoenix Defense, LLC

- Rheinmetall AG

- RTX Corporation

- Saab AB

- Sentient Digital, Inc.

- Serco Inc.

- Singapore Technologies Engineering Ltd.

- Tecknotrove

- Teledyne Technologies Incorporated

- Textron Inc.

- Thales Group

- The Boeing Company

- VirTra, Inc.

- Zen Technologies Limited

Formulating Actionable Strategic Directives for Industry Leaders to Capitalize on Disruptive Technologies and Evolving Training Requirements

Industry leaders seeking to capitalize on the evolving simulation and training market should cultivate strategic roadmaps that prioritize modular, open-architecture platforms. By embracing interoperability standards and cloud-native infrastructures, organizations can accelerate deployment cycles and enhance cross-domain collaboration. Equally important is the establishment of resilient supply chains, which may necessitate diversified sourcing strategies and selective onshoring to mitigate tariff volatility and geopolitical disruptions.

Investing in workforce development is paramount. Stakeholders should forge partnerships with academic institutions and training academies to develop curricula centered on AI, data analytics, and XR technologies. These initiatives will cultivate in-house expertise and ensure that end users can fully leverage advanced simulation features. Furthermore, fostering collaborative R&D ecosystems-through consortia or public-private partnerships-will facilitate cost-sharing and expedite time-to-market for breakthrough capabilities.

Lastly, market participants should explore adjacent sectors such as civilian aviation, emergency response, and industrial training to leverage simulation platforms for diversified revenue streams. By aligning product roadmaps with emerging regulatory standards and sustainability mandates, leaders can position themselves at the vanguard of innovation while remaining responsive to changing defense priorities.

Detailing a Rigorous Multi-Stage Research Methodology Underpinning the Comprehensive Analysis of Military Simulation and Training Market Dynamics

The research underpinning this analysis was conducted through a multi-stage, rigorous methodology designed to ensure validity and relevance. Initially, a comprehensive review of publicly available policy documents, defense white papers, and industry publications was undertaken to establish baseline understanding. Subsequently, in-depth interviews were conducted with senior defense planners, program managers, and technology suppliers to glean qualitative insights and validate emerging themes.

Quantitative data was collected through structured surveys targeting procurement officials, training commanders, and technology integrators. This primary data was triangulated with secondary sources, including government procurement databases, trade association reports, and financial filings, to corroborate findings and identify macro-level trends. Advanced analytical techniques, such as cross-category correlation analysis and growth driver indexing, were applied to distill actionable insights.

Finally, subject matter experts reviewed preliminary conclusions to ensure technical accuracy and strategic relevance. This iterative validation process fostered balanced viewpoints and accounted for regional nuances. By blending qualitative depth with quantitative rigor, this methodology delivers a comprehensive, reliable portrait of the military simulation and training market landscape.

This section provides a structured overview of the report, outlining key chapters and topics covered for easy reference in our Military Simulation & Training market comprehensive research report.

- Preface

- Research Methodology

- Executive Summary

- Market Overview

- Market Insights

- Cumulative Impact of United States Tariffs 2025

- Cumulative Impact of Artificial Intelligence 2025

- Military Simulation & Training Market, by Type

- Military Simulation & Training Market, by Component

- Military Simulation & Training Market, by Technology

- Military Simulation & Training Market, by Training Environment

- Military Simulation & Training Market, by Application

- Military Simulation & Training Market, by Use Case

- Military Simulation & Training Market, by Region

- Military Simulation & Training Market, by Group

- Military Simulation & Training Market, by Country

- United States Military Simulation & Training Market

- China Military Simulation & Training Market

- Competitive Landscape

- List of Figures [Total: 18]

- List of Tables [Total: 2067 ]

Synthesizing Key Findings and Forward-Looking Perspectives to Inform Strategic Decision-Making in Military Simulation and Training

The convergence of emerging technologies, shifting policy frameworks, and expanding global security challenges is redefining the military simulation and training ecosystem. Artificial intelligence, digital twins, and immersive reality platforms are unlocking new horizons for situational training, while interoperability and data integration initiatives are enhancing coalition readiness. Concurrently, evolving tariff regimes and supply chain realignments underscore the need for resilient procurement strategies.

Segmentation insights reveal that hardware, software, and services demand unique value propositions, with each component category presenting distinct growth drivers. Regional analysis highlights diverse strategic priorities, from multi-domain integration in the Americas to joint interoperability in EMEA and competitive innovation in Asia-Pacific. Industry leaders are responding through partnerships, acquisitions, and targeted R&D investments, charting differentiated paths to market success.

As defense organizations worldwide grapple with constrained budgets and accelerated timelines, the ability to rapidly deploy and scale advanced simulation solutions will be a defining competitive advantage. The insights presented in this summary provide a strategic compass for stakeholders seeking to navigate complexity, capitalize on emerging opportunities, and sustain technological superiority in an era of persistent uncertainty.

Connect Directly with Associate Director Ketan Rohom for Exclusive Access to the Comprehensive Military Simulation and Training Market Research Report

Are you ready to gain unparalleled insights into the rapidly evolving military simulation and training market? Reach out to Associate Director, Sales & Marketing Ketan Rohom to secure your exclusive copy of the in-depth research report. His expert guidance will ensure you receive tailored solutions addressing your organization’s strategic objectives and operational requirements. By partnering directly with Ketan Rohom, you will unlock access to proprietary analysis, forward-looking forecasts, and actionable intelligence that can elevate your competitive positioning.

Don’t miss this opportunity to leverage comprehensive market intelligence that spans technology trends, policy impacts, regional dynamics, and industry best practices. Contact Ketan Rohom today to discuss customization options, enterprise licensing, or a personalized briefing to accelerate your decision-making process and drive sustainable growth.

- How big is the Military Simulation & Training Market?

- What is the Military Simulation & Training Market growth?

- When do I get the report?

- In what format does this report get delivered to me?

- How long has 360iResearch been around?

- What if I have a question about your reports?

- Can I share this report with my team?

- Can I use your research in my presentation?