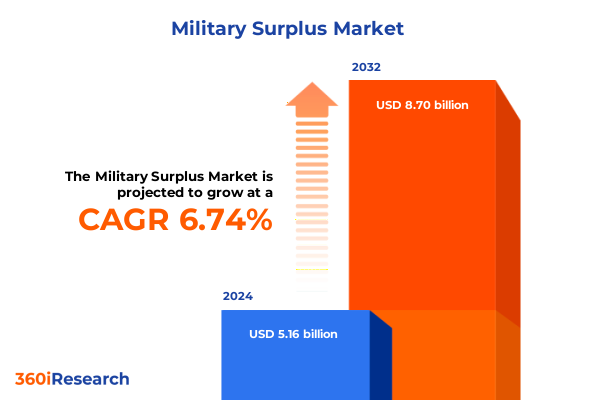

The Military Surplus Market size was estimated at USD 5.50 billion in 2025 and expected to reach USD 5.87 billion in 2026, at a CAGR of 6.76% to reach USD 8.70 billion by 2032.

Exploring the Fundamental Drivers and Emerging Patterns Reshaping the Military Surplus Landscape for Strategic Stakeholders in a Competitive Global Context

The military surplus market represents a unique convergence of historical artifacts, essential defense assets, and consumer-oriented gear. At its core, this market bridges the gap between decommissioned government equipment and a diverse audience that seeks functional, collector’s, or preparedness utility. From fatigues once worn by service members to sophisticated optics and communications equipment, surplus inventory spans an extensive spectrum of products, each carrying intrinsic value that extends beyond practical use.

Over recent years, stakeholders ranging from individual collectors and outdoor enthusiasts to law enforcement agencies and humanitarian organizations have recognized the strategic significance of surplus materiel. As traditional defense budgets fluctuate and geopolitical tensions evolve, surplus channels offer cost-effective alternatives and rapid procurement pathways. In parallel, the proliferation of digital platforms has transformed how surplus goods are cataloged, authenticated, and distributed globally, creating new opportunities for market entrants and established players alike.

This executive summary provides a holistic overview of the military surplus industry, illuminating the primary forces shaping current dynamics, the impact of recent policy shifts, and strategic considerations for decision-makers. By examining technological trends, regulatory influences, and evolving consumer preferences, this introduction sets the stage for a comprehensive understanding of the landscape and its implications for growth, innovation, and competitive positioning.

Uncovering the Pivotal Technological, Regulatory, and Market Disruptions That Are Transforming the Military Surplus Industry’s Competitive Landscape

The military surplus industry is undergoing transformative shifts driven by rapid technological innovation, evolving regulatory frameworks, and changing consumer expectations. Advanced manufacturing processes, including additive manufacturing and lightweight composite materials, have broadened the appeal of surplus items by enhancing durability and reducing weight. This technological evolution extends into the digital sphere, where blockchain-based authentication and augmented reality visualization tools are delivering unprecedented transparency and engagement for buyers.

Simultaneously, regulatory changes-ranging from tightened export controls to revisions in domestic procurement policies-have necessitated agility among suppliers and distributors. Companies are increasingly investing in compliance teams and secure logistics partnerships to navigate complex cross-border trade requirements. The rise of e-commerce and direct-to-consumer channels has also disrupted traditional auction house and specialty store models, enabling seamless global transactions and real-time inventory management.

Furthermore, sustainability considerations are reshaping supply chains, as stakeholders seek to reduce waste and extend the service life of existing equipment. Circular economy principles are being integrated into product restoration and resale strategies, bolstering both environmental stewardship and profitability. Lastly, emerging geopolitical tensions and disaster preparedness initiatives continue to fuel demand across applications ranging from emergency response to civilian protection, underscoring the dynamic nature of market drivers.

Analyzing the Comprehensive Cumulative Impact of United States Tariffs Implemented in 2025 on Military Surplus Supply Chains and Pricing Dynamics

In 2025, the United States implemented a series of sweeping tariffs on imported defense-related goods, significantly impacting the military surplus market. By imposing duties on key product categories-including optics, communication equipment, and certain textiles-these measures aimed to bolster domestic manufacturing and address trade imbalances. However, the collateral effects on surplus channels have been profound and multifaceted, reshaping cost structures and supply chain strategies across the industry.

Tariff-induced cost increases have compelled distributors to reevaluate sourcing models, shifting away from traditional foreign suppliers toward onshore refinishing and refurbishment partners. While this realignment supports local economies and accelerates inventory turnover, it has also led to higher unit costs that are often passed on to end users, particularly law enforcement agencies and non-governmental organizations operating under tight budgets. In addition, customs clearance complexities and extended lead times have accentuated the importance of strategic stockpiling, prompting many market participants to adjust their inventory planning horizons.

Despite these challenges, the 2025 tariffs have also galvanized innovation in process optimization and value-added services. Suppliers are expanding in-house testing capabilities and offering bundled maintenance packages to differentiate their offerings. At the same time, collaborative agreements between surplus vendors and domestic manufacturers have emerged, enabling streamlined certification pathways and joint product development. Together, these adaptive responses highlight the industry’s resilience amid shifting policy landscapes.

Revealing Key Market Segmentation Insights Based on Product Categories, Applications, End Users, and Sales Channels Driving Growth Opportunities

A granular examination of market segmentation reveals nuanced demand patterns and strategic growth avenues across distinct product, application, user, and distribution dimensions. Within the product category spectrum, accessories such as tactical bags, belts, and gloves demonstrate steady year-over-year growth, reflecting their universal appeal among recreational campers, emergency responders, and collecting enthusiasts. Electronics and communication items, specifically hearing protection devices and two-way radios, have outpaced broader equipment lines, driven by heightened safety protocols and field-ready operational requirements. Optics-including binoculars and precision scopes-remain a cornerstone for hunting and defense applications, while uniforms and apparel, notably camouflage cargoes, specialized footwear, and insulated jackets, cater to both functional and lifestyle markets. The weapons and ammunition segment, encompassing bullets, small arms, and tactical knives, continues to command significant revenue, with demand sustained by civilian security concerns and law enforcement procurement cycles.

In terms of application, camping and hunting represent robust end-use sectors, supported by the rising popularity of outdoor recreation and survivalist training programs. Collecting as a hobby underscores the cultural and historical value attached to surplus items, fostering active online communities and specialty retail experiences. Emergency preparedness and protection and defense use cases have surged in response to natural disasters and evolving security threats, highlighting the sector’s critical role in resilience planning.

End-user dynamics span individuals seeking personal readiness solutions, law enforcement agencies modernizing budget-friendly fleet equipment, humanitarian and non-governmental organizations requiring cost-effective gear for remote operations, and security agencies leveraging surplus for tactical deployments. Sales channel performance indicates a dual trajectory: offline retail through auction houses and specialized brick-and-mortar stores maintains traction among traditional buyers seeking hands-on inspection, whereas online platforms offer unparalleled reach, transparent pricing, and streamlined logistics.

This comprehensive research report categorizes the Military Surplus market into clearly defined segments, providing a detailed analysis of emerging trends and precise revenue forecasts to support strategic decision-making.

- Product Type

- Condition Grade

- Sales Channel

- Application Area

- End User Type

Highlighting Regional Market Dynamics and Growth Drivers in the Americas, Europe Middle East Africa, and Asia Pacific Military Surplus Sectors

Regional analysis underscores the divergent trajectories and market dynamics shaping each geographic zone’s embrace of military surplus offerings. In the Americas, strong cultural affinity for outdoor pursuits and a well-established network of collectors and reenactment communities continue to fuel demand. The United States and Canada have witnessed significant digital platform adoption among individual buyers and small enterprises, while government agencies leverage surplus channels to optimize defense budgets and rapid deployment capabilities. Economic stability and robust logistics infrastructure further amplify the region’s prominence in global trade flows.

In Europe, the Middle East, and Africa, regulatory heterogeneity and complex import export regimes require market participants to maintain specialized compliance functions. Western European nations exhibit steady appetite for surplus goods in civilian protection and historical collecting, supported by streamlined auction frameworks. Meanwhile, emerging economies across the Middle East and Africa are progressively integrating surplus procurement into national defense modernization programs, albeit with varying degrees of process maturity. Partnerships between local distribution networks and international suppliers are increasingly critical to navigate geopolitical sensitivities and trade barriers.

The Asia Pacific region is characterized by rapid defense spending growth, infrastructure development, and burgeoning consumer markets. Countries such as Australia, Japan, and South Korea display a rising preference for high-grade optics and communications gear, driven by both civilian safety initiatives and industry collaborations. Simultaneously, Southeast Asian nations are expanding auction-based surplus channels to meet growing demand for cost-efficient procurement pathways. Expansion of e-commerce ecosystems and targeted outreach campaigns are unlocking new opportunities across metropolitan and remote locales alike.

This comprehensive research report examines key regions that drive the evolution of the Military Surplus market, offering deep insights into regional trends, growth factors, and industry developments that are influencing market performance.

- Americas

- Europe, Middle East & Africa

- Asia-Pacific

Distilling Strategic Insights from Leading Companies’ Approaches to Innovation, Partnerships, and Market Expansion in the Military Surplus Sector

Leading organizations within the military surplus domain are differentiating themselves through a blend of digital innovation, strategic partnerships, and value-added services. Key distributors have invested heavily in online cataloging systems that leverage artificial intelligence to streamline search functionality and personalized recommendations, thereby enhancing the buyer experience. These platforms often incorporate real-time inventory tracking and integrated authentication features to build trust and reduce fulfillment latency.

Collaborations between surplus vendors and original equipment manufacturers have also gained traction, enabling co-development of certified refurbishment protocols and joint marketing initiatives. Such alliances facilitate accelerated product certification and open pathways to new end-use segments, particularly in law enforcement and emergency response. Furthermore, some market leaders are expanding service portfolios to include on-site training, maintenance packages, and extended warranties, positioning surplus offerings as comprehensive solutions rather than standalone assets.

Mergers and acquisitions remain a pivotal strategic lever, with established firms acquiring niche specialty retailers and digital startups to bolster their market presence. To fortify supply chain resilience, top companies are diversifying sourcing networks by cultivating relationships with domestic restoration facilities and allied international partners. These multifaceted approaches underscore the competitive intensity of the sector and the imperative to continually innovate across product, service, and distribution dimensions.

This comprehensive research report delivers an in-depth overview of the principal market players in the Military Surplus market, evaluating their market share, strategic initiatives, and competitive positioning to illuminate the factors shaping the competitive landscape.

- Americana Pipedream Apparel

- Army Navy Outdoors

- Army Surplus World, Inc.

- ASMC GmbH

- At the Front

- Brigade QM by Ira Green, Inc.

- CANEX

- Charley's Surplus.

- CHINA HENGTAI GROUP CO.,LIMITED

- Coleman's Military Surplus, LLC

- Commando Military Surplus

- General Jim's Surplus

- Global Army Surplus

- GoMilitar

- Hero Outdoors

- Major Surplus & Survival

- McGuire Army Navy.

- Military Equipment.

- MILITARY RANGE s.r.o.

- MMG Trading Ltd.

- Olive Planet Pvt Ltd

- Rothco

- Royal Military Surplus

- Smith Army Surplus

- Sportsman's Guide, LLC

- Surplus World Online

- UNIVERSAL SURPLUS

- US Patriot Tactical

- Varusteleka Oy

- Venture Surplus

Formulating Actionable Strategic Recommendations to Navigate Supply Chain Complexities and Capitalize on Emerging Trends in the Military Surplus Industry

To navigate emerging complexities and capitalize on evolving opportunities, industry leaders should adopt a multifaceted strategy centered on diversification, digital transformation, and compliance excellence. First, diversifying sourcing channels-by integrating domestic refurbishment facilities alongside traditional overseas suppliers-can mitigate the risks associated with tariff volatility and logistical disruptions. Establishing long-term agreements with multiple tier-one partners will ensure consistent inventory quality and availability.

Second, accelerating the digital transformation journey through advanced analytics, blockchain verification, and immersive product visualization will differentiate offerings and enhance customer trust. Investing in modular e-commerce architectures and API-driven inventory management systems will enable rapid scaling and seamless integration with third-party logistics and payment gateways.

Third, robust compliance frameworks are critical to managing evolving trade regulations. By creating dedicated compliance teams and leveraging automated screening tools, organizations can reduce clearance delays and avoid punitive fines. Engaging in preemptive dialogue with regulators and participating in industry advocacy groups will help shape favorable policy outcomes.

Finally, embedding sustainability and traceability into product lifecycles-through eco-friendly restoration practices and transparent provenance tracking-will address growing environmental and ethical considerations. This holistic approach of diversified sourcing, digital innovation, regulatory agility, and sustainability will position industry leaders to thrive in the next phase of the military surplus market’s evolution.

Detailing the Comprehensive Research Methodology Underpinning Data Collection, Analysis Techniques, and Validation Processes for Market Credibility

The findings presented in this report are grounded in a rigorous, multi-stage research methodology designed to ensure data integrity and actionable insights. Primary research comprised structured interviews with senior executives from surplus distributors, defense procurement officers, and supply chain experts across North America, Europe Middle East Africa, and Asia Pacific regions. These in-depth discussions provided qualitative perspectives on strategic priorities, regulatory challenges, and end-user requirements. Complementing the interviews, a series of online surveys gathered quantitative feedback from over 500 stakeholders-including individual buyers, law enforcement personnel, emergency response professionals, and NGO logistics managers-to gauge segment-specific demand drivers and purchasing behaviors.

Secondary research involved comprehensive analysis of public trade records, customs databases, industry white papers, and government policy documents to validate tariff impacts and market dynamics. Industry conferences, trade shows, and technical symposiums served as additional data sources, offering firsthand exposure to product innovations and competitive strategies. All collected data underwent a three-step validation process encompassing cross-source triangulation, statistical consistency checks, and expert panel reviews. This robust methodological framework ensures that conclusions and recommendations accurately reflect the current state of the military surplus market and support strategic decision-making across product, application, regional, and channel dimensions.

This section provides a structured overview of the report, outlining key chapters and topics covered for easy reference in our Military Surplus market comprehensive research report.

- Preface

- Research Methodology

- Executive Summary

- Market Overview

- Market Insights

- Cumulative Impact of United States Tariffs 2025

- Cumulative Impact of Artificial Intelligence 2025

- Military Surplus Market, by Product Type

- Military Surplus Market, by Condition Grade

- Military Surplus Market, by Sales Channel

- Military Surplus Market, by Application Area

- Military Surplus Market, by End User Type

- Military Surplus Market, by Region

- Military Surplus Market, by Group

- Military Surplus Market, by Country

- United States Military Surplus Market

- China Military Surplus Market

- Competitive Landscape

- List of Figures [Total: 17]

- List of Tables [Total: 3021 ]

Summarizing Key Findings and Strategic Implications for Decision Makers to Optimize Positioning in the Evolving Military Surplus Market Environment

The military surplus market is defined by its intricate interplay of historical value, functional utility, and evolving regulatory pressures. Key drivers-such as technological advancements in materials and authentication, the 2025 tariff realignments, and the surge in e-commerce adoption-have collectively reshaped how surplus goods are sourced, distributed, and consumed. Segment-level insights reveal that accessories and electronics particularly benefit from safety and recreational trends, while weapons, optics, and apparel maintain steadfast demand in security and defense circles.

Regionally, the Americas lead in digital platform penetration and consumer engagement, Europe Middle East Africa demand specialized compliance and auction services, and Asia Pacific demonstrates strong defense modernization trajectories and consumer market growth. Leading companies are setting benchmarks in innovation through AI-driven cataloging, strategic OEM partnerships, diversified sourcing, and expanded service offerings. Yet, the evolving policy environment underscores the imperative for regulatory agility and robust compliance infrastructures.

Industry participants poised for success will be those that integrate sustainable restoration practices, invest in digital transformation, and cultivate multi-modal supply chain networks. By synthesizing the complex array of market forces, this report equips decision-makers with the strategic clarity needed to optimize positioning and capitalize on emergent opportunities within the dynamic military surplus ecosystem.

Driving Strategic Engagement and Report Acquisition with Personalized Guidance from Our Associate Director of Sales and Marketing Delivering Tailored Insights

I appreciate your interest in gaining a deeper understanding of the military surplus landscape. To secure the full market research report and unlock tailored strategic insights, please reach out to our Associate Director of Sales & Marketing, Ketan Rohom. With extensive experience guiding executive decision-makers, Ketan can provide personalized support to align the report’s findings with your organization’s objectives.

You can schedule a confidential consultation to review key takeaways and determine which customized data modules will drive the highest strategic impact for your business. By partnering with Ketan, you’ll gain direct access to expert guidance on interpreting the report’s critical analyses, ensuring you harness the full value of the research. Take the next step toward informed market leadership: contact Ketan today to arrange your tailored briefing and acquire the comprehensive military surplus market report.

- How big is the Military Surplus Market?

- What is the Military Surplus Market growth?

- When do I get the report?

- In what format does this report get delivered to me?

- How long has 360iResearch been around?

- What if I have a question about your reports?

- Can I share this report with my team?

- Can I use your research in my presentation?