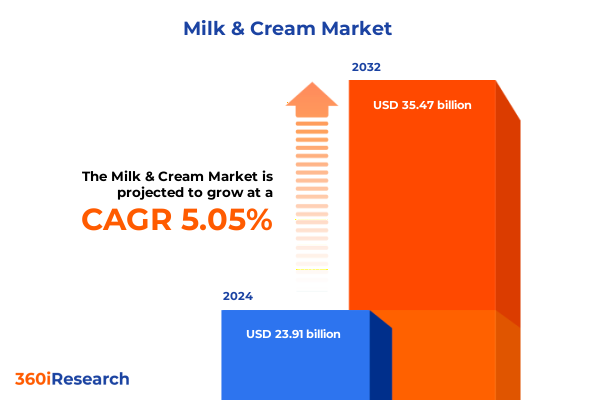

The Milk & Cream Market size was estimated at USD 25.14 billion in 2025 and expected to reach USD 26.46 billion in 2026, at a CAGR of 5.03% to reach USD 35.47 billion by 2032.

Igniting Momentum in the Milk and Cream Industry through a Strategic Examination of Consumer Demand Drivers and Market Evolution

The milk and cream sector stands at a pivotal juncture as consumer preferences evolve and industry dynamics shift to accommodate heightened demand for quality, nutrition, and sustainability. A nuanced understanding of these interlocking forces is essential for stakeholders seeking to uphold profitability while anticipating future disruptors. By systematically examining the factors driving consumption, supply chain resilience, and regulatory considerations, this introduction lays the groundwork for a comprehensive strategic assessment that informs decision-makers and industry influencers alike.

Underpinning the current market landscape is a diverse constellation of product offerings, spanning cream varieties such as half and half, heavy, light, and whipping creams, alongside milk types that range from flavored and low-fat to skim and whole milk. These variations reflect a sophisticated consumer base that values both indulgence and health, and they underscore the importance of innovation in flavor, nutritional profile, and processing techniques. Moreover, as digital channels and sustainable packaging solutions gain traction, the industry’s capacity for agility becomes a defining competitive asset. This introduction, therefore, sets the stage for an in-depth exploration of emerging trends, transformative shifts, and actionable insights critical for stakeholders seeking to thrive in the evolving milk and cream ecosystem.

Exploring the Transformative Shifts Reshaping the Milk and Cream Ecosystem Driven by Innovation, Sustainability, and Evolving Consumption Patterns

Over the past few years, the milk and cream ecosystem has undergone transformative shifts as innovation and sustainability priorities reshape product development and supply chain frameworks. Advances in processing technology have enabled producers to extend shelf life without compromising nutritional integrity, thereby minimizing waste and unlocking new distribution possibilities. Simultaneously, the rise of digitized platforms has democratized consumer access, allowing direct-to-consumer models to flourish alongside traditional supermarkets and hypermarkets.

Equally significant is the industry’s accelerated commitment to environmentally responsible practices. From lightweight glass bottles and renewable paperboard cartons to stand-up pouches that reduce material usage, packaging innovation has become a strategic imperative. This emphasis on eco-efficiency dovetails with consumer expectations for transparency around carbon footprints and ethical sourcing. As a result, leading players are embedding sustainability into core product strategies, which in turn drives differentiation and fosters deeper brand loyalty across diverse market segments.

Assessing the Cumulative Impact of New United States Tariffs on Milk and Cream Trade Flows, Cost Structures, and Competitive Strategies in 2025

In 2025, newly enacted United States tariffs have exerted a cumulative influence on both the cost structures and trading relationships within the milk and cream industry. By imposing additional duties on select dairy imports, the measures have prompted domestic suppliers to recalibrate pricing strategies, invest in processing efficiencies, and explore alternative sourcing partnerships. This tariff landscape has also invigorated discussions around supply chain security as companies seek to balance cost pressures with the imperative to maintain product consistency and quality.

Moreover, the regulatory adjustments have led to downstream effects on competitive positioning. Export-oriented firms have intensified efforts to capture value in markets less affected by U.S. trade barriers, while import-dependent distributors have diversified their supplier networks to mitigate the impact of increased duty costs. As stakeholders adapt, the tariff environment of 2025 underscores the necessity for agile risk management frameworks and proactive engagement with policy developments, ensuring that strategic responses remain aligned with long-term corporate objectives and market realities.

Unveiling Segmentation Insights across Product Varieties, Distribution Channels, and Packaging Modalities to Illuminate Consumer Preferences and Market Nuances

A deep dive into segmentation reveals how product type, distribution channel, and packaging modality shape consumer engagement and operational strategy. Within product type, the market divides into cream and milk categories, with cream encompassing half and half, heavy cream, light cream, and whipping cream, and milk spanning flavored, low fat, skim, and whole varieties. Each tier represents distinct usage occasions, from gourmet cooking to everyday breakfast routines, indicating varied growth trajectories and value propositions.

Distribution channel analysis further clarifies consumer buying patterns and logistical priorities, as channels such as convenience stores, food service operations, online retail platforms, and supermarkets and hypermarkets each embody unique operational models. Food service branches into cafeterias, hotels, and restaurants, while online retail channels bifurcate into direct company websites and third-party e-commerce platforms. This layered framework illuminates the interplay between channel-specific promotional strategies and the evolving preferences of digitally empowered shoppers.

Packaging type segmentation highlights the tactical role of bottle, carton, and pouch formats in shaping shelf appeal and supply chain efficacy. Bottle formats split into glass and plastic variants, carton solutions range between paperboard and Tetra Pak constructions, and pouch offerings include sachet and stand-up pouch designs. These packaging distinctions influence consumer perceptions of convenience, sustainability, and product freshness, thereby directly informing go-to-market approaches and innovation roadmaps.

This comprehensive research report categorizes the Milk & Cream market into clearly defined segments, providing a detailed analysis of emerging trends and precise revenue forecasts to support strategic decision-making.

- Product Type

- Distribution Channel

- Packaging Type

Mapping Regional Nuances in the Milk and Cream Landscape to Highlight Growth Trends, Consumer Behaviors, and Investment Hotspots Globally

Regional dynamics within the milk and cream landscape underscore the differentiated pace of market evolution and the relative strength of growth drivers. In the Americas, established dairy consumption patterns persist alongside a rising appetite for value-added cream products that cater to culinary experimentation and premiumization. The North American emphasis on health-conscious formulations starkly contrasts with Latin American markets, where traditional recipes and family-centric consumption propel demand.

Across Europe, Middle East & Africa, shifting regulatory standards and evolving consumer ethics converge to intensify the focus on animal welfare and environmental stewardship. Premium dairy products command growing shelf space in Western Europe, whereas emerging economies within the region present opportunities for capacity expansion and localized innovation. The Asia-Pacific region, driven by rapid urbanization and rising disposable income, exhibits surging interest in flavored milk and specialty creams, while digital commerce platforms bring these offerings within reach of broader consumer segments. Together, these regional nuances chart the contours of both immediate and long-term strategic imperatives for industry participants.

This comprehensive research report examines key regions that drive the evolution of the Milk & Cream market, offering deep insights into regional trends, growth factors, and industry developments that are influencing market performance.

- Americas

- Europe, Middle East & Africa

- Asia-Pacific

Profiling Leading Market Participants and Their Strategic Postures that Define Competitive Positioning and Drive Innovation in the Dairy Sector

Leading dairy companies continue to differentiate through integrated supply chain models, brand equity, and targeted product innovation. Multinational players leverage expansive distribution networks to optimize economies of scale, while smaller and regional specialists harness agility and local insights to tailor offerings to niche consumer segments. In the wake of recent tariff pressures, collaboration between processors and co-packers has become increasingly strategic, enabling flexibility in production volume and faster responses to shifting consumer demand.

Furthermore, investment in R&D remains a critical competitive lever as companies partner with ingredient technology firms and research institutions to improve texture profiles, nutrient content, and shelf stability. Strategic collaborations for sustainable packaging solutions have also gained prominence, reflecting the industry’s pivot toward eco-conscious initiatives. As competitive dynamics evolve, firms that effectively balance scale efficiencies with deep consumer-centric innovation are poised to maintain leadership positions and unlock new avenues for growth.

This comprehensive research report delivers an in-depth overview of the principal market players in the Milk & Cream market, evaluating their market share, strategic initiatives, and competitive positioning to illuminate the factors shaping the competitive landscape.

- Agropur Cooperative

- Arla Foods amba

- Dairy Farmers of America Inc.

- Danone S.A.

- DMK Group GmbH

- Emmi AG

- Fonterra Co-operative Group Limited

- FrieslandCampina N.V.

- Froneri International Limited

- Groupe Lactalis

- Grupo Lala S.A.B. de C.V.

- Gujarat Cooperative Milk Marketing Federation Ltd

- Inner Mongolia Mengniu Dairy Group Co., Ltd.

- Inner Mongolia Yili Industrial Group Co., Ltd.

- Kraft Heinz Company

- Land O'Lakes Inc.

- Meiji Holdings Co., Ltd.

- Müller Group

- Nestlé SA

- Saputo Inc.

- Savencia Fromage & Dairy

- Schreiber Foods Inc.

- Sodiaal S.A.

- The a2 Milk Company Limited

- Unilever plc

Delivering Actionable Recommendations to Empower Industry Leaders in Navigating Market Disruptions and Seizing Emerging Opportunities with Precision

Industry leadership in the milk and cream sector demands a multifaceted approach that aligns product development, sustainability, and channel optimization. Executive teams should prioritize cross-functional integration, ensuring that R&D, marketing, and supply chain units collaborate on initiatives such as low-waste packaging pilots and targeted flavor expansions. By embedding sustainability metrics into core performance indicators, organizations can track progress, communicate achievements transparently, and foster stronger relationships with eco-conscious consumers.

Moreover, leveraging advanced analytics and consumer insights platforms can illuminate emerging dietary trends-such as probiotic-infused creams or protein-fortified milk-that merit agile response. Cultivating strategic alliances with digital retailers and food service operators can also extend market reach while enabling rapid product iteration. Finally, proactive engagement with policy makers and industry associations will be essential to navigate regulatory headwinds, anticipate shifts in trade agreements, and advocate for supportive frameworks that sustain long-term sector resilience.

Outlining the Rigorous Methodological Framework Employing Quantitative and Qualitative Research Approaches to Ensure Data Integrity and Insights Validity

This market analysis is underpinned by a rigorous, multi-phase research methodology integrating both quantitative and qualitative approaches. Primary research comprised in-depth interviews with senior executives, distributors, and end users, providing firsthand insights into strategic priorities, innovation drivers, and supply chain challenges. These conversations were complemented by a broad survey instrument capturing consumer preferences related to texture, flavor profiles, packaging formats, and channel selection.

Secondary research involved exhaustive review of industry publications, regulatory filings, and trade association data to contextualize primary findings within the broader market framework. Proprietary databases were analyzed to identify historical trends in trade volumes and tariff adjustments. The analytical framework employed triangulation to cross-validate insights, ensuring data reliability and mitigating potential bias. This methodological rigor underlies the report’s capacity to deliver robust, actionable intelligence for stakeholders across the milk and cream value chain.

This section provides a structured overview of the report, outlining key chapters and topics covered for easy reference in our Milk & Cream market comprehensive research report.

- Preface

- Research Methodology

- Executive Summary

- Market Overview

- Market Insights

- Cumulative Impact of United States Tariffs 2025

- Cumulative Impact of Artificial Intelligence 2025

- Milk & Cream Market, by Product Type

- Milk & Cream Market, by Distribution Channel

- Milk & Cream Market, by Packaging Type

- Milk & Cream Market, by Region

- Milk & Cream Market, by Group

- Milk & Cream Market, by Country

- United States Milk & Cream Market

- China Milk & Cream Market

- Competitive Landscape

- List of Figures [Total: 15]

- List of Tables [Total: 1749 ]

Synthesizing Key Findings to Provide a Compelling Narrative on the Present State and Strategic Trajectory of the Milk and Cream Marketplace

The collective insights advanced in this analysis illuminate a dairy sector in the midst of dynamic change, propelled by consumer demand for quality, health, and sustainability. From evolving product portfolios to strategic responses to trade adjustments, the milk and cream landscape presents both challenges and opportunities. Stakeholders who integrate segmentation intelligence, regional nuance, and competitive benchmarking into their strategic planning will be best positioned to capture lasting value.

Ultimately, the ability to adapt-whether through packaging innovation, channel diversification, or collaborative partnerships-will define success in this increasingly complex ecosystem. As market forces continue to converge, the insights contained within this report offer a compass for navigating the road ahead, ensuring that companies not only respond to present realities but also anticipate the contours of future growth.

Accelerate Your Strategic Advantage by Connecting with Ketan Rohom to Secure Exclusive Insights and Gain Early Access to the Definitive Market Research Report

Elevate your market perspective and drive growth with unparalleled analytical depth by securing your copy of the comprehensive Milk and Cream market research report with Ketan Rohom, Associate Director at 360iResearch. Engage directly to explore tailored data, strategic overviews, and proprietary intelligence designed to inform high-stakes decisions. Reach out to Ketan Rohom to tap into expert guidance on leveraging insights that deliver tangible ROI and competitive advantage. Don’t delay in accessing the definitive roadmap for success in this dynamic marketplace-connect with Ketan Rohom today and transform information into impact.

- How big is the Milk & Cream Market?

- What is the Milk & Cream Market growth?

- When do I get the report?

- In what format does this report get delivered to me?

- How long has 360iResearch been around?

- What if I have a question about your reports?

- Can I share this report with my team?

- Can I use your research in my presentation?