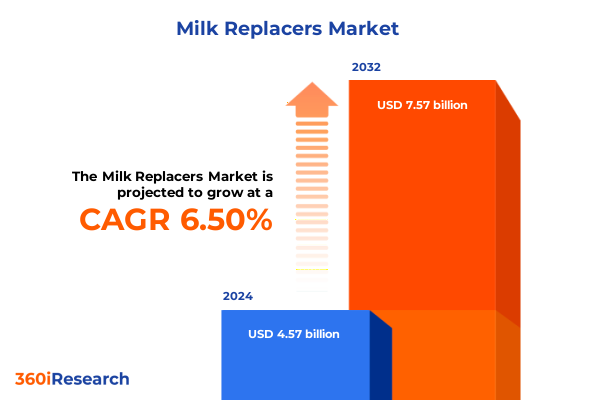

The Milk Replacers Market size was estimated at USD 4.86 billion in 2025 and expected to reach USD 5.17 billion in 2026, at a CAGR of 6.53% to reach USD 7.57 billion by 2032.

Establishing the Strategic Imperative of Milk Replacers in Modern Animal Nutrition and Emerging Market Opportunities and Dynamics

Milk replacers have evolved from simple nutritional substitutes into sophisticated formulations that play a pivotal role in neonatal care and weaning processes for livestock. As global demand for high-quality animal protein intensifies, producers have increasingly recognized the necessity of reliable and consistent feed solutions that support animal health, growth performance, and farm profitability. Contemporary milk replacers address a multitude of challenges, ranging from colostrum shortages and variable raw milk quality to labor constraints and biosecurity concerns associated with on-farm handling of fresh milk. Consequently, these specialized products have become integral to modern livestock operations seeking to minimize disease risk, standardize nutrition, and achieve greater operational predictability.

This report offers a comprehensive exploration of the milk replacer industry’s current state, examining the key drivers, transformative shifts, and influencing factors shaping this market. By delving into tariff implications, segmentation dynamics, regional variations, and competitive landscapes, stakeholders will gain an authoritative resource to support strategic planning. The ensuing sections unpack critical insights into how evolving regulatory frameworks, technological innovation, supply chain complexities, and end-user requirements converge to define emerging opportunities and challenges. Decision-makers, from executive leadership to product development teams, will find actionable intelligence that guides investment, partnership, and go-to-market strategies in this rapidly advancing domain.

Highlight the transformative shifts in the milk replacer landscape including technological advancements, sustainability mandates, and evolving preferences

The milk replacer landscape is undergoing a series of profound transformations driven by the convergence of technological progress, intensified sustainability mandates, and shifting producer preferences. Advances in ingredient science now enable formulators to develop highly specialized proteins, tailored fatty-acid profiles, and targeted immuno-support compounds. These innovations yield replacers that closely mimic mother’s milk characteristics while enhancing gut health, immune resilience, and post-weaning performance. Meanwhile, the rise of precision livestock farming introduces data-driven feeding systems that optimize feed dispensing, monitor intake patterns in real time, and facilitate rapid adjustment of nutritional plans, thereby strengthening the alignment between feed formulation and on-farm management.

Concurrently, environmental stewardship has emerged as a central concern, with producers and feed manufacturers alike seeking to reduce the carbon footprint of replacer production, packaging, and distribution. Initiatives to source sustainable ingredients, minimize waste, and implement eco-friendly packaging solutions have gained momentum, reflecting consumer demand for traceability and responsible supply chains. These strategic shifts are reinforced by tightening regulations and certification requirements across key markets. As a result, suppliers are compelled to innovate both at the ingredient level and within operational ecosystems, forging partnerships that integrate circular-economy principles and digital traceability solutions. Transitioning from traditional feed models, the industry is now characterized by agile, purpose-driven development and heightened collaboration among stakeholders.

Analyzing the cumulative impact of United States tariffs enacted in 2025 on import dynamics, production costs, and market positioning for milk replacers

In early 2025, the United States government introduced revised tariff policies on certain imported dairy-derived ingredients that directly influence the production costs of milk replacers. By increasing duties on skim milk powder, whey proteins, and specialty dairy fractions, these measures have altered the cost calculus for formulators who historically relied on competitive international sourcing. The immediate effect has been a recalibration of supplier relationships, with many manufacturers pivoting toward domestic ingredient suppliers or alternative protein sources to mitigate cost pressures. This shift has also prompted a reassessment of supply chain risk, particularly for companies with lean inventory models, necessitating closer collaboration with logistics providers and raw-material producers to secure stable access to critical components.

Beyond pricing dynamics, the tariff adjustments have reshaped competitive positioning. Smaller producers with localized operations have leveraged their proximity to dairy processors to offer shorter, more responsive supply chains, while larger multinationals have capitalized on diversified global networks to absorb tariff-related cost increases. End-users have begun demanding greater transparency regarding how tariff impacts are being managed, driving reformulations and longer-term contracts to lock in stable pricing. Regulatory authorities have also signaled the potential for further trade policy revisions, underscoring the need for market participants to remain agile. As a result, the 2025 tariff changes have not only influenced procurement strategies but have accelerated broader industry conversations about supply-chain resilience and strategic sourcing models.

Highlighting key insights across animal type segments, form distinctions, distribution channels, end user categories, and application scenarios in milk replacers

The diversity of milk replacer products is most apparent when considering the animal type segment, where formulations have been optimized for neonates ranging from calves to foals, lambs, and piglets. Within the calf segment, subtypes such as Brown Swiss, Holstein, and Jersey each exhibit unique nutritional requirements and metabolic profiles, prompting tailored protein and micronutrient blends that enhance growth uniformity and health outcomes. Transitioning to product form, manufacturers have refined both liquid concentrate and powder options to balance ease of use, storage stability, and reconstitution efficiency, thereby accommodating a wide spectrum of farm scales and infrastructure capacities.

Distribution channels further shape market dynamics, as offline venues including specialty stores, supermarkets, and veterinary clinics cater to producers seeking hands-on guidance and immediate availability, while online outlets such as direct-to-consumer websites and broader e-commerce platforms provide convenience, transparent pricing, and subscription models for recurring purchases. The role of end users is equally diverse, extending beyond dairy farms to encompass household use for companion animals, meat farms aiming to optimize weaning outcomes, and research institutions investigating novel ingredient matrices. Applications span primary replacement needs during early life, supplementary feeding regimens to bolster growth or immune support, and specialized weaning formulas designed to facilitate smooth dietary transition. By examining these intertwined segmentation dimensions, stakeholders can pinpoint high-potential niches, refine go-to-market approaches, and align product portfolios with evolving customer demands.

This comprehensive research report categorizes the Milk Replacers market into clearly defined segments, providing a detailed analysis of emerging trends and precise revenue forecasts to support strategic decision-making.

- Animal Type

- Form

- Distribution Channel

- End User

- Application

Delving into regional variations across the Americas, Europe, Middle East & Africa, and Asia-Pacific to uncover growth drivers and challenges in milk replacers

The Americas continue to lead in milk replacer adoption, with North American and Brazilian producers emphasizing uniform calf rearing protocols that reduce morbidity and enhance productivity. In these markets, supportive government programs focused on livestock health and safe feed practices have accelerated the transition from traditional colostrum reliance to standardized replacers. Shifts in consumer diets toward high-quality protein have also trickled down to farm-level imperatives, encouraging meat-producing operations to incorporate specialized weaning formulas that improve post-weaning weight gains and reduce stress-related setbacks.

Across Europe, the Middle East, and Africa, regulatory harmonization efforts around animal welfare and feed safety have stimulated demand for certified organic and non-GMO replacer formulations. Suppliers are innovating in locally sourced ingredients, collaborating with regional partners to comply with stringent traceability requirements and sustainability standards. This region also presents opportunities in emerging markets, where rising disposable incomes and modernization of pastoral systems are driving initial adoption among smallholder dairy and meat producers.

In Asia-Pacific, rapid population growth combined with surging protein consumption has spurred investment in domestic production capacities for both base ingredients and finished replacer products. Nations such as China, India, and Australia are expanding research collaborations to develop cost-effective formulations tailored to local climate, breed-specific needs, and feedstock availability. Digital platforms enabling direct sales to remote farming communities are gaining traction, bridging distribution gaps and offering targeted education on best-practice feeding protocols.

This comprehensive research report examines key regions that drive the evolution of the Milk Replacers market, offering deep insights into regional trends, growth factors, and industry developments that are influencing market performance.

- Americas

- Europe, Middle East & Africa

- Asia-Pacific

Offering strategic perspectives on competitive dynamics, innovation approaches, partnership trends, and portfolio positioning among top milk replacer companies

Global leaders in the milk replacer space have distinguished themselves through continuous product innovation, investing heavily in R&D to deliver advanced protein matrices, functional lipid carriers, and precision-nutrient dosing. Strategic partnerships with biotechnology firms have enabled these companies to incorporate novel dairy alternatives and bioactive compounds, thereby broadening their value propositions. Brand reputation and long-standing relationships with large-scale farms have cemented their status, though they face ongoing pressure to demonstrate agility in adapting to emerging tariff environments and sustainability requirements.

Mid-tier companies are carving out strong footholds by focusing on specialized segments such as organic or species-specific replacers, leveraging niche expertise and regional manufacturing facilities to cater to localized demand. Their collaborative alliances with feed distribution networks provide them with essential channels to reach both urban and rural producers, while cost-competitive formulations allow them to undercut premium offerings without sacrificing quality.

Meanwhile, emerging players and start-ups are disrupting traditional paradigms through lean operations, digital marketing strategies, and direct engagement models that offer subscription-based delivery on D2C platforms. By tapping into digital traceability tools and offering transparent ingredient sourcing, these innovators appeal to conscientious producers seeking both performance and ethical credentials. Their agile approach to product development and flexible supply-chain integrations positions them as formidable challengers in the evolving competitive landscape.

This comprehensive research report delivers an in-depth overview of the principal market players in the Milk Replacers market, evaluating their market share, strategic initiatives, and competitive positioning to illuminate the factors shaping the competitive landscape.

- Actus Nutrition

- Agrofeed

- Alltech, Inc.

- Archer-Daniels-Midland Company

- Cargill, Incorporated

- Continental Milkose India Ltd

- DeLaval International AB

- Denkavit Futtermittel GmbH

- Elvor S.A.

- EW Nutrition GmbH

- Farmerfresh Foods Private Limited.

- ForFarmers N.V.

- Kaesler Nutrition GmbH

- Masterfeeds LP

- Milk Specialties Global, LLC

- Nukamel International B.V.

- Nutrifeed B.V.

- Purina Animal Nutrition LLC

- Trouw Nutrition B.V.

- Volac International Ltd

Providing industry leaders strategic guidance to explore new growth avenues, advance sustainability practices, and streamline supply chains in milk replacers

Industry leaders seeking to capitalize on the momentum in milk replacers should explore new ingredient partnerships that diversify protein sources and optimize nutrient density. By forging alliances with suppliers of plant-based or microbial-derived lactose analogs, companies can mitigate reliance on traditional dairy fractions and enhance product differentiation. In parallel, embedding sustainability criteria into ingredient selection-such as verified carbon-neutral processing and upcycled byproducts-will resonate with environmentally focused stakeholders and meet evolving regulatory expectations.

It is essential to streamline supply chains by establishing multi-tier supplier agreements and buffer inventories for critical components, thereby reducing exposure to sudden tariff adjustments or logistical disruptions. Leaders are advised to implement agile forecasting models and invest in digital tools that provide real-time visibility into inventory flows. Moreover, prioritizing operational excellence through continuous process optimization and quality management systems can lower production costs and shorten time to market. Finally, dedicating resources to customer education-via digital channels and on-farm training programs-will strengthen brand loyalty and accelerate adoption of advanced replacer formulations.

Outlining a robust research framework blending expert interviews, secondary data analysis, and methodological triangulation to ensure reliable market insights

The insights presented in this analysis are grounded in a robust research framework that integrates qualitative and quantitative methods. Primary interviews with C-suite executives, technical directors, and leading veterinarians across multiple regions provided firsthand perspectives on emerging challenges, investment priorities, and regulatory developments. These conversations were complemented by comprehensive secondary data analysis, drawing on industry publications, regulatory filings, and global trade databases to map supply-chain movements and policy shifts.

To ensure the validity and reliability of our findings, triangulation techniques were employed, cross-referencing insights from subject-matter experts, documented case studies, and financial disclosures. Trend-mapping tools and scenario-planning exercises further enriched the analysis, allowing for the identification of potential inflection points and strategic contingencies. This methodological rigor ensures that the conclusions and recommendations herein are supported by a multifaceted evidence base, offering stakeholders a dependable roadmap for navigating the complexities of the milk replacer market.

This section provides a structured overview of the report, outlining key chapters and topics covered for easy reference in our Milk Replacers market comprehensive research report.

- Preface

- Research Methodology

- Executive Summary

- Market Overview

- Market Insights

- Cumulative Impact of United States Tariffs 2025

- Cumulative Impact of Artificial Intelligence 2025

- Milk Replacers Market, by Animal Type

- Milk Replacers Market, by Form

- Milk Replacers Market, by Distribution Channel

- Milk Replacers Market, by End User

- Milk Replacers Market, by Application

- Milk Replacers Market, by Region

- Milk Replacers Market, by Group

- Milk Replacers Market, by Country

- United States Milk Replacers Market

- China Milk Replacers Market

- Competitive Landscape

- List of Figures [Total: 17]

- List of Tables [Total: 1431 ]

Drawing together insights on market drivers, shifts, tariffs, segmentation, and regional perspectives to underscore the strategic significance of milk replacers

The evolving milk replacer market is shaped by a blend of technological breakthroughs, policy realignments, and shifting end-user demands. Rapid advancements in formulation science have enabled more precise nutrient delivery, fostering improvements in neonatal animal health and post-weaning outcomes. Concurrently, 2025 tariff adjustments have prompted strategic sourcing shifts and underscored the critical importance of supply-chain resilience. At the same time, comprehensive segmentation analysis reveals differentiated growth trajectories across animal types, form factors, distribution channels, and end-user contexts, highlighting areas for targeted product development and go-to-market focus.

Regional assessments demonstrate that the Americas maintain a leadership position backed by supportive policy frameworks and high adoption rates, while EMEA markets emphasize regulatory compliance and sustainability credentials. Asia-Pacific continues to exhibit robust expansion driven by rising protein consumption and investments in local manufacturing capabilities. Competitive dynamics span established global leaders, agile mid-tier specialists, and digitally native disruptors, each leveraging unique strengths to capture stakeholder attention. Drawing together these insights, it is clear that stakeholders who proactively adapt to regulatory shifts, harness innovation partnerships, and refine segmentation strategies will be best positioned to unlock sustained value in the milk replacer sector.

Engage with our Associate Director to unlock exclusive access to comprehensive milk replacer market research insights and drive informed strategic decisions

For a deeper dive into these insights and to secure the complete milk replacer market research report, we encourage you to connect with our Associate Director of Sales & Marketing, Ketan Rohom. He brings extensive expertise in translating complex industry data into actionable strategies tailored to your organization’s objectives.

Engaging with Ketan will provide you personalized guidance on navigating emerging trends, optimizing product portfolios, and leveraging regional opportunities. Don’t miss the opportunity to equip your team with the in-depth analysis and tactical recommendations needed to maintain a competitive edge in the evolving milk replacer landscape.

- How big is the Milk Replacers Market?

- What is the Milk Replacers Market growth?

- When do I get the report?

- In what format does this report get delivered to me?

- How long has 360iResearch been around?

- What if I have a question about your reports?

- Can I share this report with my team?

- Can I use your research in my presentation?