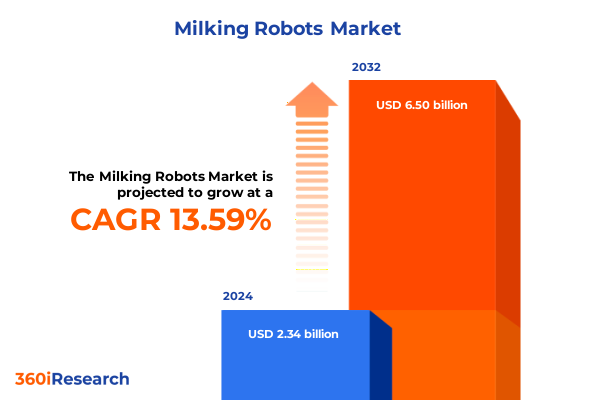

The Milking Robots Market size was estimated at USD 2.65 billion in 2025 and expected to reach USD 2.98 billion in 2026, at a CAGR of 13.62% to reach USD 6.50 billion by 2032.

Milking Robots are Revolutionizing Dairy Farming by Delivering Unprecedented Precision Efficiency Labor Optimization and Enhanced Animal Welfare

The adoption of milking robots marks a paradigm shift in modern dairy farming, driven by the convergence of technological innovation and evolving operational priorities. Rising labor costs and a global shortage of skilled farm workers have propelled farm operators to seek automated solutions that maintain consistent milking schedules while reducing human intervention. In parallel, growing awareness around animal welfare standards has underscored the importance of gentle, precise handling techniques that robotics can deliver through advanced sensors and adaptive algorithms. Consequently, dairy producers are increasingly leveraging robotic systems to streamline workflows and elevate herd health management.

Moreover, the integration of real-time data collection and connectivity features within milking robots has ushered in a new era of farm intelligence. Herd-level analytics provide actionable insights into milk yield trends, udder health metrics, and individual cow behavior, enabling dairy managers to implement targeted interventions and preventive measures. This data-driven approach not only enhances productivity but also supports compliance with regulatory frameworks governing food safety and quality assurance. As a result, robotic milking is rapidly evolving from niche deployments into core dairy infrastructure across operations of all sizes.

Transitioning from traditional parlor-based arrangements, industry leaders are now focusing on modular, scalable robotic solutions that accommodate diverse barn configurations and herd management strategies. The flexibility of robotic systems allows farms to expand capacity incrementally, matching technology adoption with herd growth and capital availability. In doing so, milking robots are redefining efficiency benchmarks, fostering sustainable resource utilization, and positioning dairy operations to meet the demands of an increasingly competitive and regulated marketplace.

From Manual Milking Practices to Intelligent Automation Dairy Farms Are Experiencing a Transformation in Operational Efficiency Sustainability and Productivity

Dairy automation has progressed through successive transformative phases, each building upon the lessons of its predecessor to unlock greater operational efficiencies. Initially, conventional milking parlors introduced mechanization in the 20th century, yet these systems remained constrained by centralized infrastructure and labor-intensive workflows. The next wave saw the advent of robotic milking stalls in the early 2000s, which decoupled milking events from human schedules by allowing cows to enter stalls voluntarily. This pioneering approach demonstrated the feasibility of continuous, cow-centric milking, paving the way for broader automation efforts.

In recent years, smart robotics have further redefined the milking landscape by integrating machine vision, artificial intelligence, and cloud-based analytics. These advancements enable robots to identify individual animals, adjust milking parameters dynamically, and detect subtle changes in milk composition and flow rates. As a result, proactive herd health interventions and predictive maintenance routines have become standard practice, minimizing downtime and enhancing overall system reliability. Furthermore, seamless connectivity between robots and farm management platforms consolidates operational data across feed, breeding, and milking processes, fostering a holistic view of dairy performance.

Looking ahead, emerging technologies such as collaborative mobile robots, autonomous cleaning units, and augmented reality maintenance tools are poised to deliver the next leap in dairy farm innovation. By orchestrating end-to-end automation-from feed preparation to milking to barn sanitation-these solutions will empower producers to optimize resource allocation, reduce environmental impact, and future-proof their businesses against evolving market and regulatory pressures. Consequently, the landscape of dairy farming is undergoing a fundamental transformation from manual routines to intelligent, interconnected operations.

Navigating the Ripple Effects of 2025 U.S. Trade Policies on Dairy Robotics Supply Chains Operational Costs and Strategic Sourcing

The introduction of new trade measures in 2025 has significantly altered the economics of supplying and deploying milking robots across North America. Notably, U.S. tariffs applied under Section 301 on select Chinese machinery and components have reached rates as high as 34 percent, while duties enacted under Section 232 on steel and aluminum have further compounded manufacturing costs. These levies have translated into materially higher prices for key robot subsystems, including precision sensors and high-torque actuators, disrupting established procurement strategies and creating budgetary pressure for both original equipment manufacturers and end users. As a result, stakeholders across the dairy sector are reevaluating sourcing decisions and exploring alternative vendor partnerships to mitigate cost inflation.

Moreover, smaller dairy operations and mid-sized cooperatives have exhibited a cautious stance toward fresh capital investments in automation, given the uncertainty surrounding long-term tariff stability. Reports indicate that robotic deployment rates plateaued in early 2025 as prospective buyers delayed procurement pending clarity on duty relief measures and potential market adjustments. In parallel, service providers offering "robots-as-a-service" models experienced increased demand as producers sought to avoid large upfront expenditures, opting instead for usage-based arrangements that transfer tariff risk onto the supplier. This shifting procurement paradigm has underscored the need for flexible financing solutions and tailored maintenance agreements that align with evolving trade policy dynamics.

In response to these challenges, the Office of the United States Trade Representative initiated an exclusion process in late 2024 for specific categories of machinery used in domestic manufacturing, opening an avenue for milking robot components to obtain temporary duty relief. Eligible parties have until March 31, 2025, to petition for exemptions, prompting robot OEMs and component suppliers to submit detailed technical justifications. As companies navigate this administrative avenue, many are simultaneously accelerating efforts to diversify supply chains, including nearshoring critical electronics to Mexico and investing in U.S.-based assembly capabilities. Such strategic shifts aim to reduce exposure to tariff volatility and cement more resilient supply chain architectures for the dairy robotics industry.

Unpacking Market Dynamics Across Product Typology System Configurations Herd Size Distribution Channels Component Layers and Installation Variants for Milking Robots

The milking robot market is differentiated across multiple dimensions that reflect variations in technological form factors, operational requirements, and service frameworks. Product types range from agile, robotic arm systems-favored for their precision within constrained parlor footprints-to cabin-style robots that provide enclosed milking environments and integrated hygiene modules. System configurations further expand choice by offering lateral designs that guide the robot along the side of each cow, parallel layouts that service animals in single-file arrangements, and rotary platforms engineered for high-throughput herds.

Additionally, herd size considerations play a pivotal role in selecting an appropriate solution. Large-scale operations typically gravitate toward fully integrated, multi-unit installations that optimize capacity utilization and data centralization. Mid-size farms frequently adopt hybrid models, combining a handful of robotic units with conventional parlors to balance throughput with capital expenditure. Meanwhile, smallholdings often prioritize modular, pay-per-use frameworks that allow incremental adoption without the need for extensive barn renovations.

Distribution channels encompass established dealer networks, direct OEM sales, and emerging online platforms. Dealers provide hands-on support and localized expertise, while direct sales facilitate customized solution design and end-to-end project management. Online marketplaces are gaining traction by offering plug-and-play kits and remote setup assistance. The component ecosystem underpins these offerings, with hardware segments-encompassing actuators, controllers, and sensors-complemented by service tiers covering corrective, predictive, and preventive maintenance. Software capabilities span analytics modules, comprehensive farm management suites, and dedicated maintenance platforms that coordinate upkeep workflows.

Finally, installation modalities range from greenfield implementations to retrofit scenarios. New installations afford farms the opportunity to build barns around robotic workflows, whereas retrofits-available in multi-stall and single-stall variants-enable integration into existing structures. This layered segmentation matrix illustrates the complex decision framework that dairy operators navigate as they align robotic capabilities with their unique operational, financial, and technical imperatives.

This comprehensive research report categorizes the Milking Robots market into clearly defined segments, providing a detailed analysis of emerging trends and precise revenue forecasts to support strategic decision-making.

- Product Type

- System Type

- Herd Size

- Distribution Channel

- Component

- Installation Type

Analyzing Regional Adoption Trends in the Americas Europe Middle East Africa and Asia-Pacific Highlighting Key Growth Drivers and Investment Hotspots

Across the Americas, investment in dairy automation has accelerated as producers face mounting labor scarcity and regulatory pressures to enhance animal health monitoring. In the United States and Canada, high-input costs coupled with industry consolidation have driven large cooperatives to deploy multi-unit robotic installations that deliver both scale efficiencies and traceability gains. Mexico’s emerging dairy sector also shows growing interest in modular robotics as farmers seek to boost margins amid competitive export markets.

In Europe, the Middle East, and Africa, stringent environmental regulations and subsidy frameworks under the European Union’s Common Agricultural Policy have spurred adoption of robots capable of precise nutrient management and waste reduction. Nations such as the Netherlands and Germany, where dairy operations are highly mechanized, lead the region in deploying advanced sensor-driven systems. Meanwhile, smaller markets in Eastern Europe are beginning to pilot entry-level robots to address rural labor shortages and improve milk quality under strict hygiene standards.

The Asia-Pacific region exhibits diverse trajectories, with New Zealand and Australia at the forefront due to their high-value export-oriented dairy industries. Government incentives for precision agriculture have propelled uptake of data-integrated milking robots that support pasture-based systems. Conversely, in China and India, rapid herd expansion and escalating labor costs are prompting large-scale farms to trial automation, though widespread adoption remains tempered by infrastructure gaps and fragmented distribution networks. Throughout the region, partnerships between local integrators and global OEMs are emerging to customize solutions that align with unique farming practices and climatic conditions.

This comprehensive research report examines key regions that drive the evolution of the Milking Robots market, offering deep insights into regional trends, growth factors, and industry developments that are influencing market performance.

- Americas

- Europe, Middle East & Africa

- Asia-Pacific

Profiling Leading Innovators Shaping the Milking Robot Landscape Through Strategic Partnerships Disruptive Technologies and Competitive Positioning

Leading the charge in milking robot innovation, several companies have cemented their positions through strategic product portfolios and collaborative ventures. A prominent global OEM distinguished itself by pioneering the first commercially viable farm-style robotic unit in the late 1990s, continually refining its design to offer modular expansions and advanced animal identification capabilities. A second market leader, backed by an established dairy equipment legacy, has leveraged its extensive service network to deliver turnkey installations and subscription-based maintenance programs that enhance uptime and system longevity.

Other players have carved niches by integrating cutting-edge analytics into their robotics platforms. One innovator has focused on cloud-enabled software that aggregates herd performance data across multiple sites, enabling real-time benchmarking and AI-driven health diagnostics. Another specialist has introduced a sensor-rich cabin concept, combining automated udder cleaning with gentle vacuum modulation to optimize milking comfort and yield consistency.

Emerging companies are also reshaping competitive dynamics through cross-industry partnerships. Collaborations between robotics OEMs and semiconductor manufacturers are accelerating the development of compact, high-efficiency actuator systems, while alliances with agritech software providers are enabling holistic farm management suites. Additionally, a growing cadre of technology startups is exploring novel financing models-such as outcome-based leasing arrangements-that lower entry barriers for smaller producers. Collectively, these initiatives underscore a vibrant ecosystem characterized by continuous innovation, strategic incumbency, and evolving service paradigms.

This comprehensive research report delivers an in-depth overview of the principal market players in the Milking Robots market, evaluating their market share, strategic initiatives, and competitive positioning to illuminate the factors shaping the competitive landscape.

- AktivPuls GmbH

- Allflex Livestock Intelligence by Merck & Co., Inc.

- AMS Galaxy USA

- BouMatic Gascoigne Melotte SPRL

- Chadha Sales Pvt Ltd

- Dairymaster

- Daviesway Pty Ltd.

- DeLaval Holding AB

- Delmer Group

- Fullwood Ltd.

- GEA Group Aktiengesellschaft

- Gemak Engineering Solutions

- Hanskamp AgroTech

- Hokofarm Group

- Ksheera Enterprises

- Lely International N.V.

- Madero Dairy Systems S. A.

- Mahesh Eng. Works

- Melasty

- MilkMan Dairy Equipment

- Milkomax, Solutions laitières inc.

- Milkwell Milking Systems

- miRobot

- Patel Brothers

- Paul Mueller Company

- Pearson Milking Technology

- System Happel GmbH

- Vansun Technologies Pvt. Ltd.

- Waikato Milking Systems NZ LP

Empowering Dairy Industry Leaders with Strategic Roadmaps for Technology Integration Workforce Development Operational Excellence and Sustainable Growth

Industry leaders must first establish a comprehensive technology roadmap that aligns automation investments with farm growth trajectories and operational objectives. By conducting pilot deployments that emphasize scalability and interoperability, decision-makers can validate system compatibility before committing to full-scale rollouts. In addition, fostering collaborative partnerships with robotics OEMs, system integrators, and component suppliers will ensure access to the latest product enhancements and service innovations.

Furthermore, prioritizing workforce development is essential to maximize the value of robotic installations. Training programs that equip farm personnel with skills in robot operation, basic troubleshooting, and data interpretation will drive higher utilization rates and enable early detection of performance anomalies. Concurrently, integrating predictive maintenance protocols-leveraging IoT-enabled sensors and remote diagnostics-can reduce downtime and extend equipment lifecycle costs.

To mitigate trade-related risks, executives should explore strategic sourcing strategies that balance tariff exposure with quality and lead-time considerations. This includes pursuing exemptions under official duty relief processes and diversifying supplier portfolios to incorporate nearshoring options. Equally important is the adoption of robust data governance frameworks that secure sensitive performance metrics while enabling seamless integration with broader farm management platforms. By coupling these measures with continuous monitoring of policy developments, dairy operations can maintain agility in the face of evolving regulatory and economic landscapes.

Understanding the Rigorous Research Approach to Data Collection Analysis Validation and Expert Engagement Ensuring Credibility of Milking Robot Market Insights

This research framework combines comprehensive primary and secondary methodologies to ensure the validity and relevance of insights. Primary data was collected through in-depth interviews with dairy producers, robotics OEM executives, system integrators, and channel partners across key markets. These discussions provided firsthand perspectives on technology adoption drivers, operational challenges, and strategic imperatives.

Secondary research involved an extensive review of industry publications, regulatory filings, technical white papers, and trade association reports. Publicly available databases from government agencies and international trade bodies were analyzed to contextualize tariff policies and regional investment trends. Proprietary company filings and investor presentations supplemented this information, offering detailed disclosures on product roadmaps and strategic initiatives.

Data triangulation was employed to cross-verify findings from multiple sources, enhancing accuracy and minimizing bias. An expert validation panel comprising agronomy specialists, automation engineers, and financial analysts provided critical reviews of preliminary conclusions. Quality assurance processes included consistency checks, gap analysis, and peer reviews to refine the final report structure. By adhering to these rigorous research protocols, the study delivers actionable intelligence that reflects the dynamic evolution of the milking robot market.

This section provides a structured overview of the report, outlining key chapters and topics covered for easy reference in our Milking Robots market comprehensive research report.

- Preface

- Research Methodology

- Executive Summary

- Market Overview

- Market Insights

- Cumulative Impact of United States Tariffs 2025

- Cumulative Impact of Artificial Intelligence 2025

- Milking Robots Market, by Product Type

- Milking Robots Market, by System Type

- Milking Robots Market, by Herd Size

- Milking Robots Market, by Distribution Channel

- Milking Robots Market, by Component

- Milking Robots Market, by Installation Type

- Milking Robots Market, by Region

- Milking Robots Market, by Group

- Milking Robots Market, by Country

- United States Milking Robots Market

- China Milking Robots Market

- Competitive Landscape

- List of Figures [Total: 18]

- List of Tables [Total: 1590 ]

Harnessing the Synergy of Intelligent Milking Robots and Dairy Operations to Forge a Sustainable High-Efficiency Future of Animal Welfare and Productivity

As dairy operations navigate the complexities of rising labor costs, evolving animal welfare standards, and global trade uncertainties, milking robots have emerged as a cornerstone technology for future resilience. By harnessing automation and analytics, producers can achieve consistent milking performance, improved herd health tracking, and streamlined maintenance workflows. The interplay between hardware innovation and software intelligence is driving a fundamental shift in how dairy farms operate, enabling data-driven decision-making at every stage of production.

Ultimately, the capacity to scale robotic deployments in alignment with herd expansion and regulatory changes will determine long-term competitiveness. By embracing modular system architectures and flexible procurement strategies, dairy stakeholders can optimize capital allocation while maintaining agility in response to market and policy shifts. Through informed engagement with research insights and strategic partnerships, industry participants are well positioned to unlock the full potential of robotic milking solutions, transforming dairy farming into a more sustainable, efficient, and profitable enterprise.

Unlock Exclusive Insights into the Milking Robot Market by Connecting with Ketan Rohom to Explore Customized Research Solutions and Drive Strategic Decisions

For a deep dive into the transformative forces shaping the milking robot market and to access exclusive research findings tailored to your strategic needs, reach out to Ketan Rohom. As Associate Director of Sales & Marketing, Ketan brings extensive industry expertise and a consultative approach to help you evaluate market opportunities and refine your growth initiatives. Engage in a personalized discussion to explore in-depth competitive benchmarks, emerging technology assessments, and customized data sets that will empower your decision-making. Connect with Ketan to secure your copy of the full market research report and gain the actionable intelligence necessary to stay ahead in the rapidly evolving dairy automation space. Take the next step toward informed investments and strategic partnerships by contacting Ketan today

- How big is the Milking Robots Market?

- What is the Milking Robots Market growth?

- When do I get the report?

- In what format does this report get delivered to me?

- How long has 360iResearch been around?

- What if I have a question about your reports?

- Can I share this report with my team?

- Can I use your research in my presentation?