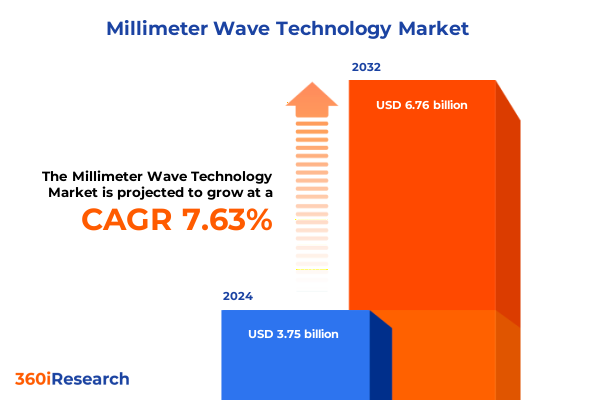

The Millimeter Wave Technology Market size was estimated at USD 3.98 billion in 2025 and expected to reach USD 4.22 billion in 2026, at a CAGR of 7.85% to reach USD 6.76 billion by 2032.

Understanding the Millimeter Wave Technology Revolution and Its Converging Role Across Connectivity Imaging and Sensing

Millimeter wave technology has rapidly evolved from a niche research topic into a cornerstone of high-performance wireless communications, sensing, and imaging solutions. Characterized by spectrum bands spanning roughly 24 to above 60 gigahertz, these frequencies offer unprecedented bandwidth capacity despite their limited propagation range. Advances in semiconductor processes, antenna design, and beamforming algorithms have mitigated inherent challenges such as path loss and atmospheric absorption, unlocking new possibilities across consumer, industrial, and defense sectors. As the industry transitions from traditional sub-6 gigahertz deployments to these higher bands, stakeholders are compelled to reassess network architectures and device capabilities.

Moreover, regulatory bodies around the world have begun to allocate additional mmWave spectrum, paving the way for broader commercial roll-outs. This convergence of technological maturity and policy alignment has fostered robust ecosystem development-from chipset manufacturers and module integrators to system architects and end-equipment suppliers. Consequently, organizations now face the imperative to invest in both R&D and ecosystem partnerships to capture value in emerging application domains. With connectivity demands intensifying and new use cases materializing, a deep understanding of the millimeter wave landscape becomes essential for informed strategic planning and competitive differentiation.

Identifying Key Technological Innovations and Strategic Inflection Points Redefining the Millimeter Wave Ecosystem for Global Connectivity

The millimeter wave arena has witnessed transformative shifts driven by breakthroughs in device miniaturization, signal processing, and network densification. Innovations in advanced packaging techniques and heterogeneous integration have enabled complex antenna arrays and adaptive beam management to fit within the form factors of smartphones, vehicles, and compact sensors. Meanwhile, machine-learning-based channel estimation and interference mitigation have elevated link reliability, fostering new service levels for enhanced mobile broadband and ultra-reliable low-latency communications.

Concurrently, the expansion of satellite constellations and high-resolution imaging platforms has broadened the horizon for mmWave applications, extending far beyond terrestrial networks. Radar systems have evolved to support diverse automotive safety features and defense surveillance imperatives, while security and surveillance technologies exploit fine-grained resolution capabilities for perimeter monitoring and gesture recognition. These strategic inflection points underscore a convergence of verticals, where connectivity, sensing, and data analytics coalesce to redefine business models and user experiences.

How Recent US Trade Measures Have Reshaped Supply Chains and Investment Dynamics within the Millimeter Wave Technology Market

Over the past year, new US trade measures targeting semiconductor equipment and manufacturing inputs have introduced pronounced shifts across the millimeter wave value chain. Import tariffs on advanced substrates and precision components have elevated sourcing complexity for chipset and module makers, compelling many to diversify suppliers and invest in localized production capabilities. Consequently, lead times and unit costs have exhibited upward pressure, prompting original equipment manufacturers and network operators to reassess total cost of ownership and procurement strategies.

This environment has also stimulated vertical integration trends, with several technology vendors acquiring or partnering with domestic fabrication facilities to secure critical inputs. Investment in research and testing facilities on home soil has accelerated, driven by incentives aimed at reshoring high-precision manufacturing. Meanwhile, equipment vendors have responded by optimizing design-to-production workflows to reduce dependency on affected supply corridors. In parallel, end users have begun to adopt more modular architectures that allow component substitutions without extensive system redesigns. Collectively, these adaptations reveal a market in flux-one where agility and supply-chain resilience have become as vital as performance metrics.

Unveiling Critical Insights from Diverse Market Segmentations Spanning Application Component Type End User Deployment and Frequency Bands

The market’s multifaceted nature becomes evident when examined through its principal segmentations. Application domains encompass 5G access, high-resolution imaging, radar operations, satellite communications, and security and surveillance. Within the 5G access sphere, enhanced mobile broadband, massive machine-type communications, and ultra-reliable low-latency communications each exhibit distinct performance and deployment considerations. In the radar category, applications bifurcate into automotive radar designed for collision avoidance and advanced driver assistance, alongside defense radar systems engineered for long-range detection and tracking.

On the component front, product portfolios span antennas, chipsets, connectors, and integrated modules, each playing a pivotal role in system performance and interoperability. End-user verticals range from aerospace and defense applications with stringent reliability requirements to consumer electronics products that prioritize compactness and power efficiency, as well as automotive, healthcare, and telecom use cases that balance performance with cost. Deployment modalities further diversify market dynamics: indoor solutions address capacity and coverage in dense urban environments, while outdoor systems contend with weather resilience and line-of-sight constraints. Lastly, frequency band segmentation-from 24 to 30 gigahertz through bands above 60 gigahertz-dictates regulatory frameworks, ecosystem readiness, and use-case suitability.

This comprehensive research report categorizes the Millimeter Wave Technology market into clearly defined segments, providing a detailed analysis of emerging trends and precise revenue forecasts to support strategic decision-making.

- Component Type

- Deployment

- Frequency Band

- Application

- End User

Exploring Regional Dynamics and Growth Drivers across the Americas Europe Middle East Africa and Asia Pacific Millimeter Wave Sector

Geographical analysis reveals pronounced distinctions in adoption momentum, regulatory frameworks, and infrastructure investment. In the Americas, robust government funding programs and progressive spectrum auctions have accelerated commercial roll-outs, particularly in urban corridors where demand for high-speed connectivity is intensifying. North American automotive manufacturers have spearheaded radar integration into next-generation vehicles, leveraging local manufacturing clusters to streamline component sourcing.

Across Europe, the Middle East, and Africa, regulatory harmonization efforts have facilitated cross-border deployments, yet spectrum fragmentation remains a challenge in certain jurisdictions. Nevertheless, defense and aerospace stakeholders in key European nations continue to advance mmWave research, underpinned by collaborative consortia and public-private partnerships. In the Middle East and Africa, infrastructure projects tied to smart city initiatives and digital transformation agendas are positioning these markets as emerging hubs for satellite link deployments and advanced surveillance applications.

The Asia-Pacific region displays the broadest spectrum of activity and the most aggressive roll-out schedules. National policies in several markets have incentivized domestic chip production, while leading telecom operators in East Asia have launched multiple mmWave 5G services. Furthermore, Asia-Pacific consumer electronics suppliers are integrating mmWave modules into flagship devices at an unprecedented pace, catalyzing ecosystem maturity and cost reductions through high-volume manufacturing.

This comprehensive research report examines key regions that drive the evolution of the Millimeter Wave Technology market, offering deep insights into regional trends, growth factors, and industry developments that are influencing market performance.

- Americas

- Europe, Middle East & Africa

- Asia-Pacific

Profiling Leading Industry Players and Their Strategic Initiatives Driving Innovation and Competitive Differentiation in Millimeter Wave Solutions

Leading technology firms have embarked on strategic initiatives to fortify their competitive positions within the millimeter wave landscape. Several chip suppliers have expanded wafer fab capacities and formed alliances with photonics specialists to develop hybrid silicon processes that boost performance while controlling thermal footprints. At the same time, antenna innovators are co-designing beamforming networks with chipset makers to optimize end-to-end transceiver efficiency and simplify integration for module vendors.

System integrators and telecom equipment providers are leveraging field trials and interoperability testbeds to validate multi-vendor solutions and expedite time to market. Partnerships between satellite operators and ground station manufacturers have yielded turnkey backhaul systems, blending terrestrial mmWave connectivity with spaceborne links. Automotive OEMs are collaborating with radar specialists to embed advanced sensors into platform architectures, creating new safety features and autonomous driving enablers. Across these efforts, intellectual property portfolios are expanding through targeted acquisitions of RF design houses and open-waveguide innovators, underscoring the critical role of R&D investments in maintaining differentiation.

This comprehensive research report delivers an in-depth overview of the principal market players in the Millimeter Wave Technology market, evaluating their market share, strategic initiatives, and competitive positioning to illuminate the factors shaping the competitive landscape.

- Anritsu Corporation

- Cisco Systems, Inc.

- Dalian Iflabel Technology Co., Ltd.

- ELVA-1 Microwave Handelsbolag

- Farran Technology Ltd.

- Fujitsu Limited

- Huawei Technologies Co., Ltd.

- Keysight Technologies, Inc.

- Mitsubishi Electric Corporation

- Movandi Corporation

- NEC Corporation

- Nokia Corporation

- Nuctech Company Limited

- NXP Semiconductors N.V.

- Qorvo, Inc.

- Qualcomm Incorporated

- Rohde & Schwarz GmbH & Co KG

- Samsung Electronics Co., Ltd.

- Siklu Communications, Ltd. by Ceragon

- Sumitomo Electric Industries, Ltd.

- Tamagawa Holdings Co., Ltd.

- Telefonaktiebolaget LM Ericsson

- Texas Instruments Incorporated

- Viavi Solutions Inc.

- Vubiq Networks, Inc.

Actionable Strategies for Industry Stakeholders to Leverage Technological Advances and Evolving Market Forces in Millimeter Wave Deployment

To capitalize on mmWave’s transformative potential, industry stakeholders must adopt a multifaceted approach that balances technology development, ecosystem collaboration, and regulatory engagement. First, prioritizing modular design practices can enable rapid substitution of components in response to evolving trade conditions or performance breakthroughs. This architectural flexibility not only mitigates supply-chain disruption risks but also accelerates product customization for diverse end-user requirements.

Second, forging strategic consortia with chipset manufacturers, antenna developers, and system integrators will facilitate interoperability and drive down integration costs. By pooling resources for shared testbed facilities and open-source channel modeling initiatives, organizations can de-risk early-stage deployments and refine beam management techniques. Third, active participation in standards-setting bodies and spectrum advocacy groups will ensure that technical roadmaps align with policy evolution, safeguarding long-term access to critical frequency bands. Finally, investing in talent development programs focused on RF design, signal processing, and mmWave propagation modeling will build the internal expertise needed to accelerate innovation cycles and maintain competitive advantage.

Rigorous Multi Stage Research Approach Employing Primary Expert Engagement Secondary Data Analysis and Methodological Triangulation

This research employs a rigorous multi-stage methodology combining primary and secondary sources to ensure robust and comprehensive insights. The study began with extensive secondary research that included the review of technical journals, regulatory filings, patent databases, and publicly available white papers to identify emerging trends, technology roadmaps, and policy developments in millimeter waves.

Building on this foundation, the process incorporated in-depth interviews with senior executives, product managers, and domain experts across chipset, antenna, module, and end-equipment segments. These conversations provided qualitative assessments of technology readiness levels, adoption barriers, and evolving customer use cases. All findings were systematically validated through a triangulation process, cross-checking quantitative supply-chain data against qualitative expert perspectives to resolve any discrepancies. Finally, the aggregated intelligence underwent peer review by industry veterans to confirm accuracy and relevance, ensuring that the final report delivers actionable guidance grounded in real-world market dynamics.

This section provides a structured overview of the report, outlining key chapters and topics covered for easy reference in our Millimeter Wave Technology market comprehensive research report.

- Preface

- Research Methodology

- Executive Summary

- Market Overview

- Market Insights

- Cumulative Impact of United States Tariffs 2025

- Cumulative Impact of Artificial Intelligence 2025

- Millimeter Wave Technology Market, by Component Type

- Millimeter Wave Technology Market, by Deployment

- Millimeter Wave Technology Market, by Frequency Band

- Millimeter Wave Technology Market, by Application

- Millimeter Wave Technology Market, by End User

- Millimeter Wave Technology Market, by Region

- Millimeter Wave Technology Market, by Group

- Millimeter Wave Technology Market, by Country

- United States Millimeter Wave Technology Market

- China Millimeter Wave Technology Market

- Competitive Landscape

- List of Figures [Total: 17]

- List of Tables [Total: 1272 ]

Synthesizing Core Findings and Strategic Imperatives to Navigate the Rapidly Evolving Millimeter Wave Technology Landscape

The convergence of technological advancement, regulatory alignment, and evolving end-user demands has positioned millimeter wave technology at the frontier of next-generation connectivity and sensing innovations. Key findings underscore that modular system design, supply-chain resilience, and cross-industry collaboration are indispensable drivers of successful deployments. Moreover, regional markets display unique trajectories influenced by spectrum policies, infrastructure funding, and manufacturing capabilities.

As the landscape continues to mature, organizations that proactively engage in standards development, diversify their sourcing strategies, and build strategic alliances will be best equipped to capture emerging opportunities. The interplay between component innovation and system integration will define the competitive battleground, with first movers in adaptive beamforming, hybrid silicon integration, and multi-band interoperability securing leadership positions. Ultimately, this research highlights that a balanced focus on technological excellence, market adaptability, and regulatory foresight will be the linchpin of sustained growth in the millimeter wave domain.

Seize the Opportunity to Gain In Depth Competitive Intelligence and Strategic Foresight on Millimeter Wave Technology Advancements Today

If you are seeking to stay ahead of the curve in millimeter wave technology and unlock actionable insights that can drive your strategic planning and investment decisions, reach out to Ketan Rohom, Associate Director of Sales & Marketing, to secure your comprehensive market research report today. This in-depth analysis provides you with the intelligence and foresight needed to navigate the competitive landscape, anticipate emerging opportunities, and align your offerings with evolving customer requirements. By collaborating directly with Ketan, you gain privileged access to bespoke data sets, expert analyst commentary, and customized consultancy services that will empower your organization to capitalize on the full potential of millimeter wave innovations. Don’t miss this chance to equip your team with the critical knowledge and recommendations that are essential for successful market entry, product development roadmaps, and strategic partnerships. Contact Ketan Rohom now to acquire this essential research asset and ensure your leadership in the rapidly transforming millimeter wave domain

- How big is the Millimeter Wave Technology Market?

- What is the Millimeter Wave Technology Market growth?

- When do I get the report?

- In what format does this report get delivered to me?

- How long has 360iResearch been around?

- What if I have a question about your reports?

- Can I share this report with my team?

- Can I use your research in my presentation?