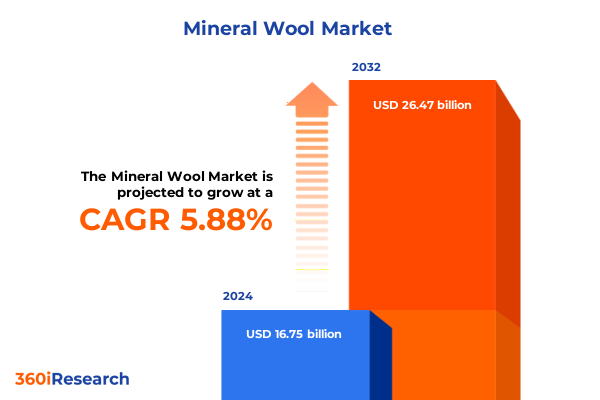

The Mineral Wool Market size was estimated at USD 17.68 billion in 2025 and expected to reach USD 18.66 billion in 2026, at a CAGR of 5.93% to reach USD 26.47 billion by 2032.

Unveiling the Critical Role of Mineral Wool in Modern Construction as Energy Efficiency, Acoustic Performance, and Fire Protection Become Nonnegotiable Standards

The evolving global emphasis on sustainability and energy conservation has elevated mineral wool to a strategic insulation material in modern construction. As building codes tighten and net-zero ambitions proliferate, the superior thermal performance, acoustic absorption, and fire resistance of mineral wool have positioned it as a critical component in achieving high-efficiency building envelopes. Regulatory bodies worldwide are reinforcing energy performance requirements, compelling architects, builders, and developers to integrate advanced insulation solutions that reduce carbon footprints and operating costs.

Simultaneously, government incentives and tax credits are catalyzing private investment in green building projects. In the United States, provisions of the Inflation Reduction Act have extended financial support for residential energy upgrades, including high-performance insulation installations. This favorable policy environment is accelerating the adoption of mineral wool across both new construction and retrofit projects, making it an indispensable material for stakeholders seeking to balance environmental responsibility with cost-effective design. As momentum builds, industry participants are compelled to innovate and scale production to meet surging demand.

Emerging Technological Innovations and Regulatory Mandates Are Reshaping the Mineral Wool Landscape with Sustainability and Performance Enhancements at the Forefront

Advancements in material science and digital technologies are revolutionizing the mineral wool sector, driving unprecedented improvements in product performance and production efficiency. Researchers are deploying AI-powered modeling tools to optimize fiber composition and thermal conductivity, while next-generation binders are enhancing durability and reducing environmental impact. These technological evolutions are shaping a new era of premium insulation solutions that deliver higher R-values and superior acoustic attenuation with leaner material footprints.

Parallel to technological innovation, circular economy initiatives are reshaping supply chains and raw material sourcing. Glass wool manufacturers are increasingly incorporating recycled cullet, achieving significant reductions in energy consumption during melting processes. Glass-to-glass recycling programs are becoming mainstream in several European markets, with leading producers targeting upwards of 80% recycled content in their insulation products. This transition not only aligns with regulatory sustainability mandates but also strengthens corporate ESG credentials, presenting mineral wool producers with a compelling differentiation opportunity in an increasingly eco-conscious marketplace.

Assessing the Cumulative Impact of Expanding United States Tariff Regimes on Mineral Wool Imports and Supply Chain Dynamics in 2025

Since early 2025, a complex web of U.S. tariff policies has significantly affected the cost structure and supply dynamics of mineral wool imports. The traditionally low Most Favored Nation (MFN) duty of approximately 3.9% on mineral wool insulation has been compounded by a universal 10% tariff enacted under emergency economic powers, effective April 5, 2025. This baseline duty applies to all source countries, substantially increasing landed costs for standard mineral wool products.

Additional country-specific levies have further intensified import expenses. Chinese-origin mineral wool now faces an extra 20% tariff under International Emergency Economic Powers Act measures, layered atop the universal duty, making effective tariffs as high as 33.9% for those shipments. Imports from Canada and Mexico are subject to a 25% surcharge under parallel IEEPA directives, though USMCA-qualifying goods are exempt from these reciprocal tariffs upon meeting strict origin criteria. While Section 232 steel and aluminum tariffs do not directly target mineral wool, there is indirect pressure on input costs for specific mineral wool variants containing recycled metal slag, as producers face elevated duties on metallic scrap.

Strategic Market Segmentation Reveals How Material, Form, Application, End Users, and Distribution Channels Drive Mineral Wool Demand and Differentiation

The mineral wool market exhibits a nuanced structure driven by material type, product form, end-use application, and purchasing channels. Within the material spectrum, glass wool commands the broadest adoption due to its cost-effectiveness and superior thermal efficiency, while rock wool is favored for high-temperature and industrial environments. Slag wool, although a smaller segment, offers a compelling sustainability profile by utilizing metallurgical byproducts.

In terms of product form, blankets and rolls continue to dominate installation projects, providing ease of handling and consistent coverage for both walls and attics. Boards and molded shapes serve specialized fire-resistant and acoustic applications, particularly in commercial and industrial facilities. Pipe sections enable precise insulation of mechanical systems, reflecting the material’s versatility across diverse installation scenarios.

Application preferences further refine demand profiles, with thermal insulation remaining the core driver of volume consumption, underpinned by rigorous building codes. Acoustic insulation requirements, motivated by occupant comfort and noise regulation compliance, are fueling the uptake of higher-density grades. Fire protection standards, especially in multi-story and public-use buildings, are reinforcing the critical role of mineral wool in passive safety systems.

End users span commercial builds, industrial operations, and residential projects. Commercial developers leverage mineral wool for façade and roofing systems to meet energy performance targets, while industrial facilities prioritize high-temperature resistance and sound absorption. On the residential front, retrofits and new-build projects are increasingly specifying mineral wool to unlock tax incentives and reduce long-term utility expenses. Distribution channels mirror these dynamics: traditional offline wholesalers and specialty distributors remain predominant, yet digital platforms are emerging as growth catalysts, expanding access and enabling smaller-volume procurement.

This comprehensive research report categorizes the Mineral Wool market into clearly defined segments, providing a detailed analysis of emerging trends and precise revenue forecasts to support strategic decision-making.

- Material Type

- Form

- Application

- End User

- Distribution Channel

Regional Market Dynamics Highlight How the Americas, Europe Middle East and Africa, and Asia Pacific Are Shaping Mineral Wool Growth Trajectories

Market momentum varies significantly across the three major global regions, influenced by local economic frameworks and policy environments. In the Americas, the United States leads innovation with robust retrofit programs and federal incentives driving mineral wool adoption in both residential and commercial sectors. Canada’s energy efficiency grants are also boosting usage, particularly in colder provinces where thermal performance is paramount.

Europe, Middle East and Africa present a heterogeneous landscape where stringent EU directives on building performance create high demand for mineral wool in Western Europe, while emerging markets in the Middle East are leveraging the material’s fire- and heat-resistant properties in mega-infrastructure developments. North African nations are increasingly adopting energy codes to mitigate extreme climate impacts, stimulating growth in both glass and rock wool segments.

Asia-Pacific stands out as the fastest-growing region, driven by rapid urbanization and infrastructure expansion in China, India, and Southeast Asia. Regulatory reforms promoting sustainable construction, paired with government-backed housing initiatives, are catalyzing large-scale adoption of mineral wool. Local manufacturing capacities are scaling up to meet surging domestic demand, while export opportunities persist as regional producers enhance product quality and compliance.

This comprehensive research report examines key regions that drive the evolution of the Mineral Wool market, offering deep insights into regional trends, growth factors, and industry developments that are influencing market performance.

- Americas

- Europe, Middle East & Africa

- Asia-Pacific

Profiling Leading Industry Players to Uncover Competitive Strengths, Market Shares, and Innovation Strategies Driving the Mineral Wool Sector Forward

The competitive landscape of the mineral wool sector is defined by a blend of global incumbents and regional specialists. Leading entities such as Rockwool International, Owens Corning, and Saint-Gobain maintain extensive production networks and invest heavily in R&D for performance enhancements. These companies have leveraged vertical integration to control raw material supply chains, ensuring consistent quality and cost management in fluctuating market conditions.

Mid-sized players, including Johns Manville and Knauf Insulation, differentiate through proprietary binder technologies and targeted sustainability programs. Their focus on developing formaldehyde-free products and increasing recycled content has resonated with specifiers aiming to achieve green building certifications. Emerging entrants are also carving niches by offering specialized solutions such as moisture-resistant mineral wool and high-density acoustic panels to meet specific application needs.

Strategic partnerships and capacity expansions have further reshaped market positioning. Most major manufacturers have announced plant upgrades or greenfield projects to increase production of glass wool and rock wool in key regions, addressing both domestic demand growth and supply chain resilience. Collaboration with local distributors and specification consultants has enabled these firms to accelerate market penetration, particularly in fast-growing Asia-Pacific and Middle Eastern markets.

This comprehensive research report delivers an in-depth overview of the principal market players in the Mineral Wool market, evaluating their market share, strategic initiatives, and competitive positioning to illuminate the factors shaping the competitive landscape.

- Armacell International S.A.

- Compagnie de Saint-Gobain S.A.

- Izocam Ticaret ve Sanayi A.Ş.

- Johns Manville Corporation

- Kingspan Group plc

- Knauf Insulation GmbH

- Luyang Energy-Saving Materials Co., Ltd.

- Owens Corning

- Paroc Group Oy

- Poly Glass Fiber Insulation Inc.

- ROCKWOOL International A/S

- TechnoNICOL Corporation

- Thermafiber, Inc.

- URSA Insulation, S.L.

- USG Corporation

Actionable Strategic Recommendations for Industry Leaders to Leverage Market Trends, Optimize Operations, and Enhance Competitive Positioning in the Mineral Wool Industry

To sustain growth and mitigate emerging risks, industry leaders should prioritize diversified sourcing strategies, including nearshoring of raw material supply and investment in domestic manufacturing capabilities to offset tariff impacts. Joint ventures with regional producers can facilitate market entry and compliance with local regulations, while co-development partnerships with technology providers can accelerate product innovation in areas such as bio-based binders and digital quality control.

Companies must also strengthen their digital and e-commerce presence to capture evolving buyer preferences for online procurement. Implementing advanced analytics in distribution networks will optimize inventory levels and reduce lead times, enhancing service levels for small and medium-sized contractors. Furthermore, proactive engagement in policy dialogues and industry consortiums can influence future regulatory frameworks and secure favorable incentive structures for sustainable insulation materials.

Elevating ESG performance through transparent reporting and third-party certification will differentiate brands in procurement processes. Leaders should set ambitious targets for recycled content and carbon intensity reduction, leveraging life-cycle assessments to quantify environmental benefits. By embedding circular economy principles into product design and end-of-life management, firms can unlock value in waste streams and reinforce long-term resource security.

Comprehensive Research Methodology Detailing Data Collection, Analysis Frameworks, and Quality Assurance Protocols Underpinning the Mineral Wool Market Study

This analysis integrates a rigorous multi-stage research approach combining primary and secondary methodologies. In the secondary phase, comprehensive literature reviews were conducted across academic journals, industry publications, trade association reports, and publicly available regulatory documents to establish a foundational understanding of market drivers, policy landscapes, and technological trends.

Primary research involved qualitative interviews with key industry stakeholders, including C-level executives, R&D directors, supply chain managers, and specification experts. These interviews provided nuanced perspectives on competitive strategies, innovation roadmaps, and emerging regional market conditions. Quantitative validation was achieved through structured surveys distributed to procurement and project management professionals across end-use segments, ensuring statistical robustness in market insights.

Data triangulation was applied to reconcile findings from multiple sources, and proprietary market modeling techniques were used to analyze cost structures, supply chain dynamics, and scenario planning for tariff impacts. Quality assurance protocols included peer review of analytical frameworks by external industry consultants and consistency checks against historical market data, ensuring both accuracy and reliability of the conclusions presented.

This section provides a structured overview of the report, outlining key chapters and topics covered for easy reference in our Mineral Wool market comprehensive research report.

- Preface

- Research Methodology

- Executive Summary

- Market Overview

- Market Insights

- Cumulative Impact of United States Tariffs 2025

- Cumulative Impact of Artificial Intelligence 2025

- Mineral Wool Market, by Material Type

- Mineral Wool Market, by Form

- Mineral Wool Market, by Application

- Mineral Wool Market, by End User

- Mineral Wool Market, by Distribution Channel

- Mineral Wool Market, by Region

- Mineral Wool Market, by Group

- Mineral Wool Market, by Country

- United States Mineral Wool Market

- China Mineral Wool Market

- Competitive Landscape

- List of Figures [Total: 17]

- List of Tables [Total: 954 ]

Conclusive Insights Synthesizing Market Drivers, Competitive Landscape, and Strategic Outlook for the Future of the Mineral Wool Industry

In conclusion, mineral wool stands at the nexus of performance, sustainability, and regulatory alignment, uniquely positioned to address the evolving demands of energy-efficient and resilient building markets. Technological advancements and circular economy initiatives are driving product enhancements, while complex tariff landscapes necessitate agile supply chain and sourcing strategies. Regional dynamics reveal differentiated growth trajectories, underscoring the need for tailored go-to-market approaches.

Competitive intensity is high, with established players leveraging scale and innovation to capture share, and niche providers gaining traction through specialized solutions. Strategic imperatives for industry stakeholders include enhancing digital distribution channels, forging strategic alliances, and embedding ESG commitments throughout the value chain. As policy frameworks tighten and environmental priorities intensify, mineral wool will continue to be a cornerstone material for high-performance construction and industrial insulation.

Ultimately, stakeholders who integrate market intelligence with proactive operational strategies will be best positioned to capitalize on emerging opportunities and sustain long-term growth in this dynamic industry.

Connect with Ketan Rohom to Secure Your Comprehensive Mineral Wool Market Research Report and Empower Informed Strategic Decision Making Today

Are you ready to gain authoritative market intelligence and actionable insights that will drive strategic decisions in the mineral wool industry? Reach out to Ketan Rohom, Associate Director of Sales & Marketing, to discuss how our comprehensive research can be tailored to your organization’s needs. Secure your copy of the full market report to guide investment priorities, optimize supply chain strategies, and outperform competitors. Connect with Ketan Rohom today to empower your business with data-driven confidence and unlock new growth opportunities

- How big is the Mineral Wool Market?

- What is the Mineral Wool Market growth?

- When do I get the report?

- In what format does this report get delivered to me?

- How long has 360iResearch been around?

- What if I have a question about your reports?

- Can I share this report with my team?

- Can I use your research in my presentation?