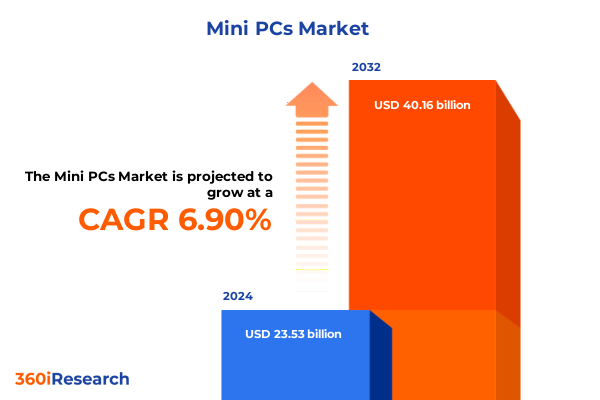

The Mini PCs Market size was estimated at USD 24.73 billion in 2025 and expected to reach USD 26.35 billion in 2026, at a CAGR of 6.88% to reach USD 39.41 billion by 2032.

Exploring the Rising Relevance of Miniaturized Computing Platforms in a Digitally Networked Economy Driven by Remote Work and Edge Solutions

The convergence of remote work, edge computing, and immersive digital experiences has elevated mini PCs from a niche solution into a vital enabler of modern IT infrastructures. As enterprises and consumers alike demand compact yet powerful devices that seamlessly integrate with cloud platforms and network-edge deployments, mini PCs have emerged as a versatile alternative to traditional desktops and bulky workstations. This executive summary opens with an exploration of how these streamlined computing platforms are responding to evolving user requirements, delivering productivity, security, and energy efficiency within constrained form factors.

Beginning with an overview of the forces reshaping end-user expectations-from hybrid work models that prioritize flexible office setups to industrial automation applications requiring ruggedized edge servers-this introduction positions mini PCs as a linchpin in next-generation digital transformation initiatives. Furthermore, by contextualizing the market within broader trends in 5G connectivity, artificial intelligence adoption, and sustainability imperatives, readers gain an early appreciation for why mini PCs are poised to redefine computing paradigms across diverse sectors.

Uncovering the Technological and Market Paradigm Shifts Reshaping the Mini PC Ecosystem Amid Accelerated Connectivity and Artificial Intelligence Demands

The mini PC landscape is experiencing transformative shifts driven by advancements in processor architectures, connectivity standards, and form factor innovations. In recent years, semiconductor vendors have delivered energy-efficient ARM-based and x86-embedded processors that pack greater compute performance into smaller footprints, enabling manufacturers to push the boundaries of thermal design and chassis miniaturization. Concurrently, the proliferation of Wi-Fi 6E and 5G modules has unlocked new use cases for wireless edge deployments in environments traditionally constrained by cabling and power availability.

Moreover, breakthroughs in AI acceleration hardware and support for heterogeneous computing workloads have expanded mini PCs beyond simple office tasks into realms like real-time video analytics, predictive maintenance in smart factories, and interactive digital signage. As a result, OEMs and ODMs are incorporating modular expansion slots, integrated GPUs, and specialized AI inference engines to meet the demands of data-intensive workloads at the network edge. Furthermore, sustainability has emerged as a critical criterion, prompting vendors to adopt recycled materials, low-power components, and carbon-neutral manufacturing processes.

In addition, the consumer segment is witnessing a resurgence of interest in home entertainment and gaming mini PCs, fueled by the availability of VR-ready compact systems and subscription-based game streaming services. This confluence of industrial, commercial, and consumer requirements underscores a broader paradigm shift: mini PCs are no longer viewed merely as space-saving alternatives but as scalable, multi-purpose computing hubs capable of addressing a spectrum of real-world challenges.

Analyzing the Amplified Costs and Supply Chain Realignments Triggered by the 2025 Tariff Escalations on Mini PC Components in the United States

The United States’ decision to impose additional tariffs on electronic components and finished goods in early 2025 has reverberated throughout the mini PC supply chain. Import duties affecting key semiconductor chips, memory modules, and chassis components have increased landed costs for manufacturers, prompting a reassessment of global sourcing strategies. While some vendors have sought tariff exemptions for critical parts, the administrative burden and timeline for relief applications have extended lead times and introduced cost uncertainty.

Consequently, many OEMs and ODMs have accelerated investments in regional manufacturing hubs and assembly facilities to mitigate exposure to U.S.-specific duties. Mexico, Vietnam, and select Eastern European sites have become focal points for secondary sourcing, enabling companies to realign production closer to target markets and curtail the impact of escalating import duties. Despite these efforts, the transition to alternative supply nodes has necessitated significant capital expenditure, tooling adjustments, and workforce training to maintain quality and throughput.

Furthermore, end users have begun to factor tariff-induced cost increases into total cost of ownership calculations, leading to heightened price sensitivity in certain verticals such as education and small business deployments. In response, vendors are optimizing SKU portfolios, emphasizing configurations that leverage locally sourced memory and storage while retaining competitive performance benchmarks. Ultimately, the cumulative effect of the 2025 tariff environment has underscored the imperative for supply chain diversification and agile manufacturing practices in sustaining mini PC market momentum.

Gaining Deep Understanding of Diverse User Requirements and System Configurations Through Comprehensive Mini PC Market Segmentation Perspectives

A nuanced analysis of mini PC demand reveals distinct strata of customer preferences and system configurations driven by type, operating system, storage technology, memory capacity, application domain, end-user profile, and sales channel dynamics. When dissecting the market by type, a clear dichotomy emerges between barebone mini PCs, which offer flexibility for customization, and ready-to-go mini PCs that appeal to buyers seeking turnkey solutions without additional component sourcing. Transitioning to operating system considerations, Chrome OS has gained traction in education and light productivity scenarios, whereas Windows continues to dominate enterprise workflows, and Linux retains a foothold in developer and industrial automation environments. Meanwhile, macOS remains limited to proprietary vendor ecosystems but commands premium segments where seamless hardware-software integration is paramount.

In terms of storage architecture, solid state drives have eclipsed hard disk drives in performance-sensitive applications, yet HDDs remain relevant for bulk data storage in media-centric and surveillance deployments. Memory capacity distinctions-below 8GB for cost-conscious basic use cases, 8GB to 16GB for mainstream business and education users, and above 16GB for high-performance computing and virtualization workloads-further stratify the market. When viewed through the lens of application, mini PCs are deployed across digital signage, education, gaming, home entertainment, and industrial automation, each segment demanding tailored form factors, thermal profiles, and connectivity options. Additionally, end users span commercial enterprises requiring bulk deployments at scale, individuals seeking compact home office or entertainment setups, and industrial operators focusing on ruggedization and environmental resilience. Finally, sales channel analysis differentiates between offline distribution through traditional reseller and retail networks and online channels, where brand websites and e-commerce platforms accelerate time-to-market and enable direct-to-consumer engagement.

This comprehensive research report categorizes the Mini PCs market into clearly defined segments, providing a detailed analysis of emerging trends and precise revenue forecasts to support strategic decision-making.

- Product Type

- Configuration Type

- Storage Type

- RAM Capacity

- Form Factor

- Processor Architecture

- Application

- End-User Industry

- Sales Channel

Identifying Regional Growth Drivers and Adoption Patterns That Define the Competitive and Technological Landscape of Mini PCs Across Global Markets

Regional dynamics play a pivotal role in defining growth trajectories and competitive pressures for mini PC vendors. In the Americas, adoption is driven by corporate IT modernization projects, financial services firms deploying branch office automation, and a burgeoning small business segment embracing hybrid work solutions. Furthermore, the presence of major chipset manufacturers and design houses contributes to a robust ecosystem focused on performance optimization and security compliance.

Across Europe, Middle East & Africa, regulatory frameworks concerning energy efficiency and data sovereignty influence purchasing decisions, prompting vendors to localize manufacturing and align product roadmaps with regional standards. Government initiatives in smart city infrastructure and public sector digitalization further stimulate demand for compact, low-notice edge computing devices. Meanwhile, local distributors and integrators are forging partnerships with OEMs to bundle mini PCs with specialized sensors and connectivity modules for tailored vertical deployments.

Meanwhile, Asia-Pacific continues to register the fastest growth, underpinned by large-scale digital infrastructure projects, high-density retail environments leveraging digital signage networks, and a vibrant gaming community fueling demand for compact, VR-capable systems. China’s domestic brands and contract manufacturers play a central role in cost leadership, while markets such as Japan, South Korea, and Australia emphasize advanced feature sets, industrial-grade reliability, and sustainability certifications as key differentiators. The interplay of these regional drivers underscores the importance of localized go-to-market strategies and adaptive product portfolios.

This comprehensive research report examines key regions that drive the evolution of the Mini PCs market, offering deep insights into regional trends, growth factors, and industry developments that are influencing market performance.

- Americas

- Europe, Middle East & Africa

- Asia-Pacific

Examining Strategic Innovations Partnerships and Competitive Dynamics Among Leading Vendors Propelling the Evolution of the Mini PC Industry

Leading vendors are differentiating through strategic partnerships, product innovation, and vertical integration to capture expanding mini PC demand. Intel, for instance, continues to refine its Atom and Core series embedded processors, enhancing performance-per-watt metrics and integrating hardware-based security features. Concurrently, AMD’s Ryzen Embedded line is gaining traction in applications requiring multi-threaded performance, while Nvidia’s Jetson modules are driving adoption in AI-enabled edge inference scenarios.

On the OEM front, companies such as ASUS and HP have introduced modular chassis options that facilitate rapid upgrades and field serviceability. Lenovo has emphasized its ThinkCentre Tiny series by integrating advanced manageability tools that ease deployment in enterprise environments, and Dell’s OptiPlex micro models combine robust support agreements with compact designs tailored to corporate desktops. Additionally, Apple’s M-series Mac Mini has carved out a premium niche by leveraging its in-house silicon architecture, delivering end-to-end optimization for creative professionals and software developers.

These competitive dynamics are further characterized by collaborations between hardware manufacturers and software vendors. Partnerships focusing on unified communications, virtualization, and security orchestration demonstrate a trend toward offering complete mini PC solutions rather than standalone devices. Moreover, alliances with distributor networks and system integrators enable rapid scaling of complex deployments in sectors such as healthcare, manufacturing, and retail.

This comprehensive research report delivers an in-depth overview of the principal market players in the Mini PCs market, evaluating their market share, strategic initiatives, and competitive positioning to illuminate the factors shaping the competitive landscape.

- HP Inc.

- Lenovo Group Ltd.

- Apple Inc.

- Dell Technologies Inc.

- ASUSTeK Computer Inc.

- Acer Inc.

- GIGABYTE Technology Co., Ltd.

- Micro-Star International Co., Ltd.

- Elitegroup Computer Systems Co., Ltd.

- IEI Integration Corp.

- QNAP Systems, Inc.

- ASRock Inc.

- OnLogic, Inc.

- Shenzhen GMK Technology Co., Ltd.

- Shuttle Inc.

- ZOTAC Technology Pte. Limited by PC Partner Group Limited

- Dynabook Singapore Pte. Ltd.

- Stealth Inc.

- Minisforum

- Athais Technosoft Pvt. Ltd.

- Azulle Tech Inc.

- Beelink, Inc.

- Shenzhen Hasee Innovation Co., Ltd.

- Shenzhen Jiteng Network Technology Co., Ltd.

Empowering Industry Leaders With Proactive Strategies to Capitalize on Emerging Markets Supply Chain Resilience and Technological Advancements

To thrive in the increasingly competitive mini PC landscape, industry leaders must implement proactive strategies that encompass supply chain agility, product differentiation, and strategic go-to-market planning. First, companies should pursue multi-sourcing agreements with semiconductor and component suppliers to mitigate the impact of geopolitical uncertainties and tariff fluctuations. This involves cultivating relationships with alternative manufacturing partners in emerging hubs such as Southeast Asia and Eastern Europe to ensure continuity and cost stability.

Furthermore, differentiating product portfolios through modular designs and scalable performance tiers will enable vendors to address diverse customer segments more effectively. Investing in advanced thermal management, integrated AI acceleration, and pre-validated software stacks can accelerate time-to-value for end users while reinforcing brand preference. In parallel, forging alliances with key software providers in areas like unified communications, virtualization management, and cybersecurity will position mini PCs as turnkey solutions for enterprise IT and Internet of Things applications.

Equally important is the adoption of sustainable manufacturing and packaging practices, which not only appeal to environmentally conscious buyers but also anticipate tightening regulatory standards on electronic waste and carbon emissions. By embedding circular economy principles into product lifecycles-such as modular repairability and recycled materials-manufacturers can bolster their corporate reputation and future-proof supply chains. Finally, refining channel strategies to balance offline partnerships with optimized e-commerce platforms and direct-to-consumer offerings will enhance market reach, improve margin control, and provide rich data insights for ongoing product refinement.

Illuminating the Rigorous Research Methodology Employed to Deliver Actionable Market Intelligence and Insight on Mini PC Demand Dynamics

This research employs a multi-stage methodology to ensure the accuracy, relevance, and depth of insights presented. The process begins with extensive secondary research, analyzing public company reports, industry publications, patent filings, regulatory documents, and reputable technology news sources to establish a foundational understanding of market drivers, challenges, and competitive landscapes.

Subsequently, primary research is conducted through structured interviews with key stakeholders, including OEM and ODM executives, component suppliers, solution integrators, and end-user representatives across multiple regions. These qualitative discussions provide first-hand perspectives on product roadmaps, deployment priorities, and supply chain strategies. Quantitative data is then gathered through targeted surveys to validate assumptions and identify emerging use cases.

Data triangulation techniques are applied to reconcile insights from secondary and primary sources, ensuring consistency and mitigating bias. Advanced analytical models segment the market along multiple dimensions, capturing the interplay between product configurations, application requirements, and regional dynamics. Throughout the research cycle, findings undergo rigorous internal validation and expert reviews to guarantee methodological integrity and actionable relevance for decision-makers.

This section provides a structured overview of the report, outlining key chapters and topics covered for easy reference in our Mini PCs market comprehensive research report.

- Preface

- Research Methodology

- Executive Summary

- Market Overview

- Market Insights

- Cumulative Impact of United States Tariffs 2025

- Cumulative Impact of Artificial Intelligence 2025

- Mini PCs Market, by Product Type

- Mini PCs Market, by Configuration Type

- Mini PCs Market, by Storage Type

- Mini PCs Market, by RAM Capacity

- Mini PCs Market, by Form Factor

- Mini PCs Market, by Processor Architecture

- Mini PCs Market, by Application

- Mini PCs Market, by End-User Industry

- Mini PCs Market, by Sales Channel

- Mini PCs Market, by Region

- Mini PCs Market, by Group

- Mini PCs Market, by Country

- United States Mini PCs Market

- China Mini PCs Market

- Competitive Landscape

- List of Figures [Total: 21]

- List of Tables [Total: 2226 ]

Summarizing Pivotal Industry Trends and Strategic Imperatives That Will Shape the Future Trajectory of the Mini PC Market Landscape Worldwide

In conclusion, the mini PC sector stands at the nexus of multiple technology megatrends, from AI-powered edge computing to flexible work environments and immersive digital experiences. Vendors that embrace modular design philosophies, invest in supply chain diversification, and cultivate software partnerships will be best positioned to capitalize on surging demand. Meanwhile, end users across enterprise, industrial, and consumer domains will increasingly reward solutions that combine high performance, energy efficiency, and seamless integration with cloud and edge ecosystems.

As regulatory landscapes evolve and tariff regimes shift, a balanced approach that prioritizes both cost optimization and product innovation will be critical. Regional market nuances-from the corporate modernization projects in the Americas to smart city initiatives in EMEA and digital signage expansions in Asia-Pacific-underscore the need for adaptive strategies and localized engagement models. Ultimately, the vendors who can deliver tailored mini PC solutions that address specific vertical requirements while maintaining global scale will drive the next wave of market growth and transformation.

Contact Ketan Rohom Today to Gain Exclusive Insights and Access the Comprehensive Mini PC Market Research Report Tailored to Your Strategic Objectives

To explore how your organization can leverage the insights presented in this executive summary, reach out directly to Ketan Rohom, Associate Director, Sales & Marketing. Ketan will guide you through tailored research packages that align with your strategic imperatives and provide the critical market intelligence you need to strengthen your competitive position. Secure your comprehensive mini PC market research report today and empower your team with data-driven analysis designed to fuel growth, innovation, and long-term success.

- How big is the Mini PCs Market?

- What is the Mini PCs Market growth?

- When do I get the report?

- In what format does this report get delivered to me?

- How long has 360iResearch been around?

- What if I have a question about your reports?

- Can I share this report with my team?

- Can I use your research in my presentation?