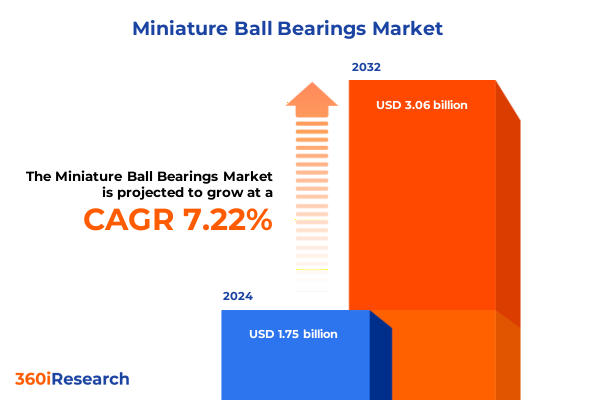

The Miniature Ball Bearings Market size was estimated at USD 1.87 billion in 2025 and expected to reach USD 2.00 billion in 2026, at a CAGR of 7.28% to reach USD 3.06 billion by 2032.

Unlocking the Essential Role of Miniature Ball Bearings in Modern Machinery with an Emphasis on Precision and Durability

In an era defined by relentless miniaturization and increasing performance demands, miniature ball bearings have become indispensable components across a diverse range of industries. These diminutive yet highly engineered parts enable precise motion control, reduce friction, and ensure reliability in applications from high-speed medical imaging devices to compact robotics within consumer electronics. As technological complexity grows, so does the importance of miniature bearings, which must deliver superior rotational accuracy under ever-tighter constraints. Consequently, manufacturers and end users alike face mounting pressure to source bearings that not only meet rigorous specifications but also conform to stringent regulatory and environmental standards.

Against this backdrop, industry stakeholders must navigate a dynamic landscape shaped by evolving materials science, shifting geopolitical tensions, and rapid advancements in manufacturing techniques. Market participants are investing heavily in research and development to optimize bearing designs, explore novel materials such as advanced ceramics and hybrid composites, and refine lubrication methods. At the same time, emerging applications in electric vehicles, aerospace control systems, and industrial automation continue to expand the addressable space for miniature ball bearings. This report begins with a comprehensive overview of the current state of the industry, establishing the foundational context for deeper analysis of transformative trends, regulatory impacts, and segmentation insights that follow.

Navigating the Wave of Technological Advancements and Market Disruptions That Are Reshaping the Miniature Ball Bearing Industry Landscape

Over the past decade, a confluence of technological breakthroughs and shifting consumer preferences has reshaped the miniature ball bearing milieu. Digitalization initiatives in smart factories have spurred demand for bearings that can operate reliably within networked systems, equipped with sensors for real-time condition monitoring. Simultaneously, additive manufacturing techniques have enabled designers to integrate compact bearing assemblies directly into complex geometries, paving the way for lighter, more efficient modules. Meanwhile, the electrification of transportation and advancements in robotics have driven requirements for low-noise, low-vibration bearings that can withstand high rotational speeds and variable load cycles.

Moreover, advancements in materials science are playing a transformative role. Innovative ceramics and metal-matrix composites are being adopted to improve wear resistance and thermal stability, thereby extending maintenance intervals and reducing lifecycle costs. These shifts are not merely incremental; they are redefining performance benchmarks and raising customer expectations across end uses such as medical devices, aerospace control systems, and precision instrumentation. As a result, manufacturers that fail to embrace these technological developments risk obsolescence, while those that adapt stand to capture a growing share of specialized applications.

Assessing the Ripple Effects of United States 2025 Tariff Policies on Supply Chains Costs and Competitive Dynamics in the Bearing Sector

In response to ongoing trade negotiations and strategic economic realignments, the United States introduced a series of tariffs affecting metal components and precision bearings in early 2025. These measures have had a cumulative impact on miniature ball bearing supply chains, particularly for companies sourcing raw materials or finished bearings from international suppliers. Costs have risen across multiple stages of production, from high-grade steel and ceramic imports to the transportation of finished assemblies, leading to tighter margins and increased pressure on pricing strategies.

Further complicating the landscape, tariff escalation on specific categories-such as high-precision steel alloys used in deep groove and angular contact bearings-has prompted some manufacturers to revisit sourcing strategies. Certain players have accelerated investments in domestic production facilities, while others have diversified procurement to alternative markets in Asia-Pacific and EMEA regions. Although these shifts mitigate immediate cost pressures, they also introduce supply chain complexity, as firms must balance lead times, quality assurance, and compliance with evolving regulatory frameworks. Consequently, industry leaders are reexamining procurement frameworks and exploring forward-contracting and supplier partnerships to hedge against future tariff fluctuations.

Revealing Critical Segmentation Insights across Types, Materials, Sealing Methods, Precision Grades, and Varied End User Industries in Miniature Bearings

A nuanced understanding of market segmentation is essential for identifying opportunities and tailoring product portfolios to precise application requirements. By type, miniatures are categorized into angular contact, deep groove, self-aligning, and thrust designs, each optimized for specific load profiles and motion characteristics. Material distinctions reveal a trade-off between performance and cost, ranging from high-purity ceramics that excel under extreme temperatures to hybrid and plastic composites that offer corrosion resistance and reduced weight, as well as traditional stainless steel and high-carbon steel for general-purpose applications. Sealing configurations further influence bearing longevity and performance, with open constructions favored in low-friction environments, sealed variants suited to harsh contaminants, and shielded versions providing a balance of protection and rotational efficiency.

Precision grade also plays a pivotal role, with ABEC ratings from 1 through 9 signifying escalating levels of dimensional tolerance and rotational smoothness. High-precision grades such as ABEC 7 and ABEC 9 find primary use in ultra-compact robotics, biomedical instruments, and aerospace control systems, whereas lower grades satisfy the requirements of consumer electronics and industrial conveyors. Finally, end-user industries delineate demand patterns: aerospace applications encompass control systems and landing gear, automotive segments include chassis, electric motor, and powertrain subsystems, while consumer electronics cover cameras, hard drives, and printers. Industrial machinery involves conveyors, gearboxes, pumps, and robotics equipment. Medical equipment needs span imaging devices and surgical tools, and robotics segments divide into assembly and inspection robots. Each category presents distinct performance imperatives, driving tailored innovation and selective investment.

This comprehensive research report categorizes the Miniature Ball Bearings market into clearly defined segments, providing a detailed analysis of emerging trends and precise revenue forecasts to support strategic decision-making.

- Type

- Sealing

- Material

- Precision Grade

- Lubrication Type

- Application

- End User Industry

- Sales Channel

Analyzing Regional Market Variations in the Miniature Ball Bearing Sector with Emphasis on Americas, EMEA, and Asia-Pacific Trends

Regional dynamics in the miniature ball bearing sector diverge significantly due to differences in industrial infrastructure, regulatory environments, and end-market demand. In the Americas, strong momentum in automotive electrification and aerospace manufacturing has sustained robust demand for high-precision bearings, reinforced by targeted incentives for domestic tooling and advanced machining capabilities. As a result, North American facilities are increasingly equipped to produce ceramic hybrid and high-grade stainless steel bearings, while South American markets focus on standard deep groove and self-aligning designs for evolving industrial applications.

Conversely, Europe, Middle East & Africa exhibit a complex tapestry of mature manufacturing hubs and emerging economies. Western Europe maintains a leadership position in research-driven bearings, especially in aerospace and medical devices, underpinned by stringent quality certifications and collaborative R&D clusters. Meanwhile, Middle Eastern investments in logistics and infrastructure are fostering growth in industrial machinery applications, and the African segment, though nascent, shows promise in general-purpose bearings for agricultural and mining equipment.

Asia-Pacific continues to dominate production volumes, leveraging cost-effective manufacturing in key hubs such as Japan, South Korea, and China. The region’s prowess in materials innovation and mass customization enables rapid scaling of both low-cost steel bearings and advanced ceramic composites. Driven by rising domestic demand for consumer electronics and expanding automation in Southeast Asia, Asia-Pacific remains central to global supply chains, even as companies worldwide evaluate nearshoring and diversification strategies to balance cost, quality, and geopolitical risk.

This comprehensive research report examines key regions that drive the evolution of the Miniature Ball Bearings market, offering deep insights into regional trends, growth factors, and industry developments that are influencing market performance.

- Americas

- Europe, Middle East & Africa

- Asia-Pacific

Exploring Competitive Landscapes and Strategic Moves of Leading Global Players in the Miniature Ball Bearings Market Ecosystem

Leading companies in the miniature ball bearing arena have adopted distinct strategies to consolidate their market positions and drive innovation. Some global incumbents have focused on vertical integration, combining steel and ceramic production with precision machining capabilities to ensure end-to-end quality control and shorten time-to-market. Others have pursued a partnership model, collaborating with specialized material suppliers and automation technology firms to co-develop next-generation bearing solutions that incorporate embedded sensors and predictive maintenance features. Strategic acquisitions remain a prominent tactic, enabling firms to broaden their product portfolios, access niche applications, and secure regional distribution networks.

At the same time, a cohort of agile, specialized manufacturers have carved out competitive niches by targeting underserved sectors, such as micro-robotics and portable medical devices. These players differentiate through ultra-high precision manufacturing and rapid prototyping services, responding swiftly to custom design requirements. Additionally, digital initiatives such as online configurators and virtual testing platforms are gaining traction among both incumbents and challengers, facilitating customer engagement and reducing development cycles. Collectively, these strategic moves underscore the importance of innovation ecosystems, supply chain resilience, and customer-centric offerings in sustaining growth within a market characterized by tightening tolerances and escalating performance benchmarks.

This comprehensive research report delivers an in-depth overview of the principal market players in the Miniature Ball Bearings market, evaluating their market share, strategic initiatives, and competitive positioning to illuminate the factors shaping the competitive landscape.

- AST Bearings LLC

- BDH International

- C&U Company Limited

- Chandan Bearings

- CHANDAN BEARINGS

- Cixing Group Co., Ltd.

- CoorsTek Inc.

- Fuda Bearing Corporation Co., Ltd.

- GRW Bearing GmbH

- JESA Bearing Solutions

- JOTA BEARING CO., LTD.

- JTEKT Corporation

- Kitanihon Seiki Co. Ltd.

- LILY BEARING

- LYC Private Limited.

- MEHUL BEARINGS

- MinebeaMitsumi Inc.

- MMB Bearings Co., Inc.

- Nachi-Fujikoshi Corp.

- NBAA Bearing Co., Ltd.

- New Hampshire Ball Bearings, Inc.

- NSK Group

- NTN Corporation

- Pacamor Kubar Bearings

- PEER Bearing Company

- Providien LLC

- RBC Bearings Incorporated

- Regal Rexnord Corporation

- Schaeffler Technologies AG & Co. KG

- Shanghai HengAn Miniature Bearing Co., Ltd.

- SKF Group

- SMB Bearings

- TFL Bearing Co., Ltd.

- The Timken Company

- Wuxi MBY Bearing Technology Co.,Ltd.

- Zhangzhou Runstar Bearings Manufacturing Co., Ltd.

Delivering Actionable Strategic Recommendations for Industry Leaders to Capitalize on Emerging Trends and Mitigate Operational Disruptions in Bearings

Industry leaders should embrace a multifaceted approach to navigate emerging challenges and capitalize on growth avenues. First, integrating advanced digital tools for real-time supply chain visibility will enable proactive responses to disruptions such as tariff changes or material shortages. By harnessing analytics and predictive algorithms, manufacturers can optimize inventory levels and improve procurement strategies. Second, co-innovation with customers and research institutions will accelerate the development of specialized bearing solutions tailored to new applications in robotics, aerospace controls, and medical instrumentation. Moreover, investing in modular production lines and flexible automation will enhance capacity agility, allowing rapid scaling of both low-volume, high-precision orders and large-volume commodity bearings.

Furthermore, diversifying sourcing strategies should be a priority. Companies that cultivate multiple supplier relationships across Asia-Pacific, the Americas, and EMEA can balance cost competitiveness with geopolitical risk mitigation. Equally important is the adoption of sustainable practices, including the use of eco-friendly lubricants and recyclable materials, which can strengthen brand equity and align with evolving regulatory mandates. Finally, upskilling the workforce through specialized training in precision machining, advanced materials, and digital manufacturing techniques will safeguard long-term competitiveness. Collectively, these recommendations position industry leaders to respond adeptly to dynamic market forces and secure lasting advantage.

Detailing Rigorous Research Methodologies Employed to Gather, Validate, and Analyze Data for Miniature Ball Bearing Industry Insights

This analysis synthesizes findings derived from a rigorous research methodology combining primary and secondary sources. Primary research entailed in-depth interviews and surveys with key stakeholders including bearing OEMs, tier-1 automotive suppliers, aerospace integrators, and industrial end users. The qualitative insights gleaned from these discussions were complemented by a proprietary database of industry events, patent filings, and regulatory filings. Secondary research involved the systematic review of technical publications, trade journals, and government reports to contextualize market developments and validate experimental findings under real-world conditions.

Data triangulation techniques were employed to ensure accuracy and consistency, cross-verifying information from multiple sources. Quantitative analysis included trend mapping of material usage, precision grade adoption, and end-user consumption patterns. Additionally, geospatial mapping highlighted regional supply chain hubs and emerging manufacturing clusters. All data underwent rigorous validation protocols, including peer review by subject matter experts and statistical outlier analysis. This comprehensive approach provides confidence that the insights presented here reflect current industry realities and anticipate future shifts with a high degree of reliability.

This section provides a structured overview of the report, outlining key chapters and topics covered for easy reference in our Miniature Ball Bearings market comprehensive research report.

- Preface

- Research Methodology

- Executive Summary

- Market Overview

- Market Insights

- Cumulative Impact of United States Tariffs 2025

- Cumulative Impact of Artificial Intelligence 2025

- Miniature Ball Bearings Market, by Type

- Miniature Ball Bearings Market, by Sealing

- Miniature Ball Bearings Market, by Material

- Miniature Ball Bearings Market, by Precision Grade

- Miniature Ball Bearings Market, by Lubrication Type

- Miniature Ball Bearings Market, by Application

- Miniature Ball Bearings Market, by End User Industry

- Miniature Ball Bearings Market, by Sales Channel

- Miniature Ball Bearings Market, by Region

- Miniature Ball Bearings Market, by Group

- Miniature Ball Bearings Market, by Country

- United States Miniature Ball Bearings Market

- China Miniature Ball Bearings Market

- Competitive Landscape

- List of Figures [Total: 20]

- List of Tables [Total: 2703 ]

Concluding Key Takeaways and Future Outlook on Technological, Regulatory, and Market Dynamics Shaping the Next Phase of Bearing Innovation

In summary, the miniature ball bearing industry stands at the intersection of technological innovation, evolving regulatory landscapes, and shifting supply chain dynamics. Key takeaways underscore the accelerating adoption of advanced materials, the increasing importance of high-precision grades for specialized applications, and the strategic responses to tariff-driven cost pressures. Regional analyses reveal both the maturation of established markets in the Americas and EMEA and the sustained production leadership of Asia-Pacific hubs. Competitive insights highlight a dual dynamic of vertical integration by major players and nimble specialization by niche manufacturers.

Looking ahead, the industry’s trajectory will be shaped by continued investments in digitalization, sustainable materials, and cross-industry collaboration to address complex performance requirements. Regulatory trends, particularly those related to environmental compliance and trade policies, are likely to influence sourcing decisions and operational footprints. Ultimately, stakeholders that adopt agile supply chain strategies, foster innovation partnerships, and invest in workforce capabilities will be best positioned to thrive in the next phase of bearing innovation. This conclusion sets the stage for informed decision-making and strategic planning as the market advances.

Engaging Directly with Industry Experts Like Ketan Rohom to Secure Your Comprehensive Market Research Report on Miniature Ball Bearings Today

To explore the full depth of this comprehensive miniature ball bearing market research report, reach out to Ketan Rohom, Associate Director, Sales & Marketing. He will guide you through the detailed findings, ensure the insights are tailored to your strategic objectives, and facilitate a seamless purchasing process. Ketan’s expertise in translating complex technical data into actionable business strategies will empower your organization to leverage these insights effectively. Engage with him to gain exclusive access to in-depth analysis, data-driven forecasts, and critical competitive intelligence that will enhance your decision-making and drive growth in this rapidly evolving industry.

By partnering with Ketan Rohom, you will receive personalized support and learn how to apply the report’s key takeaways directly to your operational and R&D initiatives. Don’t miss this opportunity to secure vital market intelligence that can strengthen supply chains, optimize product development, and sharpen your competitive edge. Connect with Ketan today to obtain the full report and ensure your organization is well-equipped to navigate the challenges and seize the opportunities presented by the global miniature ball bearing industry.

- How big is the Miniature Ball Bearings Market?

- What is the Miniature Ball Bearings Market growth?

- When do I get the report?

- In what format does this report get delivered to me?

- How long has 360iResearch been around?

- What if I have a question about your reports?

- Can I share this report with my team?

- Can I use your research in my presentation?