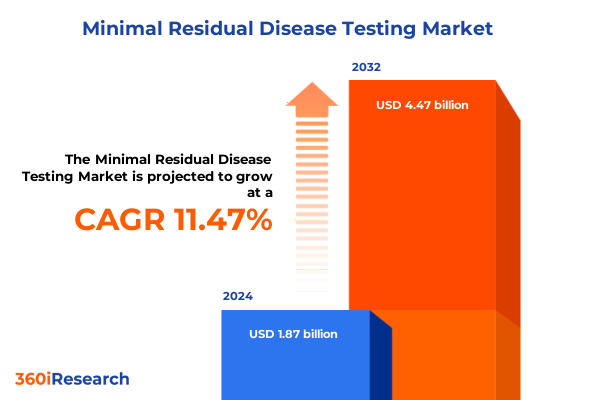

The Minimal Residual Disease Testing Market size was estimated at USD 2.08 billion in 2025 and expected to reach USD 2.31 billion in 2026, at a CAGR of 11.55% to reach USD 4.47 billion by 2032.

Understanding the Role of Minimal Residual Disease Testing in Transforming Oncologic Care Through Enhanced Diagnostic Sensitivity with Prognostic Clarity

Minimal residual disease testing represents a paradigm shift in precision oncology diagnostics, enabling clinicians to detect and quantify minute cancer cell populations that remain post-therapy. By offering sensitivity at levels unattainable through standard morphologic or imaging approaches, MRD assays empower care teams to refine risk stratification, tailor maintenance regimens, and anticipate relapse with greater confidence.

Initially introduced through flow cytometry and polymerase chain reaction techniques, MRD testing has evolved to incorporate molecular and genomic modalities that enhance analytical depth. Early adopters reported improved patient outcomes, as dynamic monitoring revealed treatment-resistant subclones and informed timely therapeutic adjustments. Consequently, MRD status has emerged as a critical prognostic marker that bridges the gap between morphological remission and true molecular clearance.

As oncology care shifts towards individualized treatment pathways, MRD testing is increasingly integrated into clinical workflows across hematologic malignancies and expanding into certain solid tumors. With each technological advance, the diagnostic window for residual disease narrows, driving demand for assays that balance sensitivity, specificity, and operational feasibility. This heightened focus on molecular residual disease underscores the growing importance of MRD testing as a cornerstone of modern cancer management.

Rapid Technological Shifts Reshaping Minimal Residual Disease Testing from Traditional Assays to Next-Generation Sequencing and AI-Driven Platforms

The MRD testing landscape has undergone rapid technological transformation punctuated by key regulatory milestones. In March 2025, an enhanced version of a leading next-generation sequencing assay received approval from a state clinical laboratory evaluation program for diffuse large B-cell lymphoma, marking the first time a U.S. institution validated NGS-based MRD detection in this indication and enabling broader clinical adoption in lymphoid cancers.

Shortly thereafter, the Centers for Medicare & Medicaid Services implemented a Clinical Laboratory Fee Schedule rate for an NGS-based MRD assay that now stands at $2,007, affirming payer recognition of the assay’s clinical value and catalyzing wider reimbursement coverage effective January 1, 2025. This rate determination underscores the agency’s willingness to support innovative diagnostics in oncology and paves the way for increased patient access.

Concurrently, the U.S. Food and Drug Administration has solidified MRD as a clinically meaningful endpoint. A recent precedent‐setting approval of a targeted immunotherapy for acute lymphoblastic leukemia based on MRD status has validated the use of molecular remission as a surrogate marker for drug efficacy, elevating MRD assessment from a niche research tool to a regulatory benchmark for novel therapies. These innovations collectively herald a new era in which advanced genomic platforms, improved instrument sensitivity, and formal regulatory frameworks converge to redefine residual disease monitoring.

Assessing the Accumulated Economic and Operational Impacts of United States Tariffs on Supply Chains and Cost Structures for Minimal Residual Disease Testing

Over the past several years, cumulative U.S. tariffs on imported laboratory reagents, instrumentation, and raw materials have exerted upward pressure on minimal residual disease testing costs. In a 2025 industry survey, 94 percent of biotechnology and diagnostic firms indicated that proposed tariffs on European imports would drive manufacturing expenses sharply higher, potentially delaying the availability of new assay reagents and instrumentation upgrades.

Moreover, ongoing Section 301 tariffs on goods imported from China have disrupted critical supply chains for components such as enzymes, proprietary reagents, and next-generation sequencing kits. Leading contract research organizations and biomanufacturing partners have resorted to stockpiling U.S.-sourced materials and shifting sample processing to domestic facilities, highlighting the fragility of international supply networks under sustained tariff pressures.

Further complicating operations, more than 70 percent of active pharmaceutical ingredients for diagnostic reagents are sourced overseas, making the sector particularly vulnerable to trade policy fluctuations and reciprocal duties. Smaller laboratory developers, with limited capital reserves, report needing over a year to qualify alternative suppliers and revalidate critical assay components, risking interruptions in test development pipelines and slowing the introduction of next-generation modalities.

In aggregate, these tariff measures have not only amplified cost structures but also reshaped strategic vendor relationships, prompting industry stakeholders to explore local sourcing, strategic stockpiling, and diversified supply arrangements to mitigate ongoing trade-driven uncertainties.

Unlocking Critical Segmentation Insights Across Test Types Applications and End-User Verticals to Illuminate Strategic Pathways in the MRD Testing Market

The MRD testing market is meticulously segmented by test type, application, and end-user to illuminate nuanced dynamics across distinct patient and stakeholder cohorts. Within the spectrum of assay modalities, cytogenetic approaches leverage chromosomal microarray and fluorescence in situ hybridization to detect structural and numerical aberrations, while flow cytometry techniques have evolved towards both multi-parameter and single-parameter platforms that measure cell surface antigen patterns at high throughput. In parallel, next-generation sequencing strategies encompass targeted panels that focus on disease-defining gene regions and whole genome sequencing methods that offer comprehensive mutational landscapes. Polymerase chain reaction variants complete the analytical toolkit, with digital PCR methods enabling absolute quantification and quantitative PCR assays delivering rapid, relative assessments of residual genomic targets.

Application-based segmentation reveals that hematologic malignancies drive MRD test utilization, starting with acute lymphoblastic leukemia, acute myeloid leukemia, and chronic lymphocytic leukemia, where early response assessment critically informs consolidation therapies. Lymphoma niches, including Hodgkin’s and non-Hodgkin’s subtypes, have adopted MRD surveillance to guide maintenance strategies and evaluate long-term remission. In multiple myeloma, deep molecular clearance correlates tightly with progression-free survival, prompting frequent MRD monitoring. Emerging applications in solid tumors such as breast and colorectal cancer are predicated on circulating tumor DNA analyses, signaling the extension of MRD principles beyond marrow-resident neoplasms.

Finally, end-user verticals encompass academic and research institutions that drive early innovation and clinical validation, biopharmaceutical companies that integrate MRD endpoints into therapeutic trials, diagnostic laboratories that operationalize high-throughput testing, and hospitals that embed MRD assessment into routine patient management. These distinct segments each contribute to market momentum, shaping product development priorities, reimbursement dialogues, and strategic collaborations.

This comprehensive research report categorizes the Minimal Residual Disease Testing market into clearly defined segments, providing a detailed analysis of emerging trends and precise revenue forecasts to support strategic decision-making.

- Test Type

- Sample Type

- Application Areas

- End-User Vertical

Evaluating Regional Dynamics in the Americas Europe Middle East & Africa and Asia-Pacific Guiding Market Expansion Strategies in MRD Testing

Regional market dynamics in minimal residual disease testing are defined by healthcare infrastructure maturity, regulatory frameworks, and local R&D investment patterns. In the Americas, particularly the United States, robust reimbursement policies, expansive clinical research networks, and the presence of leading diagnostic developers fuel widespread MRD adoption. Canada and select Latin American countries are witnessing incremental uptake as national health authorities evaluate value-based reimbursement models and support pilot programs in tertiary care centers.

Europe, the Middle East, and Africa present a heterogeneous regulatory environment influenced by the European Union’s In Vitro Diagnostic Regulation, which standardizes assay performance requirements and drives harmonization across member states. The United Kingdom and Germany lead early MRD implementation, leveraging advanced laboratory networks, whereas emerging markets in the Middle East are investing in centralized testing hubs to support regional oncology initiatives. In Africa, capacity building efforts and public-private partnerships aim to establish foundational diagnostic infrastructures, with MRD testing poised to benefit from international grants and technology transfer programs.

Asia-Pacific markets exhibit rapid expansion driven by government funding for precision medicine, rising cancer incidence, and local instrument manufacturing capabilities. Japan and South Korea have incorporated NGS-based MRD assays into national guidelines for hematologic malignancies, while China’s domestic biotech firms are scaling assays for both blood-based and marrow-based MRD detection. Southeast Asian nations are forging collaborations with global assay developers to enhance technology transfer, while Australia’s well-integrated healthcare system accelerates pilot programs in major oncology centers. These regional distinctions guide resource allocation, partnership strategies, and market entry priorities.

This comprehensive research report examines key regions that drive the evolution of the Minimal Residual Disease Testing market, offering deep insights into regional trends, growth factors, and industry developments that are influencing market performance.

- Americas

- Europe, Middle East & Africa

- Asia-Pacific

Analyzing Leadership Strategies Competitive Positioning and Collaborative Innovations from Leading Diagnostic and Biotechnology Companies in MRD Testing Market

A diverse group of diagnostic and biotechnology leaders is shaping the MRD testing market through differentiated assay platforms and strategic collaborations. One pioneering company has brought the first FDA-cleared NGS-based MRD assay to market and continues to expand its clinical footprint across lymphoid cancers through assay enhancements and payer engagement. Another organization specializes in high-sensitivity PCR kits and companion bioinformatics solutions, partnering with academic centers to validate standardized reporting formats and reduce inter-laboratory variability.

Flow cytometry providers have responded to rising demand by introducing next-generation cytometers capable of multi-parameter analysis and streamlined workflows, while global instrument manufacturers integrate digital PCR modules into existing platforms to broaden MRD testing capabilities. Leading sequencing technology vendors are extending targeted oncology panels and developing reagent kits optimized for low-input samples, facilitating ctDNA-based MRD detection in solid tumors. Large diagnostics conglomerates are forging partnerships with genomics firms and academic consortia to develop integrated MRD-driven clinical decision support tools.

These companies are also forging alliances across the value chain, from reagent suppliers to clinical reference laboratories, to accelerate assay validation and reimbursement discussions. Strategic acquisitions, co-development agreements, and joint ventures underscore a collaborative ecosystem aimed at reducing time-to-market, addressing unmet clinical needs, and establishing MRD testing as a standard of care across oncology indications.

This comprehensive research report delivers an in-depth overview of the principal market players in the Minimal Residual Disease Testing market, evaluating their market share, strategic initiatives, and competitive positioning to illuminate the factors shaping the competitive landscape.

- Adaptive Biotechnologies Corporation

- Agilus Diagnostics Ltd.

- Amgen Inc.

- ARUP Laboratories

- AstraZeneca PLC

- Asuragen Inc. by Bio-Techne Corporation

- Bio-Rad Laboratories, Inc.

- Bristol-Myers Squibb Company

- C2I Genomics Inc.

- Cergentis B.V.

- Exact Sciences Corporation

- F. Hoffmann-La Roche Ltd.

- Genetron Holdings Limited

- GRAIL, LLC by Illumina, Inc.

- Guardant Health, Inc.

- Integrated DNA Technologies, Inc.

- Invivoscribe, Inc.

- Kite Pharma, Inc. by Gilead Sciences, Inc.

- Laboratory Corporation of America Holdings

- Mdxhealth BV

- MedGenome Inc

- Mission Bio, Inc.

- Myriad Genetics, Inc.

- Natera Inc.

- NeoGenomics Laboratories, Inc.

- OPKO Health, Inc.

- Quest Diagnostics incorporated

- Sysmex Corporation

- Veracyte, Inc.

Strategic Recommendations for Industry Leaders to Accelerate Adoption Optimize Supply Chains and Foster Innovation in the MRD Testing Ecosystem

To capture the full potential of minimal residual disease testing, industry leaders should prioritize investment in multi-omics platforms that harmonize NGS, digital PCR, and advanced flow cytometry, thereby offering robust sensitivity and flexible application across diverse malignancies. Establishing strategic alliances with academic research centers and biopharma partners can accelerate clinical validation and ensure alignment of MRD endpoints with therapeutic development pipelines.

Optimizing supply chain resilience is essential in light of evolving trade policies; stakeholders must diversify reagent sourcing, qualify domestic suppliers, and implement inventory management protocols to safeguard against tariff-driven disruptions. Concurrently, proactive payer engagement and the generation of real-world evidence will fortify reimbursement negotiations by demonstrating the cost-effectiveness and clinical utility of MRD monitoring.

Investment in AI-enabled informatics and decision support tools can streamline data interpretation, shorten reporting timelines, and facilitate scalable integration into electronic health records. Finally, ongoing dialogue with regulatory bodies to clarify assay performance criteria and expedite approvals will solidify MRD testing as a recognized surrogate endpoint, driving broader adoption and reinforcing the diagnostic value proposition.

Comprehensive Research Methodology Combining Primary Interviews Secondary Data Triangulation and Expert Validation to Ensure Robust MRD Testing Market Insights

The research methodology underpinning this analysis employed a multi-tiered approach to ensure comprehensive market coverage and data validity. Secondary research sources included regulatory agency databases, peer-reviewed journals, conference proceedings, and publicly available financial reports. These insights were supplemented by industry white papers and trade publications to capture recent technological and policy developments.

Primary research consisted of structured interviews with key stakeholders, including oncologists, laboratory directors, diagnostic developers, biopharma executives, and payers. These discussions provided qualitative perspectives on clinical adoption drivers, reimbursement challenges, and competitive dynamics. Data triangulation techniques cross-referenced findings across multiple interviewees and secondary sources, enabling the identification of consistent trends and outliers.

An expert advisory panel, comprising thought leaders in oncology diagnostics and health economics, reviewed preliminary findings and validated assumptions related to segmentation, regional prioritization, and technology adoption curves. Rigorous quality assurance procedures, including peer review of report drafts and fact-checking against original data, ensured the accuracy and reliability of the insights presented.

This section provides a structured overview of the report, outlining key chapters and topics covered for easy reference in our Minimal Residual Disease Testing market comprehensive research report.

- Preface

- Research Methodology

- Executive Summary

- Market Overview

- Market Insights

- Cumulative Impact of United States Tariffs 2025

- Cumulative Impact of Artificial Intelligence 2025

- Minimal Residual Disease Testing Market, by Test Type

- Minimal Residual Disease Testing Market, by Sample Type

- Minimal Residual Disease Testing Market, by Application Areas

- Minimal Residual Disease Testing Market, by End-User Vertical

- Minimal Residual Disease Testing Market, by Region

- Minimal Residual Disease Testing Market, by Group

- Minimal Residual Disease Testing Market, by Country

- United States Minimal Residual Disease Testing Market

- China Minimal Residual Disease Testing Market

- Competitive Landscape

- List of Figures [Total: 16]

- List of Tables [Total: 2067 ]

Synthesizing Strategic Imperatives Future Outlook of Minimal Residual Disease Testing to Inform Decision Making and Drive Market Evolution

The evolution of minimal residual disease testing reflects a confluence of scientific innovation, regulatory endorsement, and shifting clinical paradigms. As genomic and digital analytic platforms deliver unprecedented sensitivity, MRD assessment is transitioning from an investigational metric to a standard component of care in hematologic malignancies and emerging solid tumor indications.

Strategic imperatives for stakeholders include fostering cross-sector collaborations, aligning assay development with therapeutic endpoints, and cultivating payer partnerships to secure sustainable reimbursement pathways. Regional market dynamics underscore the importance of tailored entry strategies that account for regulatory frameworks, healthcare infrastructure, and local stakeholder priorities.

Looking ahead, the integration of MRD data with real-world evidence and artificial intelligence-driven analytics will unlock deeper insights into treatment response, relapse prediction, and patient stratification. By synthesizing technological advancements with strategic market orchestration, industry players can drive broader MRD adoption, enhance patient outcomes, and propel the field towards a future where molecular remission guides truly personalized cancer therapy.

Engage with Ketan Rohom Associate Director of Sales and Marketing to Secure the Minimal Residual Disease Testing Market Research Report Today

Engage directly with Ketan Rohom, Associate Director of Sales and Marketing, to secure immediate access to the comprehensive market research report on minimal residual disease testing. This report delivers in-depth analysis of evolving diagnostic techniques, regulatory updates, and competitive landscapes that will equip your organization to make data-driven decisions. Reach out today to leverage these insights for strategic planning, partnership development, and operational optimization in the MRD testing field.

- How big is the Minimal Residual Disease Testing Market?

- What is the Minimal Residual Disease Testing Market growth?

- When do I get the report?

- In what format does this report get delivered to me?

- How long has 360iResearch been around?

- What if I have a question about your reports?

- Can I share this report with my team?

- Can I use your research in my presentation?