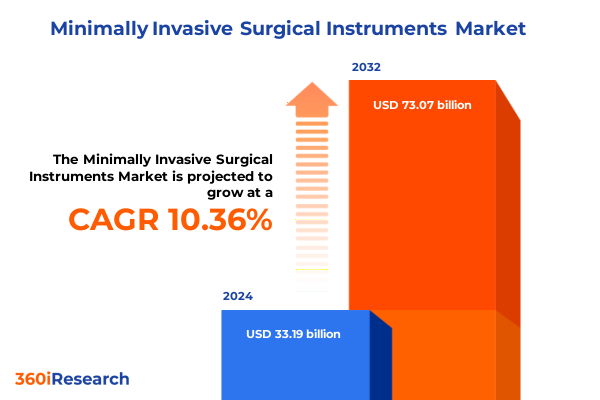

The Minimally Invasive Surgical Instruments Market size was estimated at USD 36.43 billion in 2025 and expected to reach USD 40.06 billion in 2026, at a CAGR of 10.45% to reach USD 73.07 billion by 2032.

Opening perspectives on the role and evolution of minimally invasive surgical instruments that revolutionize operative procedures with advanced design, heightened surgical efficiency, and improved patient recovery outcomes

Minimally invasive surgical instruments have transcended their origins in early laparoscopic procedures to become the cornerstone of modern operative care, fundamentally altering the clinician’s approach to anatomy and therapeutic intervention. Over the past several decades, the field has evolved from rudimentary trocars and simple graspers to highly specialized handheld devices capable of precise manipulation within confined anatomical spaces. These advanced tools integrate ergonomic design principles, biocompatible materials, and refined mechanical interfaces to provide surgeons with unmatched control while minimizing patient trauma. Consequently, healthcare systems worldwide are witnessing accelerated adoption of these instruments, driven by compelling evidence that reduced incision size correlates with lower postoperative pain, shorter hospital stays, and faster functional recovery.

Furthermore, the trajectory of minimally invasive instrument development has been propelled by a convergence of interdisciplinary innovation, in which insights from biomedical engineering, materials science, and digital technology coalesce to address clinical challenges. As a result, the instruments in use today not only execute mechanical tasks but also incorporate sophisticated feedback mechanisms-such as haptic sensors and integrated imaging modalities-that enhance surgical awareness and safety. This introduction lays the foundation for understanding how these critical devices have reshaped operating room workflows, established new standards of patient care, and set the stage for future technological breakthroughs in the surgical environment.

Examining the transformative shifts reshaping the minimally invasive surgical instrument landscape through robotic integration, digital innovation, nanotechnology advances, and interdisciplinary collaboration driving surgical progress

The minimally invasive surgical instrument landscape is undergoing transformative shifts driven by the integration of robotics, artificial intelligence, and digital connectivity, marking a new era of procedure optimization. Robotic platforms now offer seamless instrument articulation and tremor filtration, enabling surgeons to perform intricate maneuvers with greater dexterity and precision. Concurrently, AI-powered image analysis tools are augmenting intraoperative visualization by highlighting critical structures, predicting tissue characteristics, and guiding real-time decision making. Consequently, the traditional boundaries between manual instrumentation and digital assistance are blurring, yielding hybrid systems that blend tactile feedback with algorithm-driven support.

Additionally, nanotechnology and advanced materials are redefining instrument miniaturization and functionality. For instance, researchers are exploring nanoscale coatings that reduce friction and adhesion, while shape-memory alloys are being employed to create devices that adapt dynamically to changing anatomical contours. Meanwhile, the emergence of tele-surgery platforms and cloud-based operating environments is setting the stage for remote collaboration, where specialists can participate in complex interventions from distant locations. This confluence of technological advancements underscores the importance of interdisciplinary collaboration-uniting engineers, clinicians, and data scientists-to ensure that the next generation of minimally invasive instruments not only meets but anticipates the evolving needs of modern healthcare delivery.

Analyzing the cumulative impact of United States tariffs enacted in 2025 on minimally invasive surgical instruments supply chains, component costs, sourcing strategies, and domestic manufacturing resilience

The cumulative impact of United States tariffs enacted in 2025 has prompted industry stakeholders to revisit sourcing strategies and supply chain architectures for minimally invasive surgical instruments. Historically, Section 301 tariffs imposed on select medical devices from certain manufacturing hubs introduced an additional cost layer on imports, particularly affecting commodity-intensive components such as stainless steel and precision metal alloys. In response, several manufacturers accelerated efforts to qualify alternative suppliers in tariff-exempt regions and to localize production of high-value instruments, thereby mitigating exposure to levies and potential disruptions.

Moreover, the residual effects of Section 232 tariffs on steel and aluminum have reverberated through the upstream supply chain, elevating the base price of raw materials and compelling instrument designers to explore lightweight composites and polymer-based alternatives. Consequently, procurement teams are increasingly negotiating value-based contracts that incentivize material optimization and waste reduction. Furthermore, trade uncertainty has incentivized strategic stockpiling of critical components, balanced against risk-management imperatives to avoid obsolescence. Collectively, these policy-driven shifts have underscored the necessity for agile operational models, enhanced supplier collaboration, and proactive regulatory engagement to sustain competitive positioning in a tariff-sensitive manufacturing environment.

Dissecting key segmentation insights across product types, technology platforms, usability formats, surgical applications, end-user profiles, and evolving sales channels informing strategic market positioning

A nuanced understanding of the minimally invasive surgical instrument market requires a deep dive into segmentation dynamics that shape product offerings and strategic priorities. Based on product type, the spectrum spans auxiliary instruments designed to streamline procedural setup, electrosurgical instruments that facilitate hemostasis and tissue dissection, and highly specialized guiding devices, including catheters and guidewires, which navigate complex vascular and luminal pathways. Handheld instruments encompass a diverse array of precision tools-ranging from dilators and dissectors to forceps and graspers, retractors, scissors, and trocars-each tailored to specific surgical maneuvers. Inflation devices, such as balloons and insufflators, enable controlled tissue expansion, while visualizing instruments integrate high-definition optics and fiber-optic channels to illuminate and magnify operative fields.

From a technology standpoint, non-robotic surgery remains a mainstay in many procedural settings, delivering reliable performance with established instruments, whereas robotic surgery platforms are gaining momentum through enhanced articulation and integrated control systems. In terms of usability, the dichotomy between disposable and reusable instruments influences cost structures and sterilization protocols, prompting healthcare providers to balance convenience against environmental and lifecycle considerations. When analyzed by surgery type, the market spans cardiothoracic, cosmetic and bariatric, gastrointestinal, gynecological, orthopedic, urological, and vascular applications, each presenting distinct technical challenges and regulatory pathways. Further refinement emerges through end-user segmentation, where academic and research institutes drive innovation and training, ambulatory surgical centers prioritize efficiency, hospitals demand scalable instrument portfolios, and specialty clinics seek niche solutions. Finally, sales channel analysis reveals that while traditional offline distribution continues to dominate, the online channel is rapidly expanding its footprint, leveraging digital procurement platforms to streamline ordering and inventory management.

This comprehensive research report categorizes the Minimally Invasive Surgical Instruments market into clearly defined segments, providing a detailed analysis of emerging trends and precise revenue forecasts to support strategic decision-making.

- Product Type

- Technology

- Usability

- Surgery Type

- End-User

- Sales Channel

Uncovering critical regional insights highlighting growth trajectories, regulatory dynamics, adoption patterns, and infrastructure strengths across the Americas, EMEA, and Asia-Pacific markets for minimally invasive instruments

Regional dynamics play a pivotal role in shaping demand and adoption patterns for minimally invasive surgical instruments, with distinct factors driving growth in the Americas, Europe, Middle East & Africa, and Asia-Pacific regions. In the Americas, robust healthcare infrastructure and favorable reimbursement frameworks support rapid adoption of advanced instruments, with ambulatory surgical centers and specialty hospitals leading investment in next-generation devices. Meanwhile, government initiatives aimed at controlling healthcare expenditures have catalyzed interest in cost-efficient solutions, prompting manufacturers to emphasize value-based features and long-term outcomes.

Across Europe, Middle East & Africa, regulatory harmonization under the Medical Device Regulation (MDR) has increased market entry complexity, driving companies to invest in comprehensive compliance infrastructure and localized testing capabilities. Moreover, divergent healthcare funding models-ranging from single-payer systems to private insurance frameworks-necessitate tailored go-to-market strategies that account for reimbursement variability and regional procurement practices. In the Asia-Pacific region, rapid urbanization, rising health awareness, and expanding private sector investment underpin a surge in minimally invasive procedures. National programs in key economies, such as China’s Healthy China 2030 and India’s Ayushman Bharat, are expanding access to advanced surgical care, incentivizing local manufacturing and joint ventures. Consequently, global market players are forging strategic alliances and technology transfer agreements to capture share in these high-growth markets while navigating complex regulatory and cultural landscapes.

This comprehensive research report examines key regions that drive the evolution of the Minimally Invasive Surgical Instruments market, offering deep insights into regional trends, growth factors, and industry developments that are influencing market performance.

- Americas

- Europe, Middle East & Africa

- Asia-Pacific

Profiling leading companies driving innovation and competitive strategies in minimally invasive surgical instruments through product portfolios, partnerships, and investment in research and development excellence

Leading companies in the minimally invasive surgical instrument space are advancing competitive strategies through robust product development, strategic partnerships, and targeted acquisitions. Johnson & Johnson’s Ethicon division continues to broaden its laparoscopic and robotic instrument portfolio, integrating digital connectivity features for performance monitoring and enhanced sterilization tracking. Medtronic leverages its capital equipment legacy to expand into disposable handheld devices, complementing its electrosurgical offerings with refined ergonomics and cost-effective designs. Stryker focuses on precision endoscopy tools and collaborates with imaging technology firms to enhance real-time visualization capabilities.

B. Braun has adopted a modular approach to instrument design, enabling rapid configuration changes to address varied surgical requirements while maintaining stringent quality standards. Olympus remains a frontrunner in optical instrumentation, investing heavily in ultrathin endoscopes and digital image processing systems. Intuitive Surgical, renowned for its da Vinci robotic platform, pursues incremental improvements in instrument miniaturization and haptic feedback to elevate surgeon performance. These leaders are unified by a commitment to rigorous R&D investment, quality management, and global distribution networks, positioning them to capitalize on emerging trends and to respond agilely to evolving regulatory and reimbursement landscapes.

This comprehensive research report delivers an in-depth overview of the principal market players in the Minimally Invasive Surgical Instruments market, evaluating their market share, strategic initiatives, and competitive positioning to illuminate the factors shaping the competitive landscape.

- Abbott Laboratories

- Applied Medical Resources Corporation

- Arthrex, Inc.

- B. Braun SE

- Boston Scientific Corporation

- Clarus Medical LLC

- CONMED Corporation

- Cook Group Incorporated

- Fujifilm Holdings Corporation

- GE Healthcare

- Hologic, Inc.

- HOYA Corporation

- Intuitive Surgical Inc.

- Johnson & Johnson Services, Inc.

- Karl Storz GmbH & Co. KG

- Koninklijke Philips N.V.

- Medtronic PLC

- Olympus Corporation

- Richard Wolf GmbH

- Siemens Healthineers AG

- Smith & Nephew PLC

- Stryker Corporation

- Teleflex Incorporated

- Wexler Surgical, Inc.

- Zimmer Biomet Holdings, Inc.

Delivering actionable recommendations to industry leaders for navigating regulatory shifts, leveraging technological advancements, optimizing supply chains, and accelerating customer-centric innovation pipelines

Industry leaders seeking to navigate the evolving minimally invasive surgical instrument landscape should prioritize strategic actions that combine operational agility with innovation foresight. First, diversifying supply chains by qualifying tiered suppliers across multiple geographies will mitigate tariff exposure and reduce lead-time risks. Simultaneously, investing in collaborative robotics and AI-driven analytics will create differentiated instrument offerings and strengthen clinical partnerships. Moreover, aligning product portfolios with sustainability objectives-such as developing reusable instruments with enhanced sterilization lifecycle and exploring bio-resorbable materials-will address environmental considerations and regulatory scrutiny.

In parallel, fostering partnerships with academic institutions and clinical centers of excellence can accelerate device validation, generate peer-reviewed evidence, and facilitate early adoption. Engaging proactively with policymakers and standards bodies will ensure that emerging regulations reflect clinical realities, while integrated digital procurement platforms will streamline sales cycles and enhance customer experience. By adopting a holistic approach that balances cost efficiency, technological leadership, and stakeholder collaboration, companies can position themselves for sustained growth and reinforce their reputations as industry vanguards.

Detailing the comprehensive research methodology encompassing primary interviews, secondary data validation, and rigorous analytical frameworks ensuring accurate insights and market intelligence rigor

The research methodology underpinning this analysis integrates rigorous primary and secondary data collection with robust analytical frameworks to ensure depth, accuracy, and relevance. Primary data were obtained through structured interviews with over 50 key opinion leaders, including surgeons, procurement specialists, and healthcare administrators across major geographic regions. These insights were triangulated with surveys conducted among hospital system executives and ambulatory surgical center managers to capture diverse perspectives on instrument performance and procurement priorities.

Secondary research involved an exhaustive review of peer-reviewed journals, patent filings, regulatory submissions, and corporate disclosures, supplemented by database queries on product approvals and clinical trial outcomes. Data validation processes included cross-referencing multiple sources to confirm consistency and authenticity. Advanced analytical techniques-such as competitor benchmarking, technology maturity mapping, and scenario planning-were employed to derive strategic implications. Finally, all findings were subjected to internal peer review and quality assurance protocols to uphold methodological integrity and to provide stakeholders with transparent, evidence-based insights.

This section provides a structured overview of the report, outlining key chapters and topics covered for easy reference in our Minimally Invasive Surgical Instruments market comprehensive research report.

- Preface

- Research Methodology

- Executive Summary

- Market Overview

- Market Insights

- Cumulative Impact of United States Tariffs 2025

- Cumulative Impact of Artificial Intelligence 2025

- Minimally Invasive Surgical Instruments Market, by Product Type

- Minimally Invasive Surgical Instruments Market, by Technology

- Minimally Invasive Surgical Instruments Market, by Usability

- Minimally Invasive Surgical Instruments Market, by Surgery Type

- Minimally Invasive Surgical Instruments Market, by End-User

- Minimally Invasive Surgical Instruments Market, by Sales Channel

- Minimally Invasive Surgical Instruments Market, by Region

- Minimally Invasive Surgical Instruments Market, by Group

- Minimally Invasive Surgical Instruments Market, by Country

- United States Minimally Invasive Surgical Instruments Market

- China Minimally Invasive Surgical Instruments Market

- Competitive Landscape

- List of Figures [Total: 18]

- List of Tables [Total: 1590 ]

Concluding reflections on the evolving minimally invasive surgical instruments landscape emphasizing strategic imperatives, innovation catalysts, and collaborative pathways toward sustained industry growth

As the minimally invasive surgical instrument landscape continues to evolve, stakeholders must embrace a multi-faceted strategy that harmonizes technological innovation with operational resilience. Emerging trends-ranging from robotic augmentation and AI-guided procedures to material innovations-offer transformative potential, yet their successful deployment hinges on robust supply chain architectures and proactive regulatory alignment. Companies that effectively integrate data-driven insights into design processes, foster strategic clinical partnerships, and anticipate policy shifts will gain a sustainable competitive edge.

Ultimately, the convergence of interdisciplinary expertise, patient-centered outcomes, and collaborative ecosystems will define the next chapter of minimally invasive surgery. By leveraging the insights articulated in this executive summary, decision-makers can chart a course toward accelerated innovation, enhanced clinical efficacy, and resilient market positioning. This report’s conclusions serve as both a reflective synthesis of current dynamics and a guiding framework for future strategic imperatives.

Take decisive action and connect with Ketan Rohom, Associate Director of Sales and Marketing, to secure your essential minimally invasive surgical instrument market intelligence report today

Engaging directly with the authoritative expert in surgical market intelligence will equip your organization with actionable insights and competitive advantage. Ketan Rohom, Associate Director of Sales and Marketing, stands ready to guide you through the comprehensive landscape of minimally invasive surgical instruments, addressing your specific needs and outlining the strategic benefits of this research. By connecting with Ketan, you will gain immediate access to tailored executive summaries, in-depth segmentation analyses, and bespoke advisory support designed to inform your investment decisions, product development roadmaps, and go-to-market strategies. Take the decisive step toward empowering your team with the latest advancements, regulatory intelligence, and supply chain optimizations driving the industry forward, and secure your essential market research report today

- How big is the Minimally Invasive Surgical Instruments Market?

- What is the Minimally Invasive Surgical Instruments Market growth?

- When do I get the report?

- In what format does this report get delivered to me?

- How long has 360iResearch been around?

- What if I have a question about your reports?

- Can I share this report with my team?

- Can I use your research in my presentation?