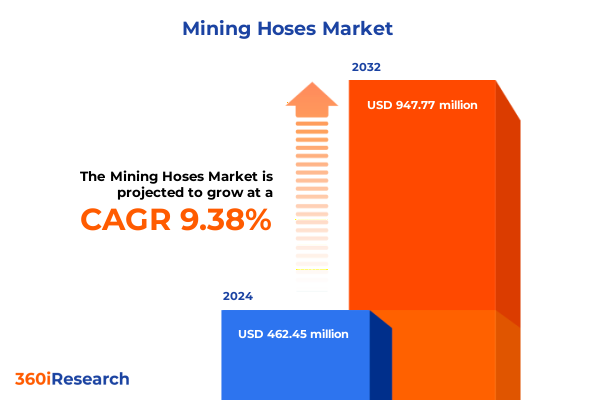

The Mining Hoses Market size was estimated at USD 504.32 million in 2025 and expected to reach USD 552.10 million in 2026, at a CAGR of 9.43% to reach USD 947.76 million by 2032.

Exploring the Critical Importance of Robust Mining Hoses and the Emerging Technological Forces Reshaping Material Transfer in Mining

Mining hoses form the vital arteries of modern extraction and processing operations, enabling reliable conveyance of abrasive slurries, corrosive fluids, and high-pressure air streams across diverse geological contexts. From opencast coal pits to deep underground metal seams, these engineered flexible conduits confront extreme wear, variable pressures, and harsh environmental conditions on a daily basis. Consequently, mining professionals rely on hoses that not only withstand mechanical fatigue but also resist chemical attack, temperature extremes, and cyclical loading that can otherwise compromise operational continuity.

Furthermore, the rapid pace of technological innovation in materials science and manufacturing processes is elevating hose performance benchmarks to previously unattainable levels. As demands for greater uptime and lower total cost of ownership intensify, stakeholders are looking beyond conventional rubber compounds toward advanced polymers, hybrid reinforcements, and smart sensor integration. Moreover, evolving regulations on environmental emissions and worker safety are refocusing engineering strategies around leak prevention and real-time monitoring. This introduction sets the stage for a comprehensive exploration of how mining hoses are reshaping industry standards and driving competitive differentiation.

Unveiling the Major Transformative Transitions in Mining Hose Technology and Value Chains Redefining Operational Efficiencies Across Mines

In recent years, a confluence of technological breakthroughs and process innovations has catalyzed transformative shifts in the mining hose landscape. Emergent abrasion-resistant liners, for example, leverage nanocomposite additives to extend service life by more than 50 percent compared to traditional rubber formulations. Simultaneously, advanced weaving techniques for reinforcement layers have reduced weight by up to 30 percent while maintaining equivalent burst resistance, simplifying installation and lowering energy consumption during pump operations.

Meanwhile, the advent of digital sensing technologies is redefining how maintenance is approached. Embedded fiber-optic or piezoelectric sensors now offer continuous feedback on internal pressure, temperature, or wear patterns, enabling predictive analytics to flag potential failures before they occur. As a result, end users are shifting from reactive replacement schedules to condition-based maintenance models that maximize uptime and optimize spare-parts inventories. These converging trends underscore a broader value-chain evolution-from raw material innovation to end-to-end digital lifecycle management-ultimately enhancing safety, reliability, and operational efficiency.

Analyzing the Multilayered Effects of 2025 United States Tariffs on Mining Hose Supply Chains Costs and Industry Response Strategies

The introduction of new tariffs on manufactured mining hoses and key polymer feedstocks by the United States in early 2025 has reverberated throughout global supply networks. Many hose assemblies and raw materials such as thermoplastic compounds and specialized rubber blends are subject to additional duties, which has elevated landed costs for domestic assemblers and end users. In response, distributors have begun to adjust procurement strategies, with some diversifying supplier portfolios to include duty-free jurisdictions or near-shoring production to Latin America and Southeast Asia.

Concurrently, manufacturers are accelerating the adoption of in-house compounding capabilities to mitigate price volatility from tariff fluctuations. By blending critical polymers internally, they reduce reliance on imported pre-compounded hose stock, thereby preserving margin and insulating customers from abrupt price surges. Moreover, several leading global suppliers have explored tariff optimization structures such as tariff-engineering approaches and bonded-warehouse programs, allowing for deferred duty payments until final composition and end-use classification. These strategic pivots illustrate how the sector is proactively adapting to evolving trade policies to sustain supply continuity and cost predictability.

Distilling Crucial Segmentation Dynamics Based on Product Type Material Operating Pressure Diameter and Application to Guide Strategic Decisions

When evaluating product categories, the mining hose market encompasses a broad spectrum of solutions tailored to specific operational demands. Abrasive material hoses, air suction and discharge hoses, slurry hoses, and water suction and delivery hoses each play a distinct role, yet all are available in PVC, rubber, and thermoplastic constructs to serve varying performance priorities. These polymer options allow operators to align hose characteristics with medium properties-whether conveying corrosive slurries, transferring high-abrasion particulates, or maintaining pressurized airflow.

Delving deeper into material segmentation reveals that PVC, rubber, and thermoplastic compounds are not only differentiated by mechanical and chemical resistance profiles, but also by their primary application in coal mining versus metal mining environments. PVC variants excel in moderate-duty dewatering tasks within coal operations, whereas rubber blends often dominate heavy-duty slurry conveyance in metal ore processing. Thermoplastics, with their outstanding abrasion resistance and lightweight profile, increasingly bridge both subsegments, delivering balanced performance across mineral categories.

Another critical dimension is operating pressure, which breaks down into high-pressure, medium-pressure, and low-pressure hoses-each further refined by internal diameters spanning from less than one inch to in excess of four inches. High-pressure lines typically accommodate dense, abrasive slurries requiring robust reinforcement in larger bore sizes, while low-pressure lines handle dewatering or suction duties in more compact diameters, optimizing energy usage and handling ease.

Diameter considerations also play a pivotal role, as hoses ranging from sub-one-inch profiles to greater than four inches are matched to application flow rates and pump characteristics across both coal and metal contexts. Meanwhile, end-use applications in coal and metal mining are refined further by the type of contractor engagement, equipment manufacturer partnerships, or direct deployment by mining companies, each with its own lifecycle management protocols. Ultimately, whether destined for surface or underground operations, these segmentation insights underpin strategic planning from product development through aftermarket support.

This comprehensive research report categorizes the Mining Hoses market into clearly defined segments, providing a detailed analysis of emerging trends and precise revenue forecasts to support strategic decision-making.

- Product Type

- Material

- Operating Pressure

- Hose Diameter

- Application

- End User

Examining Geographical Patterns and Regional Market Drivers Across the Americas Europe Middle East Africa and Asia Pacific Mining Hose Sectors

Across the Americas, mining hose technologies have been shaped by vast geographies and diverse mineral portfolios. North America’s mature coal and metal corridors have prioritized hoses with enhanced abrasion resistance to sustain long-distance slurry transport in large open-pit operations. Simultaneously, Latin American initiatives in copper and iron ore extraction have driven demand for hoses optimized for high-temperature stability and UV resistance, reflecting sun-exposed equipment in equatorial climates.

Transitioning to the Europe, Middle East, and Africa region, stringent environmental and safety regulations have pushed European miners to adopt hoses with minimal leakage potential and halogen-free compound formulations. In the Middle East, infrastructure investments in new mining concessions emphasize rapid deployment and modular maintenance, favoring hoses that combine plug-and-play fittings with baked-on abrasion-resistant linings. African mining houses, meanwhile, have placed a premium on cost-effective refurbishing programs that extend hose lifecycles through remanufacturing and advanced inspection protocols.

The Asia-Pacific landscape stands out for its dual focus on scalability and innovation. Australian operations in metallurgical coal have pioneered high-pressure slurry systems, prompting suppliers to integrate steel-wire reinforcement for extreme wear tolerance. Meanwhile, Southeast Asian rare earth and nickel projects have accelerated the use of lightweight thermoplastic hoses that streamline handling in confined subterranean shafts. Collectively, these regional nuances highlight how geography and regulatory dynamics shape the R&D priorities and product portfolios of leading industry players.

This comprehensive research report examines key regions that drive the evolution of the Mining Hoses market, offering deep insights into regional trends, growth factors, and industry developments that are influencing market performance.

- Americas

- Europe, Middle East & Africa

- Asia-Pacific

Highlighting Pioneering Innovators and Competitive Dynamics Among Leading Manufacturers Shaping the Global Mining Hose Industry

Leading manufacturers in the mining hose arena are distinguished by their unique approaches to innovation, global reach, and aftermarket support. One prominent player has leveraged decades of polymer research to introduce proprietary nanostructured liners, claiming up to threefold improvements in abrasion life under standardized testing protocols. Another global firm has focused on digital aftersales services, deploying cloud-based condition monitoring dashboards that integrate with customer ERP systems and facilitate predictive maintenance across dispersed mine sites.

Collaborations between hose suppliers and major pump OEMs are further intensifying competitive differentiation. Joint development agreements have yielded integrated hose-pump assemblies that minimize pressure losses and simplify field calibrations, thereby reducing total installation time and alignment errors. Equally, select firms are forging alliances with material science startups to co-develop next-generation elastomers that self-heal micro-cracks and resist chemical attack from emerging mining reagents.

Regional champions also play a pivotal role. In Latin America and Southeast Asia, smaller manufacturers have capitalized on local market knowledge to offer tailored hose refurbishing and inspection services, shortening lead times and reducing freight expenses. These strategic positioning efforts underscore an industry dynamic where both global scale and local agility are essential to meeting the complex demands of today’s mining operations.

This comprehensive research report delivers an in-depth overview of the principal market players in the Mining Hoses market, evaluating their market share, strategic initiatives, and competitive positioning to illuminate the factors shaping the competitive landscape.

- Alfagomma S.r.l.

- Continental AG

- Dixon Valve & Coupling Company, LLC

- Eaton Corporation plc

- Gates Industrial Corporation plc

- Kuriyama of America, Inc.

- Manuli Hydraulics S.p.A.

- OSW Eschbach GmbH

- Parker Hannifin Corporation

- PIRTEK USA LLC

- Productos y Mangueras Especiales SA

- Qingdao David Technology Co., Ltd.

- Salem-Republic Rubber Company

- Semperit AG Holding

- Trelleborg AB

Strategic Roadmap for Industry Leaders to Enhance Product Resilience Optimize Supply Chains and Seize Growth Opportunities in Mining Hose Markets

Industry leaders must prioritize durability enhancements by investing in advanced compound research and accelerated life-cycle testing. By partnering with material science labs to evaluate novel polymers under simulated mining conditions, firms can validate next-generation hose formulations well before field deployment. In parallel, a shift toward modular reinforcement architectures-such as interchangeable braid layers-can facilitate rapid on-site repairs and minimize downtime, enhancing overall operational resilience.

Supply chain optimization remains essential in the face of tariff uncertainty and raw-material price swings. Strategic collaborations with bonded-warehouse operators and near-shore production facilities can reduce duty exposure and ensure just-in-time availability. Moreover, establishing multi-tier supplier scorecards driven by key performance indicators-such as on-time delivery, defect rates, and technical support responsiveness-ensures that critical hose components maintain consistent quality standards.

Embracing digital transformation will further differentiate forward-thinking companies. Integrating embedded sensors with AI-driven analytics can unveil new maintenance paradigms, enabling real-time adjustments to operational parameters and proactive replacement scheduling. Finally, deepening partnerships across the mining ecosystem-from pump OEMs to end-use contractors-can support co-innovation initiatives, aligning product roadmaps with emerging extraction methodologies and fostering shared investments in testing and regulatory compliance.

Rigorous Multimethod Research Framework Incorporating Primary Insights Secondary Analysis and Quantitative Validation to Ensure Credible Mining Hose Market Perspectives

This study integrates both primary and secondary research methodologies to deliver a rigorous and balanced perspective on the mining hose sector. Primary inputs were gathered through structured interviews with procurement directors, maintenance engineers, and operations managers at leading mining companies, complemented by surveys of hose distributors and contract fabricators. These firsthand insights informed critical sections on application requirements and service-lifecycle expectations.

Secondary research encompassed a comprehensive review of industry journals, trade publications, patent filings, and regulatory documents. Emphasis was placed on cross-referencing polymer innovation case studies with mining-specific white papers to triangulate performance benchmarks. Quantitative validation was achieved through analysis of production data from equipment OEMs, internal testing results provided by key manufacturers, and import/export statistics from relevant trade associations.

Finally, all findings underwent a multi-tiered quality assurance process, including expert panel reviews and alignment checks against global standards for industrial hoses. This multimethod approach ensures the credibility and applicability of our insights for decision makers seeking a thorough understanding of current challenges, emerging opportunities, and strategic imperatives in the mining hose market.

This section provides a structured overview of the report, outlining key chapters and topics covered for easy reference in our Mining Hoses market comprehensive research report.

- Preface

- Research Methodology

- Executive Summary

- Market Overview

- Market Insights

- Cumulative Impact of United States Tariffs 2025

- Cumulative Impact of Artificial Intelligence 2025

- Mining Hoses Market, by Product Type

- Mining Hoses Market, by Material

- Mining Hoses Market, by Operating Pressure

- Mining Hoses Market, by Hose Diameter

- Mining Hoses Market, by Application

- Mining Hoses Market, by End User

- Mining Hoses Market, by Region

- Mining Hoses Market, by Group

- Mining Hoses Market, by Country

- United States Mining Hoses Market

- China Mining Hoses Market

- Competitive Landscape

- List of Figures [Total: 18]

- List of Tables [Total: 4134 ]

Synthesizing Key Findings and Future Outlook to Guide Decision Makers Toward Sustainable Growth in Mining Hose Innovations and Applications

In summary, mining hoses stand at the intersection of material science advancements, digital transformation, and evolving trade policies. The integration of next-generation polymers and smart sensing capabilities promises to elevate operational reliability while reducing lifecycle costs. Concurrently, the imposition of new tariffs has stimulated innovative supply chain adaptations, from in-house compounding to strategic near-shoring, reflecting a sector that responds proactively to external pressures.

Segmentation insights reveal a market characterized by diversity in product types, materials, operating pressures, diameters, applications, and end-use environments. Regional analysis further highlights how local regulatory frameworks and extraction practices drive differentiated performance requirements. Leading suppliers are navigating these complexities through collaborative R&D ventures, digital aftersales services, and localized support networks. Looking ahead, companies that combine technical excellence with agile supply strategies and integrated digital offerings will be best positioned to capitalize on emerging mining opportunities while safeguarding operational continuity and safety.

Connect with Ketan Rohom to Unlock Comprehensive Market Intelligence and Secure Your Competitive Advantage in the Mining Hose Landscape

To seize the full power of these in-depth insights, reach out directly to Ketan Rohom, Associate Director of Sales & Marketing, for tailored guidance and immediate access to the complete market research report. Ketan brings a wealth of industry expertise and can walk you through the key findings, answer your specific questions, and facilitate a customized package that aligns with your strategic goals. Engaging with Ketan early ensures you position your organization at the forefront of innovation, taking advantage of emerging opportunities and mitigating potential risks in the mining hose sector. Connect today to secure your competitive edge and unlock the comprehensive intelligence that will drive your next phase of growth.

- How big is the Mining Hoses Market?

- What is the Mining Hoses Market growth?

- When do I get the report?

- In what format does this report get delivered to me?

- How long has 360iResearch been around?

- What if I have a question about your reports?

- Can I share this report with my team?

- Can I use your research in my presentation?