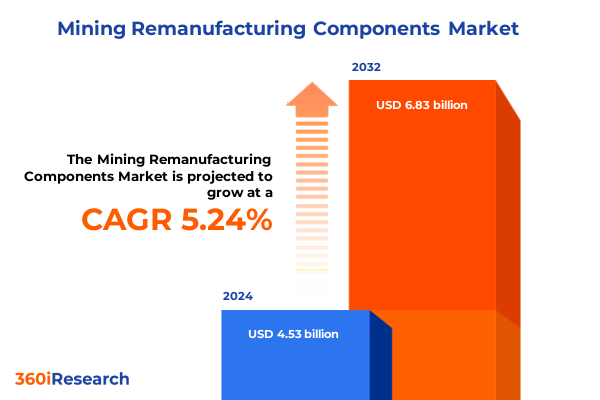

The Mining Remanufacturing Components Market size was estimated at USD 4.77 billion in 2025 and expected to reach USD 5.01 billion in 2026, at a CAGR of 5.26% to reach USD 6.83 billion by 2032.

Introduction to the strategic role of remanufacturing in mining fleets and how component recovery supports uptime, sustainability, and lifecycle planning

The mining sector’s remanufacturing and components aftermarket has evolved into a strategic pillar for operational resilience and cost management. This introduction outlines the primary themes of analysis, frames the scope of component and equipment coverage, and sets the context for how remanufacturing intersects with fleet uptime, sustainability objectives, and total cost of ownership considerations.

Remanufacturing of core components such as axles, differentials, engine parts and transmissions presents operators with an opportunity to restore performance while preserving capital. As fleets grow in scale and as environmental regulations tighten, operators increasingly rely on systematic component recovery, rebuild, and replacement strategies to maintain productivity. Meanwhile, service providers and OEMs adapt their offerings to incorporate refurbished cores, advanced diagnostics, and modular repair workflows.

This report begins by situating remanufacturing within the broader lifecycle management of mining equipment and then explores the operational, regulatory, and commercial forces that shape decisions across haul trucks, hydraulic excavators, wheel loaders, and other heavy assets. By focusing on component-level technical pathways, equipment interoperability, and service delivery models, the subsequent sections provide a granular view of how remanufacturing integrates with maintenance planning and aftermarket supply chains.

How digital diagnostics, modular design, and sustainability mandates are reshaping remanufacturing choices and aftermarket service economics

The landscape for remanufacturing mining components has shifted rapidly in response to technological advances, environmental pressures, and evolving supply chain dynamics. Over the past several years, digital diagnostics and condition-based monitoring have reduced uncertainty around component health and have enabled targeted rebuilds that preserve original equipment performance characteristics. This technological maturity has, in turn, influenced choices between repair, rebuild, and outright replacement.

Concurrently, sustainability commitments from operators and financiers have elevated remanufacturing as a credible circular-economy strategy. Reusing and restoring core components reduces material consumption and the embodied emissions associated with new manufacturing. As stakeholders increasingly measure lifecycle impacts, remanufacturing transitions from a cost-management tactic to an operational sustainability imperative.

On the commercial front, the aftermarket is seeing a redistribution of value. Independent remanufacturers, specialized repair shops, and OEM-authorized service centers are all redefining value propositions through extended warranties, performance guarantees, and integrated service contracts. At the same time, procurement teams are recalibrating supplier evaluation criteria to emphasize turnaround time, traceability of refurbishment processes, and compatibility with fleet telematics.

Finally, as equipment architectures become more modular, remanufacturing pathways have broadened. Subassemblies and modular component designs allow for selective remanufacture and staged upgrades, reducing downtime and improving cost predictability. Together, these shifts are reshaping maintenance strategies and encouraging investment in remanufacturing capabilities across the value chain.

Cumulative implications of recent United States tariff policy on remanufacturing supply chains, sourcing strategies, and onshore refurbishment economics

Recent tariff adjustments and trade policy shifts in the United States have had a cumulative effect on supply chain configurations, procurement strategies, and the economics of remanufacturing. Tariffs increase the landed cost of imported components and raw materials, which places upward pressure on the replacement pathway and makes remanufacturing comparatively more attractive. In response, procurement teams are reevaluating sourcing strategies to mitigate exposure to tariffs through supplier diversification, regional sourcing, or longer-term contracts.

Compliance and administrative burdens also rise with tariff regimes. Remanufacturers and parts distributors must invest in classification, documentation, and customs processes to ensure proper treatment at borders. This administrative overhead can lengthen lead times and increase working capital requirements, which in turn affects inventory strategies and service-level commitments. As a result, many firms prioritize building deeper relationships with domestic remanufacturing partners or developing onshore refurbishment capacity to reduce reliance on cross-border shipments.

Tariffs can also accelerate the adoption of local value chains, prompting OEMs and tier suppliers to expand regional remanufacturing footprints. This localization reduces transit risk and allows providers to offer faster turnaround and more integrated service packages. Meanwhile, operators and service providers often redirect investment toward predictive maintenance and inventory optimization to offset the unpredictability introduced by tariff-related supply disruptions.

Taken together, the cumulative policy environment compels organizations to balance cost, reliability, and compliance. Strategic responses center on reconfiguring supply networks, strengthening onshore capabilities, and increasing transparency in parts provenance, all of which materially affect how remanufacturing is positioned within procurement and maintenance frameworks.

Comprehensive segmentation across components, equipment, service models, mining subindustries, and end-user profiles to reveal targeted remanufacturing opportunities

A precise segmentation framework illuminates where technical expertise and commercial opportunity converge across component, equipment, service, industry, and end-user dimensions. Based on component type, the market encompasses axles, differentials, engine components, final drives, hydraulic components, torque converters, and transmission components. Engine components further include crankshafts, cylinder heads, pistons and rings, and turbochargers, while hydraulic components break down into cylinders, pumps, and valves. Transmission components are analyzed through bearings, clutch assemblies, and gear sets. This component-level granularity is vital for understanding remanufacturing complexity, core recovery programs, and the specialized tooling required for different subassemblies.

Based on equipment type, the analysis covers crawler dozers, crushers and screening equipment, drilling machines, haul trucks, hydraulic excavators, wheel dozers, and wheel loaders. Crushers and screening equipment are examined with attention to cone crushers, impact crushers, and jaw crushers, and wheel loaders are considered as both compact and standard variants. Equipment-level segmentation clarifies the distinct duty cycles, wear profiles, and maintenance cadences that drive remanufacturing demand and influence inventory strategies for cores and spare parts.

Based on service type, the landscape is segmented into rebuild and overhaul services, repair services, and replacement services. Each service category carries different cycle times, quality controls, and warranty implications; rebuild and overhaul services demand comprehensive teardown and testing, repair services focus on targeted interventions to restore function, and replacement services emphasize availability and interchangeability.

Based on mining industry, the coverage includes coal mining, metal mining, and mineral mining. Metal mining is subdivided into copper, gold, iron ore, and nickel, while mineral mining includes limestone, phosphate, and potash. These industry distinctions affect component wear characteristics and maintenance rhythms due to variable abrasiveness, loading patterns, and operating environments. Finally, based on end-user, the segmentation distinguishes large mining companies, mining equipment OEMs, and small and medium mining enterprises, highlighting differences in procurement sophistication, capital access, and readiness to adopt remanufacturing programs. Collectively, this segmentation framework guides targeted product development, aftermarket service design, and client engagement strategies.

This comprehensive research report categorizes the Mining Remanufacturing Components market into clearly defined segments, providing a detailed analysis of emerging trends and precise revenue forecasts to support strategic decision-making.

- Component Type

- Service Type

- Equipment Type

- Mining Method

- Mining Industry

- End-User

How diverse regional supply chains, regulatory regimes, and industrial capacities shape remanufacturing strategies across the Americas, EMEA, and Asia-Pacific

Regional dynamics shape remanufacturing strategies through variations in ore types, regulatory regimes, labor markets, and logistics infrastructure. In the Americas, established mining hubs combine mature supply chains with strong independent service networks and a growing appetite for sustainability-aligned remanufacturing. North and South American operations often prioritize fleet availability and regulatory compliance, which drives investments in local refurbishment centers and collaborative supply arrangements with service providers. These regional characteristics support strategies that emphasize rapid turnaround and end-to-end traceability in core management.

In Europe, the Middle East and Africa, the landscape is heterogeneous. European jurisdictions tend to emphasize environmental regulation and circular-economy targets, encouraging certified remanufacturing processes and higher technical standards for reconditioned components. Meanwhile, countries across the Middle East and Africa present a mix of emerging opportunities, differing maintenance capabilities, and logistics challenges that influence where centralized remanufacturing hubs can cost-effectively serve multiple projects. Across this broad region, geopolitical risk and infrastructure variability shape the feasibility of cross-border remanufacturing operations.

In the Asia-Pacific, high mining intensity, rapid fleet turnover in some markets, and close proximity to major manufacturing centers create both opportunity and complexity. The region supports a dense network of OEMs, independent rebuilders, and aftermarket suppliers that can deliver scalable refurbishment services, particularly when paired with local fabrication and machining capabilities. As a result, Asia-Pacific dynamics often favor hybrid models that combine regional manufacturing competence with localized service delivery to minimize downtime and control logistics costs.

Understanding these regional distinctions enables firms to align remanufacturing investments with the logistics, regulatory, and operational realities that vary considerably across the Americas, Europe Middle East & Africa, and Asia-Pacific.

This comprehensive research report examines key regions that drive the evolution of the Mining Remanufacturing Components market, offering deep insights into regional trends, growth factors, and industry developments that are influencing market performance.

- Americas

- Europe, Middle East & Africa

- Asia-Pacific

Profiles and strategic behaviors of OEMs, independent remanufacturers, technology providers, and service integrators shaping aftermarket competitiveness

The competitive landscape for remanufacturing and components aftermarket is populated by several archetypes that drive innovation, quality, and scale. Original equipment manufacturers continue to influence technical standards and parts interchangeability by offering factory-authorized refurbishment and certified rebuilt programs that preserve brand integrity. Independent remanufacturers and specialist rebuild shops differentiate through agility, competitive turnaround times, and the ability to tailor repairs to nonstandard fleets. Distributors and parts networks play a critical role in ensuring availability and in managing the logistics of core collection, storage, and return.

Technology providers supply diagnostic tools, condition-monitoring platforms, and process automation that increase the precision and repeatability of remanufacturing workflows, enabling tighter quality control and faster validation. Service integrators combine diagnostic, logistics, and refurbishment capabilities under single contracts, offering operators simplified vendor management and predictable service levels. Financing partners and fleet managers also shape the market by underwriting core recovery programs, enabling performance-based agreements, and facilitating CapEx-to-Opex transitions for clients prioritizing lifecycle cost optimization.

Across these company types, successful players typically invest in documented quality systems, traceability mechanisms, and robust testing protocols to validate remanufactured components. Collaboration between OEMs, independent service providers, and technology vendors is increasingly common, creating hybrid offerings that marry brand assurance with flexible service delivery. For market participants seeking to scale, strategic partnerships, investments in centralized testing facilities, and a focus on repeatable processes prove essential to establish competitive advantage.

This comprehensive research report delivers an in-depth overview of the principal market players in the Mining Remanufacturing Components market, evaluating their market share, strategic initiatives, and competitive positioning to illuminate the factors shaping the competitive landscape.

- Caterpillar Inc.

- Komatsu Limited

- Hitachi Construction Machinery Co, Ltd.

- Liebherr-International Deutschland GmbH

- Epiroc AB

- Volvo AB

- AB SKF

- Allison Transmission Holdings Inc.

- Aramine

- Bell Equipment Limited

- Cotta, LLC

- Cummins Inc.

- Dana Incorporated

- Deere & Company

- Haladjian SA

- Hindle Group Ltd.

- Hydraulex International Holdings, Inc. by TERREPOWER

- J.C.Bamford Excavators Limited

- Metso Corporation

- Phillips Global by Baughan Group's

- Pivot Equipment Parts

- Probe Group

- PT Sanggar Sarana Baja

- Quaker Houghton

- Rolls-Royce PLC

- Sandvik AB

- Schaeffler AG

- SRC Holdings Corporation

- Swanson Industries, Inc.

- The Weir Group PLC

Actionable strategic steps for operators and service providers to scale remanufacturing through quality, partnerships, data integration, and sustainability alignment

Leaders preparing to capture value in remanufacturing should prioritize operational rigor, strategic partnerships, and targeted investments in technology. First, standardize refurbishment processes and implement certified quality controls that ensure consistent performance and reduce field failures. Investing in advanced nondestructive testing, precision machining, and validation protocols yields higher first-pass yields and strengthens customer confidence in rebuilt components. Second, develop core reclamation and logistics programs that minimize idle time for returned components and reduce transit-related risks. Centralized tracking and transparent provenance records enhance core recovery rates and facilitate warranty management.

Third, cultivate partnerships with diagnostic and telematics providers to enable condition-based maintenance and predictive rebuild scheduling. Integrated data streams allow service providers and operators to plan rebuilds proactively rather than reactively, improving resource allocation and reducing emergency downtime. Fourth, evaluate hybrid service models that combine OEM-certified refurbishment with independent remanufacturing capacity to balance brand assurance with cost flexibility. Fifth, align remanufacturing offerings with sustainability goals by quantifying environmental benefits and communicating lifecycle advantages to stakeholders and regulators.

Finally, embed commercial constructs that support long-term relationships: performance-based contracts, bundled servicing, and financing solutions that spread refurbishment costs over predictable intervals. These approaches make remanufacturing more accessible to a wider set of end-users and support adoption among small and medium enterprises that lack in-house capabilities. Collectively, these actions create a defensible market position and position firms to respond to supply-chain disruptions and evolving regulatory expectations.

Robust mixed-methods research combining primary interviews, technical lifecycle mapping, and expert validation to underpin component remanufacturing analysis

This research employed a mixed-methods approach that combined primary interviews, technical literature review, and supply-chain mapping to ensure a multifaceted understanding of remanufacturing dynamics. Primary research included structured interviews with maintenance managers, remanufacturing engineers, parts distributors, and procurement specialists to capture operational realities and vendor selection criteria. These qualitative insights were cross-checked against technical standards, industry white papers, and published best practices to validate repair methodologies and quality metrics.

In parallel, the study mapped typical component lifecycles and failure modes using maintenance logs, workshop reports, and publicly available engineering documentation. This mapping informed the analysis of refurbishment complexity for subsystems such as engine internals, hydraulic pumps, and transmission gear sets. Logistics and customs considerations were examined through trade documentation review and discussions with logistics operators to identify common bottlenecks in core movement and return flows.

To enhance reliability, findings underwent triangulation via multiple sources and were reviewed by subject-matter experts in remanufacturing engineering and aftermarket service delivery. Limitations were documented where data variability or proprietary constraints limited direct observation; in such cases, the analysis relied on validated expert judgment and scenario-based reasoning. Ethical research practices were followed throughout, with confidential information anonymized and consent obtained for interview contributions.

This section provides a structured overview of the report, outlining key chapters and topics covered for easy reference in our Mining Remanufacturing Components market comprehensive research report.

- Preface

- Research Methodology

- Executive Summary

- Market Overview

- Market Insights

- Cumulative Impact of United States Tariffs 2025

- Cumulative Impact of Artificial Intelligence 2025

- Mining Remanufacturing Components Market, by Component Type

- Mining Remanufacturing Components Market, by Service Type

- Mining Remanufacturing Components Market, by Equipment Type

- Mining Remanufacturing Components Market, by Mining Method

- Mining Remanufacturing Components Market, by Mining Industry

- Mining Remanufacturing Components Market, by End-User

- Mining Remanufacturing Components Market, by Region

- Mining Remanufacturing Components Market, by Group

- Mining Remanufacturing Components Market, by Country

- United States Mining Remanufacturing Components Market

- China Mining Remanufacturing Components Market

- Competitive Landscape

- List of Figures [Total: 18]

- List of Tables [Total: 2226 ]

Synthesis of remanufacturing benefits and strategic imperatives to embed component refurbishment as a repeatable value-creation capability in mining operations

Remanufacturing of mining components occupies a strategic intersection of operational resilience, cost management, and environmental stewardship. This conclusion synthesizes the prior analysis and reaffirms that investment in remanufacturing capabilities yields operational advantages through improved turnaround, enhanced traceability, and alignment with sustainability objectives. Technological enablers such as condition-based monitoring and nondestructive testing reduce uncertainty and allow stakeholders to adopt more precise rebuild strategies that preserve performance.

Regional and policy contexts matter: logistics infrastructure, regulatory expectations, and trade measures influence whether centralized or localized remanufacturing models prove most effective. The diversity of mining subindustries and equipment duty cycles underscores the need for tailored service models and component-specific process expertise. For operators, the decision to remanufacture hinges on the interplay between asset criticality, downtime tolerance, and the availability of certified refurbishment partners.

Ultimately, organizations that combine rigorous quality systems, data-driven maintenance philosophies, and strategic partnerships will be best positioned to harness the benefits of remanufacturing. These capabilities reduce risk, enable faster recovery from component failures, and contribute to broader corporate objectives tied to sustainability and capital efficiency. The path forward requires coordinated investments across people, process, and technology to convert remanufacturing from an intermittent fix into a systematic value-creation engine.

Secure the authoritative mining remanufacturing components report with personalized briefings and tailored datasets to accelerate supplier and aftermarket decisions

Ketan Rohom, Associate Director, Sales & Marketing, is ready to assist with tailored access to the full market research report and to coordinate a confidential briefing that aligns with strategic priorities. Reach out to secure a bespoke package that includes executive briefings, data extracts, and workshop options designed to accelerate decision-making and implementation.

To facilitate an efficient purchase and onboarding process, Ketan can arrange a demonstration of the report structure, sample chapters, and the primary datasets used in the analysis. Prospective clients will benefit from an orientation call to identify the specific sections and supplementary materials most relevant to their objectives, whether they need component-level intelligence, equipment-focused insights, or service delivery benchmarks.

Engaging directly enables rapid clarification of methodology, coverage, and customization options so that the final deliverable supports procurement, operations, aftermarket strategy, or business development initiatives. For organizations pursuing partnerships, procurement optimization, or remanufacturing scale-up, this direct contact point provides a practical route to obtain the research, request bespoke analysis, and schedule a consultancy session to translate insights into next steps.

Contact Ketan to finalize a purchase, schedule an executive briefing, or obtain a customized extract tailored to your remit in mining remanufacturing components and aftermarket services

- How big is the Mining Remanufacturing Components Market?

- What is the Mining Remanufacturing Components Market growth?

- When do I get the report?

- In what format does this report get delivered to me?

- How long has 360iResearch been around?

- What if I have a question about your reports?

- Can I share this report with my team?

- Can I use your research in my presentation?