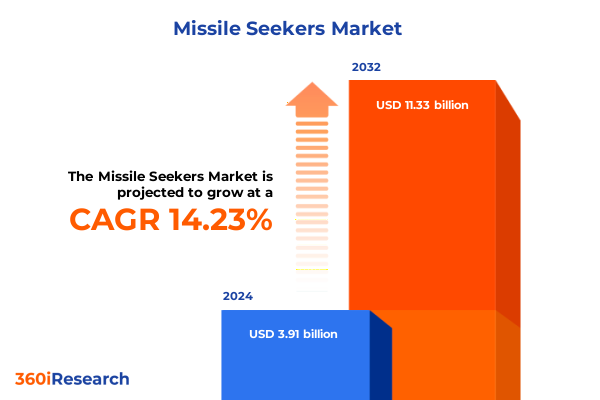

The Missile Seekers Market size was estimated at USD 4.42 billion in 2025 and expected to reach USD 5.00 billion in 2026, at a CAGR of 14.39% to reach USD 11.33 billion by 2032.

Comprehensive Exploration of Missile Seeker Technologies and Strategic Drivers Defining the Future of Global Defense and Surveillance Systems

The accelerating pace of innovation in missile seeker technology has transformed the strategic calculus of defense and national security establishments worldwide. Modern seeker systems are enabling unprecedented levels of target acquisition accuracy, multi-dimensional threat discrimination, and adaptive countermeasure resistance. As sophisticated electronic warfare capabilities proliferate across potential adversaries, defense decision-makers must understand how seeker subsystems collaborate with digital signal processing, artificial intelligence, and network-centric architectures to sustain operational superiority.

This executive summary distills the key themes and findings of an exhaustive study into missile seeker evolution, encompassing technological breakthroughs, regulatory and policy developments, segmentation dynamics, and regional growth differentials. By illuminating the interplay between sensor modalities, platform requirements, and end-user imperatives, this analysis equips defense industry leaders, procurement authorities, and technology investors with the strategic perspective needed to channel R&D resources and optimize acquisition roadmaps. Through a multi-angle lens, this introduction sets the stage for a deeper exploration of market drivers, barriers, and actionable opportunities.

Insightful Analysis of Paradigm Shifts Influencing Missile Seeker Development from Technological Advancements to Evolving Geopolitical Threat Landscapes

The missile seeker landscape has been reshaped by a confluence of advances in semiconductor miniaturization, machine learning-driven target recognition, and multi-spectral sensor fusion. Innovations in photonic integrated circuits have enabled imaging infrared seekers to deliver higher resolution thermal signatures with reduced size, weight, and power footprints. Concurrently, the integration of passive radar techniques has matured, allowing seeker heads to exploit electronic support measures and passive RF imaging for clandestine threat detection without active emissions. These developments have widened the spectrum of engagement options, facilitating both precision strike and low-observable profiling missions.

Geopolitical tensions and evolving threat scenarios have spurred transformative shifts in defense procurement priorities. Nations facing proliferation of short-range tactical missile arsenals have increasingly invested in dual-mode seekers capable of switching seamlessly between infrared radar and laser radar modalities. Meanwhile, the intensification of anti-access/area denial strategies in contested maritime theaters has accelerated the deployment of advanced active radar seekers optimized for continuous wave and pulse Doppler operation. As competitors pursue asymmetric advantages, the alignment of seeker performance with mission-specific parameters-whether beyond-visual-range interception or terminal phase discrimination-has become a critical focal point for defense planners.

These transformations underscore a broader realignment of research and development budgets toward seeker architectures that emphasize adaptability, network interoperability, and electronic counter-countermeasure resilience. The convergence of sensor technologies with data analytics platforms is catalyzing next-generation seeker capabilities, marking a decisive shift from incremental upgrades to foundational leaps in detection, classification, and engagement precision.

Comprehensive Assessment of United States Tariff Policies Enacted in 2025 and Their Cascading Effects on Missile Seeker Supply Chains and Technology Adoption

In 2025, new tariff measures imposed by the United States introduced heightened import duties on key electronic components and specialized materials integral to seeker manufacturing. These levies have reverberated across global supply chains, compelling prime contractors and subsystem suppliers to reevaluate sourcing strategies and mitigate cost pressures. While domestic production incentives have gained traction, the steep learning curves and capital investments required to establish indigenous fabrication capabilities have created near-term challenges for small and midsize enterprises reliant on established import channels.

The accumulation of tariffs has also influenced alliances and partnership models. To hedge against further escalations, several defense contractors have entered strategic joint ventures or licensing agreements with non-U.S. suppliers in allied countries offering preferential trade terms. This realignment has enabled continuity in access to advanced infrared detectors, laser diodes, and radar modules, but it also introduces layers of technical oversight and export compliance complexity. As a result, program schedules for seeker integration have experienced shifts, prompting program managers to adopt more flexible risk-management frameworks.

Looking ahead, the cumulative impact of these tariff policies is likely to accelerate investment in modular seeker architectures that allow for greater component interchangeability. By fostering competition among a broader pool of suppliers, defense stakeholders can seek to absorb cost fluctuations while preserving performance benchmarks. Nonetheless, navigating the evolving regulatory landscape will require agile supply chain governance and close collaboration with policy experts to anticipate and adapt to further tariff developments.

In-Depth Insights into Diverse Missile Seeker Segmentation Revealing Performance Variations and Strategic Opportunities across Seeker Types Platforms Ranges

The first lens through which to view seeker segmentation emphasizes the underlying sensor modality. Active radar variants split into continuous wave and pulse Doppler configurations, each optimized for either stealthy emissions or high-velocity closure rate detection. Dual-mode seekers, capable of toggling between infrared radar and laser radar channels, have emerged as versatile solutions that reconcile the need for both long-range target detection and precise terminal guidance. Within the imaging infrared domain, seekers differentiate between medium-wave and short-wave infrared bands to balance atmospheric transmission characteristics against resolution demands. Pure infrared designs further bifurcate into imaging and non-imaging formats, while laser seekers branch into designator tracking and semi-active laser homing modalities. Passive radar seekers complement these capabilities by harnessing electronic support measures and passive RF imaging to achieve covert surveillance without revealing platform position.

Platform orientation offers a second perspective on segmentation, where seeker integration varies according to mission profile. Air-to-air seekers are engineered for either beyond-visual-range engagements or short-range dogfight scenarios, demanding differing trade-offs in seeker agility and signal processing speed. Anti-ship seekers are calibrated for long-range maritime targeting or short-range littoral operations, with guidance systems attuned to sea clutter and jamming resilience. Anti-tank seekers split between man-portable designs, enabling dismounted forces to employ precision firepower, and vehicle-mounted systems that integrate into armored formations. Ballistic missile defense seekers alternate between midcourse exoatmospheric detection and terminal phase endoatmospheric discrimination, while surface-to-air solutions span long-, medium-, and short-range engagements tailored to layered air defense architectures.

Examining range category reveals clear market differentiation between long-range seekers, which prioritize extended detection windows and multistatic radar support, medium-range seekers that balance detection radius and seeker compactness, and short-range seekers calibrated for rapid reaction times in high-threat environments. Finally, segmentation by end user highlights the distinct requirements of air force, army, and navy forces, each of which imposes unique specifications on seeker robustness, environmental hardening, and interoperability with command-and-control networks.

This comprehensive research report categorizes the Missile Seekers market into clearly defined segments, providing a detailed analysis of emerging trends and precise revenue forecasts to support strategic decision-making.

- Seeker Type

- Range Category

- Platform

- End User

Regional Dynamics Shaping the Trajectory of Missile Seeker Adoption and Development in the Americas Europe Middle East Africa and Asia Pacific

The Americas region continues to lead in seeker technology innovation and procurement volume, driven by robust defense budgets and expansive testing ranges. North American defense agencies prioritize integration of artificial intelligence and machine learning into seeker signal processing, supporting autonomous target recognition and dynamic threat prioritization. Meanwhile, Latin American markets exhibit growing interest in basic infrared and laser seekers tailored to border security and counter-drug operations, catalyzing entry-level investments and feasibility studies.

In Europe, Middle East, and Africa, collaborative defense initiatives underpin significant seeker development programs. European Union member states and NATO allies coordinate on dual-use sensor standards, facilitating cross-border industrial cooperation. The Middle East has accelerated acquisitions to bolster missile defense grids against regional threats, favoring active radar and imaging infrared seekers compatible with layered interceptors. African nations, while operating on constrained budgets, have adopted cost-effective infrared seeker subsystems for field surveillance and limited air defense roles, often through grant-backed procurement agreements.

The Asia-Pacific theatre exhibits some of the fastest growth in seeker deployment, as regional powers enhance anti-access capabilities and bolster maritime domain awareness. China’s indigenous seeker programs have matured rapidly, challenging Western suppliers to innovate ahead. Simultaneously, India’s defense modernization plans emphasize overcoming material dependencies, spurring domestic seeker production initiatives. Southeast Asian navies and air forces are diversifying seeker portfolios to address asymmetric threats, procurement cycles often reflecting shifting geopolitical alignments and technology transfer agreements.

This comprehensive research report examines key regions that drive the evolution of the Missile Seekers market, offering deep insights into regional trends, growth factors, and industry developments that are influencing market performance.

- Americas

- Europe, Middle East & Africa

- Asia-Pacific

Strategic Assessment of Leading Missile Seeker Developers and Their Innovative Roadmaps Driving Next Generation Detection and Tracking Capabilities

Leading defense contractors have expanded their seeker portfolios through targeted acquisitions and collaborative R&D alliances. One prominent firm has harnessed its expertise in photonic sensors to deliver high-resolution imaging infrared seekers, while another global player has leveraged its maritime systems division to integrate long-range active radar seekers onto naval platforms. A technology-centric enterprise has capitalized on its artificial intelligence research to introduce adaptive target recognition algorithms, moving away from legacy filter banks to neural-network-enabled guidance packages.

Strategic partnerships between prime system integrators and specialized component manufacturers have proliferated, enabling seamless integration of electro-optical subassemblies, inertial measurement units, and GPS-aided navigation modules. Several key players have also established innovation hubs in proximity to universities and defense research institutes, accelerating proof-of-concept testing for dual-mode seekers and multispectral sensor fusion prototypes. Competitive differentiation increasingly stems from the ability to field modular seeker architectures that support plug-and-play upgrades, thereby extending platform life cycles and reducing total ownership costs.

Moreover, a surge in start-up activity in the unmanned systems space has introduced fresh approaches to seeker design, often emphasizing open-architecture frameworks and software-defined sensor suites. These emerging entrants, backed by venture capital and defense accelerator programs, are poised to drive disruptive innovations in seeker miniaturization and cybersecurity hardening, reinforcing the importance of vigilant competitive intelligence for established industry leaders.

This comprehensive research report delivers an in-depth overview of the principal market players in the Missile Seekers market, evaluating their market share, strategic initiatives, and competitive positioning to illuminate the factors shaping the competitive landscape.

- BAE Systems plc

- Bharat Electronics Limited

- Israel Aerospace Industries Ltd.

- Leonardo S.p.A.

- Lockheed Martin Corporation

- MBDA S.A.

- Northrop Grumman Corporation

- Rafael Advanced Defense Systems Ltd.

- Raytheon Technologies Corporation

- Saab AB

- Thales S.A.

Actionable Strategies for Industry Leaders to Capitalize on Emerging Trends in Missile Seeker Technologies and Strengthen Competitive Positioning

Industry leaders should prioritize investment in scalable seeker architectures that accommodate evolving sensor modalities and algorithmic enhancements. By embracing modular design principles, organizations can reduce upgrade cycles and rapidly integrate new detector technologies without overhauling entire guidance systems. This approach also mitigates the risks associated with shifting tariff policies by facilitating component substitution across diverse supplier networks.

A second recommendation is to deepen collaboration with allied nations on joint seeker development programs. Shared funding models and harmonized export controls enable cost-sharing and accelerated fielding timelines, while fostering interoperability among coalition forces. Defense firms should seek out multilateral demonstrator initiatives that validate seeker performance in contested electromagnetic environments and extreme climatic conditions.

Finally, cultivating expertise in AI-driven signal processing and cybersecurity resilience will be critical for sustaining seeker effectiveness in the face of advanced electronic warfare threats. Embedding self-learning algorithms and robust encryption layers at the sensor-processing interface can enhance countermeasure resistance and ensure mission success. Organizations should integrate formal testing protocols for algorithmic integrity and conduct regular red-teaming exercises to identify potential vulnerabilities in seeker software stacks.

Comprehensive Overview of Research Methodology Employed to Ensure Rigorous Data Validation and Robust Insights in Missile Seeker Market Analysis

The research methodology underpinning this market intelligence report combines primary interviews with defense procurement officers, seeker subsystem engineers, and strategic planners, alongside exhaustive secondary research from open-source defense journals, patent filings, and government policy documents. Data triangulation ensures that performance claims are validated through cross-referencing technical specifications, field trial reports, and academic publications. Quantitative data on procurement cycles, R&D spending, and platform deployments have been standardized to account for fiscal year variations and reporting thresholds across multiple countries.

Expert workshops and advisory board consultations were employed to test emerging technology hypotheses and refine segmentation criteria. Workshops included end-user military officers who provided operational insights into seeker performance metrics under real-world conditions. Complementary case studies examined legacy seeker upgrade programs, drawing lessons on integration pitfalls and cost-management strategies. All research activities adhered to strict confidentiality agreements and compliance with international data protection standards.

This methodology fosters a rigorous, multi-angle understanding of the missile seeker market, balancing technical depth with strategic context. It enables stakeholders to navigate complex regulatory landscapes, assess competitive dynamics, and forecast technology adoption curves with confidence in the underlying data integrity.

This section provides a structured overview of the report, outlining key chapters and topics covered for easy reference in our Missile Seekers market comprehensive research report.

- Preface

- Research Methodology

- Executive Summary

- Market Overview

- Market Insights

- Cumulative Impact of United States Tariffs 2025

- Cumulative Impact of Artificial Intelligence 2025

- Missile Seekers Market, by Seeker Type

- Missile Seekers Market, by Range Category

- Missile Seekers Market, by Platform

- Missile Seekers Market, by End User

- Missile Seekers Market, by Region

- Missile Seekers Market, by Group

- Missile Seekers Market, by Country

- United States Missile Seekers Market

- China Missile Seekers Market

- Competitive Landscape

- List of Figures [Total: 16]

- List of Tables [Total: 1272 ]

Conclusive Perspectives Highlighting Strategic Implications and Core Takeaways from the Missile Seeker Landscape Evaluation

The evaluation of missile seeker technologies reveals a landscape defined by rapid innovation, geopolitical nuance, and supply chain intricacy. Sensor modalities have matured from singular approaches to hybrid architectures, while platform integration demands have expanded to include networked operations and AI-driven adaptability. Tariff developments and trade realignments have introduced both challenges and incentives for diversified sourcing, prompting industry players to cultivate greater modularity and resilience.

Segmentation analysis highlights the necessity of aligning seeker type with mission-specific performance requirements, whether ensuring rapid target acquisition at short ranges or sustaining high-resolution tracking at extended distances. Regional insights underscore distinct procurement drivers, from maritime defense imperatives in the Asia-Pacific to coalition interoperability priorities in EMEA. Leading companies continue to differentiate through targeted acquisitions, collaborative R&D, and start-up partnerships, reflecting a competitive imperative to deliver integrated electronic warfare resilience alongside core sensing capabilities.

Taken together, these findings point to a critical junction for defense stakeholders: those who strategically invest in flexible architectures, robust supply chain governance, and algorithmic innovation will secure enduring advantages. As the missile seeker domain advances toward more autonomous, multi-sensor ecosystems, timely, data-driven decisions will be paramount for sustaining operational superiority and driving next-generation capability development.

Compelling Call for Immediate Engagement with Associate Sales & Marketing Leader to Secure Comprehensive Missile Seeker Market Intelligence Solutions

The depth and breadth of the insights presented throughout this executive summary only scratch the surface of the comprehensive analysis available in the full missile seeker market intelligence report. To unlock detailed data, strategic frameworks, and tailored guidance that will empower your organization to anticipate technological evolutions, navigate regulatory complexities, and outpace emerging competitors, you are invited to connect with Ketan Rohom, Associate Director of Sales & Marketing. Ketan brings a deep understanding of defense industry dynamics and will guide you through the options for accessing proprietary research, customized briefings, and interactive workshops designed to catalyze your strategic decision-making.

Engaging with Ketan ensures you gain priority access to the latest findings on seeker type performance trade-offs, platform integration case studies, supply chain resilience strategies, and scenario planning forecasts. With his support, you can secure the full report tailored to your organization’s unique needs, arrange one-on-one consultations with subject matter experts, and explore subscription models that provide ongoing updates as the missile seeker landscape continues to evolve. Reach out today to elevate your competitive positioning and harness actionable intelligence that drives innovation and growth.

- How big is the Missile Seekers Market?

- What is the Missile Seekers Market growth?

- When do I get the report?

- In what format does this report get delivered to me?

- How long has 360iResearch been around?

- What if I have a question about your reports?

- Can I share this report with my team?

- Can I use your research in my presentation?