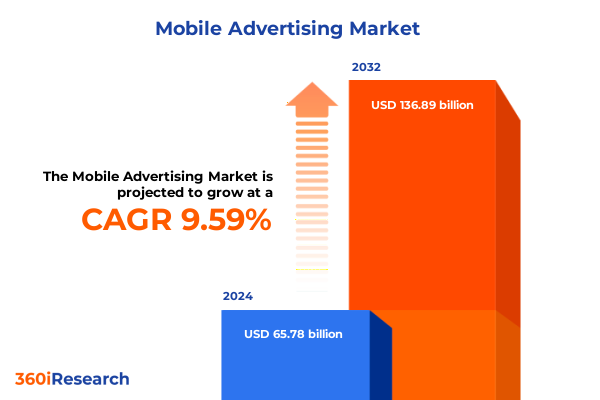

The Mobile Advertising Market size was estimated at USD 71.98 billion in 2025 and expected to reach USD 78.78 billion in 2026, at a CAGR of 10.72% to reach USD 146.89 billion by 2032.

Charting the Course of Mobile Advertising in an Accelerated Era of Technological Breakthroughs and Evolving Consumer Interactions

In an environment where consumer behavior and technological capabilities evolve at breakneck speed, understanding the nuances of mobile advertising has never been more critical. Marketers are contending with shifting audience expectations as data privacy concerns rise, platform regulations tighten, and measurement standards advance. Meanwhile, emerging technologies such as artificial intelligence, machine learning, augmented reality, and 5G connectivity are redefining the boundaries of what is possible on mobile screens. This transformation demands a fresh perspective on strategy, investment, and execution that aligns with the new realities of audience engagement.

Against this backdrop, the executive summary presents a comprehensive examination of the forces shaping mobile advertising today. It synthesizes practical insights into the rapid diffusion of interactive ad formats, the growing importance of first-party data strategies, and the resurgence of contextual advertising in a privacy-first world. By spotlighting both macrolevel shifts and granular tactical developments, this report establishes a strategic foundation for navigating the complexity of the mobile channel, enabling decision makers to capitalize on emerging opportunities and mitigate evolving challenges.

Unveiling the Pivotal Technological and Regulatory Transformations Reshaping Mobile Advertising Strategy and User Engagement Patterns

The mobile advertising landscape is undergoing transformative shifts driven by a convergence of technology, regulation, and consumer sentiment. Mobile operating systems are integrating privacy controls that restrict third-party cookie access and limit identifier availability, prompting advertisers to embrace alternative measurement frameworks such as probabilistic modeling, clean rooms, and conversion APIs. In parallel, the proliferation of programmatic platforms and real-time bidding accelerates media transactions while raising the bar for transparency and brand safety. These platforms are increasingly leveraging artificial intelligence to optimize bids, predict consumer intent, and personalize creative at scale, ushering in highly customized ad experiences.

Simultaneously, regulatory frameworks around the globe are reshaping data collection practices and user consent protocols, demanding robust governance and compliance programs. As regulatory scrutiny expands across regions, advertisers must balance performance objectives with lawful, ethical data stewardship. Furthermore, consumer expectations for relevance and value continue to climb, reinforcing the necessity for contextually aligned messaging that respects user experience. Taken together, these factors compel advertisers and technology providers to forge new partnerships, invest in advanced analytics, and adopt a privacy-by-design mindset to thrive in a competitive, fast-evolving ecosystem.

Assessing the Far-Reaching Consequences of 2025 United States Tariff Policies on Mobile Advertising Ecosystem and Supply Chain Dynamics

The accumulation of United States tariff measures enacted throughout 2025 has introduced profound implications for the mobile advertising ecosystem, particularly by disrupting supply chains and altering cost structures. Tariffs on semiconductors and electronic components have elevated manufacturing expenses for smartphone and tablet producers, which in turn affects device availability, shipment timelines, and overall handset pricing. As device costs rise, consumer upgrade cycles have lengthened, reducing churn rates and leading to a slower refresh of installed bases-trends that have downstream effects on app install volumes and in-app ad inventory.

Moreover, sustained tariffs have catalyzed a geographic realignment of production footprints, with manufacturers increasing shipments from India, Vietnam, and Mexico to circumvent levies on Chinese-origin goods. This shift has mitigated some supply constraints but has also introduced variability in part quality and logistical complexity. To adapt, advertisers and technology partners have had to refine their audience forecasting models, reoptimize performance benchmarks, and invest in emerging markets where device penetration remains robust. Collectively, these adjustments underscore the importance of agility and supply chain resilience in the face of evolving trade policies.

Illuminating Segmentation Dimensions Driving Mobile Advertising Outcomes Across Devices Platforms Channels Formats Pricing Models and Industry Verticals

At the core of mobile advertising innovation lies the ability to tailor strategies to distinct audience segments defined by device preferences, operating environments, and content consumption behaviors. Mobile campaigns must account for the divergent user experiences across smartphones and tablets, each with varying screen sizes, usage contexts, and engagement patterns. Similarly, advertisers need to differentiate between Android and iOS ecosystems, optimizing creative formats and bid strategies to reflect platform-specific user demographics and technical specifications.

Equally important is understanding the tension between in-app and mobile web channels, where ad load, navigation flows, and viewability metrics differ substantially. Interactivity options also vary across banner, interstitial, native, rich media, and video formats, demanding nuanced creative and placement strategies to maintain user attention and drive conversions. Pricing frameworks-from cost per acquisition and cost per click to cost per install, cost per thousand impressions, and cost per view-shape campaign design and performance evaluation, influencing how marketers allocate budgets across channels and formats.

Finally, the industry vertical introduces another layer of complexity, with automotive strategies emphasizing dealership and OEM promotions, financial services campaigns split between banking and insurance offerings, entertainment narratives tailored to gaming and streaming audiences, retail initiatives varying across apparel, electronics, and grocery segments, telecommunications tactics differentiated between internet service providers and mobile operators, and travel and tourism messaging addressing both airlines and hotels. Integrating these segmentation dimensions fosters a cohesive, high-impact approach to mobile advertising that delivers relevance and efficiency.

This comprehensive research report categorizes the Mobile Advertising market into clearly defined segments, providing a detailed analysis of emerging trends and precise revenue forecasts to support strategic decision-making.

- Ad Format

- Device Type

- Platform

- Channel

- Pricing Model

- Industry Vertical

Revealing the Distinctive Mobile Advertising Trends and Opportunities Across the Americas Europe Middle East Africa and Asia Pacific Markets

Regional dynamics continue to shape the contours of mobile advertising growth and innovation. In the Americas, strong smartphone penetration, advanced 5G deployment, and mature programmatic markets drive sophisticated omni-channel strategies and audience extension initiatives. North American advertisers prioritize measurement harmonization across walled gardens, enhanced attribution models, and high-impact video formats to capture the attention of digitally native consumers.

Meanwhile, Europe, the Middle East, and Africa are navigating a complex regulatory tapestry marked by stringent privacy directives, diverse language and cultural considerations, and varying levels of mobile infrastructure maturity. Advertisers in these regions focus on contextual relevance, compliance with consent frameworks, and partnerships with local publishers and ad tech firms to optimize reach and brand safety.

In the Asia-Pacific, rapid adoption of super-apps, the ubiquity of mobile wallets, and an enthusiasm for social commerce create fertile ground for immersive experiences and performance-driven campaigns. Markets such as India and Southeast Asia are characterized by cost-efficient user acquisition opportunities, while more developed economies like Japan, South Korea, and Australia emphasize premium ad inventory, interactive formats, and loyalty-driven engagement.

This comprehensive research report examines key regions that drive the evolution of the Mobile Advertising market, offering deep insights into regional trends, growth factors, and industry developments that are influencing market performance.

- Americas

- Europe, Middle East & Africa

- Asia-Pacific

Highlighting Leading Innovators and Strategic Collaborators Shaping the Future of Mobile Advertising Through Partnerships and Technology Investments

Leading companies are at the forefront of advancing mobile advertising technology and fostering collaboration across the ecosystem. Technology giants invest heavily in artificial intelligence and machine learning to refine audience segmentation, predictive targeting, and budget optimization, while leveraging massive troves of first-party data to deliver personalized ad experiences at scale. Programmatic platforms continue to evolve, integrating unified auction environments that merge mobile web and in-app inventory, enabling holistic campaign management across multiple channels.

Innovative ad networks and demand-side platforms partner with measurement specialists, data clean-room providers, and identity resolution services to improve cross-platform attribution and deliver transparent insights into user journeys. Mobile operating system developers are also enhancing privacy features and consent mechanisms, prompting advertisers to adopt privacy-centric architectures that utilize deterministic and probabilistic signals for audience modeling. In parallel, creative studios are collaborating with ad tech innovators to produce engaging formats-such as playable ads, shoppable videos, and augmented reality experiences-that resonate with on-the-go consumers and drive higher engagement rates.

This comprehensive research report delivers an in-depth overview of the principal market players in the Mobile Advertising market, evaluating their market share, strategic initiatives, and competitive positioning to illuminate the factors shaping the competitive landscape.

- Accenture plc

- Admarket Advertising

- Alibaba Group Holding Limited.

- Amazon.com, Inc.

- ByteDance Ltd.

- Cheil Worldwide Inc.

- Daniel J. Edelman Holdings, Inc.

- Deloitte Touche Tohmatsu Limited

- Dentsu Inc.

- Deutsch Inc.

- Droga5, LLC

- FCB Worldwide, Inc.

- Google LLC

- Havas SA

- Hurra Communications GmbH

- International Business Machines Corporation

- Leo Burnett Company, Inc.

- M+C Saatchi Group

- Mailchimp

- McCann Erickson Worldwide, Inc.

- Meta Platforms, Inc.

- MullenLowe Group Limited

- NP Digital, LLC

- Omnicom Group Inc

- Publicis Groupe S.A.

- R/GA LLC

- Seagull Advertising

- Synapse Marketing Consultancy Pvt. Ltd.

- Tencent Holdings Limited

- Wieden+Kennedy

- WPP plc

Empowering Industry Leaders with Strategic Actions to Capitalize on Emerging Mobile Advertising Technologies and Mitigate Evolving Market Challenges

Industry leaders should prioritize the adoption of AI-driven personalization engines that dynamically tailor ad creative and messaging to individual user contexts, thereby increasing relevance and reducing ad fatigue. Concurrently, organizations must invest in robust data governance frameworks that ensure compliance with evolving global privacy regulations, while also leveraging first-party data to build direct-to-consumer relationships and reduce reliance on third-party identifiers.

To optimize measurement and attribution, brands should integrate multi-touch attribution models and server-to-server conversion APIs, enabling a single source of truth that aligns with both walled-garden and open-web performance metrics. Additionally, diversifying ad spend across emerging formats-such as interactive video, contextual native placements, and connected TV extensions-can unlock new engagement opportunities and mitigate dependency on any single channel.

Finally, supply chain volatility requires a proactive approach to regional inventory sourcing and partnerships with inventory aggregators to ensure consistent ad delivery. By fostering cross-functional collaboration among marketing, technology, and procurement teams, organizations can enhance agility, mitigate risk, and sustain campaign effectiveness in the face of continual market flux.

Outlining the Rigorous Research Approach Integrating Quantitative Analytics Qualitative Interviews and Proprietary Data Sources to Ensure Robust Findings

This research synthesizes insights from a rigorous, multi-stage process designed to capture both breadth and depth in understanding mobile advertising trends. Primary research included in-depth interviews with senior marketing and ad operations executives, technology providers, and creative agencies to gather qualitative perspectives on strategy, innovation, and operational challenges. Complementing these findings, a series of quantitative online surveys captured performance benchmarks, budget allocation patterns, and technology adoption rates across diverse industry verticals.

Secondary research leveraged a comprehensive review of publicly available reports, regulatory documents, platform disclosures, and peer-reviewed studies to contextualize primary insights within broader market and policy developments. Proprietary data sources-including anonymized campaign performance metrics, device shipment trends, and supply chain analyses-were integrated to provide robust evidence of evolving dynamics. Finally, all inputs were validated through expert panel workshops that stress-tested hypotheses, refined segmentation frameworks, and ensured the research outputs reflect real-world applicability.

This section provides a structured overview of the report, outlining key chapters and topics covered for easy reference in our Mobile Advertising market comprehensive research report.

- Preface

- Research Methodology

- Executive Summary

- Market Overview

- Market Insights

- Cumulative Impact of United States Tariffs 2025

- Cumulative Impact of Artificial Intelligence 2025

- Mobile Advertising Market, by Ad Format

- Mobile Advertising Market, by Device Type

- Mobile Advertising Market, by Platform

- Mobile Advertising Market, by Channel

- Mobile Advertising Market, by Pricing Model

- Mobile Advertising Market, by Industry Vertical

- Mobile Advertising Market, by Region

- Mobile Advertising Market, by Group

- Mobile Advertising Market, by Country

- United States Mobile Advertising Market

- China Mobile Advertising Market

- Competitive Landscape

- List of Figures [Total: 18]

- List of Tables [Total: 2067 ]

Synthesizing Critical Mobile Advertising Insights to Guide Decision Makers Toward Sustainable Growth and Innovation in an Ever-Changing Digital Ecosystem

Bringing together technology innovation, shifting consumer expectations, and regulatory evolution, the mobile advertising landscape presents both formidable challenges and unprecedented opportunities. Successful marketers will be those who strike the right balance between performance optimization and privacy stewardship, leveraging advanced analytics to deliver personalized experiences that resonate in context while safeguarding user trust. Agility in campaign execution, underpinned by diversified format and channel strategies, will be essential for sustaining growth amid competitive pressures and fluctuating supply chains.

As the digital ecosystem continues to evolve, the ability to harness first-party data, navigate complex consent landscapes, and invest in emerging technologies will distinguish market leaders from followers. By applying a holistic, segmentation-driven approach, brands can unlock deeper consumer insights, achieve higher efficiency in ad spend, and foster long-term loyalty. Ultimately, the forward-looking organizations that embrace innovation, collaboration, and ethical data practices will define the next era of mobile advertising success.

Connect with Ketan Rohom to Unlock Comprehensive Mobile Advertising Insights and Gain a Competitive Edge with Our Exclusive Market Research Report

Embark on a strategic partnership to elevate your mobile advertising initiatives to new heights by leveraging comprehensive, data-driven insights tailored to your brand’s unique objectives. Connect with Ketan Rohom, Associate Director of Sales & Marketing, to explore how our exclusive market research report can empower your team with actionable intelligence, uncover untapped opportunities, and reinforce competitive positioning. Reach out today to secure access to a definitive guide that will inform your next phase of growth and innovation in the ever-evolving mobile advertising ecosystem

- How big is the Mobile Advertising Market?

- What is the Mobile Advertising Market growth?

- When do I get the report?

- In what format does this report get delivered to me?

- How long has 360iResearch been around?

- What if I have a question about your reports?

- Can I share this report with my team?

- Can I use your research in my presentation?