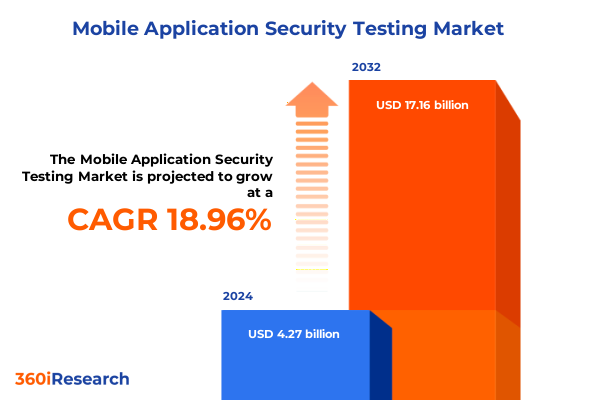

The Mobile Application Security Testing Market size was estimated at USD 5.08 billion in 2025 and expected to reach USD 6.04 billion in 2026, at a CAGR of 18.98% to reach USD 17.16 billion by 2032.

Navigating the Evolving Landscape of Mobile Application Security Testing to Safeguard Enterprise Assets and User Trust in a Connected World

The proliferation of mobile devices and the growing complexity of application ecosystems have elevated security testing from a niche technical requirement to a strategic imperative for organizations worldwide. In today’s hyperconnected environment, mobile applications serve as critical interfaces between enterprises and their customers, handling sensitive data and enabling essential services across industries. As a result, vulnerabilities in these applications can translate into significant operational, financial, and reputational losses, making robust security testing an indispensable element of digital transformation journeys.

This executive summary distills key insights from an in-depth analysis of the mobile application security testing landscape, highlighting transformative shifts, tariff impacts, segmentation nuances, regional dynamics, leading companies, and actionable recommendations for industry leaders. By weaving together data-driven perspectives and expert analysis, the report illuminates the strategic underpinnings that drive competitive advantage in this rapidly evolving domain. Whether you are a cybersecurity leader seeking to optimize testing programs or a decision-maker evaluating market provider offerings, these synthesized findings will guide your approach to safeguarding mobile applications against escalating threats while unlocking business value.

Identifying the Major Paradigm Shifts Transforming Mobile Application Security Testing Methodologies and Business Value Propositions Worldwide

The mobile application security testing market is undergoing profound paradigm shifts that are redefining traditional approaches and elevating the role of proactive, integrated testing within the software lifecycle. One of the most significant transformations is the widespread adoption of risk-based testing strategies, which prioritize assessment efforts based on the potential impact and likelihood of specific vulnerabilities. This shift toward targeted testing allows organizations to allocate resources more efficiently, focusing on critical application components and user touchpoints where breaches would incur the highest costs.

Simultaneously, the DevSecOps movement has accelerated the integration of security processes into continuous integration and continuous delivery pipelines, ensuring that application security checkpoints are automated, consistent, and inseparable from development workflows. This embedded security approach reduces remediation cycles, improves collaboration between development and security teams, and fosters a culture of “security as code.” Moreover, the infusion of artificial intelligence and machine learning capabilities into testing tools has enhanced threat detection accuracy, enabling dynamic analysis engines to identify novel attack vectors and anomalous behavior patterns. Together, these transformative shifts are reshaping the mobile application security testing landscape, empowering organizations to anticipate threats, streamline testing lifecycles, and reinforce resilience against an ever-evolving adversary.

Examining How the 2025 United States Tariff Revisions Are Reshaping Cost Structures and Security Investment Decisions in Mobile Application Testing

In 2025, revisions to United States tariff structures have material implications for mobile application security testing, particularly as many specialized testing tools, hardware appliances, and third-party software components are sourced internationally. Heightened duty rates on overseas imports have increased the cost base for proprietary dynamic and interactive analysis platforms, prompting service providers to reassess pricing models and invest in local development alternatives. For enterprises relying on managed services contracts, these added expenses may translate into budget reallocations or phased rollouts of testing initiatives to mitigate financial strain.

Furthermore, supply chain considerations extend beyond simple cost inflation; disruptions in component availability and delayed software licensing renewals can delay testing cycles and elevate exposure to security risks. To adapt, market participants are diversifying their procurement strategies, exploring open-source tool integrations, and negotiating long-term supply agreements that hedge against further tariff escalations. At the same time, these tariff-induced pressures have accelerated innovation in domestic tool development and fostered closer partnerships between U.S.-based vendors and global technology firms. As a result, stakeholders are recalibrating their security investment decisions, balancing short-term cost containment with long-term imperatives for robust, scalable testing solutions.

Refining Mobile App Security Testing with Strategic Segmentation by Service, Technology, Deployment, Platform, Organization Size, and Industry

Customizing security testing offerings demands a nuanced understanding of market segmentation across multiple dimensions. Service categories span consulting engagements, managed services, penetration testing packages, and targeted training programs, with managed services further breaking down into continuous monitoring, incident response, and patch management. In parallel, software solutions encompass dynamic application security testing tools, interactive application security testing engines, runtime application self-protection components, and static application security testing suites. These diverse offerings cater to varied organizational needs, from ad-hoc vulnerability assessments to fully outsourced testing frameworks.

The choice of testing technology-be it dynamic or static analysis, interactive self-protection, or hybrid approaches-fundamentally shapes how vulnerabilities are detected and prioritized. Deployment models range from on-premises installations, favored by highly regulated industries seeking full data control, to cloud-based platforms that offer rapid scalability and reduced infrastructure overhead. Mobile application platforms further complicate the landscape, as Android, iOS, HTML5, and Windows environments each present unique security challenges, tooling requirements, and compliance considerations. Organizational scale also plays a pivotal role: large enterprises often demand integrated testing ecosystems with centralized dashboards and enterprise-grade SLAs, while small and medium enterprises gravitate toward modular, cost-effective solutions that deliver rapid time-to-value. Finally, end-user sectors such as banking, financial services and insurance, government, healthcare, IT and telecom, and retail impose specialized compliance mandates and threat profiles, underscoring the imperative for segmentation-aware testing strategies that align tightly with industry-specific risk appetites and regulatory frameworks.

This comprehensive research report categorizes the Mobile Application Security Testing market into clearly defined segments, providing a detailed analysis of emerging trends and precise revenue forecasts to support strategic decision-making.

- Testing Type

- Testing Approach

- Application Platform

- Deployment Mode

Deciphering Regional Variations in Mobile Application Security Testing Trends and Adoption Rates across the Americas, EMEA, and Asia-Pacific Markets

Regional dynamics exert a profound influence on mobile application security testing practices, as adoption rates and maturity levels vary significantly across hemispheres. In the Americas, robust regulatory landscapes in North America and the growing digital economies of Latin America have spurred widespread uptake of advanced testing methodologies, driven by stringent data protection regulations and high-profile breach incidents. Conversely, Europe, the Middle East & Africa exhibit a mosaic of compliance drivers-ranging from GDPR enforcement in Europe to cybersecurity mandates in Gulf Cooperation Council states-encouraging harmonized testing protocols and heightened investment in penetration testing and managed services.

Meanwhile, the Asia-Pacific region presents a dual narrative: established markets like Japan and Australia demonstrate mature testing ecosystems with integrated DevSecOps practices, while emerging Southeast Asian and South Asian economies prioritize rapid adoption of cloud-based testing solutions to support accelerating mobile penetration and digital transformation agendas. Economic growth trajectories, regulatory evolutions, and local innovation ecosystems in each region shape how service providers tailor their portfolios, whether through localized training offerings, partnerships with regional technology firms, or the deployment of multilingual testing platforms. As global enterprises scale across these geographies, they must navigate regional variances in threat landscapes, compliance norms, and technology readiness to maintain consistent security postures worldwide.

This comprehensive research report examines key regions that drive the evolution of the Mobile Application Security Testing market, offering deep insights into regional trends, growth factors, and industry developments that are influencing market performance.

- Americas

- Europe, Middle East & Africa

- Asia-Pacific

Mapping the Competitive Landscape of Leading Mobile Application Security Testing Providers and Their Innovations to Drive Market Leadership

The competitive landscape of mobile application security testing is populated by a blend of established cybersecurity giants, specialized testing vendors, and emerging disruptors. Legacy providers have expanded their portfolios to include comprehensive security scanning suites that integrate dynamic, static, and interactive self-protection capabilities, leveraging decades of threat intelligence and research. At the same time, pure-play testing firms have carved out niches by offering highly customizable pen testing engagements, boutique training services, and white-glove incident response teams focused exclusively on mobile threats.

Amid this dynamic arena, supplier differentiation increasingly hinges on the integration of AI-driven analytics, real-time risk dashboards, and low-code/no-code testing workflows that accommodate rapid release cycles. Partnerships between testing vendors and major cloud platform operators have also become common, enabling streamlined deployment and embedded security checks within popular DevOps toolchains. Meanwhile, acquisitive consolidation among leading players is driving convergence, as larger vendors seek to augment their capabilities through targeted buyouts of specialized startups. This evolving mosaic of market participants reflects a broader trend toward platform-centric security ecosystems, where breadth of coverage, depth of expertise, and seamless integration serve as benchmarks for market leadership.

This comprehensive research report delivers an in-depth overview of the principal market players in the Mobile Application Security Testing market, evaluating their market share, strategic initiatives, and competitive positioning to illuminate the factors shaping the competitive landscape.

- A&O IT Group

- Appknox Inc.

- Astra IT, Inc.

- BreachLock Inc.

- Cigniti Technologies Limited

- Cyberops

- Detox Technologies

- eSec Forte Technologies Private Ltd.

- eShard

- HCL Technologies Limited

- Indian Cyber Security Solutions

- Indusface Pvt ltd.

- Komodo Consulting

- Kratikal Tech Pvt. Ltd

- Nettitude Limited

- NowSecure, Inc.

- Positive Technologies

- Synack, Inc.

- Synopsys, Inc.

- TestingXperts

- Valency Networks, LLP

- ValueMentor

- Varutra Consulting

- Wattlecorp Cyber Risk Management Services LLC

- Wattlecorp Cybersecurity Labs LLP

Actionable Recommendations for Industry Leaders to Embed Robust Security Testing Frameworks and Enhance Protective Postures in Mobile Applications

Industry decision-makers must embrace a multifaceted approach to fortify mobile application security testing programs effectively. First, adopting risk-based methodologies ensures that the most vulnerable application components and user pathways receive priority attention, thereby maximizing the impact of limited testing budgets. Organizations should integrate security gates directly into DevOps pipelines, leveraging automation to enable continuous, real-time vulnerability detection and remediation feedback loops.

Second, a hybrid deployment strategy that balances cloud-native testing solutions with on-premises integrations can provide the flexibility needed to address both compliance requirements and scalability demands. Third, investing in staff upskilling through targeted training modules-spanning secure coding practices, threat modeling, and advanced penetration testing techniques-will cultivate a security-conscious culture and reduce reliance on external services for basic testing tasks. Additionally, forging strategic alliances with testing vendors that offer modular, API-driven platforms can streamline toolchain interoperability and accelerate innovation. By implementing these recommendations, leaders can achieve a resilient security posture that aligns with organizational risk tolerances and adapts swiftly to emerging threat vectors.

Detailing the Rigorous Methodological Approach and Data Collection Processes Underpinning the Mobile Application Security Testing Market Analysis

This analysis is grounded in a comprehensive, multi-stage research methodology that triangulates primary and secondary data sources to ensure robust insights. Primary research comprised in-depth interviews with cybersecurity practitioners, mobile application developers, and C-suite executives responsible for security strategy, offering qualitative perspectives on evolving testing practices and vendor performance. Secondary research included the systematic review of industry reports, peer-reviewed publications, regulatory frameworks, and vendor white papers to map technology advancements and market drivers.

Quantitative data was validated through a structured survey of service providers and end users across key regions, capturing metrics on tool adoption rates, testing frequency, budget allocations, and perceived barriers. Data synthesis involved cross-referencing responses with publicly available financial statements, patent filings for emerging testing technologies, and vulnerability disclosure databases. Analytical frameworks such as SWOT and Porter’s Five Forces were applied to derive competitive, regulatory, and innovation dynamics influencing the mobile application security testing market. Rigorous quality controls, including data triangulation and expert panel reviews, were executed to certify the accuracy and relevance of all findings.

This section provides a structured overview of the report, outlining key chapters and topics covered for easy reference in our Mobile Application Security Testing market comprehensive research report.

- Preface

- Research Methodology

- Executive Summary

- Market Overview

- Market Insights

- Cumulative Impact of United States Tariffs 2025

- Cumulative Impact of Artificial Intelligence 2025

- Mobile Application Security Testing Market, by Testing Type

- Mobile Application Security Testing Market, by Testing Approach

- Mobile Application Security Testing Market, by Application Platform

- Mobile Application Security Testing Market, by Deployment Mode

- Mobile Application Security Testing Market, by Region

- Mobile Application Security Testing Market, by Group

- Mobile Application Security Testing Market, by Country

- United States Mobile Application Security Testing Market

- China Mobile Application Security Testing Market

- Competitive Landscape

- List of Figures [Total: 16]

- List of Tables [Total: 795 ]

Summarizing Key Findings and Strategic Implications to Guide Next Steps in Strengthening Mobile Application Security Testing Initiatives

Our investigation reveals that the mobile application security testing landscape is characterized by dynamic shifts toward risk-centric, automated testing within DevSecOps frameworks, underpinned by AI-driven detection capabilities. The 2025 U.S. tariff revisions have introduced cost pressures that are accelerating domestic tool innovation and reshaping procurement strategies. Segmentation insights underscore the necessity of tailoring testing solutions by service type, technology, deployment mode, platform, organizational scale, and industry-specific mandates to achieve optimal effectiveness.

Regionally, the Americas lead in stringent regulatory-driven adoption, EMEA exhibits unified compliance responses, and Asia-Pacific balances maturity in established markets with rapid uptake in emerging economies. Competitive analysis highlights a convergence toward integrated security platforms, with market leaders differentiating through proprietary analytics, strategic alliances, and seamless DevOps integration. Collectively, these findings forge a strategic blueprint for organizations seeking to enhance their mobile security testing programs, guiding resource allocation, vendor selection, and process optimization to mitigate risks and drive sustainable growth.

Connect Directly with Associate Director of Sales & Marketing for Exclusive Offer on the Mobile Application Security Testing Market Research Report Purchase

We invite you to connect directly with Ketan Rohom, our Associate Director of Sales & Marketing, to secure unparalleled insights into the mobile application security testing arena. Ketan’s deep expertise and consultative approach ensure you gain tailored guidance on how to leverage the full breadth of our research report for strategic planning, investment decisions, and competitive advantage. By engaging now, you’ll receive priority access to customized data extracts, exclusive pricing options, and expert walkthroughs to help you extract maximum value from the study. This is your opportunity to empower your organization with the actionable intelligence needed to safeguard applications, drive innovation, and strengthen trust with users. Reach out today to transform these comprehensive research findings into immediate strategic wins for your mobile security initiatives and ensure your enterprise remains ahead of emerging threats and market evolutions.

- How big is the Mobile Application Security Testing Market?

- What is the Mobile Application Security Testing Market growth?

- When do I get the report?

- In what format does this report get delivered to me?

- How long has 360iResearch been around?

- What if I have a question about your reports?

- Can I share this report with my team?

- Can I use your research in my presentation?