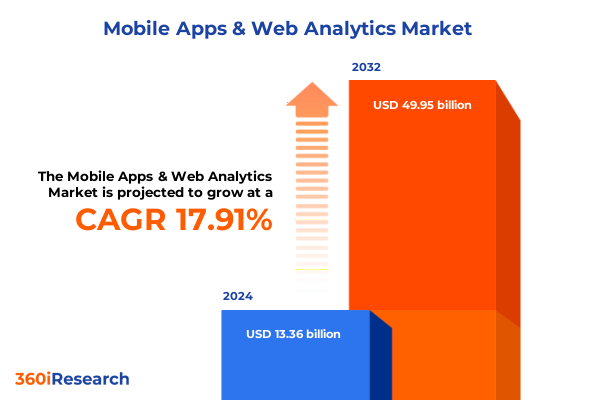

The Mobile Apps & Web Analytics Market size was estimated at USD 15.63 billion in 2025 and expected to reach USD 18.32 billion in 2026, at a CAGR of 18.04% to reach USD 49.95 billion by 2032.

Innovative Beginnings: Setting the Stage for the Next Era of Mobile Application and Web Analytics Excellence Across Industries

In today’s digital-first world, the convergence of mobile applications and web analytics has become a cornerstone of strategic decision-making across every industry. The rapid proliferation of smartphones, coupled with evolving consumer behaviors, has transformed how businesses collect, interpret, and act upon data. Mobile devices now account for nearly two-thirds of global web traffic, highlighting the critical role that seamless analytics plays in understanding user journeys and optimizing engagement-an imperative illustrated by Cisco’s finding that 82% of mobile web traffic is video-related and demands real-time performance monitoring. Furthermore, average daily time spent on apps has climbed to 4.9 hours, underscoring the importance of intuitive design and personalized experiences to retain user attention and drive revenue.

Against this backdrop, enterprises are investing in sophisticated analytics frameworks that bridge mobile and web environments, enabling a single view of the customer. Real-time dashboards, anomaly detection, and predictive modeling empower organizations to pivot quickly in response to emerging trends. The dynamic nature of user preferences-evident in a 23% higher retention rate for apps with gamified experiences-requires analytics platforms to deliver actionable insights with minimal latency. Consequently, businesses that embrace an integrated analytics approach gain a competitive edge, leveraging data to inform product roadmaps, refine marketing campaigns, and enhance customer support. Transitioning from disparate data silos to cohesive, real-time analytics ecosystems sets the foundation for accelerated innovation and sustained growth.

Revolutionary Shifts Redefining User Engagement and Analytics Capabilities in the Mobile App and Web Ecosystem

The analytics ecosystem is undergoing a fundamental transformation driven by the integration of artificial intelligence and machine learning. Modern platforms leverage AI to automate anomaly detection, predict user behavior, and generate recommendations that drive personalized interactions. According to Querio, 75% of businesses now employ AI analytics, with 80% reporting measurable gains in operational efficiency and decision quality. This shift from descriptive to prescriptive analytics enables organizations to move beyond retrospective reporting and adopt forward-looking strategies that anticipate customer needs in real time.

Simultaneously, an increasingly complex privacy landscape is reshaping data collection and processing practices. The United States now hosts a patchwork of state-level privacy statutes that augment the California Consumer Privacy Act, with new regulations in Maryland, Minnesota, and Vermont imposing stringent data minimization and consumer rights provisions. As businesses navigate these divergent requirements, demand is growing for privacy-centric analytics solutions that emphasize first-party data, consent management, and pseudonymization techniques-approaches that help maintain compliance while preserving analytical depth.

Advancements in connectivity, particularly the rapid rollout of 5G and edge computing, are unlocking new possibilities for real-time analytics at scale. Global 5G connections surpassed two billion in late 2024, with North America poised to eclipse 4G adoption by 2025. By processing data closer to the source through edge deployments, organizations can drastically reduce latency, support mission-critical applications, and enable richer, context-aware experiences in areas such as AR-driven retail, telemedicine, and industrial automation.

Concurrently, the industry is pivoting to cookieless tracking and server-side tagging frameworks to adapt to browser deprecations and privacy mandates. Platforms are adopting advanced consent management tools that inform users, capture explicit opt-ins, and route data through secure server environments. Best practices now emphasize robust data governance, real-time data validation, and seamless integration with marketing automation systems to ensure analytics continuity in a privacy-first era.

Assessing the Multifaceted Impact of United States 2025 Tariff Policies on Mobile Application and Web Analytics Operations

In early 2025, the United States enacted a new tranche of reciprocal tariffs aimed at key technology imports, marking a significant turning point for businesses reliant on global supply chains. Automotive manufacturers and semiconductor firms reported immediate cost pressures, with companies like Texas Instruments warning of reduced demand and citing tariff-related disruptions in their earnings calls. While the tariffs primarily targeted hardware components, their ripple effects extended to software vendors and service providers, as clients grappled with higher infrastructure expenses and delayed project timelines.

IT infrastructure leaders have faced notable procurement challenges, with server and networking equipment costs rising by 15–20% amid tariff-induced surcharges on Chinese-manufactured goods. Organizations are diversifying suppliers, exploring domestic manufacturing partnerships, and extending hardware refresh cycles to mitigate immediate budgetary impacts. Notably, Intel and Micron accelerated capacity expansions in Arizona and Idaho, but these nearshoring efforts required elevated capital commitments and lengthened deployment schedules.

The inflationary pressure extends to cloud and managed service providers, who have absorbed increased networking and hardware expenditures, translating into incremental unit costs. IDC has highlighted that the new tariffs will dampen global IT spending growth, as elevated technology prices and supply chain bottlenecks erode business confidence and temper investment in advanced analytics projects. Companies accelerating digital transformation plans may experience postponements, particularly in capital-intensive initiatives like on-premises data center upgrades.

Meanwhile, leading vendors are adapting strategies to navigate the tariff environment. Some are revising their global manufacturing footprints, seeking tariff exemptions for strategic product lines, and offering structured financing to soften the cost impact for enterprise clients. Others are bundling analytics and support services to maintain value propositions, recognizing that client retention hinges on predictable total cost of ownership in a volatile trade policy landscape.

Deep Dive into Segmentation Insights Uncovering Component, Deployment, Application, Organization Size and Category Nuances Driving Performance

A granular examination of market segmentation reveals nuanced dynamics that shape vendor strategies and client priorities. Segmenting by Component uncovers a bifurcation between Services, which encompass consulting, integration and deployment, and support and maintenance, and Solutions, which span data analytics, data discovery, data management, and data visualization. This division underscores the critical interplay between end-to-end service engagements and technology-driven software offerings, as enterprises seek cohesive solutions that combine technical expertise with robust analytics tooling.

Deployment mode presents a strategic choice between on-cloud and on-premises architectures. Cloud environments offer scalability and rapid feature rollouts, appealing to organizations pursuing agile analytics deployments. Conversely, on-premises infrastructure resonates with clients emphasizing data sovereignty, latency control, and customized security protocols, particularly in regulated industries where compliance mandates dictate local data residency.

Application-based segmentation highlights the broad functional scope of analytics platforms. From content and email marketing to heat map analysis and marketing automation, these tools enable targeted user insights and campaign optimization. Mobile advertising and marketing analysis further refine this focus, delivering granular attribution and engagement metrics that support performance-driven growth. Social media engagement analytics complete the spectrum, tracking cross-channel interactions and sentiment to inform brand strategies.

Organizational size and vertical categorization illuminate how analytics needs vary across enterprises and industries. Large enterprises leverage sophisticated, multi-module analytics suites to coordinate global operations, while small and medium-sized enterprises often opt for modular, cost-effective platforms that deliver rapid time-to-value. Industry verticals-from automotive and financial services to healthcare, manufacturing, media and entertainment, retail and eCommerce, telecommunication, transportation and logistics, and travel and hospitality-each impose unique data requirements, regulatory considerations, and performance benchmarks that analytics vendors must address to secure market share.

This comprehensive research report categorizes the Mobile Apps & Web Analytics market into clearly defined segments, providing a detailed analysis of emerging trends and precise revenue forecasts to support strategic decision-making.

- Component

- Deployment

- Application

- Organization Size

- Application Category

Regional Dynamics Illuminating Growth Patterns and Adoption Trends Across the Americas, Europe Middle East & Africa, and Asia-Pacific Analytics Markets

Regional variation in analytics adoption reflects distinct economic conditions, regulatory environments, and digital maturity levels. In the Americas, market growth is propelled by significant investments in cloud-native analytics and marketing automation, with North America’s advanced technology infrastructure serving as a launchpad for innovation. US enterprises prioritize integrated analytics suites that unify web, mobile, and customer relationship management data to deliver comprehensive, omni-channel insights.

Europe, Middle East & Africa exhibits a more heterogeneous landscape, shaped by diverse privacy regulations and data sovereignty requirements. The European Union’s stringent GDPR framework necessitates privacy-first analytics architectures, prompting organizations to invest in on-premises and private cloud solutions that ensure compliance. Meanwhile, Middle Eastern and African markets are rapidly adopting cloud-based analytics to support digital transformation initiatives in sectors such as energy, telecommunications, and public services.

Asia-Pacific stands out for its accelerated mobile-first adoption, particularly in Southeast Asia and India, where burgeoning smartphone penetration drives demand for consumer analytics and mobile advertising optimization. Local digital ecosystems, characterized by platform diversity and regional social media networks, require multi-vendor analytics strategies that cater to unique user behaviors. In Australia and Japan, advanced manufacturing and automotive hubs are integrating predictive analytics with IoT and edge computing to advance Industry 4.0 objectives.

Across all regions, the convergence of 5G, AI-driven analytics, and privacy-preserving technologies is narrowing the gap between developed and emerging markets. Strategic partnerships between global vendors and local system integrators help facilitate knowledge transfer, enabling sustained analytics growth underpinned by tailored, region-specific solutions.

This comprehensive research report examines key regions that drive the evolution of the Mobile Apps & Web Analytics market, offering deep insights into regional trends, growth factors, and industry developments that are influencing market performance.

- Americas

- Europe, Middle East & Africa

- Asia-Pacific

Strategic Company Profiles Highlighting Competitive Differentiators and Innovation Strategies Shaping the Mobile App and Web Analytics Market

The competitive landscape in mobile application and web analytics is dominated by major technology conglomerates offering integrated ecosystems. Google Analytics and Firebase Analytics lead the market with free and scalable analytics tiers, leveraging their native integrations with cloud infrastructure and advertising platforms to deliver comprehensive performance insights. Adobe Analytics, as part of a broader experience cloud, excels in omnichannel attribution, providing enterprise clients with deep segmentation and real-time reporting capabilities that align with large-scale marketing operations. Oracle and Microsoft, through Oracle Analytics Cloud and Azure Application Insights, respectively, differentiate themselves by offering tightly integrated stacks that bridge analytics with database, middleware, and cloud-native services.

Specialized analytics vendors have carved out significant market share by focusing on behavioral analytics and user journey optimization. Mixpanel’s event-based tracking and cohort analysis empower product teams to understand user retention drivers, while Amplitude’s patented Behavioral Graph technology enables customer pathing and churn prediction for clients like Netflix and Peloton. Flurry Analytics and Localytics cater to mobile-first enterprises, offering streamlined SDK integrations and campaign attribution features tailored to app-based engagement scenarios.

Emerging players are gaining traction by addressing niche requirements and leveraging privacy-first architectures. Heap’s automatic data capture eliminates manual event instrumentation, reducing time-to-insight and ensuring compliance with GDPR through server-side data routing. CleverTap and MoEngage focus on personalized engagement through AI-driven segmentation and multilingual support, appealing to fast-growing brands in Asia-Pacific and Latin America. The evolving landscape underscores the convergence of unified data capture, consent management, and AI automation as the key determinants of competitive differentiation.

This comprehensive research report delivers an in-depth overview of the principal market players in the Mobile Apps & Web Analytics market, evaluating their market share, strategic initiatives, and competitive positioning to illuminate the factors shaping the competitive landscape.

- 42matters AG

- Adjust GmbH

- Adobe Inc.

- Alchemer LLC

- Amazon Web Services, Inc.

- Amplitude, Inc.

- AppFollow

- Apphud

- Apple Inc.

- Applied Technologies Internet SAS

- AppsFlyer Ltd.

- AppTweak SA

- Branch Metrics, Inc

- Broadcom Inc.

- Chartbeat, Inc.

- Comscore, Inc.

- Contentsquare

- Conva Ventures Inc.

- Countly Ltd.

- Datamatics Global Services Limited

- Flurry, Inc.

- FullStory, Inc.

- Glassbox Ltd.

- Google LLC

- Heap Inc.

- International Business Machines Corporation

- Microsoft Corporation

- Microstrategy Incorporated

- Mixpanel, Inc.

- Mobius Solutions, Ltd.

- MoEngage, Inc.

- Open Text Corporation

- Oracle Corporation

- Pendo.io, Inc.

- Plausible Insights OÜ

- QlikTech International AB

- Qonversion Inc.

- Quantum Metric, Inc.

- Salesforce, Inc.

- SAP SE

- SAS Institute Inc.

- Singular Labs, Inc.

- Smartlook.com

- Splunk Inc.

- Teradata Corporation

- TIBCO Software Inc.

- Upland Software, Inc.

- UXCam

- Webtrends Inc.

Action-Oriented Recommendations Empowering Industry Leaders to Drive Innovation and Sustain Competitive Advantage in Analytics Deployment

Industry leaders should prioritize the integration of AI-driven analytics engines that provide prescriptive and predictive insights. By embedding machine learning models directly into analytics workflows, organizations can automate decision-making processes, accelerate time-to-value, and surface growth opportunities in real time. Investing in AI talent and governance frameworks will ensure that insights remain accurate, transparent, and ethically responsible.

To mitigate geopolitical and tariff-related risks, companies must diversify their vendor ecosystems and consider hybrid deployment models. Leveraging a mix of on-premises and cloud infrastructure allows enterprises to balance cost, compliance, and performance requirements. Establishing strategic partnerships with regional system integrators and hardware suppliers can further insulate operations from supply chain disruptions.

A privacy-first analytics posture is imperative in the current regulatory environment. Organizations should adopt advanced consent management platforms, anonymization techniques, and server-side tagging to safeguard user data while maintaining analytical fidelity. Collaborating with legal and compliance teams early in the analytics lifecycle will streamline policy adherence and enhance consumer trust.

Finally, cultivating a data-driven culture through cross-functional collaboration and upskilling initiatives is essential. Empowering business units with self-service analytics tools, guided by centralized governance, will democratize insights and foster accountability. Regular training programs that cover privacy regulations, AI ethics, and advanced analytics techniques will prepare workforces to harness emerging technologies effectively.

Rigorous Research Methodology Outlining Data Collection, Analysis Techniques, and Quality Assurance for Comprehensive Market Insights

This research integrates both primary and secondary methodologies to ensure the robustness of findings. Primary research comprised in-depth interviews with senior executives, analytics practitioners, and IT decision-makers, supplemented by structured surveys that captured quantitative perspectives on technology adoption, budget allocation, and strategic priorities.

Secondary research involved an exhaustive review of academic literature, industry white papers, regulatory filings, and credible news outlets. Publicly available data sources such as federal trade publications, regulatory announcements, and vendor disclosures provided contextual grounding. Triangulation techniques were employed to reconcile disparate data points, ensuring consistent and accurate insights.

Data validation and quality assurance processes included cross-referencing interview findings with market indicators and vendor performance metrics. An internal peer review mechanism vetted methodological frameworks, statistical analyses, and interpretive narratives. Ethical guidelines and confidentiality protocols were maintained throughout primary research, safeguarding the anonymity of respondents and the integrity of proprietary information.

The final report synthesizes these inputs into actionable insights, with clearly documented assumptions and limitations. A glossary of key terms and a detailed explanation of analytical models are provided to enhance transparency and facilitate replication or extension of the study by future researchers.

This section provides a structured overview of the report, outlining key chapters and topics covered for easy reference in our Mobile Apps & Web Analytics market comprehensive research report.

- Preface

- Research Methodology

- Executive Summary

- Market Overview

- Market Insights

- Cumulative Impact of United States Tariffs 2025

- Cumulative Impact of Artificial Intelligence 2025

- Mobile Apps & Web Analytics Market, by Component

- Mobile Apps & Web Analytics Market, by Deployment

- Mobile Apps & Web Analytics Market, by Application

- Mobile Apps & Web Analytics Market, by Organization Size

- Mobile Apps & Web Analytics Market, by Application Category

- Mobile Apps & Web Analytics Market, by Region

- Mobile Apps & Web Analytics Market, by Group

- Mobile Apps & Web Analytics Market, by Country

- United States Mobile Apps & Web Analytics Market

- China Mobile Apps & Web Analytics Market

- Competitive Landscape

- List of Figures [Total: 17]

- List of Tables [Total: 1272 ]

Closing Thoughts Emphasizing the Strategic Imperatives and Future-Ready Perspectives in Mobile Application and Web Analytics

The convergence of mobile application and web analytics, fueled by AI, 5G, and advanced privacy frameworks, marks a pivotal moment for enterprises aiming to deepen customer engagement and drive operational excellence. As digital ecosystems grow increasingly complex, the ability to integrate disparate data sources into unified, real-time analytics platforms will distinguish industry leaders from laggards.

Emerging challenges-from tariff-induced cost pressures to evolving privacy regulations-underscore the importance of adaptive strategies that balance innovation with compliance. Organizations that proactively diversify their technology partnerships, invest in hybrid deployments, and champion a privacy-first ethos will be well-positioned to navigate uncertainty and capitalize on growth opportunities.

Ultimately, the future of analytics lies in the seamless blending of predictive intelligence, ethical data practices, and cross-functional collaboration. By adhering to the recommendations outlined in this summary and leveraging the detailed insights contained in the full report, decision-makers can chart a course toward sustained competitive advantage and transformative business outcomes.

Engaging Call to Action Connects Readers with Ketan Rohom for Exclusive Access to the In-Depth Analytics Market Research Report

Don’t miss the opportunity to leverage these insights and drive transformative growth in your organization. Reach out to Ketan Rohom, Associate Director of Sales & Marketing, to request a personalized executive briefing, explore tailored research packages, and secure priority access to the comprehensive mobile application and web analytics market research report. Empower your strategy with data-driven intelligence today.

- How big is the Mobile Apps & Web Analytics Market?

- What is the Mobile Apps & Web Analytics Market growth?

- When do I get the report?

- In what format does this report get delivered to me?

- How long has 360iResearch been around?

- What if I have a question about your reports?

- Can I share this report with my team?

- Can I use your research in my presentation?