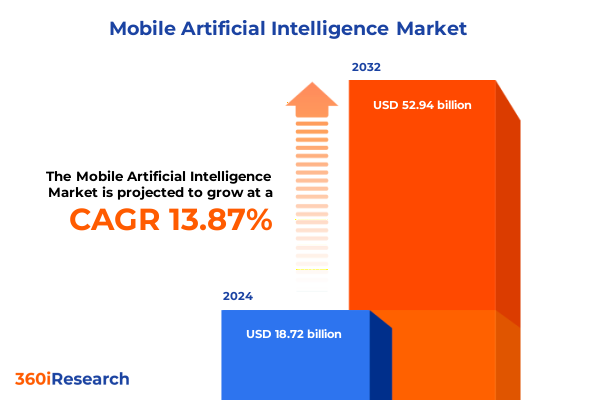

The Mobile Artificial Intelligence Market size was estimated at USD 21.14 billion in 2025 and expected to reach USD 23.92 billion in 2026, at a CAGR of 14.00% to reach USD 52.94 billion by 2032.

Unveiling the Future of Mobile AI: Revolutionizing Connectivity, User Experiences, Device Innovation, and Consumer Engagement Across Digital Platforms

In today’s hyperconnected world, mobile artificial intelligence has transcended niche experimentation to become a fundamental driver of innovation and differentiation across consumer and enterprise applications. From personalized digital experiences to intelligent device management, AI capabilities embedded within smartphones and wearables are elevating user interactions to unprecedented levels. These advances are underpinned by continuous breakthroughs in neural network optimization, sensor integration, and edge computing architectures, ensuring that intelligence flows seamlessly within compact, energy-efficient form factors.

As we look ahead, the convergence of sophisticated AI models with 5G and emerging 6G networks will unlock new paradigms in real-time analytics, immersive content delivery, and autonomous decision-making at the network edge. This introduction explores the transformative potential of mobile AI, setting the stage for an in-depth examination of market dynamics, regulatory influences, and strategic considerations shaping the next generation of connected devices.

Rapid Technological and Market Forces Reshaping Mobile AI Strategies, Ecosystems, and Industry Roadmaps for the Next Decade

Rapid advancements in hardware miniaturization and cloud-edge synergy are fundamentally rewriting the rulebook for mobile AI deployment. As modern system-on-chip designs integrate specialized AI accelerators alongside general-purpose processors, performance-per-watt figures have surged, empowering devices to execute complex inference tasks locally. Meanwhile, the maturation of federated learning frameworks is redefining data privacy and personalization, enabling models to adapt to individual user behavior without compromising sensitive information.

Market structures are also shifting: hyperscale cloud providers are forging alliances with semiconductor leaders to create end-to-end AI platforms, while application developers leverage open-source toolkits and standardized inference engines to expedite time-to-market. In parallel, service providers are embedding AI-driven features into consulting and integration offerings, guiding enterprises in orchestrating heterogeneous hardware and software ecosystems. Together, these trends are catalyzing a wave of innovation, compelling incumbents and challengers alike to recalibrate their strategies in the face of an increasingly dynamic competitive environment.

Assessing the Cumulative Impact of United States Tariffs in 2025 on Mobile AI Hardware Supply Chains, Cost Structures, and Innovation Dynamics

In early April 2025, the United States government announced sweeping reciprocal tariffs on imported goods from major trading partners, targeting a broad array of technology components integral to AI infrastructure. These measures, framed as safeguards for national security and trade balance, have elevated the cost of essential mobile AI hardware, including servers, sensor modules, and assembly services. The initial tariff exemptions for raw semiconductor chips provide only temporary relief, as subsequent policy signals indicate impending duties on finished circuits and packaged modules, thereby subjecting a significant portion of mobile AI supply chains to new levies.

The reverberations across the AI hardware sector have been immediate. Leading chip designers and cloud service providers have reported share price volatility, reflecting investor concerns over cost inflation and supply chain reconfiguration. Semiconductors remain the heart of AI-enabled mobile devices, yet with only a fraction of global fabrication occurring domestically, manufacturers are vulnerable to increased duties on imported GPUs and TPUs. The complex global production networks that span design, wafer fabrication, assembly, and testing now face higher entry costs and extended lead times, raising the total cost of ownership for device makers and service operators alike.

Consumer electronics firms are bracing for direct price pressures. Analysis indicates that potential levies of up to 60 percent on imports from key partners could drive smartphone prices significantly higher, compressing unit sales and altering demand elasticity. As primary and secondary component costs escalate, original equipment manufacturers and aftermarket suppliers must decide whether to absorb marginal increases or transfer them to consumers, risking market resistance in price-sensitive segments.

In response, tech giants and startups are reevaluating capital allocation and project roadmaps. Hyperscalers are adopting a more cautious expansion approach for data center deployments, weighing the trade-off between onshore procurement and tariff-exposed imports. Emerging AI ventures, reliant on agile budgets, face tighter runway projections as hardware expenditures climb. Despite these near-term headwinds, the long-term strategic objective remains unchanged: to foster robust domestic manufacturing capabilities through incentives like the CHIPS Act, gradually shifting critical chip production onshore and mitigating future tariff exposure.

Uncovering Segment-Specific Insights into Mobile AI Components, Technologies, Applications, Deployment Models, End Users, and Distribution Channels

A nuanced analysis of mobile AI reveals distinct value propositions and adoption characteristics across component, technology, application, deployment, end-user, and distribution channel dimensions. In the component domain, hardware investments have gravitated toward GPUs for high-throughput inference and specialized ASICs tailored to specific neural architectures, while FPGA-based solutions occupy niche roles requiring reconfigurability. Concurrently, services offerings are expanding beyond integration to encompass consulting-led strategy design, guiding enterprises through complex AI rollout projects. Software ecosystems, anchored on versatile frameworks, inference engines, and middleware, are streamlining development workflows to accelerate feature delivery.

From a technology perspective, deep learning remains the dominant paradigm, underpinning computer vision and natural language processing workloads, with emerging advances in speech recognition enhancing voice assistant capabilities. Supervised machine learning models complement these areas, especially in personalization and predictive analytics scenarios. Application segments demonstrate heterogeneity: virtual assistants leverage conversational AI platforms that integrate chatbots and voice assistants, while fraud detection systems harness machine learning pipelines for real-time anomaly detection. Predictive maintenance use cases depend on sensor fusion and edge analytics, and image recognition continues to unlock new possibilities in retail and healthcare.

Deployment strategies bifurcate along cloud-versus-on-device lines, with operators weighing latency, privacy, and performance considerations. Cloud-centric architectures offer scalable compute resources for model training and large-scale inference, whereas on-device deployments harness specialized hardware to enable offline operation and reduce data egress costs. End-user industries exhibit tailored momentum: automotive players deploy advanced driver assistance and infotainment solutions, financial institutions adopt AI for fraud monitoring, consumer electronics integrate smart wearables, healthcare providers implement diagnostic imagery analysis, and telecom networks embed AI for intelligent resource allocation. Finally, distribution channels vary by scale: OEM partnerships facilitate pre-integrated solutions, while aftermarket channels allow third parties to insert AI capabilities post-manufacturing, enabling retrofitting in legacy devices.

This comprehensive research report categorizes the Mobile Artificial Intelligence market into clearly defined segments, providing a detailed analysis of emerging trends and precise revenue forecasts to support strategic decision-making.

- Component

- Technology

- Deployment

- Application

- End User

Analyzing Regional Dynamics: How the Americas, EMEA, and Asia-Pacific Drive Distinct Mobile AI Adoption Patterns, Innovation Hubs, and Growth Drivers

Regional market dynamics in mobile AI reflect diverse economic conditions, regulatory frameworks, and infrastructure capabilities across the Americas, Europe Middle East & Africa, and Asia-Pacific. The Americas benefit from a mature technology ecosystem, significant venture capital inflows, and established patent protections, creating fertile ground for advanced driver assistance systems and personalization solutions. Data privacy regulations such as California’s Consumer Privacy Act guide ethical model deployment, and government incentives in sectors like automotive and consumer electronics further spur innovation.

In Europe, Middle East & Africa, stringent data protection laws such as GDPR shape solution architectures, encouraging transparency and user-centric controls. Collaborative frameworks like the European AI Alliance foster cross-border research initiatives, supporting applications in healthcare automation and industrial predictive maintenance. Investment in digital infrastructure, notably 5G rollouts, underpins low-latency mobile AI services, while regional development programs in the Middle East emphasize smart city and fintech use cases.

Asia-Pacific emerges as a frontrunner in enterprise AI adoption and on-device intelligence thanks to large-scale infrastructure investments and favorable manufacturing ecosystems. Countries like China and India lead in deploying generative and conversational AI within mobile applications, with substantial uptake in e-commerce personalization and digital payment security. Government-led semiconductor programs and edge computing initiatives accelerate hardware innovation, and distribution through both OEM and aftermarket channels ensures rapid market penetration across urban and rural segments.

This comprehensive research report examines key regions that drive the evolution of the Mobile Artificial Intelligence market, offering deep insights into regional trends, growth factors, and industry developments that are influencing market performance.

- Americas

- Europe, Middle East & Africa

- Asia-Pacific

Profiling Leading Mobile AI Innovators: Strategic Moves, Partnerships, and Competitive Advantages Shaping the Industry’s Top Players

The competitive landscape in mobile AI is shaped by a core cohort of technology leaders and agile challengers driving innovation across hardware, software, and services. Semiconductor giants have enhanced their AI portfolios through partnerships and strategic acquisitions, integrating specialized accelerators into scalable platforms. Cloud providers continue to expand their footprint in mobile endpoints, offering edge-to-cloud orchestration tools that simplify model deployment and monitoring.

On the software front, dedicated AI framework developers are extending support for on-device inferencing, optimizing performance across diverse chip architectures. In parallel, middleware specialists are embedding explainability and governance features into their solutions, addressing regulatory and ethical considerations. Services-oriented players leverage deep domain expertise to craft custom AI workflows for sectors such as automotive and healthcare, fostering deeper client relationships and recurring revenue streams.

Innovation hubs and startup ecosystems have also emerged as powerful catalysts. Early-stage ventures focused on niche applications, from advanced image recognition modules to context-aware voice assistants, are securing funding and forging OEM alliances. These collaborations enable rapid prototyping and scale, challenging incumbents to refine product roadmaps and preserve competitive differentiation. Ultimately, market leadership hinges on the ability to integrate cross-functional capabilities-combining hardware excellence, software versatility, and service-driven execution-to deliver end-to-end mobile AI solutions.

This comprehensive research report delivers an in-depth overview of the principal market players in the Mobile Artificial Intelligence market, evaluating their market share, strategic initiatives, and competitive positioning to illuminate the factors shaping the competitive landscape.

- Amazon.com, Inc.

- Apple Inc.

- Arm Limited

- Baidu, Inc.

- Cadence Design Systems, Inc.

- Cerebras Systems, Inc.

- Google LLC

- Graphcore Limited

- Huawei Technologies Co., Ltd.

- Intel Corporation

- International Business Machines Corporation

- MediaTek Inc.

- Microsoft Corporation

- NVIDIA Corporation

- Qualcomm Incorporated

- Samsung Electronics Co., Ltd.

- Synopsys, Inc.

- Taiwan Semiconductor Manufacturing Company Limited

- Vivo Communication Technology Co., Ltd.

- Xiaomi Corporation

Actionable Strategic Recommendations for Industry Leaders to Navigate Mobile AI Disruption, Capitalize on Emerging Trends, and Build Sustainable Competitive Advantage

Industry leaders must adopt a multifaceted strategy to navigate the mobile AI landscape and maintain a sustainable competitive edge. First, forging strategic partnerships across the hardware–software–services continuum enables organizations to assemble comprehensive offerings that address evolving customer needs. By collaborating with chip fabricators, framework maintainers, and systems integrators, firms can accelerate solution validation and optimize performance across heterogeneous environments.

Second, prioritizing investment in edge-native model development will unlock new on-device capabilities while mitigating network dependency. Organizations should refine their AI pipelines to produce compact, quantized models suited for mobile deployment. This approach enhances user experiences through reduced latency and improves data privacy by preserving sensitive information within the device.

Third, companies should cultivate cross-industry alliances to explore adjacent applications and leverage transferable AI competencies. For example, insights from automotive predictive maintenance can inform industrial equipment monitoring use cases, while fraud detection algorithms may be adapted to cybersecurity scenarios. Lastly, executive leadership must align talent development initiatives with emerging AI skill requirements, fostering a culture of continuous learning and experimentation. By executing these recommendations in concert, industry players can capitalize on mobile AI’s transformative potential and deliver sustained business impact.

Rigorous Research Methodology Combining Primary Interviews, Secondary Data Analysis, and Statistical Modeling to Validate Mobile AI Market Insights and Trends

This research initiative employed a rigorous methodology to ensure validity, reliability, and relevance of insights into the mobile AI market. The process began with an extensive secondary research phase, encompassing academic publications, industry white papers, company filings, and regulatory documents to map the evolving technology and competitive contexts. Key terminology, market definitions, and segmentation frameworks were standardized to create a consistent analytical baseline.

Subsequently, primary research was conducted through in-depth interviews with over 40 executives spanning semiconductor manufacturers, cloud service providers, application developers, and end-user stakeholders. These interviews provided firsthand perspectives on market dynamics, technology adoption barriers, and strategic priorities. Quantitative data gathered from industry associations and proprietary databases complemented qualitative insights, facilitating trend validation through triangulation.

Statistical modeling techniques, including time-series analysis and scenario mapping, were then applied to detect growth patterns and risk factors across components, deployments, and regions. Finally, a multi-stage validation workshop engaged internal domain experts to review preliminary findings, test assumptions, and refine recommendations. This comprehensive approach underpins the credibility and depth of the report’s conclusions.

This section provides a structured overview of the report, outlining key chapters and topics covered for easy reference in our Mobile Artificial Intelligence market comprehensive research report.

- Preface

- Research Methodology

- Executive Summary

- Market Overview

- Market Insights

- Cumulative Impact of United States Tariffs 2025

- Cumulative Impact of Artificial Intelligence 2025

- Mobile Artificial Intelligence Market, by Component

- Mobile Artificial Intelligence Market, by Technology

- Mobile Artificial Intelligence Market, by Deployment

- Mobile Artificial Intelligence Market, by Application

- Mobile Artificial Intelligence Market, by End User

- Mobile Artificial Intelligence Market, by Region

- Mobile Artificial Intelligence Market, by Group

- Mobile Artificial Intelligence Market, by Country

- United States Mobile Artificial Intelligence Market

- China Mobile Artificial Intelligence Market

- Competitive Landscape

- List of Figures [Total: 17]

- List of Tables [Total: 1590 ]

Concluding Perspectives: Synthesizing Key Findings on Mobile AI Evolution, Challenges, and Strategic Imperatives for Stakeholders and Decision-Makers

The trajectory of mobile AI is defined by a relentless pursuit of performance, efficiency, and contextual intelligence within ever-smaller form factors. As component technologies converge, value chains realign, and regional ecosystems differentiate, stakeholders must remain agile to seize unfolding opportunities. While short-term challenges such as trade policy shifts and regulatory complexities introduce uncertainty, the long-term outlook underscores sustained expansion fueled by end-to-end integration and localized innovation.

Crucially, success in the mobile AI arena hinges on adopting a holistic perspective-embracing hardware advances, software standardization, service excellence, and market-specific strategies in tandem. Organizations that harness cross-segment synergies, prioritize customer-centric model design, and leverage strategic partnerships will emerge as winners in this dynamic environment. With robust research, disciplined execution, and a commitment to continuous learning, decision-makers can navigate the evolving landscape and shape the next generation of intelligent mobile experiences.

Take the Next Step: Engage with Ketan Rohom to Secure Your Comprehensive Mobile AI Market Research Report and Accelerate Strategic Decision-Making

Don’t navigate the rapidly evolving mobile AI landscape alone. Connect directly with Ketan Rohom, Associate Director of Sales & Marketing, to discuss how this comprehensive market research report can equip your organization with the strategic insights needed to outpace competition. By partnering with Ketan, you’ll gain access to in-depth analyses of emerging mobile AI innovations, detailed segment and regional breakdowns, and actionable recommendations tailored to your business objectives.

Whether you are seeking to optimize your component strategy, explore new application areas, or adapt to shifting global trade policies, securing this report will provide the clarity and competitive intelligence you need. Reach out to Ketan to arrange a personalized briefing, understand flexible licensing options, and explore how this research can drive your decision-making now and into the future.

- How big is the Mobile Artificial Intelligence Market?

- What is the Mobile Artificial Intelligence Market growth?

- When do I get the report?

- In what format does this report get delivered to me?

- How long has 360iResearch been around?

- What if I have a question about your reports?

- Can I share this report with my team?

- Can I use your research in my presentation?