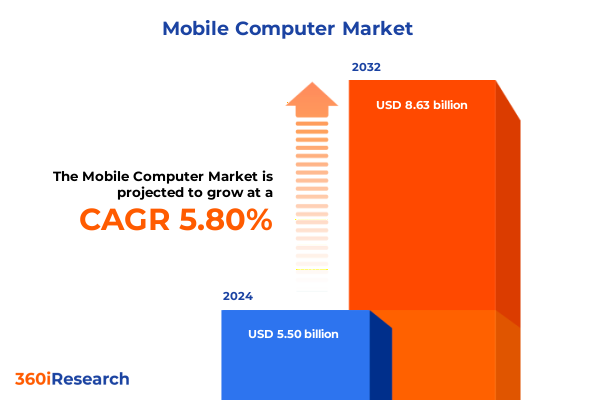

The Mobile Computer Market size was estimated at USD 5.82 billion in 2025 and expected to reach USD 6.16 billion in 2026, at a CAGR of 6.31% to reach USD 8.93 billion by 2032.

Framing the Mobile Computer Market with a Deep Introduction Highlighting Key Drivers, Technological Breakthroughs, and Critical Industry Context

The mobile computer market has emerged as a cornerstone of digital transformation, enabling businesses to deploy powerful computing capabilities in environments ranging from factory floors to field operations. As organizations strive to enhance operational agility and drive process efficiencies, mobile computing devices-spanning handheld scanners to vehicle-mounted terminals-serve as pivotal tools for frontline workers. Beyond traditional use cases, such devices now underpin emerging models such as remote asset management, on-the-go diagnostics, and immersive workforce training. This introduction provides a lens to appreciate how evolving business needs and technological advancements are converging to redefine productivity and connectivity at the edge.

In recent years, the proliferation of high-performance processors and miniaturized hardware components has accelerated the development of mobile computers that are both robust and versatile. The advent of modular architectures has empowered manufacturers to offer tailored solutions that combine durability, battery life, and computational prowess. Meanwhile, the maturation of edge computing paradigms is shifting data processing closer to the source, reducing latency and strengthening data sovereignty. These trends underscore the critical role of mobile computers in bridging enterprise workflows with real-time analytics, setting the stage for the transformative shifts explored in subsequent sections.

Moreover, as organizations face the dual imperatives of cost efficiency and workforce empowerment, the integration of mobile computing into broader digital strategies has become essential. This narrative positions the market landscape within a broader industrial context, reflecting the interplay between technological innovation, end-user requirements, and strategic imperatives. By framing the mobile computer market through these dimensions, decision-makers can chart informed pathways to leverage device capabilities, optimize deployments, and capitalize on emerging avenues for value creation.

Exploring Transformative Technological Shifts and Emerging Trends Reshaping the Competitive Dynamics and Value Propositions across the Mobile Computing Industry

The mobile computing industry is undergoing a period of rapid evolution driven by converging technological breakthroughs and shifting stakeholder expectations. Advanced semiconductor roadmaps are introducing increasingly powerful yet energy-efficient processors that extend device lifecycles and enable sophisticated on-device analytics. Simultaneously, the rollout of 5G networks is redefining connectivity paradigms, facilitating high-speed data transfer and low-latency applications, such as real-time visual inspection and augmented reality–enabled maintenance workflows. These developments signify a departure from conventional mobility solutions and herald newfound potential for on-site intelligence and automation.

Furthermore, software ecosystems are becoming more open and interoperable, empowering developers to build cross-platform applications that seamlessly integrate with enterprise resource planning systems and cloud services. The rise of containerization and microservices architectures has also allowed device manufacturers to streamline firmware updates and deploy security patches without interrupting critical operations. As a result, organizations gain both flexibility and resilience, with the capacity to adapt their mobile computing fleet to dynamic business requirements while safeguarding sensitive information.

In parallel, sustainability concerns and regulatory frameworks are prompting a reevaluation of materials and manufacturing processes. The adoption of recyclable components and energy-efficient design practices is gradually becoming a competitive differentiator. Looking ahead, the integration of artificial intelligence at the edge promises to unlock predictive maintenance and contextual decision support directly on mobile platforms, further amplifying the transformative impact of these shifts on the broader industry.

Analyzing the Cumulative Impact of 2025 United States Tariffs on Component Sourcing, Supply Chain Resilience, and Cost Structures in Mobile Computing

In 2025, the cumulative effects of United States tariffs on imported components and finished devices have reverberated throughout the mobile computer supply chain. Elevated duties on processors, displays, and assembly fees have introduced new cost considerations that require strategic sourcing adjustments. Suppliers have responded by diversifying their manufacturing bases, exploring nearshoring alternatives, and renegotiating agreements to mitigate the impact of elevated import tariffs. Although these measures help absorb some cost pressures, procurement teams must remain vigilant to potential volatility in trade policies as geopolitical dynamics evolve.

Moreover, end users are beginning to recalibrate total cost of ownership calculations in light of duty-driven price fluctuations. This has led to an increased interest in devices designed for extended service life, underpinned by modular replacement parts and scalable maintenance programs. Consequently, equipment leasing and device-as-a-service models are gaining traction as alternatives to traditional capex procurement, providing flexibility while offsetting immediate financial burdens. The interplay of tariffs and commercial innovation is therefore shaping procurement strategies and vendor relationships across the mobile computer ecosystem.

Beyond cost pressures, supply chain resilience has taken on renewed significance. Organizations are implementing greater inventory buffers and regionalizing their distribution networks to avoid potential bottlenecks. Simultaneously, predictive demand modeling tools are being deployed to forecast component availability and optimize lead times. These adaptive practices underscore the market’s collective shift toward building robust frameworks that can withstand fluctuating trade conditions and maintain service continuity for critical mobile computing deployments.

Uncovering Critical Customer Segmentation Insights by Device Type, Operating System, End User, Connectivity, Processor, and Distribution Channel Dynamics

When examining the mobile computer market through the lens of device type segmentation, a clear delineation of use cases emerges. Handheld units designed for industrial environments-encompassing rugged personal digital assistants and pocket PCs-enable rapid data capture and barcode scanning in distribution centers and retail settings. Meanwhile, laptops in convertible, traditional, and ultrabook form factors cater to knowledge-intensive roles that demand both portability and high processing capabilities. In scenarios that require extreme durability, fully rugged and semi-rugged devices are deployed to withstand shock, moisture, and temperature extremes, ensuring uninterrupted operations in harsh field conditions. Additionally, tablets in book-style and slate configurations offer a balance between display size and mobility, supporting tasks from patient charting to inventory audits. Finally, vehicle-mounted solutions-including dashboard- and forklift-integrated terminals-provide steadfast connectivity and computational power for logistics fleets and warehouse automation platforms.

Building upon device classifications, operating systems represent another critical dimension of segmentation. Android’s open-source framework continues to gain popularity among manufacturers seeking customization and cost efficiency, while iOS devices are favored for their polished user experience and stringent security protocols. Linux-based platforms carve out a niche where specialized applications and real-time performance are paramount, particularly in telecommunications and industrial automation. Concurrently, Windows-based mobile computers remain integral in enterprise environments that require seamless integration with legacy software and standardized management tools.

End-user segmentation further illuminates demand patterns across different verticals. Consumer deployments of mobile computers emphasize form factor appeal and multimedia functionality, whereas education sectors prioritize device management controls and collaborative learning capabilities. Within enterprise contexts, mobile computing is instrumental in field service, logistics, and retail point-of-sale applications, often requiring robust security and device management solutions. Government agencies leverage rugged and secure platforms for public safety and inspection tasks, whereas healthcare providers adopt sanitized mobile devices to streamline patient care, electronic medical record access, and telehealth interactions.

Connectivity options also shape product design and deployment strategies. Bluetooth-only configurations cater to short-range data exchange and peripheral pairing, while Wi-Fi–only devices serve indoor applications where network infrastructure is readily available. The emergence of cellular-enabled units-spanning 3G, 4G, and 5G technologies-enables true mobility, unlocking remote site monitoring, mobile payment processing, and augmented reality assistance. Processor architectures constitute an additional layer of differentiation, with AMD’s Ryzen series, ARM’s Cortex and Neoverse cores, and Intel’s Core lineup offering variable performance profiles that align with specific power and compute requirements. Finally, distribution channels-ranging from corporate direct sales and OEM partnerships to distributor-led offline retail and digital storefronts hosted by e-commerce platforms and manufacturers-facilitate diverse go-to-market strategies, ensuring that devices are accessible across multiple procurement pathways.

This comprehensive research report categorizes the Mobile Computer market into clearly defined segments, providing a detailed analysis of emerging trends and precise revenue forecasts to support strategic decision-making.

- Device Type

- Operating System

- End User

- Connectivity

- Processor Type

- Distribution Channel

Evaluating Regional Market Dynamics across Americas, Europe Middle East & Africa, and Asia-Pacific to Identify Unique Growth Drivers and Strategic Imperatives

Across the Americas, the mobile computer market is characterized by a mature technology infrastructure, robust logistics networks, and strong demand from sectors such as manufacturing, retail, and transportation. In North America, high corporate IT budgets and advanced digital initiatives have driven the adoption of ruggedized handhelds and connected vehicle terminals, while in Latin America, public sector investments in digital governance initiatives and the modernization of supply chains have spurred demand for versatile tablet and laptop solutions.

In Europe, Middle East & Africa, regulatory frameworks and regional economic disparities create a mosaic of market conditions. Western European nations exhibit elevated requirements for data privacy and device certification, fostering demand for secure mobile computing platforms that comply with stringent standards. In contrast, emerging markets within the Middle East and Africa prioritize cost-effective solutions to support infrastructure development and public safety applications, leading to a varied mix of entry-level tablets and modular rugged devices.

The Asia-Pacific region is witnessing a surge in mobile computer deployments, underpinned by rapid industrial automation in China, the expansion of smart logistics corridors in Southeast Asia, and the early adoption of 5G networks in advanced economies such as Japan, South Korea, and Australia. Government-led initiatives, including smart city programs and national digitalization roadmaps, are further accelerating demand for integrated mobile computing solutions that combine IoT connectivity with artificial intelligence–driven analytics. Together, these regional insights highlight the importance of tailored strategies that align product portfolios with localized infrastructure, regulatory landscapes, and end-user requirements.

This comprehensive research report examines key regions that drive the evolution of the Mobile Computer market, offering deep insights into regional trends, growth factors, and industry developments that are influencing market performance.

- Americas

- Europe, Middle East & Africa

- Asia-Pacific

Profiling Leading Mobile Computer Industry Players and Their Strategic Initiatives Driving Innovation, Competitive Positioning, and Market Evolution

Leading players in the mobile computer industry are differentiated by their commitment to innovation, strategic partnerships, and vertical-specific solutions. Enterprise-focused providers have invested heavily in modular hardware architectures that facilitate rapid customization, allowing system integrators to tailor devices for sectors from logistics to healthcare. Meanwhile, major semiconductor firms are forging alliances with software developers to embed edge AI capabilities within mobile platforms, enabling use cases such as real-time image recognition and anomaly detection directly on the device.

Several manufacturers have also prioritized sustainability, introducing device recycling programs and energy-optimized designs that align with corporate environmental objectives. Others are expanding their global service networks, offering end-to-end support ranging from deployment consulting to multi-year maintenance contracts. In addition, acquisitions of niche technology startups have allowed established companies to integrate proprietary software modules-such as secure communication stacks and specialized sensor interfaces-into their core product lines, thus enhancing competitive differentiation.

Furthermore, forward-thinking firms are leveraging data analytics and telematics to offer proactive support and to optimize device uptime. By analyzing usage patterns and environmental conditions, they can predict maintenance requirements and preemptively address potential failures. This blend of hardware innovation, software integration, and service excellence underscores the strategic imperatives that are shaping the competitive landscape of the mobile computer market.

This comprehensive research report delivers an in-depth overview of the principal market players in the Mobile Computer market, evaluating their market share, strategic initiatives, and competitive positioning to illuminate the factors shaping the competitive landscape.

- Acer Incorporated

- AIMobile Co., Ltd.

- Apple Inc.

- ASUSTeK Computer Inc.

- Bluebird Inc.

- Casio Computer Co., Ltd.

- Dell Technologies Inc.

- Denso Wave Incorporated

- HP Inc.

- Huawei Technologies Co., Ltd.

- Keyence Corporation

- Lenovo Group Limited

- M3 Mobile Co., Ltd.

- Microsoft Corporation

- Newland Auto-ID Tech Co., Ltd.

- Samsung Electronics Co., Ltd.

- SATO Holdings Corporation

- Shenzhen Emdoor Information Co., Ltd.

- Suprema Inc.

- TouchStar Technologies Ltd.

- Trimble Inc.

- Unitech Electronics Co., Ltd.

- Urovo Technology Co., Ltd.

- Xiaomi Corporation

- Xplore Technologies Corp.

Presenting Actionable Strategic Recommendations for Industry Leaders to Capitalize on Market Trends, Mitigate Challenges, and Maximize Technological Investments

To capitalize on evolving market dynamics, industry leaders should prioritize a modular product architecture that supports rapid configuration and replacement of critical components. This approach not only reduces device downtime but also aligns with sustainability objectives by enabling targeted upgrades rather than full device replacements. At the same time, cultivating partnerships with 5G network providers and IoT ecosystem vendors will unlock new revenue streams tied to connectivity-enabled services, such as remote diagnostics and fleet management solutions.

Moreover, organizations are advised to invest in robust cybersecurity protocols and standardized device management frameworks to safeguard sensitive data across distributed work environments. By harmonizing security policies and lifecycle management tools, enterprises can mitigate risks associated with firmware vulnerabilities and unauthorized access. In parallel, exploring flexible purchasing models-such as leasing, device-as-a-service, and outcome-based pricing-can alleviate capital constraints while delivering predictable total cost of ownership, thereby enhancing budgetary agility and procurement efficiency.

Finally, aligning product roadmaps with vertical-specific needs-whether in healthcare, government, or logistics-will be essential for driving differentiation. Tailored solutions that incorporate specialized software, ruggedization levels, and user-centric interfaces can significantly improve adoption rates and user satisfaction. By executing these actionable recommendations, companies can strengthen their market position, foster deeper customer relationships, and unlock sustainable growth in the mobile computing sector.

Detailing the Robust Research Methodology, Data Collection Processes, and Analytical Frameworks Ensuring Rigorous Insights and Validated Industry Intelligence

This research is grounded in a rigorous methodology that combines primary and secondary data sources to ensure both depth and accuracy of insights. Primary research involved structured interviews with device manufacturers, system integrators, and enterprise end users across multiple regions, providing firsthand perspectives on deployment challenges, technology preferences, and procurement strategies. Additionally, surveys conducted with industry stakeholders yielded quantitative data on device selection criteria and usage patterns, enabling comprehensive trend analysis.

Complementing these efforts, secondary research sources such as public company filings, patent databases, regulatory documents, and industry journals were systematically reviewed. This layer of data provided context on competitive moves, technology roadmaps, and regulatory shifts influencing the market landscape. A dedicated data validation team then cross-verified the collected information through triangulation, ensuring consistency across disparate sources and flagging anomalies for further review.

Analytical frameworks, including value chain mapping and scenario planning, were applied to interpret the data and forecast potential market trajectories qualitatively. Expert panel discussions were organized to challenge assumptions and refine key findings, resulting in a robust set of strategic insights. This multi-stage research approach guarantees that the conclusions and recommendations presented herein are both reliable and actionable for stakeholders seeking to navigate the dynamic mobile computing ecosystem.

This section provides a structured overview of the report, outlining key chapters and topics covered for easy reference in our Mobile Computer market comprehensive research report.

- Preface

- Research Methodology

- Executive Summary

- Market Overview

- Market Insights

- Cumulative Impact of United States Tariffs 2025

- Cumulative Impact of Artificial Intelligence 2025

- Mobile Computer Market, by Device Type

- Mobile Computer Market, by Operating System

- Mobile Computer Market, by End User

- Mobile Computer Market, by Connectivity

- Mobile Computer Market, by Processor Type

- Mobile Computer Market, by Distribution Channel

- Mobile Computer Market, by Region

- Mobile Computer Market, by Group

- Mobile Computer Market, by Country

- United States Mobile Computer Market

- China Mobile Computer Market

- Competitive Landscape

- List of Figures [Total: 18]

- List of Tables [Total: 3021 ]

Concluding the Executive Summary with Key Takeaways, Strategic Reflections, and the Roadmap for Future Market Engagement in Mobile Computing

The mobile computer market is at a pivotal juncture where technological innovation, policy developments, and shifting workforce paradigms intersect to create new imperatives for industry participants. Throughout this executive summary, we have highlighted how advanced processors, next-generation connectivity, and agile distribution models are reshaping the competitive landscape. Tariff-induced cost pressures and supply chain adjustments have underscored the need for resilient procurement strategies, while segmentation and regional nuances reveal targeted avenues for product differentiation.

Key takeaways emphasize the importance of modular device architectures, tailored vertical solutions, and integrated software–hardware ecosystems. Furthermore, leading companies are demonstrating that sustainability initiatives and proactive service models can function as powerful differentiators in a crowded market. As organizations seek to harness the full potential of mobile computing, they must balance innovation with operational rigor, embedding security and lifecycle management within every stage of the deployment.

Looking ahead, the acceleration of edge AI, expanded 5G coverage, and evolving end-user expectations will continue to drive industry transformation. By synthesizing the insights and strategic recommendations provided, stakeholders can build a robust roadmap for future engagement in the mobile computer market, ensuring that they remain agile, secure, and positioned for long-term success.

Connect Directly with Ketan Rohom to Gain Exclusive Access to In-Depth Mobile Computer Market Research and Elevate Your Strategic Roadmap

To secure unparalleled insight into the dynamic mobile computer landscape and gain a competitive edge, engage directly with Ketan Rohom, Associate Director, Sales & Marketing at 360iResearch, to acquire the full market research report. By partnering with Ketan, you will unlock a tailored briefing that highlights critical strategic themes, technological imperatives, and region-specific considerations essential for informed decision-making. The comprehensive deliverable will arm your executive team with nuanced analysis and validated intelligence, ensuring that you capitalize on emerging opportunities while mitigating evolving risks. Reach out to Ketan Rohom today to discuss licensing arrangements, data customization requests, and collaboration pathways that align with your organizational objectives and accelerate your strategic roadmap.

- How big is the Mobile Computer Market?

- What is the Mobile Computer Market growth?

- When do I get the report?

- In what format does this report get delivered to me?

- How long has 360iResearch been around?

- What if I have a question about your reports?

- Can I share this report with my team?

- Can I use your research in my presentation?