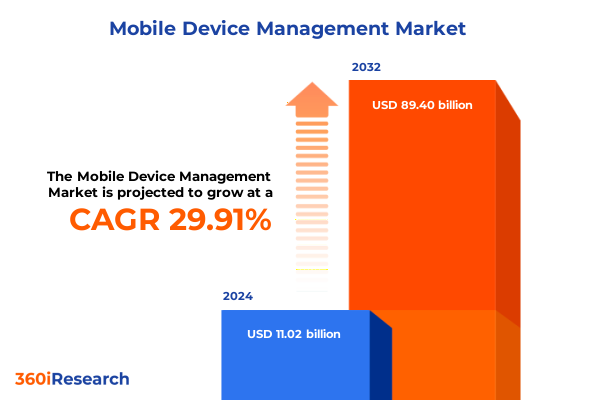

The Mobile Device Management Market size was estimated at USD 14.32 billion in 2025 and expected to reach USD 18.09 billion in 2026, at a CAGR of 29.90% to reach USD 89.40 billion by 2032.

Setting the Stage for a New Era of Mobile Device Management Excellence in an Increasingly Complex Enterprise Ecosystem and Agile Security Resilience

The modern enterprise operates within a landscape defined by unprecedented mobility, where employees, contractors, and partners demand seamless access to corporate resources from anywhere in the world. This dynamic environment presents a dual challenge: how can organizations empower a distributed workforce with agility while ensuring that sensitive data and critical applications remain protected against an expanding array of threats? The answer lies in the strategic adoption of mobile device management (MDM) solutions designed to balance user experience and security controls.

As organizations continue to embrace remote and hybrid work models following the acceleration of digital transformation initiatives, the complexity of managing diverse device fleets has grown exponentially. Fragmented endpoint configurations, inconsistent policy enforcement, and unpatched vulnerabilities have become common pain points, creating potential entry points for cyber adversaries. Consequently, industry leaders are prioritizing MDM as a foundational component of their unified endpoint management strategy, enabling centralized visibility and automated policy enforcement across laptops, smartphones, and tablets alike.

Looking ahead, the convergence of edge computing, the Internet of Things, and emerging wireless technologies such as 5G is poised to further diversify the mobile ecosystem. In turn, this will place additional demands on IT and security teams to orchestrate device provisioning, application distribution, and threat remediation in real time. By framing MDM as an enabler of both operational efficiency and proactive risk posture, organizations can lay the groundwork for long-term resilience and innovation in an increasingly complex enterprise environment.

Identifying Transformative Shifts that Are Redefining How Organizations Secure and Manage Mobile Devices Across Dynamic Digital Work Environments

Organizations today stand at a pivotal moment, as several transformative shifts are simultaneously redefining how mobile endpoints are governed and protected. First, the rapid proliferation of remote and hybrid work arrangements has shifted the perimeter from a physical office to any location with network connectivity. As a result, organizations are moving beyond traditional VPN-centric architectures toward Zero Trust frameworks that verify every access request, device posture, and user identity before granting entry to corporate assets.

Meanwhile, the integration of artificial intelligence and machine learning into endpoint management platforms is revolutionizing how IT teams identify anomalies and automate remediation. Behavioral analytics now scan device usage patterns to detect unauthorized applications, unusual data transfers, or signs of compromise, enabling preemptive action without adding manual overhead. This shift from reactive to predictive security marks a critical inflection point.

Simultaneously, the industry is witnessing increasing demand for a unified endpoint management approach that consolidates mobile, desktop, and IoT device administration under a single pane of glass. By breaking down tool silos and standardizing policy enforcement, organizations can achieve operational consistency and drive down administrative costs. Moreover, as sustainability gains traction, solutions that extend device lifecycles and support eco-friendly procurement models are garnering attention. Collectively, these convergence trends signal a new era in which mobility management is not just a support function but a strategic enabler of business agility and risk mitigation.

Exploring the Comprehensive Impact of Recent United States Tariffs on Mobile Device Management Supply Chains and Enterprise Cost Structures in 2025

In 2025, the United States enacted a series of tariff adjustments targeting imported electronic devices and components, reshaping cost structures across the mobile device management ecosystem. Hardware manufacturers have responded by revising pricing on smartphones, tablets, laptops, and networking equipment, which in turn has amplified total cost of ownership estimates for end users. This tectonic shift has compelled many organizations to re-examine device procurement strategies and explore alternatives such as device-as-a-service and hardware leasing models.

Beyond sticker price inflation, these tariffs have disrupted global supply chains, prompting selectors to diversify supplier portfolios and onshore manufacturing where feasible. In response, MDM solution providers have emphasized modular software architectures that minimize reliance on proprietary device configurations. Such agility enables rapid onboarding of alternative hardware without extensive redevelopment, mitigating the impact of fluctuating component availability and regional trade policies.

These policy-driven changes have also accelerated interest in functionality models like bring your own device, where employees leverage personal assets for work. By reducing upfront investments in corporate-owned hardware, organizations can partially offset elevated import costs. However, the move toward BYOD places greater emphasis on secure containerization, identity management, and compliance monitoring-areas where advanced MDM platforms demonstrate clear differentiation. As enterprises navigate this evolving backdrop, the interplay between regulatory developments and technology strategies underscores the need for adaptive device management frameworks.

Unearthing Critical Insights from Detailed Segmentation of Services Versus Software, Multiple Device Types, Functional Models, Platforms, Deployment Approaches, Enterprise Sizes and Industry Verticals

The mobile device management market reveals nuanced performance when analyzed across multiple dimensions, each illuminating distinct opportunities and challenges. When viewed through the lens of component-based segmentation, organizations weigh investments in services such as deployment, training, and support against licensing fees for platform software, often seeking bundled packages that streamline vendor management. Transitioning focus between services and software highlights trade-offs between predictable recurring expenses and variable service engagements.

Device type segmentation further underscores priority allocations, as laptops continue to command significant administrative attention due to their broad application profiles, user demographics, and platform diversity. Meanwhile, smartphones remain at the forefront of mobility initiatives, driven by the ubiquity of iOS and Android ecosystems, with tablets occupying a specialized niche for vertical-specific use cases such as field service and education.

Functional model distinctions feature prominently in strategic roadmaps, particularly through bring your own device, corporate-owned personally enabled, and corporate-owned, personally disabled approaches. Each framework entails unique governance requirements-from containerization for personal devices to strict policy enforcement on corporate assets-shaping feature selection and licensing structures. This variety necessitates granular customization capabilities within management consoles.

Platform differentiation is equally critical, as Android, iOS, and Windows each present disparate security architectures, development toolchains, and compliance standards. Organizations with heterogeneous fleets demand unified consoles that abstract these complexities, delivering consistent policy application while accommodating platform-specific controls. Across deployment options, cloud-hosted solutions offer rapid scalability and simplified upgrades, whereas on-premise implementations remain preferred by security-sensitive sectors seeking greater infrastructure control. Enterprise size also influences decision criteria, with large organizations prioritizing deep integration and advanced automation, and small to medium enterprises gravitating toward turnkey solutions with minimal overhead. Finally, industry verticals ranging from banking, financial services, and insurance to government, healthcare, information technology, manufacturing, retail, and transportation each impose specialized regulatory and operational mandates. Vendors that embed vertical-specific compliance templates, reporting dashboards, and workflow automations gain traction by aligning with unique sectoral workflows.

This comprehensive research report categorizes the Mobile Device Management market into clearly defined segments, providing a detailed analysis of emerging trends and precise revenue forecasts to support strategic decision-making.

- Component

- Device Type

- Functionality

- Platform Type

- Deployment Type

- Enterprise Size

- Industry Verticals

Deciphering Regional Dynamics across the Americas, Europe Middle East and Africa and Asia Pacific for Mobile Device Management Growth and Innovation

Regional market dynamics in the Americas reflect a mature landscape where established enterprises drive the adoption of advanced mobile device management capabilities. With stringent data privacy regulations at both federal and state levels, organizations are prioritizing solutions that offer fine-grained access controls, encryption key management, and comprehensive audit trails. Meanwhile, rising interest in edge computing and 5G connectivity creates new use cases for field service automation and real-time data synchronization, accelerating deployment of sophisticated MDM features.

In contrast, Europe, the Middle East, and Africa present a heterogeneous environment characterized by regulatory complexity, geopolitical considerations, and varying levels of IT infrastructure maturity. General Data Protection Regulation requirements in Europe compel strict data residency and processing standards, while public sector agencies in the Middle East seek sovereign cloud offerings to safeguard national security interests. Across Africa, expanding mobile broadband coverage is unlocking opportunities for digital inclusion initiatives, with MDM playing a pivotal role in secure e-learning and telemedicine deployments. Vendors that can navigate these multifaceted requirements through localized data centers, tailored compliance modules, and multilingual support services are well positioned to capture growth.

Asia-Pacific stands out as the fastest-growing region, fueled by burgeoning smartphone penetration, government digital transformation programs, and robust investments in smart manufacturing. Countries such as India, China, and Australia are driving expansive rollouts of cloud-based device management services, emphasizing cost efficiency and rapid time to value. In markets with nascent cybersecurity regulations, there is heightened sensitivity to endpoint threats, prompting organizations to prioritize integrated threat detection, secure application distribution, and remote remediation capabilities. The confluence of diverse regulatory landscapes and technological investments makes the region a strategic focal point for global MDM vendors seeking sustainable expansion.

This comprehensive research report examines key regions that drive the evolution of the Mobile Device Management market, offering deep insights into regional trends, growth factors, and industry developments that are influencing market performance.

- Americas

- Europe, Middle East & Africa

- Asia-Pacific

Showcasing Key Market Players and Their Strategic Initiatives Driving Competitive Advantage and Technological Leadership in Mobile Device Management

Leading players in the mobile device management domain are refining their portfolios through a combination of organic development, strategic partnerships, and targeted acquisitions. One prominent vendor has enhanced its platform by embedding artificial intelligence–driven threat analytics alongside sandboxed application testing, enabling proactive identification of zero-day vulnerabilities and malicious code. Another competitor has doubled down on user experience by integrating certificateless authentication and single sign-on capabilities that streamline access across mobile, web, and desktop applications, reducing friction while bolstering security.

Partnership ecosystems are also expanding, with alliances between MDM providers and managed security service firms designed to deliver 24/7 monitoring and rapid incident response. This collaborative model addresses a growing gap in in-house cybersecurity expertise, particularly among small and medium enterprises seeking enterprise-grade protection. Meanwhile, mergers with network connectivity specialists aim to create unified offerings that merge device management with secure WAN optimization, catering to customers with distributed operational footprints.

Innovation extends to cross-platform compatibility, as vendors race to support new form factors such as IoT sensors, industrial robots, and wearable devices. By exposing open APIs and modular SDKs, solution providers empower enterprises to integrate MDM controls into bespoke applications and proprietary hardware. These strategic initiatives demonstrate a clear industry trajectory: competitive differentiation will hinge on the ability to deliver comprehensive, adaptive, and extensible device management experiences that address both current and emerging enterprise requirements.

This comprehensive research report delivers an in-depth overview of the principal market players in the Mobile Device Management market, evaluating their market share, strategic initiatives, and competitive positioning to illuminate the factors shaping the competitive landscape.

- 42Gears Mobility Systems Private Limited

- baramundi software AG

- BlackBerry Limited

- Cisco Systems, Inc.

- Citrix Systems, Inc.

- Google LLC

- International Business Machines Corporation

- Ivanti, Inc.

- Jamf Holding Corp.

- Kaseya Limited

- Microsoft Corporation

- Miradore Oy

- Mitsogo Inc.

- NinjaOne, Inc.

- ProMobi Technologies Private Limited

- Samsung Electronics Co., Ltd.

- Sophos Ltd.

- SOTI Inc.

- VMware, Inc.

- Zoho Corporation

Delivering Actionable Recommendations to Guide Industry Leaders through Integration of Advanced Security AI Analytics User Experience and Compliance Strategies in Mobile Device Management

To maintain a leadership position in the mobile device management arena, organizations should adopt a unified endpoint management strategy that harmonizes mobile and traditional desktop security controls under a single management platform. This consolidation reduces complexity, prevents policy drift, and enables centralized reporting that supports compliance audits and executive decision-making. Additionally, embracing a Zero Trust posture is critical; businesses must implement continuous device health assessments, adaptive access policies, and identity-centric controls to mitigate evolving threat vectors.

Next, leveraging AI-powered analytics within MDM solutions can transform vast quantities of telemetry into actionable insights. Organizations should prioritize platforms that offer anomaly detection, predictive maintenance alerts for device health issues, and automated remediation workflows. By automating repetitive tasks, IT teams can redirect focus toward strategic initiatives, such as rolling out new productivity applications or refining employee experience policies.

Furthermore, enhancing user experience remains paramount. Enterprises should develop clear, role-based governance structures that delineate acceptable use guidelines and streamline onboarding processes. Embedding user education modules, such as in-app policy prompts and just-in-time training, helps foster security awareness without undermining efficiency. Finally, to navigate complex regulatory landscapes, businesses must partner with vendors that offer comprehensive compliance frameworks, regional data localization options, and audit-ready reporting. Collectively, these recommendations will enable industry leaders to harness the full potential of mobile device management while safeguarding organizational assets.

Detailing a Robust Research Methodology Combining Primary Expert Interviews Secondary Data Analysis and Cross-Validation Techniques for Comprehensive Insights

This research employs a multi-tiered methodology to ensure robust and reliable findings. Secondary research formed the initial foundation, drawing upon publicly available regulatory filings, vendor whitepapers, industry news releases, and technical documentation to map the competitive landscape and identify macroeconomic drivers. Additionally, analyst briefings and financial reports were reviewed to understand historical growth patterns and capital investment trends.

Primary research was conducted through in-depth interviews and structured surveys with senior IT executives, security architects, and procurement specialists across key industry verticals. These conversations provided nuanced perspectives on feature requirements, procurement cycles, and pain points associated with mobile device deployments. Supplemental interviews with channel partners and system integrators yielded additional insights into implementation best practices and regional go-to-market strategies.

Data triangulation techniques were employed to validate qualitative and quantitative findings. Cross-referencing vendor claims with user feedback and third-party security assessments ensured that product capabilities were accurately represented. Finally, the research team synthesized these inputs through a combination of thematic analysis and scenario modeling, yielding actionable insights that resonate with decision-makers and support strategic planning.

This section provides a structured overview of the report, outlining key chapters and topics covered for easy reference in our Mobile Device Management market comprehensive research report.

- Preface

- Research Methodology

- Executive Summary

- Market Overview

- Market Insights

- Cumulative Impact of United States Tariffs 2025

- Cumulative Impact of Artificial Intelligence 2025

- Mobile Device Management Market, by Component

- Mobile Device Management Market, by Device Type

- Mobile Device Management Market, by Functionality

- Mobile Device Management Market, by Platform Type

- Mobile Device Management Market, by Deployment Type

- Mobile Device Management Market, by Enterprise Size

- Mobile Device Management Market, by Industry Verticals

- Mobile Device Management Market, by Region

- Mobile Device Management Market, by Group

- Mobile Device Management Market, by Country

- United States Mobile Device Management Market

- China Mobile Device Management Market

- Competitive Landscape

- List of Figures [Total: 19]

- List of Tables [Total: 1272 ]

Concluding the Executive Summary by Highlighting Strategic Imperatives and Future Trajectories for Mobile Device Management in Dynamic Enterprise Environments

In conclusion, mobile device management has emerged as a strategic imperative for organizations seeking to balance agility, security, and cost efficiency in a decentralized work landscape. The evolving convergence of remote work models, edge computing, and regulatory requirements signals a sustained elevation of MDM’s role beyond mere device provisioning toward comprehensive risk management and operational optimization.

Adaptive segmentation across component, device type, functionality, platform, deployment model, enterprise size, and vertical demonstrates that one-size-fits-all approaches no longer suffice. Instead, organizations must tailor their strategies to specific technical architectures, user behaviors, and regulatory environments. Regional nuances further underscore the importance of contextually aware solutions that can accommodate diverse compliance frameworks and infrastructural capabilities.

As key vendors continue to refine their offerings through AI integration, unified endpoint management, and partnership ecosystems, industry leaders are urged to adopt a proactive posture. By embedding Zero Trust principles, leveraging predictive analytics, and prioritizing user-centric design, enterprises can unlock new levels of productivity while maintaining resilient defenses against emerging threats. The insights presented in this summary provide a strategic roadmap for navigating the complexities of modern mobility management and positioning organizations for sustained success.

Compelling Call-to-Action to Engage with Ketan Rohom for Expert Guidance and Acquisition of the Comprehensive Mobile Device Management Market Research Report

To secure your organization’s competitive edge and operational resilience in the rapidly evolving mobile device management landscape, reach out to Ketan Rohom, Associate Director of Sales & Marketing. Ketan can provide tailored guidance on leveraging the full depth of this market research report to inform budget allocations, streamline deployment strategies, and align technology roadmaps with emerging security and compliance imperatives. Engage now to ensure your decision-makers have the insights they need to optimize device management investments, accelerate digital transformation initiatives, and maintain a proactive posture against evolving threats. Connect with Ketan to access comprehensive analysis, customized executive briefings, and strategic support for unlocking new avenues of growth and efficiency.

- How big is the Mobile Device Management Market?

- What is the Mobile Device Management Market growth?

- When do I get the report?

- In what format does this report get delivered to me?

- How long has 360iResearch been around?

- What if I have a question about your reports?

- Can I share this report with my team?

- Can I use your research in my presentation?