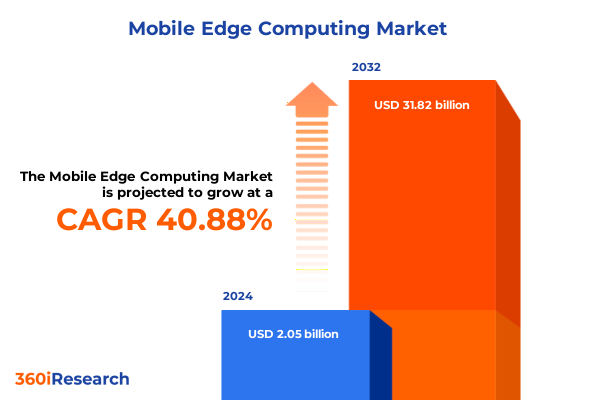

The Mobile Edge Computing Market size was estimated at USD 1.93 billion in 2025 and expected to reach USD 2.57 billion in 2026, at a CAGR of 34.29% to reach USD 15.25 billion by 2032.

Understanding the Critical Importance of Mobile Edge Computing for Next-Generation Digital Infrastructures and Business Innovation

Mobile Edge Computing has emerged as a pivotal technology for organizations grappling with the exponential surge in data traffic and the imperative for real-time processing. Traditional centralized cloud architectures are reaching their limits as latency-sensitive applications demand near-instantaneous responses. By relocating compute resources closer to end users and connected devices, mobile edge computing reduces network congestion, minimizes data traversal time, and supports ultra-responsive services. This proximity fundamentally transforms how enterprises, service providers, and system integrators design and deliver solutions, enabling latency-critical use cases such as autonomous vehicles, remote healthcare diagnostics, and immersive media experiences.

As industries embrace more sophisticated digital strategies, the role of mobile edge computing extends beyond technical optimization into a cornerstone of competitive differentiation. Decision-makers across sectors now recognize that edge deployments enhance quality of service, drive operational efficiency, and unlock new revenue streams through innovative service offerings. With this technology, organizations can tailor computing environments to localized demands, enforce data sovereignty, and capitalize on emerging business models. Consequently, understanding the unique advantages and implementation considerations of edge computing is essential for any enterprise committed to maintaining its market leadership in an increasingly connected era.

Emerging Technological Paradigms and Market Forces Driving Disruptive Transformations in Mobile Edge Computing Ecosystems Worldwide

The mobile edge computing landscape is undergoing a profound metamorphosis fueled by several converging technological forces. First, the widespread deployment of advanced 5G networks is creating unprecedented bandwidth and ultra-low latency capabilities, which in turn propel edge use cases that were previously unattainable. Parallel advances in IoT sensor proliferation and AI-powered analytics have expanded the scope of real-time data capture and interpretation at the network’s periphery. These dual trends have accelerated the shift from reactive to predictive operations, enabling smart manufacturing lines to self-optimize and intelligent transportation systems to dynamically reroute traffic based on live conditions.

In addition, the rise of containerization and microservices architectures, coupled with open standards for edge orchestration, is dismantling legacy silos and fostering interoperability across cloud-native environments, on-premise deployments, and multi-vendor ecosystems. Network slicing techniques now allow operators to partition resources for specific verticals, ensuring quality of service and security tailored to critical applications. These transformative shifts are reshaping competitive dynamics by lowering barriers to entry for niche innovators while challenging incumbents to rapidly adapt their infrastructures and business models.

Assessing the Compounding Consequences of the 2025 United States Tariff Regime on Mobile Edge Computing Deployment and Cost Structures

In 2025, the United States introduced a revised tariff regime targeting network equipment components and edge server microelectronics imported from key manufacturing hubs in Asia-Pacific. This development has exerted upward pressure on capital expenditure for both network operators and enterprise IT organizations that depend on high-performance edge platforms. As a result, procurement cycles have lengthened, with stakeholders increasingly evaluating alternative supply sources, including domestic contract manufacturers and regional logistics hubs. This pivot reflects a strategic balancing act between managing immediate cost escalations and ensuring long-term resilience in global supply chains.

Additionally, the tariff-induced cost increases have prompted a reevaluation of total cost of ownership models for edge deployments. Many organizations are now spreading expenditures over managed service agreements rather than outright hardware purchases, seeking to mitigate initial financial outlays. While this shift introduces new operating expense considerations, it also fosters deeper partnerships with service providers that can absorb tariff impacts through scale advantages. Ultimately, the evolving regulatory environment underscores the importance of flexible deployment strategies and diversified sourcing to sustain momentum in mobile edge computing adoption.

Revealing Nuanced Insights Across Deployment Models Connectivity Technologies Components and End User Applications in Mobile Edge Computing

Analyzing the market through the lens of deployment model reveals that offloading compute workloads to cloud-based edge repositories versus localized on premise edge nodes involves distinct trade-offs in scalability, security, and integration complexity. Cloud-centric solutions offer agile provisioning and elastic resource scaling, whereas on premise architectures deliver tighter control over data governance and predictable performance for mission-critical operations. Transitioning between these models requires a nuanced orchestration framework that can dynamically allocate workloads based on latency, workload type, and compliance mandates.

Connectivity technology segmentation further refines this analysis, as traditional 4G networks support baseline edge interactions but cannot address the demanding requirements of emerging use cases. The rollout of 5G Non Standalone and subsequent Standalone deployments has catalyzed edge scenarios that demand enhanced reliability and minimal jitter. Meanwhile, Wi-Fi continues to serve as a complementary access layer within enterprise and campus environments, dynamically offloading noncritical traffic. Component segmentation underscores the critical role of software solutions complemented by a spectrum of managed services, professional services consulting engagements, and integration projects that ensure smooth end to end functionality. End user verticals ranging from hyperscale cloud service providers to telecom carriers and diversified enterprise infrastructures drive nuanced platform requirements, while application segmentation highlights diverse use cases across healthcare, media and entertainment, smart cities and retail, smart manufacturing-encompassing both discrete and process operations-and transportation and logistics spanning maritime, rail, and roadway environments.

This comprehensive research report categorizes the Mobile Edge Computing market into clearly defined segments, providing a detailed analysis of emerging trends and precise revenue forecasts to support strategic decision-making.

- Component

- Network Type

- Edge Location

- Application

- End-User

- Enterprise Size

Examining Regional Variations and Strategic Advantages Across the Americas Europe Middle East Africa and Asia Pacific in Mobile Edge Innovation

The Americas region continues to lead in strategic deployments of edge infrastructure due to robust investment in fiber backhaul, mature regulatory frameworks, and strong collaboration between tier one carriers and hyperscale cloud platforms. North American enterprises prioritize low latency and data sovereignty, particularly in critical sectors such as financial services and autonomous mobility. Latin American markets, while smaller in scale, exhibit rapid adoption of hybrid edge architectures to support digital commerce and smart city mobility initiatives.

In the Europe, Middle East and Africa region, regulatory emphasis on data privacy and cross border data flows shapes edge compute strategies, with many stakeholders pursuing on premise nodes to comply with stringent GDPR provisions. Gulf Cooperation Council countries are investing heavily in intelligent transport and smart infrastructure projects, leveraging localized edge clusters to enhance public safety and service delivery. In contrast, sub Saharan Africa faces connectivity challenges but demonstrates high growth potential through public private partnerships that bridge urban and rural digital divides. Meanwhile, Asia Pacific’s exceptional pace of 5G expansion and large scale manufacturing ecosystems makes it a hotbed for edge innovation, with China, Japan, and South Korea pioneering commercial deployments, and Southeast Asian nations exploring use cases that integrate IoT with edge AI for agriculture and logistics.

This comprehensive research report examines key regions that drive the evolution of the Mobile Edge Computing market, offering deep insights into regional trends, growth factors, and industry developments that are influencing market performance.

- Americas

- Europe, Middle East & Africa

- Asia-Pacific

Highlighting Leading Industry Players and Strategic Collaborations Shaping the Competitive Landscape of the Mobile Edge Computing Market

Industry players are rapidly forging partnerships to accelerate edge roadmap execution. Leading network equipment vendors have aligned with cloud hyperscalers to develop integrated offerings that combine logic, storage, and AI accelerators at the network perimeter. Simultaneously, systems integrators and managed service providers have expanded their portfolios to deliver end-to-end edge operations, from initial network planning to continuous orchestration and lifecycle management. In parallel, pure play edge platform vendors are differentiating through modular architectures that prioritize open APIs and multi-tenant support, addressing the diverse needs of telecom operators, enterprise IT teams, and emerging digital service providers.

Collaborative consortiums and standards bodies are also influencing competitive dynamics by defining interoperability specifications, security frameworks, and performance benchmarks. Large telecommunications operators leverage their expansive infrastructure footprints to offer localized edge nodes, whereas cloud service providers capitalize on their global data center networks to provide seamless hybrid models. Meanwhile, specialized startups focus on vertical specific solutions, such as real time analytics for healthcare or predictive maintenance for manufacturing lines. The interplay among these varied stakeholders underscores a vibrant ecosystem where strategic alliances and co innovation are essential for sustained leadership.

This comprehensive research report delivers an in-depth overview of the principal market players in the Mobile Edge Computing market, evaluating their market share, strategic initiatives, and competitive positioning to illuminate the factors shaping the competitive landscape.

- Accenture Plc

- ADLINK Technology Inc.

- Advantech Co., Ltd.

- Akamai Technologies, Inc.

- Amazon Web Services Inc.

- Arista Networks, Inc.

- AT&T Inc.

- Aviat Networks, Inc.

- Broadcom Inc.

- Capgemini SE

- Cisco Systems Inc.

- Cloudflare, Inc.

- Dell Technologies Inc.

- EdgeConneX Inc.

- Ericsson

- Google LLC

- Hewlett Packard Enterprise Development LP

- Huawei Technologies Co., Ltd.

- Intel Corporation

- International Business Machines Corporation

- Lanner Electronics Inc

- Lenovo Group Ltd.

- Lumen Technologies Inc.

- Microsoft Corporation

- Nokia Corporation

- NVIDIA Corporation

- Oracle Corporation

- Schneider Electric SE

- Siemens AG

Actionable Strategies for Industry Leaders to Capitalize on Emerging Opportunities and Navigate Challenges in Mobile Edge Computing

To harness the full potential of mobile edge computing, industry leaders should prioritize the development of interoperable platforms that enable workload portability across cloud and on premise environments. Embracing open standards and contributing to collaborative forums will lower integration barriers and foster a robust developer community for edge applications. In parallel, companies must implement comprehensive security methodologies that address threats at every layer of the edge stack, from radio access points to orchestration software, ensuring end to end integrity and compliance with evolving data protection regulations.

Leaders should also invest in talent development programs that align IT and network engineering skills with emerging requirements in edge AI and containerized deployments. Forging partnerships with academic institutions and industry consortia can accelerate the creation of specialized curricula and certification tracks. Furthermore, adopting flexible consumption models-such as managed service agreements or outcome based contracts-can mitigate tariff impacts and optimize capital deployment. By combining technical agility with strategic alliances and a customer centric mindset, organizations will be well positioned to capitalize on the next wave of edge driven innovation.

Transparent Overview of Research Methodology Incorporating Qualitative and Quantitative Analyses to Deliver Rigorous Mobile Edge Computing Insights

This research employs a hybrid methodology that integrates qualitative interviews with quantitative data analysis to deliver a balanced and rigorous examination of the mobile edge computing market. Primary research involved in depth discussions with C level executives, network architects, and solution providers to capture firsthand insights on adoption drivers, technical challenges, and procurement strategies. Secondary research encompassed an extensive review of industry publications, technology white papers, regulatory filings, and academic studies to validate emerging trends and benchmark performance metrics.

Data triangulation ensured the robustness of findings by cross referencing vendor press releases, patent filings, and real world deployment case studies. Market segmentation relied on a dual approach of top down assessment of global technology expenditures and bottom up analysis of regional infrastructure investments. Furthermore, forecasting assumptions were stress tested across multiple scenarios, reflecting variations in regulatory policies, connectivity technology rollouts, and geopolitical dynamics. This comprehensive framework underpins the reliability of the strategic insights presented in this report.

This section provides a structured overview of the report, outlining key chapters and topics covered for easy reference in our Mobile Edge Computing market comprehensive research report.

- Preface

- Research Methodology

- Executive Summary

- Market Overview

- Market Insights

- Cumulative Impact of United States Tariffs 2025

- Cumulative Impact of Artificial Intelligence 2025

- Mobile Edge Computing Market, by Component

- Mobile Edge Computing Market, by Network Type

- Mobile Edge Computing Market, by Edge Location

- Mobile Edge Computing Market, by Application

- Mobile Edge Computing Market, by End-User

- Mobile Edge Computing Market, by Enterprise Size

- Mobile Edge Computing Market, by Region

- Mobile Edge Computing Market, by Group

- Mobile Edge Computing Market, by Country

- United States Mobile Edge Computing Market

- China Mobile Edge Computing Market

- Competitive Landscape

- List of Figures [Total: 18]

- List of Tables [Total: 3498 ]

Synthesizing Key Findings and Strategic Implications to Provide a Clear Perspective on the Maturing Mobile Edge Computing Market

In summary, mobile edge computing stands at the nexus of network evolution and digital transformation, offering a strategic pathway to unlock ultra low latency, enhance security, and drive localized intelligence. The convergence of 5G, containerization, and AI at the network edge is catalyzing novel use cases across industries, while evolving regulatory and tariff environments underscore the need for adaptive deployment strategies. Stakeholders must adopt a nuanced approach to segmentation, balancing cloud based elasticity with on premise control, and tailor solutions to regional nuances in regulatory landscapes and connectivity maturity.

Looking ahead, organizations that cultivate open ecosystems, engage in strategic partnerships, and commit to continuous innovation will lead the next phase of mobile edge adoption. By aligning technical roadmaps with emerging business models and optimizing supply chain resilience, enterprises and service providers can mitigate risk and capitalize on the dynamic growth opportunities that define this critical technology frontier.

Engage with Our Associate Director to Gain Immediate Access to the Full Comprehensive Mobile Edge Computing Market Research Report

To secure comprehensive insights into the dynamic mobile edge computing landscape and make data-driven strategic decisions, engage directly with Ketan Rohom, Associate Director of Sales & Marketing at 360iResearch. Ketan brings deep expertise in telecommunications, digital infrastructure, and market intelligence, offering personalized guidance on how this research can address your organization’s specific priorities. By connecting with him, you will gain early access to detailed analyses, bespoke data sets, and executive briefings that align with your deployment, investment, and partnership strategies. Reach out today to initiate a consultation and discover how this extensive report can accelerate your momentum in edge compute innovation, mitigate emerging risks, and position your enterprise at the forefront of technological evolution.

- How big is the Mobile Edge Computing Market?

- What is the Mobile Edge Computing Market growth?

- When do I get the report?

- In what format does this report get delivered to me?

- How long has 360iResearch been around?

- What if I have a question about your reports?

- Can I share this report with my team?

- Can I use your research in my presentation?