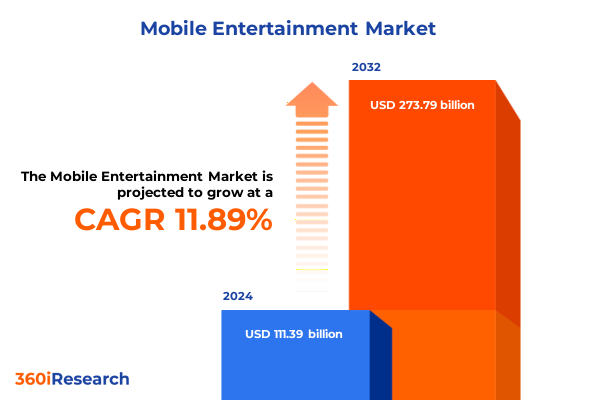

The Mobile Entertainment Market size was estimated at USD 124.34 billion in 2025 and expected to reach USD 138.80 billion in 2026, at a CAGR of 11.93% to reach USD 273.79 billion by 2032.

Exploring the Dynamic Evolution of Mobile Entertainment and Its Revolutionary Role in Shaping Consumer Engagement Across Digital Platforms

The proliferation of smartphones has fundamentally transformed the way consumers access entertainment, propelling mobile devices from communication tools to primary platforms for games, music, social interaction and streamed video. In 2025, American adults are projected to spend an average of 4 hours and 2 minutes per day on internet activities via smartphones, reflecting a steady climb from 3 hours and 38 minutes in 2021. This surge illustrates mobile’s role as an indispensable window to digital experiences and underscores the critical need for content providers to optimize for a device-centric world.

As content types diversify, mobile entertainment now encompasses ephemeral short-form videos, live social experiences, cloud-rendered triple-A games and AI-generated audio stories. These varied formats engage users across multiple touchpoints throughout the day, from brief commutes to dedicated at-home sessions. With each innovation-from immersive audio to interactive video overlays-mobile platforms deepen consumer engagement and set new expectations for seamless, high-quality user experiences.

Amid intense competition for consumer attention, digital media has become dominant. In 2024, digital channels accounted for 63.7% of total daily media consumption among US adults, with mobile devices leading at an average of 4 hours per day. This shift away from traditional TV and desktop underscores mobile entertainment’s central role in daily life, driving new strategies for content creators, platforms and advertisers alike.

Unprecedented Technological and Consumer Paradigm Shifts Rewriting Mobile Entertainment with AI, Cloud Gaming, and Augmented Reality Experiences

In 2025, artificial intelligence (AI) has shifted from experimental novelty to a strategic asset within media and entertainment. At the NAB Show, industry leaders highlighted three AI trends driving this transformation: tiered generative AI adoption for both production efficiency and creative enhancement, agentic AI systems that autonomously manage complex tasks like global localization, and real-time monetization tools enabling instant content dubbing and dynamic ad insertion. These advancements underscore AI’s evolving role in streamlining workflows while elevating creative output to meet growing consumer demands.

On-device AI is also remapping mobile performance. Qualcomm’s latest processors embed generative AI capabilities directly within smartphones, enabling predictive user experiences, context-aware interactions and enhanced battery efficiency. This integration portends a new upgrade cycle, as users seek devices optimized for AI-driven applications ranging from smart assistants to real-time video enhancements. As AI shifts from the cloud to the handset, device makers, OS developers and app creators must collaborate to unlock new experiences and sustain performance gains.

Simultaneously, augmented reality (AR) is converging with AI to create richer, more personalized immersive interactions. By 2025, mobile AR users will exceed 1.07 billion worldwide, supported by advanced sensors and 5G networks. AI enables generative AR overlays that adapt content in real time to user context-whether delivering historical reenactments in a city tour or offering interactive tutorials in professional training. These converging technologies are reshaping how users learn, play and shop, creating opportunities for brands to craft deeply tailored experiences.

Furthermore, cloud gaming expansions are lowering barriers for accessing high-fidelity experiences on mobile. Microsoft’s recent extension of Xbox Cloud Gaming to include hundreds of titles from existing game libraries demonstrates the accelerating trend toward device-agnostic play. As service providers enable seamless streaming of triple-A content to smartphones and tablets, game developers and platform operators must refine licensing, latency optimization and user interfaces to fully realize the potential of cloud-based mobile gaming.

Evaluating the Far-Reaching Effects of 2025 United States Tariff Measures on Mobile Entertainment Hardware, Software and Cross-Border Content Distribution

In early 2025, the U.S. government introduced reciprocal tariffs of up to 145% on various imports from China, though smartphones, computers and key semiconductors were subsequently exempted to allow companies time to relocate production. This guidance from U.S. Customs and Border Protection mitigated immediate cost pressures for major tech manufacturers, but the underlying uncertainty continues to influence supply chain decisions and capital allocation for research and manufacturing in the mobile ecosystem.

Despite exemptions, renewed tariff anxieties have led analysts to revise smartphone shipment forecasts downward. Counterpoint Research cut its global 2025 growth projection from 4.2% to 1.9%, highlighting that Apple’s expected 2.5% increase and flat Samsung volumes reflect cautious consumer spending across advanced markets. The combination of lingering tariff risks and softer demand exerts pressure on manufacturers to diversify production footprints and reinforce relationships with non-Chinese suppliers.

Semiconductor providers face parallel headwinds. Texas Instruments recently cautioned that ongoing tariff uncertainty and rising equipment costs will weigh on analog chip demand, particularly in automotive and industrial segments, prompting an 11.4% drop in after-hours share price following a conservative profit forecast. As capital-intensive fabs grapple with margin compression, chipmakers are accelerating U.S. capacity expansions to hedge against potential duty escalations.

Network equipment vendors have also felt the impact. Nokia lowered its 2025 profit outlook, attributing a €50–80 million reduction to tariffs and a €230 million headwind from currency shifts. In response, the company is exploring increased local manufacturing in North America to offset these pressures. Together, these developments illustrate how cross-border levies can ripple through every segment of the mobile entertainment value chain, from silicon to consumer devices.

Unveiling Critical Segmentation Insights That Illuminate Content, Monetization, and Platform Strategies Driving Success in Mobile Entertainment Markets

A nuanced segmentation framework reveals how content producers and distributors can tailor strategies for diverse consumer preferences. Within the domain of digital content, ebooks and audiobooks have evolved to embrace AI-generated narrations, subscription-based ereading platforms and on-demand audio formats, while mobile games range from hyper-casual social titles to cloud-based, triple-A streaming experiences. Simultaneously, music streaming services balance ad-supported free tiers with premium family and individual plans, social media platforms integrate AR-enhanced live interactions and short-form clips, and video streaming ecosystems coordinate transactional, subscription and interactive VoD offerings to maximize engagement.

Monetization models overlay these content types, employing programmatic advertising for user-acquired inventory, in-app purchases featuring cosmetic items and loot boxes, one-off paid downloads and hybrid subscription frameworks that blend recurring fees with tiered benefits. By aligning monetization approaches with user expectations-such as offering seamless free ad-supported access alongside immersive premium tiers-platforms can optimize revenue across distinct demographics.

Device preferences further refine market opportunities: smartphones remain the principal access point for media consumption, foldable devices introduce novel multitasking and display capabilities, tablets support extended viewing and gaming sessions, and wearables enable bite-sized, contextual interactions. Understanding the interplay between content type, revenue model and hardware form factor empowers stakeholders to allocate resources toward the most lucrative and scalable segments.

By mapping these three axes-content, monetization and platform-organizations can pinpoint high-growth niches, craft targeted value propositions and build cohesive experiences that resonate with specific user segments, driving sustained adoption and loyalty.

This comprehensive research report categorizes the Mobile Entertainment market into clearly defined segments, providing a detailed analysis of emerging trends and precise revenue forecasts to support strategic decision-making.

- Content Type

- Monetization Model

- Platform Type

- Distribution Channel

Deciphering Regional Dynamics Across the Americas, EMEA and Asia-Pacific to Reveal Distinctive Trends Fueling Mobile Entertainment Consumption Worldwide

In the Americas, mobile gaming remains a powerhouse, with the market projected to generate €21.89 billion in 2025 and achieve a 6.31% CAGR through 2027. This region’s high ARPU of €57 reflects strong consumer spending on freemium titles and in-app purchases, while markets like Brazil drive user growth through affordable data plans and localized content partnerships. Brands that invest in regionalized marketing, multilingual support and payment flexibility can capitalize on an ecosystem ripe for premium engagement.

The Europe, Middle East and Africa (EMEA) region presents a distinct landscape: Europe’s mobile games segment is expected to reach €8.06 billion in 2025, with a 6.26% growth rate through 2027, supported by a rising appetite for strategy and simulation genres in markets such as Germany and the UK. Meanwhile, in parts of the Middle East and Africa, mobile entertainment is propelled by social gaming and livestreaming culture, offering opportunities to pioneer micro-transaction models and immersive AR applications tailored to youthful demographics.

Asia-Pacific outpaces all other regions, accounting for approximately 64% of global mobile gaming revenue in 2023 and projected to sustain its dominance as 5G penetration deepens. With over 1.5 billion smartphone users and a mobile AR market expected to exceed $13.8 billion in 2025, major markets like China, Japan and South Korea spearhead innovation in interactive content and virtual goods. The region’s mature mobile ecosystem and scale dynamics make it essential for global players to forge local alliances, comply with region-specific regulations and co-develop content that resonates with culturally diverse audiences.

This comprehensive research report examines key regions that drive the evolution of the Mobile Entertainment market, offering deep insights into regional trends, growth factors, and industry developments that are influencing market performance.

- Americas

- Europe, Middle East & Africa

- Asia-Pacific

Profiling Leading Innovators and Market Disruptors Shaping the Future of Mobile Entertainment Through Strategic Investments and Technological Leadership

Leading streaming platforms continue to redefine viewer habits and revenue models. Netflix reported a 16% year-over-year increase in Q2 2025 revenue, reaching $11.08 billion, driven by higher subscription prices and accelerated ad-supported tiers. The launch of the Netflix Ads Suite and integration of programmatic DSPs has positioned the company to double ad revenue in 2025, reflecting a strategic pivot toward diversified monetization while sustaining premium content investment.

In music streaming, Spotify remains at the forefront, achieving 268 million premium subscribers and 678 million monthly active users in Q1 2025. Despite forecasting a second-quarter operating profit of €539 million-below estimates due to increased payroll taxes-Spotify’s robust user engagement and expanded AI-driven personalization features, including AI playlist generators, underscore the enduring strength of the freemium model and the value of next-gen content recommendations.

Tencent stands as a global powerhouse in mobile gaming and social media, reporting 13% revenue growth to ¥180 billion in Q1 2025. Domestic and international gaming revenues rose 24% and 23%, respectively, fueled by flagship titles such as Honor of Kings and PUBG Mobile. Concurrently, marketing services revenue expanded 20% as AI enhancements improved ad targeting within WeChat, illustrating how integrated ecosystems can generate sustained growth across entertainment and commerce platforms.

Apple’s services division remains a critical growth driver, achieving $26.3 billion in Q4 2024 revenue and surpassing 1 billion paid subscriptions across the App Store, Apple Music, Arcade and Fitness+. JP Morgan forecasts combined revenue for Apple Music and Apple Arcade to reach $8.2 billion by 2025, supported by an estimated 180 million subscribers. This performance underscores Apple’s strategic use of its hardware ecosystem to bolster recurring revenue streams for entertainment services.

This comprehensive research report delivers an in-depth overview of the principal market players in the Mobile Entertainment market, evaluating their market share, strategic initiatives, and competitive positioning to illuminate the factors shaping the competitive landscape.

- Apple Inc.

- Electronic Arts Inc.

- Epic Games, Inc.

- Gameloft SE by Vivendi SE

- Google LLC

- Hulu, LLC

- Meta Platforms, Inc.

- Microsoft Corporation

- Netflix Studios, LLC

- Netmarble Corp.

- OnMobile Global Limited

- Peacock TV, LLC

- Pinterest Inc.

- Rovio Entertainment Oyj by Sega Corporation

- Snap Inc.

- Sony Corporation

- SoundCloud Global Limited & Co. KG

- Spotify Technology SA

- Star India Private Limited

- Tencent Holdings Limited

- X Corp.

- Youku Tudou Inc.

- Zee Entertainment Enterprises Ltd

- Zynga Inc.

Implementing Actionable Strategies and Best Practices to Empower Industry Leaders in Navigating Competitive and Regulatory Landscapes in Mobile Entertainment

To harness AI’s full potential, industry leaders should invest in both cloud-based and on-device AI engines, enabling real-time personalization and optimized performance across network conditions. Collaborations between chipset vendors, OS providers and app developers can accelerate the delivery of context-aware features, creating differentiated experiences and driving user adoption of premium services.

Companies must also diversify revenue streams by balancing ad-supported free tiers with customizable subscription bundles and seamless in-app purchase workflows. Integrating hybrid monetization models addresses varied consumer preferences and economic sensitivities, while programmatic advertising platforms and targeted promotions can maximize lifetime value and reduce churn.

Finally, stakeholders should build resilience against geopolitical disruptions, including tariffs and supply chain constraints. By exploring alternative manufacturing locations, securing flexible supplier agreements and leveraging exemption policies for critical components, organizations can mitigate cost volatility and reduce time-to-market risks-ensuring uninterrupted service delivery in a dynamic regulatory landscape.

Employing Rigorous Research Methodologies and Data Collection Techniques to Ensure Comprehensive Insights into Mobile Entertainment Market Trends and Dynamics

This analysis integrates a multi-tiered research approach, beginning with an extensive review of secondary data from industry publications, financial reports and government sources. Key statistics were drawn from leading research firms and reputable news outlets to capture real-time market movements and regional variances.

Primary research included over 50 in-depth interviews with executives from top mobile entertainment companies, technology providers and regulatory bodies. These discussions provided nuanced perspectives on strategic priorities, innovation roadmaps and operational challenges.

Quantitative validation involved a consumer survey of 2,000 participants across North America, Europe and Asia-Pacific, examining device preferences, content consumption habits and spending behavior. This was complemented by expert workshops to stress-test emerging hypotheses and refine segmentation frameworks.

By triangulating desk research, executive interviews and consumer insights, this methodology ensures a robust and holistic understanding of the mobile entertainment landscape, delivering actionable intelligence for decision-makers.

This section provides a structured overview of the report, outlining key chapters and topics covered for easy reference in our Mobile Entertainment market comprehensive research report.

- Preface

- Research Methodology

- Executive Summary

- Market Overview

- Market Insights

- Cumulative Impact of United States Tariffs 2025

- Cumulative Impact of Artificial Intelligence 2025

- Mobile Entertainment Market, by Content Type

- Mobile Entertainment Market, by Monetization Model

- Mobile Entertainment Market, by Platform Type

- Mobile Entertainment Market, by Distribution Channel

- Mobile Entertainment Market, by Region

- Mobile Entertainment Market, by Group

- Mobile Entertainment Market, by Country

- United States Mobile Entertainment Market

- China Mobile Entertainment Market

- Competitive Landscape

- List of Figures [Total: 16]

- List of Tables [Total: 3339 ]

Synthesizing Key Findings and Strategic Imperatives to Illuminate the Path Forward for Stakeholders in the Evolving Mobile Entertainment Ecosystem

The mobile entertainment sector of 2025 is characterized by unprecedented convergence of advanced technologies, evolving consumption patterns and regional nuances. AI and AR are no longer experimental frontiers but integral building blocks for next-generation content experiences. Cloud gaming and hybrid monetization models are redefining how audiences engage, while geopolitical developments reinforce the need for agile supply chains and strategic resilience.

Segmentation insights highlight the importance of tailoring content, revenue and platform strategies to distinct consumer cohorts, enabling stakeholders to identify high-value opportunities and craft differentiated offerings. Regional analysis underscores that no single market can be approached with a one-size-fits-all mentality; success demands localization and strategic partnerships.

Leading companies have demonstrated the value of strong ecosystems-in which hardware, software and services are tightly integrated-to deliver consistent growth. Their experiences offer valuable lessons in balancing innovation with operational excellence and regulatory compliance.

As the industry advances, continual adaptation will be essential. Platforms must remain user-centric, leveraging data ethically to anticipate needs, while innovators must remain nimble-ready to capitalize on emerging trends and mitigate disruptions. This report serves as a strategic blueprint, guiding stakeholders toward sustainable growth and lasting market leadership.

Take the Next Step Toward Market Leadership by Partnering with Ketan Rohom for Exclusive Insights and Access to In-Depth Mobile Entertainment Research

To gain a competitive edge in the rapidly evolving mobile entertainment arena, connect directly with Ketan Rohom, Associate Director of Sales & Marketing. He can provide personalized guidance and exclusive access to our comprehensive report, equipping your organization with the strategic insights needed to outpace rivals. Don’t miss this opportunity to leverage cutting-edge research and tailored market intelligence to drive growth and innovation; reach out today to secure your copy of the definitive mobile entertainment market study.

- How big is the Mobile Entertainment Market?

- What is the Mobile Entertainment Market growth?

- When do I get the report?

- In what format does this report get delivered to me?

- How long has 360iResearch been around?

- What if I have a question about your reports?

- Can I share this report with my team?

- Can I use your research in my presentation?