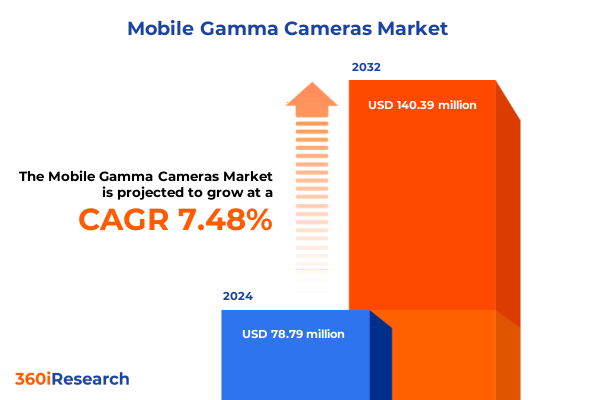

The Mobile Gamma Cameras Market size was estimated at USD 83.12 million in 2025 and expected to reach USD 89.42 million in 2026, at a CAGR of 7.77% to reach USD 140.38 million by 2032.

Transformative Point-of-Care Nuclear Imaging Unleashes Unprecedented Diagnostic Agility and Precision for Patients Across Diverse Settings

The mobile gamma cameras market is reshaping how diagnostic imaging is delivered, combining advanced detector technologies with the agility to reach patients wherever they are. Portable nuclear imaging systems have transcended traditional hospital boundaries, enabling high-quality single-photon emission computed tomography to be performed at the bedside, in operating rooms, and even in remote or resource-constrained settings. This evolution addresses critical challenges posed by patient mobility limitations and rising demand for point-of-care diagnostics, especially among geriatric and critically ill populations.

Healthcare providers are driven by value-based care models that seek to reduce readmissions and accelerate treatment decisions. Mobile gamma cameras support these goals by minimizing patient transport risks, streamlining workflow in outpatient centers, and lowering overall procedural turnaround times. Concurrently, the miniaturization of solid-state and scintillation detectors has unlocked new possibilities in spatial resolution and sensitivity, fueling broader adoption across industrial inspection, research, and security screening applications. As a result, stakeholders from nuclear medicine departments to manufacturing quality control teams are recognizing the strategic potential of portable gamma imaging solutions in enhancing both clinical outcomes and operational efficiency.

Innovative AI-Powered Hybrid Imaging and Wearable Technologies Are Redefining the Future of Mobile Gamma Camera Applications

Today’s mobile gamma cameras are at the forefront of a technology-driven renaissance in nuclear imaging, marked by the convergence of artificial intelligence, multi-modality integration, and wearability. AI algorithms embedded in imaging platforms are automating lesion detection, optimizing scan parameters, and dramatically reducing operator training requirements. These enhancements not only elevate diagnostic accuracy but also foster remote collaboration through cloud-enabled data sharing and real-time consultation with specialists.

Meanwhile, hybrid systems that fuse gamma imaging with optical or fluorescence modalities are emerging, offering clinicians contextual anatomical references alongside functional nuclear insights in a single session. This multi-modality approach is proving especially valuable in intraoperative environments, where real-time feedback can guide surgical margins. Additionally, the advent of wearable gamma cameras is unlocking continuous physiological monitoring, a breakthrough for chronic disease management and pediatric care. Collectively, these transformative shifts are redefining how and where nuclear diagnostics occur, broadening the reach of sophisticated imaging to new patient cohorts and use cases.

Significant Section 301 Tariff Enhancements on Detector Semiconductors and Metal Components Dramatically Alter Cost Dynamics

In January 2025, the United States Trade Representative finalized a 50% Section 301 tariff on semiconductor imports, including cadmium zinc telluride detectors essential to solid-state gamma cameras. This adjustment represents a twofold increase from the previous 25% rate and directly elevates manufacturing costs for CZT-based devices and other advanced electronic subcomponents. Concurrently, derivative steel and aluminum products, which contribute to camera enclosures and support structures, faced 25% duties as of March 12, 2025, further intensifying cost pressures on portable imaging equipment suppliers.

Healthcare providers already allocate over 10% of budgets to supply expenses, and these tariff increases risk cascading price hikes that could affect acquisition decisions for mobile gamma systems. In response, industry leaders are diversifying supply chains, pursuing nearshoring options, and negotiating tariff exclusions where possible. While the long-term objective remains to incentivize domestic manufacturing, the short-term impact on device availability and capital expenditure underscores the importance of strategic sourcing and tariff mitigation plans.

Comprehensive Multi-Dimensional Segmentation Illustrates How Application, Technology, End Users, and Portability Shape Market Dynamics

Insight into market segmentation reveals how mobile gamma cameras cater to specialized demands across four distinct dimensions. In industrial inspection, material analysis and pipeline inspection rely on portable SPECT systems to detect subsurface anomalies and ensure structural integrity. Nuclear medicine applications are driven by planar imaging for quick assessments and SPECT for comprehensive functional studies. Research institutions leverage preclinical imaging in animal models and radiopharmaceutical research to advance novel tracers, while security screening deployments focus on baggage inspection at airports and border security checkpoints.

From a technology perspective, cadmium zinc telluride solid-state detectors deliver high energy resolution and compact form factors, contrasting with sodium iodide scintillation crystals that remain the workhorse for cost-sensitive deployments. End users range from hospital-based units and standalone diagnostic centers, where private and public hospitals differ in procurement cycles, to industrial users in manufacturing and oil & gas sectors requiring ruggedized systems. Research institutes, both academic and private labs, prioritize modular platforms that can integrate custom software for experimental protocols.

Portability considerations further refine the landscape: cart-based systems, whether standard or specialized, offer stability and accessory integration; handheld models, available in dual-head or single-head configurations, emphasize maneuverability; and emerging wearable options, including clip-on sensors and vest-based arrays, promise continuous in situ monitoring. Each segmentation dimension shapes purchase drivers, deployment strategies, and feature prioritization among stakeholders.

This comprehensive research report categorizes the Mobile Gamma Cameras market into clearly defined segments, providing a detailed analysis of emerging trends and precise revenue forecasts to support strategic decision-making.

- Portability

- Application

- End User

Diverse Regional Trajectories Highlight How North America, EMEA, and Asia-Pacific Drive Varied Adoption Paths

The Americas region remains the epicenter of mobile gamma camera adoption, driven by leading healthcare infrastructures in the United States and Canada. Robust reimbursement frameworks, supportive regulatory pathways, and a growing shift toward outpatient nuclear imaging have cemented North America’s position as a demand hub. Additionally, Latin American markets are showing early signs of investment in portable imaging technologies to address healthcare access gaps across remote areas.

Europe, Middle East & Africa (EMEA) demonstrates varied adoption trajectories, with Western European nations benefiting from integrated healthcare networks and increasing focus on patient-centered care models. Countries such as Germany and the United Kingdom emphasize intraoperative nuclear imaging capabilities, while Nordic regions are exploring sustainable device lifecycles. In the Middle East, government-led healthcare modernization programs are funding acquisitions of mobile SPECT units, and Africa is gradually introducing these technologies in specialized oncology and cardiology centers.

Asia-Pacific is experiencing rapid uptake fueled by expanding healthcare infrastructure, rising prevalence of chronic diseases, and targeted government initiatives to bolster domestic medical device manufacturing. Japan and South Korea are adopting advanced CZT-based platforms in research hospitals, whereas China and India are focused on scalable sodium iodide systems to serve high-volume outpatient clinics. Southeast Asian markets are also exploring partnerships with international suppliers to bring portable gamma imaging to emerging care settings.

This comprehensive research report examines key regions that drive the evolution of the Mobile Gamma Cameras market, offering deep insights into regional trends, growth factors, and industry developments that are influencing market performance.

- Americas

- Europe, Middle East & Africa

- Asia-Pacific

Leading Manufacturers and Agile Innovators Are Advancing AI, Connectivity, and Custom Modular Architectures to Stand Out

Industry incumbents and disruptive innovators are intensifying efforts to differentiate in the mobile gamma camera sector. Siemens Healthineers is integrating AI-powered image reconstruction and advanced analytics into next-generation platforms, positioning itself as a leader in ease-of-use and diagnostic throughput. GE Healthcare continues to expand battery life and wireless connectivity, targeting emergency response and mobile clinic environments with its portable systems. Philips Healthcare is focusing on lightweight designs and user-friendly interfaces, aiming to democratize access to nuclear imaging in smaller healthcare settings.

Canon Medical Systems and Mediso Ltd. are pursuing niche applications, with Canon emphasizing sensitivity enhancements for early oncology detection and Mediso optimizing its SPECT systems for combined diagnostic and therapeutic workflows. Meanwhile, Digirad Corporation and Dilon Technologies are leveraging modular architectures to support customization for industrial inspection and security screening. Emerging players such as Spectrum Dynamics Medical are pushing the wearable gamma camera frontier, collaborating with academic partners to pilot clip-on and vest-based monitoring prototypes.

This comprehensive research report delivers an in-depth overview of the principal market players in the Mobile Gamma Cameras market, evaluating their market share, strategic initiatives, and competitive positioning to illuminate the factors shaping the competitive landscape.

- Biodex Medical Systems, Inc.

- Digirad Corporation

- Dilon Technologies, LLC

- Gamma Medica Incorporated

- General Electric Company

- Koninklijke Philips N.V.

- Mediso Ltd.

- Mediso Medical Imaging Systems Ltd

- Oncovision S.L.

- PHDS Co.

- SENSE+ Diagnostics, Inc.

- Siemens Healthineers AG

- Spectrum Dynamics Medical Ltd

Proactive Supply Chain Diversification, Digital Platform Development, and Collaborative Co-Development Are Imperative for Sustained Leadership

Industry leaders should proactively cultivate diversified manufacturing footprints to mitigate tariff risks and enhance supply chain resilience. Strategic nearshoring of detector assembly and enclosure fabrication can reduce exposure to Section 301 duties while accelerating time-to-market. It is also critical to establish partnerships with semiconductor and scintillator suppliers to secure allocation agreements and explore tariff exclusion applications.

Investment in digital ecosystems is paramount; manufacturers must deploy cloud-based platforms that facilitate remote calibration, predictive maintenance, and AI-driven quality assurance. Engaging with regulatory bodies early to certify software updates and AI tools will shorten approval cycles and reinforce market trust. Additionally, companies should tailor product portfolios across the segmentation dimensions-offering specialized cart-based systems for industrial clients, handheld dual-head solutions for surgical suites, and wearable prototypes to capture emerging continuous monitoring use cases.

Finally, forging collaborations with clinical research institutions and security agencies can drive co-development of novel imaging protocols and applications. These alliances not only incubate next-generation features but also validate performance in real-world environments, creating robust case studies that support broader commercialization efforts.

Rigorous Multi-Tiered Research Combining Secondary Analysis, Expert Interviews, and Data Triangulation Ensures Analytical Precision

This research leverages a robust, multi-tiered methodology designed to ensure comprehensive and reliable insights. Secondary research encompassed a thorough review of regulatory filings, tariff notices, industry white papers, and peer-reviewed journals to map technological innovations and policy impacts. Proprietary databases were cross-referenced to identify historical adoption trends and material cost fluctuations.

Primary research involved structured interviews with nuclear medicine physicians, hospital procurement officers, industrial inspection managers, and security screening experts to validate market drivers, segmentation preferences, and regional demand patterns. Data triangulation was applied by reconciling perspectives from supply chain executives, manufacturing partners, and end users, ensuring consistency across quantitative and qualitative inputs.

Finally, the findings were subjected to an internal validation process, including expert panel reviews. Analytical frameworks, such as Porter’s Five Forces and scenario-based sensitivity analysis, were employed to assess competitive intensity and tariff-related cost sensitivities. This rigorous approach provides a transparent foundation for the insights and recommendations presented.

This section provides a structured overview of the report, outlining key chapters and topics covered for easy reference in our Mobile Gamma Cameras market comprehensive research report.

- Preface

- Research Methodology

- Executive Summary

- Market Overview

- Market Insights

- Cumulative Impact of United States Tariffs 2025

- Cumulative Impact of Artificial Intelligence 2025

- Mobile Gamma Cameras Market, by Portability

- Mobile Gamma Cameras Market, by Application

- Mobile Gamma Cameras Market, by End User

- Mobile Gamma Cameras Market, by Region

- Mobile Gamma Cameras Market, by Group

- Mobile Gamma Cameras Market, by Country

- United States Mobile Gamma Cameras Market

- China Mobile Gamma Cameras Market

- Competitive Landscape

- List of Figures [Total: 15]

- List of Tables [Total: 2385 ]

Strategic Alignment of Innovation, Supply Chain Agility, and Digital Integration Will Define the Market Leaders in Mobile Gamma Imaging

The mobile gamma camera market is poised for continued transformation as technological advancements converge with evolving healthcare delivery models. The surge in solid-state detector innovation, coupled with AI-enabled imaging platforms, is set to enhance diagnostic precision and operational efficiency. At the same time, tariff-induced cost volatility underscores the necessity for agile supply chains and strategic manufacturing decisions.

Key segmentation lenses-from application and technology to end user and portability-highlight the market’s complexity and opportunity. Regional dynamics further indicate that while North America leads adoption, significant growth will stem from EMEA modernization efforts and Asia-Pacific infrastructure expansion. Competitive landscapes are shaped by both legacy healthcare giants and nimble startups, all racing to embed advanced analytics, modularity, and connectivity into their offerings.

Moving forward, companies that successfully align product innovation with supply chain resilience, digital ecosystem integration, and cross-sector collaborations will secure leadership positions. The insights and recommendations herein provide a strategic roadmap for stakeholders seeking to capitalize on the evolving mobile gamma camera landscape.

Unlock Critical Market Insights and Tailored Intelligence by Connecting Directly with Ketan Rohom for Your Mobile Gamma Cameras Market Report Purchase

To secure your organization’s competitive edge and access our comprehensive insights on the mobile gamma cameras market, reach out to Ketan Rohom, Associate Director for Sales & Marketing at 360iResearch. You can engage with our team to customize the report according to your strategic needs and ensure your investment in market intelligence delivers maximum value. Contact Ketan to discuss bespoke industry analysis, detailed data inquiries, and exclusive briefings that will empower your next steps in the rapidly evolving mobile gamma camera landscape.

- How big is the Mobile Gamma Cameras Market?

- What is the Mobile Gamma Cameras Market growth?

- When do I get the report?

- In what format does this report get delivered to me?

- How long has 360iResearch been around?

- What if I have a question about your reports?

- Can I share this report with my team?

- Can I use your research in my presentation?