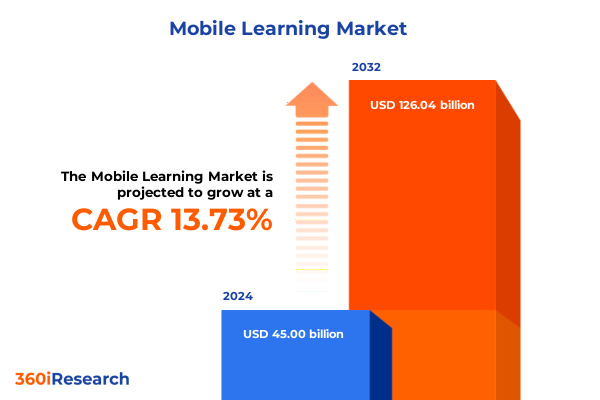

The Mobile Learning Market size was estimated at USD 51.06 billion in 2025 and expected to reach USD 57.94 billion in 2026, at a CAGR of 15.02% to reach USD 136.04 billion by 2032.

Unleashing the Power of Mobile Learning to Revolutionize Knowledge Delivery Across All Sectors in a Fast-Paced Digital Era

The accelerating pace of digital transformation has elevated mobile learning from a complementary tool to a strategic imperative for organizations, educational institutions, and governments alike. Today’s dynamic learning landscape demands flexible access to knowledge that aligns with fast-moving operational requirements, remote workforces, and geographically dispersed learners. Mobile devices have emerged as the primary interface for content consumption, collaboration, and performance support, thereby redefining how education and training are conceived and delivered in a global context.

In this rapidly evolving ecosystem, learners expect seamless, intuitive experiences that adapt to their schedules and learning preferences. Enterprise leaders recognize that mobile learning initiatives drive not only cost efficiencies by reducing travel and classroom overhead but also sustain continuous skill development through bite-sized microlearning and real-time reinforcement. As new generations enter the workforce with an inherent affinity for smartphones and tablets, the imperative to integrate learning into daily workflows has never been more urgent.

Moreover, policymakers and educational authorities are increasingly advocating for mobile-first strategies to bridge connectivity gaps and enhance digital inclusion. By prioritizing mobile platforms, stakeholders can circumvent infrastructure limitations, extend reach into underserved regions, and foster lifelong learning cultures. In sum, mobile learning stands at the nexus of technological innovation and pedagogical evolution, offering a transformative path toward more agile, personalized, and impact-driven education.

Embracing Groundbreaking Technological and Pedagogical Shifts That Are Reshaping Mobile Learning Beyond Traditional Boundaries

The mobile learning landscape is undergoing profound shifts as emerging technologies and evolving pedagogies converge to redefine learning experiences. Artificial intelligence (AI) and machine learning algorithms now enable hyper-personalization, delivering dynamic content recommendations based on individual performance metrics and contextual data. This level of customization enhances learner engagement by adapting difficulty levels, content formats, and pacing in real time, ensuring that knowledge retention and skill mastery are optimized.

Simultaneously, the proliferation of high-speed 5G networks and edge computing capabilities has expanded the bandwidth available for immersive learning modalities. Augmented reality (AR) and virtual reality (VR) applications are no longer confined to specialized labs; they are accessible via mobile headsets and smartphones, delivering experiential simulations for medical training, industrial maintenance, and language immersion, among other domains. These interactive environments foster deeper cognitive engagement and practical skill development by situating learners in realistic scenarios.

In parallel, microlearning and modular content design have gained traction as effective strategies to accommodate busy schedules and reinforce learning through spaced repetition. Short-form videos, interactive quizzes, and gamified modules seamlessly integrate with social collaboration tools, enabling peer-to-peer knowledge sharing and just-in-time support. As a result, organizations can rapidly deploy targeted training interventions to address critical skills gaps, drive performance outcomes, and cultivate a culture of continuous improvement across multiple tiers of learners.

Assessing the Far-Reaching Consequences of 2025 United States Import Tariffs on Hardware and Connectivity Tools for Mobile Learning

In 2025, U.S. import tariffs on electronics and telecommunications equipment have had a cascading effect on the mobile learning ecosystem by elevating the cost of hardware devices commonly used for content consumption. Tariffs initially imposed on select categories of smartphones and tablets have prompted device manufacturers and content providers to reassess procurement strategies and negotiate volume discounts to mitigate price increases. This environment has encouraged more organizations to explore device-agnostic approaches, emphasizing web-based platforms and progressive web apps to preserve accessibility irrespective of hardware brand or operating system.

The heightened cost pressures have also catalyzed a surge in local assembly and manufacturing partnerships. Learning technology companies are capitalizing on regional trade incentives and specialized economic zones within the United States to establish production facilities tailored to educational hardware like rugged tablets for field training and enterprise-grade smartphones for frontline employees. These onshore initiatives foster supply chain resilience while minimizing exposure to volatile tariff schedules, thus ensuring uninterrupted access to critical learning devices across corporate and government sectors.

Furthermore, the ripple effects of tariff-induced cost fluctuations have reinforced the value proposition of cloud-based deployment models. By decoupling software services from hardware dependencies, educational institutions and enterprises can offset capital expenditure by subscribing to scalable, usage-based learning platforms. In doing so, they can allocate resources toward content development, user support, and platform integrations, rather than bulk hardware purchases. This strategic pivot underscores the importance of flexible deployment frameworks in navigating the complexities of international trade policies and sustaining innovation in mobile learning.

Uncovering Actionable Market Segmentation Patterns to Enhance Targeted Mobile Learning Delivery and Drive Sustainable Engagement Strategies

Analyzing the mobile learning market through multiple lenses reveals nuanced opportunities for tailored solution delivery. When considering the core components, hardware devices form the foundational layer, complemented by managed and professional services that facilitate implementation, customization, and ongoing maintenance. Software services bifurcate into content management systems, which curate and author learning assets, and learning management systems, which track and assess learner performance across digital channels. These interdependent elements ensure that organizations can deploy cohesive learning ecosystems aligned with strategic objectives.

Deployment models further differentiate offerings, as cloud-based solutions, whether hosted in hybrid, private, or public environments, provide rapid scalability and minimize upfront infrastructure investments. Conversely, on-premises infrastructures remain viable for organizations with stringent data sovereignty requirements or specialized integration needs. The choice of deployment mode hinges on factors such as regulatory compliance, anticipated user volume, and existing IT frameworks.

From a pedagogical standpoint, asynchronous learning affords learners the flexibility to access recorded or self-paced modules at their convenience, while synchronous modalities-delivered via virtual classrooms or webinars-facilitate real-time interaction and instructor-led guidance. These modes cater to distinct learning objectives, with asynchronous options excelling in foundational knowledge acquisition and synchronous formats driving collaborative problem-solving and peer engagement.

Considering device preferences, PCs and laptops continue to support complex simulations and collaborative platforms, whereas smartphones and tablets empower bite-sized, on-the-go access and performance-support tools. Finally, end users span corporate stakeholders-from small and medium enterprises to large enterprises-alongside government agencies, higher education institutions, and K-12 schools. Course offerings diversify across academic curricula, corporate training programs, and government certification pathways to address the evolving skill requirements of each segment.

This comprehensive research report categorizes the Mobile Learning market into clearly defined segments, providing a detailed analysis of emerging trends and precise revenue forecasts to support strategic decision-making.

- Component

- Learning Type

- Device

- Course

- Deployment Mode

- End User

Navigating Diverse Regional Dynamics to Tailor Mobile Learning Solutions for Distinct Market Conditions and Regulatory Environments

Regional disparities in infrastructure, regulatory frameworks, and digital literacy levels drive differentiated adoption rates and solution preferences across major global markets. In the Americas, advanced telecommunications networks and favorable regulatory landscapes support rapid implementation of mobile learning initiatives in corporate and academic spheres. Leading organizations leverage integrated mobile platforms to streamline compliance training, professional development, and academic coursework, often adopting subscription-based cloud models to maintain budgetary flexibility.

Europe, the Middle East, and Africa present a complex mosaic of technological maturity and policy environments. While Western European nations prioritize data privacy and interoperability standards within mobile learning deployments, emerging markets across Africa and the Middle East focus on expanding connectivity and reducing educational inequities. Collaborative partnerships between public institutions and private edtech firms are prevalent, aiming to deliver scalable mobile solutions for vocational training and digital literacy campaigns.

In the Asia-Pacific region, exponential smartphone penetration and a strong emphasis on lifelong learning underpin robust demand for microlearning and mobile-first applications. Governments in East Asia champion digital classrooms, integrating mobile platforms into national education strategies, whereas Southeast Asian economies with burgeoning startup ecosystems drive innovation in localized content and multilingual learning environments. These regional dynamics underscore the necessity for vendors to adopt adaptive go-to-market strategies that resonate with diverse stakeholder priorities and infrastructure capabilities.

This comprehensive research report examines key regions that drive the evolution of the Mobile Learning market, offering deep insights into regional trends, growth factors, and industry developments that are influencing market performance.

- Americas

- Europe, Middle East & Africa

- Asia-Pacific

Analyzing Strategic Movements and Innovations from Leading Mobile Learning Providers Shaping the Future of Digital Education Services

Leading providers in the mobile learning arena are adopting distinct strategic approaches to differentiate their offerings and strengthen market positioning. Established enterprise software vendors are integrating AI-driven analytics into their platforms, enabling organizations to derive predictive insights on learner performance and adapt curriculum pathways accordingly. By embedding advanced reporting dashboards and real-time feedback loops, they cater to executive stakeholders seeking measurable training ROI and operational leaders focused on workforce upskilling.

Simultaneously, specialized content providers are expanding their portfolios through strategic partnerships and acquisitions to offer niche, domain-specific modules ranging from cybersecurity microcredentials to compliance certifications. These alliances accelerate time-to-market for new course libraries while ensuring pedagogical rigor and industry relevance. Additionally, several vendors are extending their ecosystems by embedding social collaboration and peer-to-peer networking features that enhance learner engagement and foster knowledge communities.

On the hardware front, manufacturers of education-grade devices are investing in ruggedized form factors, extended battery life, and integrated remote management capabilities to support decentralized learning scenarios. By offering bundled device-and-platform packages, they provide turnkey solutions for sectors such as field services, healthcare training, and public safety education. This verticalized approach enables providers to address sector-specific challenges while delivering cohesive user experiences across mobile endpoints.

This comprehensive research report delivers an in-depth overview of the principal market players in the Mobile Learning market, evaluating their market share, strategic initiatives, and competitive positioning to illuminate the factors shaping the competitive landscape.

- 2U, Inc.

- Babbel GmbH

- Berlitz Corporation

- Blackboard Inc.

- Chegg, Inc.

- Coursera, Inc.

- Degreed, Inc.

- Duolingo, Inc.

- EF Education First Ltd.

- Guild Education, Inc.

- Houghton Mifflin Harcourt Publishing Company

- inlingua International Ltd.

- iTutorGroup Limited

- John Wiley & Sons, Inc.

- Learneo, Inc.

- McGraw Hill LLC

- Memrise Limited

- Microsoft Corporation

- Pearson Education Limited

- Pearson plc

- Pluralsight, LLC

- Rosetta Stone, Ltd.

- Sanako Oy

- Skillsoft, Inc.

- Udemy, Inc.

- Vipkid Hk Limited

- Voxy, Inc.

Formulating Pragmatic Recommendations for Industry Leaders to Accelerate Adoption, Optimize Offerings, and Strengthen Competitive Positioning

Industry leaders should adopt a mobile-first mindset by prioritizing responsive design and intuitive user interfaces across all learning assets. By leveraging AI-driven personalization engines, organizations can tailor content recommendations and assessments to individual learner profiles, thereby maximizing engagement and retention. It is crucial to integrate microlearning modules within workflow applications and collaboration platforms to ensure that training becomes an organic element of daily operations rather than a separate, time-consuming activity.

To mitigate risks associated with fluctuating hardware costs and supply chain constraints, decision-makers are advised to diversify device procurement through strategic partnerships with regional assemblers and local distributors. Concurrently, exploring progressive web applications and cross-platform standards reduces dependency on specific operating systems, enabling seamless delivery across diverse device ecosystems. This approach not only enhances accessibility but also supports future-proofing strategies by accommodating emerging technologies without major overhauls.

Furthermore, fostering strategic alliances with content creators, edtech startups, and academic institutions can amplify course offerings and accelerate innovation cycles. Joint development initiatives and co-branding arrangements enable rapid deployment of specialized learning pathways aligned with industry certifications and regulatory requirements. Finally, investing in robust analytics infrastructures and data governance practices ensures organizations can measure learning efficacy, demonstrate compliance, and continuously refine program effectiveness based on empirically derived insights.

Detailing a Robust Mixed-Method Research Framework Combining Primary Interviews and Secondary Insights to Validate Market Intelligence

This market analysis is grounded in a comprehensive research methodology that synthesizes quantitative and qualitative approaches to deliver robust insights. Primary research included structured interviews with senior executives from leading enterprises, edtech providers, and government agencies, as well as focus group discussions with instructional designers and learners across corporate, academic, and public sectors. These firsthand perspectives illuminated critical pain points, adoption drivers, and future investment priorities for mobile learning initiatives.

Secondary research involved an exhaustive review of industry publications, white papers, regulatory filings, and reputable news outlets to validate market dynamics and technological trends. Data triangulation was applied to reconcile disparate findings and ensure consistency across multiple sources. In addition, the analysis incorporated real-world case studies detailing successful deployment models, cost-optimization strategies, and learner engagement metrics to provide actionable benchmarks.

A systematic framework was employed to segment the market by component, deployment mode, learning type, device, end user, and course category. Geographic segmentation reflected regional variances in infrastructure readiness, regulatory mandates, and cultural preferences. All data points underwent rigorous validation through cross-referencing and expert peer review to guarantee the integrity, relevance, and timeliness of the insights presented.

This section provides a structured overview of the report, outlining key chapters and topics covered for easy reference in our Mobile Learning market comprehensive research report.

- Preface

- Research Methodology

- Executive Summary

- Market Overview

- Market Insights

- Cumulative Impact of United States Tariffs 2025

- Cumulative Impact of Artificial Intelligence 2025

- Mobile Learning Market, by Component

- Mobile Learning Market, by Learning Type

- Mobile Learning Market, by Device

- Mobile Learning Market, by Course

- Mobile Learning Market, by Deployment Mode

- Mobile Learning Market, by End User

- Mobile Learning Market, by Region

- Mobile Learning Market, by Group

- Mobile Learning Market, by Country

- United States Mobile Learning Market

- China Mobile Learning Market

- Competitive Landscape

- List of Figures [Total: 18]

- List of Tables [Total: 2067 ]

Concluding Strategic Imperatives That Align Mobile Learning Evolution with Organizational Objectives to Maximize Impact and ROI

As mobile learning continues to redefine conventional boundaries of education and training, organizations must embrace strategic imperatives that align technology investments with evolving learner expectations. The confluence of AI-driven personalization, immersive learning modalities, and modular content architectures offers unprecedented opportunities to enhance performance and drive measurable outcomes. However, success hinges on a cohesive approach that integrates hardware, software, and services within adaptive deployment models tailored to specific operational contexts.

Forward-thinking enterprises and institutions will prioritize agility in solution design, ensuring seamless interoperability across devices and platforms. This adaptability, coupled with diversified procurement channels and localized manufacturing partnerships, will buffer against trade policy volatility and supply chain disruptions. Equally important is the cultivation of robust analytics capabilities to monitor engagement, assess learning efficacy, and steer continuous improvement cycles based on empirical evidence.

By internalizing these strategic imperatives, stakeholders can transform mobile learning from a cost-saving adjunct to a core enabler of workforce agility, academic excellence, and societal resilience. The collective impact of targeted segmentation insights, regional nuance, and competitive innovations sets the stage for a new era in which mobile learning becomes the cornerstone of lifelong skill development and knowledge democratization.

Engage with Ketan Rohom to Secure Essential Mobile Learning Market Insights and Propel Your Organization Ahead of Industry Transformations

Engaging with Ketan Rohom, Associate Director of Sales & Marketing, unlocks unparalleled access to comprehensive insights that empower your organization to thrive in the rapidly evolving mobile learning environment. By securing the full mobile learning market research report, decision-makers gain deep visibility into shifting consumer preferences, emerging technologies, and regulatory landscapes that will define the next wave of digital learning. This resource offers a detailed roadmap for aligning product strategies with market demand, optimizing investments, and outpacing competitors. Reach out today to transform your strategic planning with data-driven perspectives and expert guidance tailored to your business objectives. Partner now to take decisive action and harness the untapped opportunities at the intersection of mobility and education.

- How big is the Mobile Learning Market?

- What is the Mobile Learning Market growth?

- When do I get the report?

- In what format does this report get delivered to me?

- How long has 360iResearch been around?

- What if I have a question about your reports?

- Can I share this report with my team?

- Can I use your research in my presentation?