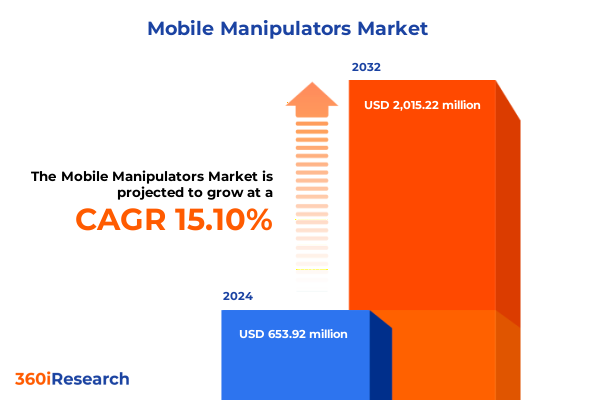

The Mobile Manipulators Market size was estimated at USD 747.71 million in 2025 and expected to reach USD 856.05 million in 2026, at a CAGR of 14.89% to reach USD 1,976.81 million by 2032.

Transforming Automation Landscapes with Mobile Manipulators through Seamless Integration of Mobility and Precision in Modern Industrial Contexts

Mobile manipulators represent a fusion of autonomous mobility platforms and precision robotic arms, enabling complex handling tasks in dynamic environments that traditional fixed robots cannot address. By combining an on-board locomotion system with versatile end effectors, these systems navigate semi-structured spaces while performing assembly, pick-and-place, and inspection duties. Early deployments have demonstrated tangible benefits in logistics hubs, where 73 Autopicker units at a major ecommerce distribution center in Colorado reduced labor requirements by over 80 percent and enabled uninterrupted lights-out operations.

Beyond warehousing, mobile manipulators are increasingly adopted where flexibility and adaptability are paramount. Advances in modular robotic design and customizable software frameworks allow these machines to transition between tasks from machine tending on the factory floor to patient assistance in healthcare settings. As end users demand solutions that can rapidly reconfigure for varying throughput and precision requirements, mobile manipulators are positioned at the forefront of next-generation automation strategies.

Emerging Technological and Operational Paradigm Shifts Shaping the Future Trajectory of Mobile Manipulator Deployments

The mobile manipulator landscape is undergoing rapid evolution driven by innovations in artificial intelligence, edge computing, and sustainable design. Recent breakthroughs in real-time navigation and self-optimization algorithms are enhancing operational reliability in unstructured environments, enabling these systems to adapt to changing conditions without extensive reprogramming. At the same time, modular hardware architectures facilitate quick swaps of grippers and sensor payloads, aligning with the growing demand for customized automation that addresses unique process requirements across sectors like manufacturing and inspection.

Concurrently, digital transformation imperatives are reshaping end-user expectations, with companies seeking integrated data analysis and management platforms that deliver actionable insights from robotic operations. By leveraging cloud-connected software suites, mobile manipulators now support predictive maintenance workflows, reducing unplanned downtime. Sustainability has also emerged as a core design principle, with next-generation systems incorporating energy-efficient power management and recyclable materials to meet corporate and regulatory environmental targets. This confluence of AI-driven autonomy, modular flexibility, and green engineering is redefining the competitive landscape for mobile manipulator providers.

Comprehensive Analysis of the 2025 US Tariff Regime and Its Far Reaching Consequences on the North American Mobile Manipulator Industry

United States tariff policies enacted in early 2025 have injected significant uncertainty into the mobile manipulator supply chain, reshaping investment and deployment decisions across North American operations. Touted as a measure to bolster domestic manufacturing competitiveness, the tariffs on Chinese-origin robotics components have increased landed costs and delayed capital projects. Major buyers in the automotive and logistics sectors have adopted a “wait-and-see” posture, deferring large-scale automation rollouts until trade policies stabilize.

Key components such as sensors, actuators, semiconductors, and camera modules have borne the brunt of rate increases, with applied duties raising part costs by as much as 22 percent for certain actuator assemblies and 18 to 22 percent for imaging sensors. These escalated procurement expenses have compressed profit margins and compelled suppliers to pass additional charges onto system integrators, further exacerbating hesitancy among price-sensitive end users.

In response, leading robotics OEMs and integrators have diversified sourcing, shifting production footprints toward Southeast Asia, India, and Mexico, while select advanced manufacturers pursue partial reshoring of critical sub-assemblies. This strategic realignment aims to mitigate tariff exposure and enhance supply chain resilience, yet the transition has entailed extended lead times and increased logistical complexity during the reconfiguration period.

Smaller enterprises and capital-constrained operations have been particularly affected, with many delaying or scaling back pilot programs in sectors such as textiles and food processing where automation investments were nascent. While large strategic accounts sustain momentum through in-house absorption of incremental costs, smaller adopters continue to evaluate total cost of ownership implications, mindful of reduced ROI expectations driven by both hardware tariffs and a 25 percent steel levy that indirectly impacts mobile platform chassis expenses.

Despite these headwinds, domestic policy incentives such as the CHIPS and Science Act and emerging collaborative initiatives are fostering local manufacturing capabilities for semiconductors and control electronics. These efforts are expected to gradually offset tariff-induced price inflation and support the long-term competitiveness of U.S. mobile manipulator producers, offering a potential pathway to restore project timelines and renew automation investment cycles.

In Depth Examination of Market Segmentation Dynamics Spanning Component, Automation Levels, Modules, Industry Verticals and Distribution Channels

Analysis of component segmentation reveals that hardware continues to dominate capital expenditures, with control systems and end effectors at the center of innovation as integrators strive to enhance precision and reliability. Meanwhile, investment in software and services is rising, driven by demand for advanced control and automation platforms alongside data analysis suites that deliver operational intelligence. As organizations weigh the benefits of integration, maintenance, and training services against the capital intensity of robotic hardware, a balanced portfolio approach is emerging to maximize uptime and scalability.

Exploring automation levels, mobile manipulator deployments span from semi-autonomous solutions that operate under human supervision to fully autonomous systems capable of executing complex sequences without intervention. This spectrum enables phased integration strategies, where organizations pilot semi-autonomous workflows before transitioning to more advanced, self-directed operations once confidence in reliability and ROI is established.

Module-level analysis highlights the symbiotic relationship between grip and manipulation capabilities and mobility and navigation subsystems. While sophisticated grippers deliver dexterous handling for pick and place applications, robust navigation architectures ensure consistent routing through dynamic environments, underscoring the importance of end-to-end system coherence in mission-critical use cases.

Industry end users such as logistics and warehouse operations lead adoption, capitalizing on the agility of mobile manipulators to streamline order fulfillment, palletizing, and quality inspections. Concurrently, applications across machine tending, material transportation, and inspection tasks are gaining traction, reflecting a broadening set of use cases and an appetite for modular, reconfigurable automation.

Distribution channels bifurcate between direct sales relationships with strategic accounts and global networks of distributors and dealers that extend market reach. This dual-channel approach supports both bespoke system integrations for large enterprises and off-the-shelf solutions for mid-market customers seeking rapid deployment and standardized support offerings.

This comprehensive research report categorizes the Mobile Manipulators market into clearly defined segments, providing a detailed analysis of emerging trends and precise revenue forecasts to support strategic decision-making.

- Component

- Mobility Platform

- Automation Level

- Payload Capacity

- Application

- End User Industry

- Distribution Channel

- Enterprises Size

Strategic Regional Perspectives on Mobile Manipulator Growth Patterns and Adoption Drivers across the Americas, Europe Middle East Africa and Asia Pacific

The Americas region continues to lead mobile manipulator adoption, fueled by robust capital expenditure cycles in North America and a concentration of strategic distribution hubs. According to IFR data, U.S. robot installations rose ten percent in 2022 to nearly forty thousand units, with the automotive sector accounting for over forty-seven percent of that growth. These adoption trends reflect a mature ecosystem supported by leading integrators, favorable R&D incentives, and rising labor costs that accelerate automation investments.

Across Europe, Middle East and Africa, harmonized safety standards and interoperable certification frameworks are unifying diverse markets under shared regulatory umbrellas. Germany remains the regional bellwether with more than twenty-five thousand industrial robot installations, while Italy and France experienced installation gains of eight and thirteen percent respectively in 2022. Emerging piloting in smart logistics corridors and smart city initiatives in Gulf states further extend the addressable market beyond traditional manufacturing hubs.

In the Asia-Pacific region, rapid industrialization and significant investment in automation technologies have propelled deployment volumes to commanding levels. Accounting for nearly three-quarters of global industrial robot installations in 2022, key markets such as China, Japan, and South Korea continue to expand their robotics footprints. Concurrently, government-backed automation drives in India and last-mile logistics experiments across Southeast Asia are broadening the application scope, demonstrating that APAC will remain a global growth engine for mobile manipulators over the coming decade.

This comprehensive research report examines key regions that drive the evolution of the Mobile Manipulators market, offering deep insights into regional trends, growth factors, and industry developments that are influencing market performance.

- Americas

- Europe, Middle East & Africa

- Asia-Pacific

Profiling Key Market Leaders Driving Mobile Manipulator Innovation through Strategic Reshoring, Partnerships, Product Development and Market Penetration

Global incumbents and emerging specialists alike are shaping the mobile manipulator ecosystem through diverse strategies. ABB, with a heritage in industrial automation, is repositioning its robotics division via a planned spin-off to unlock focused investment in next-generation systems and cloud-native software integration. At the same time, collaborative robot frontrunners such as FANUC and Yaskawa are broadening their offerings with modular end-effectors designed for rapid task reconfiguration.

Concurrently, digital-first innovators including Mobile Industrial Robots and Fetch Robotics are scaling global sales networks to deliver turnkey solutions, emphasizing maintenance services and remote diagnostics to enhance customer uptime. Specialized startups such as Apptronik and Figure AI are navigating tariff challenges by diversifying supplier partnerships, while Agility Robotics is seizing opportunities in domestic production to capitalize on U.S. labor shortages and nearshoring incentives. Iconic laboratories like Boston Dynamics continue to drive brand visibility by showcasing advanced humanoid prototypes, setting aspirational benchmarks for autonomy and dexterity in forthcoming mobile manipulator lines.

This comprehensive research report delivers an in-depth overview of the principal market players in the Mobile Manipulators market, evaluating their market share, strategic initiatives, and competitive positioning to illuminate the factors shaping the competitive landscape.

- Kuka AG

- Boston Dynamics, Inc.

- ABB Ltd.

- FANUC Corporation

- Omron Corporation

- Exail Technologies SA

- United Robotics Group GmbH

- Panasonic Holdings Corporation

- Staubli International AG

- Rockwell Automation, Inc.

- Kawasaki Heavy Industries, Ltd.

- Teradyne, Inc.

- Agility Robotics, Inc.

- Beijing Geekplus Technology Co., Ltd.

- Comau S.p.A.

- ROKAE (Beijing) Robotics Co., LTD.

- Diligent Robotics, Inc.

- Zebra Technologies Corporation

- Neobotix GmbH

- SCIO Automation GmbH

- Rainbow Robotics Co., Ltd.

- Asratec Corporation

- Collaborative Robotics Inc.

- PAL ROBOTICS SL.

- F&P Robotics AG

- Autonox Robotics GmbH

- Continental AG

- inVia Robotics, Inc.

- Mitsubishi Electric Corporation

- Mujin Corp.

- Toshiba Corporation

Actionable Executive Recommendations for Harnessing Technological Advances, Mitigating Trade Risks and Future Proofing Mobile Manipulator Strategies

Industry leaders should prioritize diversification of component sourcing to mitigate future tariff risks, leveraging supplier networks across Southeast Asia, Mexico, and domestic U.S. facilities to build resilient supply chains. Parallel investment in edge computing and AI-based control algorithms will enhance system autonomy, enabling more reliable navigation and task execution in complex environments.

Executives must also pursue partnerships with software integrators and data analytics firms to develop unified platforms that deliver predictive maintenance and performance benchmarking, reducing downtime and optimizing operational efficiency. Aligning automation roadmaps with sustainability goals through energy-efficient power management and recyclable materials will satisfy corporate ESG mandates while fostering long-term cost savings.

Strategic pilot programs in semi-structured sectors such as logistics and warehousing offer low-risk entry points for validating new mobile manipulator capabilities. Scaling from semi-autonomous workflows to fully autonomous operations should follow demonstrable ROI milestones, ensuring stakeholder buy-in and disciplined capital allocation.

Finally, investing in workforce reskilling and cross-functional automation centers of excellence will accelerate adoption by equipping teams to manage, maintain, and continuously improve robotic deployments. By harmonizing these imperatives, organizations can build a sustainable competitive advantage that endures beyond short-term trade dynamics and technological disruptions.

Robust Multi Tier Research Methodology Leveraging Primary Expert Interviews, Secondary Research, Data Triangulation and Validation Protocols

This research was conducted using a rigorous mixed-methods approach, beginning with primary interviews conducted with senior executives, system integrators, and end-user automation specialists to capture qualitative insights on deployment challenges and investment rationales. Complementing these interactions, quantitative surveys were administered across a cross-section of industries to validate priorities in component sourcing, application maturity, and regional expansion.

Secondary research involved systematic review of publicly available filings, patent databases, academic journals, trade association publications, and government policy documents to map emerging trends and regulatory impacts. Key data points were cross-referenced against International Federation of Robotics installation figures and tariff schedules to ensure accuracy.

Market estimates and segmentation analysis were triangulated through corroboration of multiple data sources, followed by validation workshops with independent subject-matter experts. An iterative process of peer review and scenario modeling under various trade and technological scenarios further reinforced the robustness of findings, providing stakeholders with high-confidence strategic guidance.

This section provides a structured overview of the report, outlining key chapters and topics covered for easy reference in our Mobile Manipulators market comprehensive research report.

- Preface

- Research Methodology

- Executive Summary

- Market Overview

- Market Insights

- Cumulative Impact of United States Tariffs 2025

- Cumulative Impact of Artificial Intelligence 2025

- Mobile Manipulators Market, by Component

- Mobile Manipulators Market, by Mobility Platform

- Mobile Manipulators Market, by Automation Level

- Mobile Manipulators Market, by Payload Capacity

- Mobile Manipulators Market, by Application

- Mobile Manipulators Market, by End User Industry

- Mobile Manipulators Market, by Distribution Channel

- Mobile Manipulators Market, by Enterprises Size

- Mobile Manipulators Market, by Region

- Mobile Manipulators Market, by Group

- Mobile Manipulators Market, by Country

- United States Mobile Manipulators Market

- China Mobile Manipulators Market

- Competitive Landscape

- List of Figures [Total: 20]

- List of Tables [Total: 1908 ]

Final Reflections on Mobile Manipulator Evolution, Market Dynamics and Strategic Imperatives for Sustained Competitive Advantage and Growth

Mobile manipulators have transcended conceptual pilots to become critical enablers of flexible and scalable automation across diverse sectors. Despite immediate disruptions from U.S. tariff policies and global supply chain realignments, sustained interest in digital integration, AI-driven autonomy, and bespoke end-user applications underscores long-term growth potential. By understanding segmentation drivers, regional dynamics, and competitive landscapes, decision makers can craft targeted strategies that unlock the full value of mobile manipulator technology.

As industries contend with shifting trade regulations and evolving operational demands, the ability to adapt through supply chain diversification, software-centric innovation, and strategic collaborations will differentiate market leaders. The synthesis of these elements points to a future where mobile manipulators deliver not only cost efficiencies but also transformative operational agility, reshaping how goods and services flow through modern economies.

Connect with Ketan Rohom to Secure Your Comprehensive Mobile Manipulator Market Research Report and Drive Strategic Decision Making with Confidence

Ready to advance your strategic initiatives with in-depth analysis and actionable intelligence on the mobile manipulator market? Connect directly with Ketan Rohom, Associate Director of Sales & Marketing, to secure your definitive market research report. Gain privileged access to comprehensive insights, expert commentary, and tailored recommendations that will empower your organization to navigate dynamic industry shifts and unlock new growth opportunities. Reach out today to ensure your competitive edge in the evolving landscape of mobile manipulators.

- How big is the Mobile Manipulators Market?

- What is the Mobile Manipulators Market growth?

- When do I get the report?

- In what format does this report get delivered to me?

- How long has 360iResearch been around?

- What if I have a question about your reports?

- Can I share this report with my team?

- Can I use your research in my presentation?