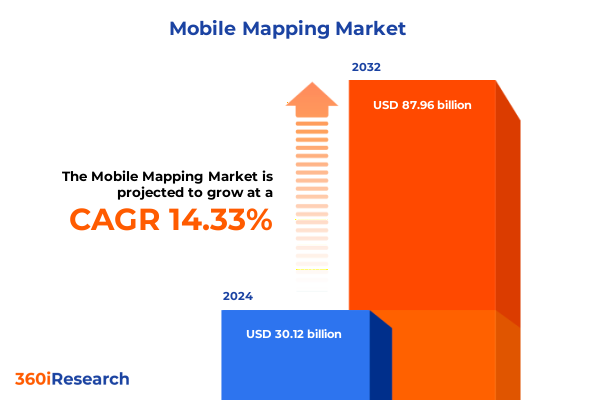

The Mobile Mapping Market size was estimated at USD 33.57 billion in 2025 and expected to reach USD 37.42 billion in 2026, at a CAGR of 14.75% to reach USD 87.96 billion by 2032.

Navigating the New Era of Mobile Mapping With Cutting-Edge Technologies Emerging Industry Dynamics and Regulatory Considerations in a Rapidly Evolving Geospatial Landscape

In today’s rapidly evolving geospatial environment, mobile mapping has emerged as a critical capability for a wide range of sectors including infrastructure monitoring, autonomous navigation, and resource management. The convergence of advanced sensor technologies with powerful data processing platforms is fundamentally reshaping how organizations capture and leverage spatial intelligence. As urbanization trends accelerate and digital twin initiatives proliferate, the demand for accurate, real-time mapping solutions has never been greater. Consequently, stakeholders across public, private, and research domains are reevaluating their geospatial strategies to ensure agility and resilience in the face of emerging challenges.

With the proliferation of high-precision positioning systems and next-generation LiDAR sensors, the industry is witnessing an unprecedented fusion of hardware and software innovations. Photogrammetric techniques, whether deployed via aerial platforms or unmanned aerial vehicles, are being supplemented by spectral imaging modalities that offer deep insights into environmental conditions and material properties. This multi-sensor paradigm is giving rise to more robust mapping workflows that can be tailored to diverse applications ranging from precision agriculture to utility asset management. Moreover, the integration of cloud-native architectures and edge computing is enabling near-instantaneous data ingestion and analysis, reducing the latency between field capture and actionable insights.

Against this backdrop, this executive summary provides a succinct yet comprehensive overview of the transformative forces at play within the mobile mapping landscape. By synthesizing key shifts in technology adoption, analyzing the implications of recent trade policies, and revealing strategic segmentation and regional dynamics, this document lays the groundwork for informed decision-making. Furthermore, it highlights leading industry players and distills actionable recommendations to help executives chart a clear path toward sustainable growth.

Unveiling the Transformative Shifts Redefining Mobile Mapping Through Innovation Partnerships and Data-Driven Approaches Across Applications Such as Infrastructure Monitoring Autonomous Navigation and Environmental Management

Over the past five years, the mobile mapping sector has undergone a series of transformative shifts that have redefined traditional geospatial paradigms. First, the migration toward modular sensor arrays has enabled organizations to construct bespoke mapping platforms by selecting from a palette of GNSS units, LiDAR modules, and high-resolution imaging cameras. This composability has reduced entry barriers for specialized deployments and accelerated the pace of innovation. Concurrently, the rise of artificial intelligence and machine learning has infused mapping workflows with automated feature extraction and semantic segmentation capabilities, transforming raw point clouds and imagery into rich digital assets with significantly lower manual intervention.

In parallel, collaborative models have emerged, as technology providers, systems integrators, and end users forge strategic alliances to co-develop digital twin frameworks. The confluence of cloud-enabled analytics platforms and edge processing engines empowers field operators to conduct real-time quality checks and adaptive mission planning, ensuring that data fidelity aligns with project objectives. Additionally, the growing emphasis on sustainability and environmental stewardship has prompted the integration of spectral imaging techniques to monitor vegetation health, water quality, and land-use changes, thereby broadening the scope of mobile mapping beyond traditional infrastructure and construction applications.

Moreover, regulatory and interoperability standards have evolved to support greater data sharing and platform neutrality. Open data initiatives and standardized metadata schemas are facilitating cross-sector collaboration, driving new service models based on geospatial-as-a-service. As a result, businesses are transitioning from hardware-led capital expenditures toward recurring revenue streams centered on data analytics, managed services, and software subscriptions. These cumulative shifts are charting a new trajectory for mobile mapping, one defined by agility, intelligence, and sustainable value creation.

Assessing the Cumulative Impact of United States Section 301 Tariffs Effective January 2025 on Mobile Mapping Technologies Supply Chains Cost Structures and Strategic Responses

In December 2024, the Office of the United States Trade Representative announced an increase in Section 301 tariffs on a range of technology imports from the People’s Republic of China, with key product categories such as semiconductors and critical minerals elevated to 50 percent effective January 1, 2025. This adjustment directly impacts the cost base of mobile mapping hardware, as GNSS receivers, LiDAR sensors, and high-resolution imaging cameras rely heavily on advanced semiconductor components. At the same time, the imposition of a 25 percent duty on select critical minerals, including certain permanent magnets and tungsten products, has compounded cost pressures on sensor manufacturing and assembly.

The cumulative effect of these duties has manifested in multiple dimensions across the mobile mapping value chain. From an operational standpoint, procurement lead times have extended by an estimated 20 to 30 weeks due to tariff-induced disruption in global supply networks, slowing down project deployment and field scheduling. In addition, service providers report margin compression as fixed-price contracts struggle to accommodate elevated hardware costs, occasionally prompting renegotiations and contract extensions. The tariff-driven inflationary environment has also catalyzed a strategic shift toward nearshoring and supplier diversification, with a growing number of vendors relocating component fabrication to tariff-exempt regions to stabilize cost-of-goods-sold and reduce exposure to further policy volatility.

Going forward, industry participants are exploring software-defined mapping solutions and sensor fusion techniques that minimize reliance on tariff-affected hardware. By leveraging advanced photogrammetric algorithms and open-architecture sensor modules, organizations aim to offset cost increases and maintain competitive differentiation. Although these strategic responses require upfront investment in R&D and integration, they represent critical pathways to resilience in a landscape where trade policy remains an unpredictable variable.

Revealing Critical Segmentation Insights Based on Technology Component Application Deployment Mode End User Pricing Model to Illuminate Mobile Mapping Market Dynamics

In-depth segmentation reveals how the mobile mapping ecosystem can be dissected to illuminate nuanced market dynamics across multiple dimensions. When examining technology, one must consider the distinct roles of global navigation satellite systems and LiDAR, both of which serve as foundational positioning and ranging solutions. Within GNSS, mass-market units prevail in consumer-focused applications, while survey-grade GNSS underpins high-precision workflows. LiDAR further subdivides into airborne, mobile, and terrestrial configurations, each optimized for deployment altitude and coverage requirements. Photogrammetric methods span aerial, drone-based, and satellite platforms, complementing LiDAR’s spatial density with cost-effective image-derived mapping. Spectral imaging, including hyperspectral, multispectral, and thermal modalities, supplies essential data layers for environmental assessment and material characterization.

Exploring the component landscape uncovers a tripartite structure of hardware, services, and software. Hardware comprises cameras, GNSS receivers, inertial measurement units, and specialized LiDAR sensors. Services encompass consulting and training engagements, data processing and analytics, and end-to-end mapping solutions, where data visualization, three-dimensional modeling, and geographic information system integration play indispensable roles. Software offerings range from GNSS correction suites to sophisticated LiDAR processing applications and simultaneous localization and mapping (SLAM) platforms. In application terms, the industry extends across agriculture and forestry management, autonomous vehicle navigation, construction and infrastructure inspection, surveying and mapping operations, and utilities and asset management, including both electric and water network oversight.

Deployment modes illustrate flexibility in form factors, from backpack and handheld units to drone-based UAV systems, maritime-mounted arrays, and vehicle-mounted rigs. Drone platforms diversify further into fixed-wing and rotary-wing configurations to meet endurance and maneuverability needs. End-user profiles span automotive manufacturers, construction firms, government bodies, mining operators, and research institutions, each with distinct procurement criteria. Finally, pricing models encompass outright hardware sales, pay-per-use arrangements calculated per hour or per project, and subscription-based services offered on monthly or annual terms.

This comprehensive research report categorizes the Mobile Mapping market into clearly defined segments, providing a detailed analysis of emerging trends and precise revenue forecasts to support strategic decision-making.

- Technology

- Component

- Deployment Mode

- Pricing Model

- Application

- End User

Highlighting Key Regional Insights Across the Americas Europe Middle East Africa and Asia-Pacific to Reveal Growth Drivers and Market Nuances in Mobile Mapping

Regional variations play a pivotal role in shaping mobile mapping trajectories, reflecting differentiated investment climates, regulatory frameworks, and technology adoption patterns. In the Americas, the convergence of federal infrastructure modernization programs and robust private-sector demand has driven widespread deployment of GNSS-enabled mapping vehicles and airborne LiDAR surveys. North American clients are particularly focused on digital twin initiatives in urban planning, leading to new partnerships between mapping technology providers and municipal agencies. Meanwhile, Latin American markets are increasingly leveraging drone-based photogrammetry to support agricultural monitoring and resource management, despite lingering gaps in regulatory harmonization.

Across Europe, the Middle East, and Africa, the emphasis on sustainability and environmental regulation mandates advanced spectral imaging and high-resolution photogrammetric mapping. European construction and utilities sectors, under strict carbon reduction targets, are turning to mobile LiDAR and SLAM-based systems to optimize energy infrastructure and rail network maintenance. In the Middle East, national smart city visions are fueling demand for integrated geospatial platforms, while African research institutions are piloting handheld and backpack solutions for biodiversity conservation projects in remote regions. These diverse geospatial ecosystems underscore the importance of interoperability standards and data-sharing protocols to unlock cross-border collaboration.

In the Asia-Pacific region, rapid urbanization and autonomous vehicle testing corridors are central to the mobile mapping roadmap. China’s domestic sensor manufacturers are scaling capabilities to meet both in-country demand and export orders, fostering a competitive landscape for GNSS and LiDAR producers. Japan and South Korea emphasize robotic mapping solutions for both indoor and outdoor environments, leveraging SLAM innovations to streamline factory digitization and port logistics. Meanwhile, Southeast Asian governments are investing in coastline mapping and flood risk modeling, often through drone-based multi-sensor surveys that integrate thermal and multispectral imaging. This mosaic of regional imperatives highlights the need for agile go-to-market strategies that account for localized regulatory, infrastructure, and commercial drivers.

This comprehensive research report examines key regions that drive the evolution of the Mobile Mapping market, offering deep insights into regional trends, growth factors, and industry developments that are influencing market performance.

- Americas

- Europe, Middle East & Africa

- Asia-Pacific

Profiling Key Industry Players Driving Innovation and Competition in Mobile Mapping Through Technology Development Strategic Partnerships and Market Expansion Initiatives

Leading players in the mobile mapping arena are distinguished by their ability to integrate end-to-end workflows and deliver scalable solutions tailored to specific industry challenges. One prominent hardware diver emerges as a benchmark for GNSS precision and ruggedized mounting assemblies, while another commands the photogrammetry segment through advanced camera systems and turnkey data processing platforms. A third globally recognized enterprise offers a comprehensive LiDAR portfolio and cloud-based analytics for infrastructure inspection, forging strategic alliances with construction firms and municipal agencies. Concurrently, a specialist in spectral imaging has expanded its solution suite to include hyperspectral analytics tools, enabling environmental monitoring and resource assessment at unprecedented spatial resolutions.

On the software and services front, an established geospatial intelligence provider has cultivated a robust ecosystem of GIS integration modules and three-dimensional modeling extensions, bolstering its market share through value-added subscription services. Another rising competitor leverages artificial intelligence to automate feature extraction from point clouds, streamlining deliverables for surveyors and asset managers. Additionally, several nimble startups are exploring sensor fusion approaches and open-architecture SLAM frameworks, targeting niche use cases such as autonomous navigation in indoor environments and drone swarm coordination for large-area mapping. These innovative entrants are challenging incumbents by offering lower total cost of ownership through software-defined mapping techniques and modular hardware compatibility.

Across this competitive landscape, collaboration emerges as a defining strategy. Industry leaders are engaging in co-development partnerships, joint ventures, and academic consortia to advance interoperability standards and promote scalable platform architectures. By balancing specialized technology stacks with broad ecosystem alliances, these companies are positioning themselves to capture the next wave of mobile mapping growth.

This comprehensive research report delivers an in-depth overview of the principal market players in the Mobile Mapping market, evaluating their market share, strategic initiatives, and competitive positioning to illuminate the factors shaping the competitive landscape.

- Apple Inc.

- Cisco Systems, Inc.

- Comtech Telecommunications Corporation

- Cyclomedia Technology BV

- Foursquare Labs, Inc.

- Garmin Ltd.

- GeoSLAM by FARO Technologies, Inc.

- Google LLC by Alphabet Inc.

- GreenValley International

- Hexagon AB

- Hi-Target Surveying Instrument Co. Ltd.

- Imajing SAS

- ISGroup by KPN

- Javad GNSS Inc.

Strategic and Actionable Recommendations for Industry Leaders to Navigate Supply Chain Challenges Leverage Emerging Technologies and Capitalize on Growth Opportunities in Mobile Mapping

To navigate the evolving mobile mapping ecosystem and sustain competitive advantage, industry leaders must adopt a multi-pronged strategic approach. First, supply chain resilience should be enhanced through supplier diversification and nearshoring initiatives. By cultivating relationships with component fabricators across tariff-exempt regions and establishing contingency inventories, organizations can mitigate the impact of trade policy shifts and logistical disruptions. Concurrently, investing in software-defined mapping solutions that reduce hardware dependency will curb cost escalation and accelerate deployment timelines, while enabling more flexible system upgrades over time.

Next, forging deep partnerships with ecosystem stakeholders-from sensor manufacturers to cloud analytics providers-will accelerate innovation cycles and broaden service offerings. Co-development agreements can facilitate joint R&D in emerging areas such as machine learning-based feature classification, semantic mapping, and digital twin orchestration. Equally critical is the engagement with regulatory bodies to advocate for harmonized data-sharing protocols and interoperable metadata standards, thereby unlocking new use cases and enhancing data monetization opportunities. Moreover, embedding sustainability considerations into technology roadmaps, including low-power sensor arrays and eco-conscious manufacturing practices, will resonate with environmentally focused end users and align corporate social responsibility objectives with market demand.

Finally, nurturing specialized talent through targeted training programs and academia-industry collaborations will ensure organizations possess the expertise to integrate multi-sensor data streams and translate them into actionable insights. By coupling technical proficiency with domain-specific knowledge, companies can deliver differentiated outcomes for sectors ranging from smart cities to precision agriculture, solidifying their position in an increasingly competitive mobile mapping landscape.

Outlining the Comprehensive Research Methodology Employing Primary Secondary Data Collection Expert Interviews and Rigorous Analysis to Ensure Reliability and Validity

This research leverages a hybrid methodology designed to ensure both depth and rigor in capturing the nuances of the mobile mapping ecosystem. Secondary research began with an extensive review of public domain materials, including government trade notices, industry white papers, peer-reviewed journals, and technical standards publications. Key sources comprised regulatory announcements from the Office of the United States Trade Representative, authoritative geospatial journals, and leading academic works in remote sensing and photogrammetry.

Primary insights were gathered through structured interviews with senior executives, product managers, and technical specialists from hardware vendors, software providers, and end-user organizations. These dialogues provided real-world perspectives on supply chain considerations, technology adoption barriers, and future investment priorities. To triangulate these findings, quantitative data was normalized and cross-referenced against proprietary databases and publicly available datasets, enabling consistency checks and outlier detection.

Analytical frameworks, such as SWOT analysis, Porter's Five Forces, and technology adoption curves, were applied to interpret market dynamics and competitive positioning. A rigorous validation process involved iterative peer reviews and expert panel discussions, ensuring methodological transparency and integrity. Geographic coverage was ensured by incorporating inputs from diverse regions, including North America, EMEA, and Asia-Pacific, reflecting localized conditions and regulatory nuances. This robust research approach underpins the strategic recommendations and insights presented herein.

This section provides a structured overview of the report, outlining key chapters and topics covered for easy reference in our Mobile Mapping market comprehensive research report.

- Preface

- Research Methodology

- Executive Summary

- Market Overview

- Market Insights

- Cumulative Impact of United States Tariffs 2025

- Cumulative Impact of Artificial Intelligence 2025

- Mobile Mapping Market, by Technology

- Mobile Mapping Market, by Component

- Mobile Mapping Market, by Deployment Mode

- Mobile Mapping Market, by Pricing Model

- Mobile Mapping Market, by Application

- Mobile Mapping Market, by End User

- Mobile Mapping Market, by Region

- Mobile Mapping Market, by Group

- Mobile Mapping Market, by Country

- United States Mobile Mapping Market

- China Mobile Mapping Market

- Competitive Landscape

- List of Figures [Total: 18]

- List of Tables [Total: 2385 ]

Concluding Insights Summarizing Key Findings and Strategic Imperatives to Guide Decision-Making in the Mobile Mapping Industry Amid Technological and Policy Shifts

In summary, the mobile mapping industry stands at a pivotal juncture shaped by rapid technological innovation, policy realignments, and evolving application demands. The integration of advanced GNSS, LiDAR, photogrammetric, and spectral imaging modalities is redefining the boundaries of what is possible in spatial data capture and analysis. Simultaneously, the imposition of heightened tariffs on key components has underscored the significance of supply chain resilience and adaptive cost management strategies.

Segmentation analysis reveals that organizations must adopt a holistic view across technology types, service models, deployment modes, end-user requirements, and pricing strategies to unlock new revenue streams and operational efficiencies. At the regional level, distinct growth trajectories in the Americas, EMEA, and Asia-Pacific necessitate tailored go-to-market approaches that align with local regulatory, infrastructural, and commercial imperatives. Furthermore, the competitive landscape is witnessing dynamic interplay between established incumbents and agile newcomers, each leveraging specialized capabilities and strategic alliances to capture market share.

As the industry accelerates toward digital twin implementations, autonomous navigation applications, and sustainable infrastructure projects, the capacity to translate complex geospatial data into actionable insights will become a key differentiator. Ultimately, the insights and recommendations outlined in this executive summary offer a roadmap for decision-makers seeking to capitalize on emerging trends, overcome supply chain constraints, and chart a course for long-term value creation in the mobile mapping domain.

Engage with Associate Director Ketan Rohom for Personalized Briefings and Secure Your Comprehensive Mobile Mapping Market Research Report Today to Unlock Actionable Insights

To explore these findings in greater depth and discover how they apply to your organization’s unique requirements, we invite you to engage directly with Ketan Rohom, Associate Director of Sales and Marketing. Leveraging an extensive network of industry contacts and deep expertise in geospatial technologies, Ketan can provide personalized briefings that focus on your specific challenges and growth objectives. Whether you are evaluating sensor platforms, reassessing your supply chain, or seeking to refine your go-to-market strategy, his insights will help align your plans with the latest market dynamics and policy developments.

By securing the full comprehensive mobile mapping market report, you will gain access to detailed datasets, proprietary analyses, and exclusive expert interviews that delve into advanced topics such as sensor fusion algorithms, regulatory forecasting, and emerging service models. This tailored engagement ensures that you receive actionable intelligence designed to accelerate decision-making and inform investment prioritization. Don’t miss the opportunity to harness these strategic insights and strengthen your position in the competitive mobile mapping landscape. Contact Ketan Rohom today to schedule a consultation and obtain the definitive resource on mobile mapping market trends and strategic imperatives.

- How big is the Mobile Mapping Market?

- What is the Mobile Mapping Market growth?

- When do I get the report?

- In what format does this report get delivered to me?

- How long has 360iResearch been around?

- What if I have a question about your reports?

- Can I share this report with my team?

- Can I use your research in my presentation?