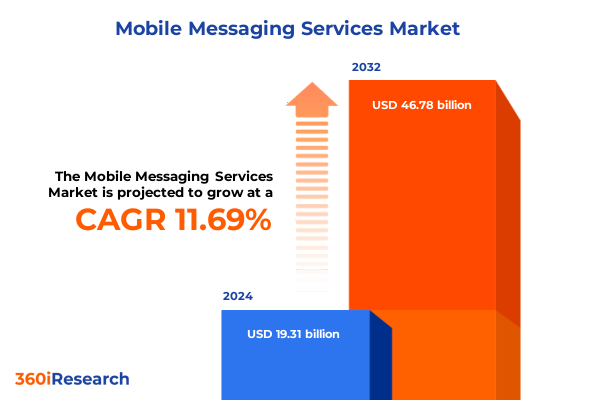

The Mobile Messaging Services Market size was estimated at USD 21.57 billion in 2025 and expected to reach USD 24.10 billion in 2026, at a CAGR of 11.69% to reach USD 46.78 billion by 2032.

Unleashing the Power of Mobile Messaging as a Strategic Cornerstone for Personalized, Secure, and Ubiquitous Business Communication Across All Channels

As the global population embraces mobile connectivity, over 6.2 billion smartphone users have come to rely on messaging platforms for critical alerts, one-time passwords, and dynamic promotions that populate everyday life. The near-universal reach of SMS, with open rates exceeding 98 percent, underscores the channel’s enduring effectiveness for time-sensitive communication in sectors ranging from banking to healthcare. Transitioning from person-to-person exchanges to application-to-person dialogues, businesses are integrating messaging into their customer engagement strategies to deliver personalized notifications, transactional verifications, and targeted marketing campaigns that drive real-time interactions without compromising security or compliance.

In the broader digital ecosystem, messaging services have evolved from simple text-based exchanges to rich, interactive experiences that leverage multimedia, interactive buttons, and encryption protocols. This transformation is fueled by increasing mobile penetration and enterprise demand for seamless, automated workflows. As organizations prioritize customer journey orchestration across channels, mobile messaging stands out as a versatile, cost-effective conduit for engagement, offering measurable performance metrics and near-instantaneous delivery. In this competitive landscape, understanding the foundational drivers, historical context, and emerging opportunities in mobile messaging is paramount for decision-makers seeking to harness its full strategic potential.

How Next Generation Networks, Rich Communication Services, AI Chatbots, and Omnichannel Integration Are Redefining Mobile Messaging Experiences

The deployment of next-generation networks has unlocked unprecedented capabilities for mobile messaging, enabling carriers to deliver high-bandwidth, low-latency services that support advanced features like immersive media and near-real-time interactivity. By mid-2025, 5G subscriptions are projected to surpass 2.9 billion globally, with 5G networks expected to handle 80 percent of mobile traffic by 2030, positioning enhanced messaging channels to capitalize on faster data transfer and network slicing for priority delivery of critical alerts. This infrastructural shift provides the foundation for the proliferation of rich communication formats that go beyond plain text.

Evaluating the Cumulative Impact of Rising United States Tariffs on Telecommunications Infrastructure, Service Costs, and Messaging Ecosystem Dynamics

In 2025, new tariff measures imposed by the United States government have introduced layered duties on imported telecom hardware, with levies on data center components, network switches, and smartphone modules reaching up to 145 percent for select Chinese-origin products. Corporate leaders across telecommunications and technology sectors have warned that these costs are increasingly passed through to consumers, eroding profit margins and prompting extended upgrade cycles for devices and infrastructure. Service providers face capex pressures as every dollar allocated to tariff-inflated equipment translates to less investment in network densification and rural broadband initiatives.

Wireless carriers and messaging API platforms are also absorbing cost increases for critical hardware and server infrastructure that underpin messaging gateways and cloud-based services. Some operators have sought to diversify supplier portfolios and negotiate domestic manufacturing partnerships to mitigate tariff impacts, yet a persistent 10 to 25 percent uplift in import costs continues to reverberate across service fees and implementation timelines. As a result, messaging solution providers are evaluating architectural shifts toward scalable microservices and containerized deployments that reduce hardware dependencies and preserve agility in a volatile trade policy environment.

Deconstructing Critical Market Segmentation to Reveal Insights into Messaging Types, Service Models, Deployment Modes, and Industry Applications

Segmenting the mobile messaging landscape by communication type reveals distinct pathways for business and personal interactions. The application-to-person (A2P) segment, encompassing promotional campaigns and transactional alerts, is differentiated from peer-to-peer (P2P) traffic, with enterprises tailoring content to marketing offers or time-sensitive one-time passwords. Understanding these nuances allows solution providers to optimize delivery protocols and security frameworks for each messaging category.

The diversity of service types-from legacy SMS and MMS to emerging Rich Communication Services and AI-powered chatbots-enables organizations to select the optimal channel for engagement, balancing cost structures with the need for multimedia elements and real-time interaction. Likewise, deployment models span cloud-based solutions in both private and public clouds, as well as on-premises architectures built on open-source or proprietary platforms, reflecting varying requirements for control, scalability, and compliance.

End-user segmentation further differentiates the value proposition for messaging services, as consumer-facing deployments emphasize seamless user experiences across digital touchpoints, whereas enterprise and SMB applications prioritize integration with CRM systems and operational workflows. Industry vertical focus drives tailored feature sets, with BFSI leveraging secure authentication, healthcare harnessing appointment reminders and medical alerts, and retail activating promotions across brick-and-mortar and e-commerce channels. Finally, application-specific use cases-ranging from customer care and emergency alerts to promotional broadcasts and transactional verifications-define messaging strategies that align with organizational objectives and compliance standards.

This comprehensive research report categorizes the Mobile Messaging Services market into clearly defined segments, providing a detailed analysis of emerging trends and precise revenue forecasts to support strategic decision-making.

- Messaging Type

- Service Type

- Deployment Mode

- End User

- End User

Uncovering Key Regional Dynamics Shaping Mobile Messaging Evolution Across the Americas, EMEA, and Asia Pacific Markets

In the Americas, advanced 5G and RCS adoption is propelled by widespread smartphone penetration and significant investment from leading carriers, positioning North America as a test bed for interactive messaging campaigns, AI-driven chatbots, and omnichannel orchestration that leverage existing SMS infrastructure as a reliable fallback. The region’s mature regulatory environment and high consumer expectations for security and personalization drive continuous innovation in business messaging solutions.

Europe, the Middle East, and Africa emphasize robust data privacy regulations, public sector communication services, and multilingual support across diverse markets, leading to growth in secure messaging for government alerts, healthcare notifications, and financial services. Compliance with GDPR and national data protection laws influences deployment choices, with enterprises favoring private cloud and on-premises models to maintain data sovereignty and meet stringent audit requirements.

Asia-Pacific exhibits the highest mobile user growth and rapid digital transformation, underpinned by a large Android base and high smartphone adoption rates. Messaging services in this region are integrating with super-apps and local chat platforms to deliver rich conversational experiences, while enterprises capitalize on cloud-native chatbots and AI-powered engagement tools to scale customer service. The region’s trajectory is accentuated by data indicating that Asia-Pacific accounts for the largest share of global A2P traffic, driven by its massive installed smartphone base.

This comprehensive research report examines key regions that drive the evolution of the Mobile Messaging Services market, offering deep insights into regional trends, growth factors, and industry developments that are influencing market performance.

- Americas

- Europe, Middle East & Africa

- Asia-Pacific

Profiling Market Leaders Driving Innovation in Mobile Messaging Through AI, RCS, Cloud Deployments, and Strategic Global Expansion

Market leaders are differentiating through strategic investments in interactive messaging capabilities and platform expansions. Infobip, Sinch, and Gupshup have prioritized Rich Communication Services business messaging, leveraging Omdia data to guide their roadmap for rich media features and conversational workflows. Gupshup’s recent $60 million financing underscores the momentum behind global expansion and AI-driven chatbot innovations that enhance campaign performance and streamline customer interactions.

Meanwhile, major social media and messaging platform owners, notably Meta’s WhatsApp Business, continue to integrate AI agents that deliver personalized experiences at scale. Meta’s increased capital allocation of over $64 billion to AI underscores the critical role of generative models and automated agents in future messaging ecosystems. These developments compel traditional telecom providers and CPaaS vendors to form strategic alliances, expand their API portfolios, and invest in unified messaging frameworks that support rapid channel expansion and advanced analytics capabilities.

This comprehensive research report delivers an in-depth overview of the principal market players in the Mobile Messaging Services market, evaluating their market share, strategic initiatives, and competitive positioning to illuminate the factors shaping the competitive landscape.

- BT GROUP PLC

- Cisco Systems, Inc.

- Flock FZ-LLC

- Google LLC

- International Business Machines Corporation

- Kakao Corp.

- KDDI Corporation

- LINE Corporation

- Mattermost, Inc.

- Meta Platforms, Inc.

- Microsoft Corporation

- Nokia Corporation

- Orange SA

- Rakuten Group, Inc.

- Reliance Industries Ltd.

- Rocket.Chat Technologies Corp.

- Ryver LLC

- Signal Messenger LLC

- SK Telecom Co., Ltd.

- Telefonaktiebolaget LM Ericsson

- Telegram Group Inc.

- Tencent Holdings Ltd.

- T‑Mobile USA, Inc.

- Verizon Communications, Inc.

- Viber Media S.a r.l.

- Vodafone Group PLC

- WeChat International Pte. Ltd.

- WhatsApp LLC by Meta Platforms, Inc.

Actionable Strategies for Industry Leaders to Navigate Technological Disruption, Regulatory Challenges, and Competitive Differentiation in Messaging

To secure competitive advantage, industry leaders must prioritize the integration of Rich Communication Services across core messaging platforms, ensuring seamless compatibility with fallback SMS channels. Investing in AI-powered chatbots that automate routine inquiries and gather real-time customer insights will enhance operational efficiency and elevate user satisfaction. Given the material impact of import tariffs on hardware costs, organizations should explore diversified supply chains and cloud-native architectures that reduce reliance on physical infrastructure.

Transparent Research Methodology Underpinning Comprehensive Analysis of Mobile Messaging Market Trends, Drivers, and Segmentation Frameworks

This analysis is founded on a thorough research methodology that combines primary interviews with industry executives, in-depth surveys of end-users across targeted verticals, and expert consultations to validate emerging trends. Secondary research encompassed a comprehensive review of credible sources including regulatory filings, technology whitepapers, and standard-setting organization reports. Data triangulation techniques ensured consistency by cross-referencing multiple independent datasets, while qualitative insights from focus groups enriched quantitative findings. Continuous peer review and iterative validation were employed to maintain analytical rigor and objectivity.

This section provides a structured overview of the report, outlining key chapters and topics covered for easy reference in our Mobile Messaging Services market comprehensive research report.

- Preface

- Research Methodology

- Executive Summary

- Market Overview

- Market Insights

- Cumulative Impact of United States Tariffs 2025

- Cumulative Impact of Artificial Intelligence 2025

- Mobile Messaging Services Market, by Messaging Type

- Mobile Messaging Services Market, by Service Type

- Mobile Messaging Services Market, by Deployment Mode

- Mobile Messaging Services Market, by End User

- Mobile Messaging Services Market, by End User

- Mobile Messaging Services Market, by Region

- Mobile Messaging Services Market, by Group

- Mobile Messaging Services Market, by Country

- United States Mobile Messaging Services Market

- China Mobile Messaging Services Market

- Competitive Landscape

- List of Figures [Total: 17]

- List of Tables [Total: 2226 ]

Synthesizing Core Insights and Strategic Imperatives That Define the Future Trajectory of Mobile Messaging Services and Business Communications

The mobile messaging landscape is undergoing a profound transformation driven by next-generation networks, evolving communication standards, and artificial intelligence innovations. Stakeholders who harness the power of Rich Communication Services, omnichannel integration, and cloud-native deployment will unlock new dimensions of customer engagement. Conversely, those who fail to adapt may cede market share to nimble competitors that leverage data-driven insights and scalable architectures. As the industry navigates tariff pressures and regulatory complexities, strategic agility and collaborative partnerships will prove essential for sustained growth and differentiation.

Seize the Opportunity to Acquire the Definitive Mobile Messaging Market Research Report by Connecting with Ketan Rohom for Purchase Details

For personalized assistance with purchasing this in-depth market research report, please reach out to Ketan Rohom, Associate Director of Sales & Marketing. He can provide tailored guidance on accessing the comprehensive analysis of message type dynamics, service innovations, tariff impacts, and regional strategies that will empower your organization’s strategic planning and execution.

- How big is the Mobile Messaging Services Market?

- What is the Mobile Messaging Services Market growth?

- When do I get the report?

- In what format does this report get delivered to me?

- How long has 360iResearch been around?

- What if I have a question about your reports?

- Can I share this report with my team?

- Can I use your research in my presentation?