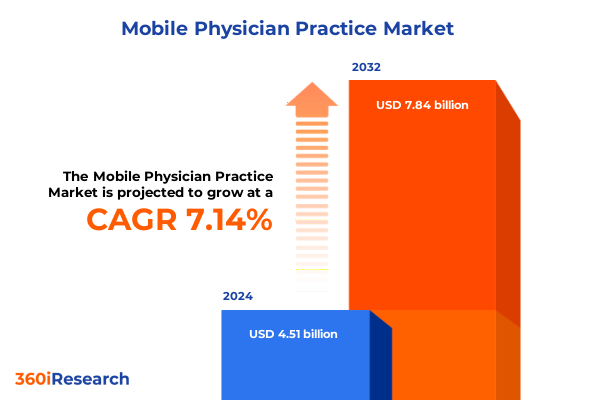

The Mobile Physician Practice Market size was estimated at USD 4.84 billion in 2025 and expected to reach USD 5.20 billion in 2026, at a CAGR of 7.13% to reach USD 7.84 billion by 2032.

Unveiling the Evolution of Physician Care Delivery Through Mobile and Digital Innovations That Are Redefining Patient Engagement

Mobile physician practice represents a paradigm shift in care delivery, leveraging portability and digital connectivity to meet patients where they are. Physicians equipped with mobile clinics and connected platforms can deliver personalized consultations, diagnostics, and follow-up services outside traditional brick-and-mortar settings. This evolution bridges the gap between patient-centric expectations and the constraints of conventional practice models.

The convergence of telehealth technologies, remote monitoring, and on-the-go clinical capabilities has been fueled by consumer demands for convenience and timely access to care. As patients increasingly prioritize flexibility, mobile practitioners adapt by integrating app-based scheduling, electronic health record interoperability, and virtual follow-ups to maintain continuity. Consequently, this hybrid model not only enhances patient satisfaction but also supports preventive and chronic disease management in community and home environments.

Furthermore, regulatory and reimbursement frameworks have begun to accommodate mobile physician services, recognizing their potential to reduce system-level costs and alleviate the burden on emergency departments. By aligning policy incentives with technological readiness, healthcare stakeholders are fostering environments in which mobile and digital-first care models can thrive. This introduction sets the stage for a comprehensive examination of the forces reshaping physician practice in 2025 and beyond.

Exploring the Transformative Forces Shaping Mobile Physician Practice Across Technology Advances Policy Overhauls and Consumer Expectations

The landscape of mobile physician practice is being transformed by an unprecedented acceleration in digital health adoption. Developments in cloud computing, mobile applications, and secure data exchange platforms are enabling physicians to conduct virtual consultations, share real-time diagnostic information, and manage electronic health records remotely. As a result, the speed and efficiency of care delivery have improved markedly, empowering practitioners to respond dynamically to patient needs outside the confines of traditional clinics.

Concurrently, shifts in consumer behavior are driving a new era of healthcare personalization. Patients now expect seamless, on-demand access to medical advice and services, mirroring experiences in other industries. In response, providers are embracing user-friendly interfaces and patient engagement tools that simplify appointment booking, symptom tracking, and follow-up communications. This consumer-centric focus not only fosters stronger provider–patient relationships but also supports proactive management of health outcomes through timely interventions.

Policy and regulatory overhauls have further accelerated this transformation. Recent updates to reimbursement codes and licensure flexibilities have legitimized cross-state telemedicine and mobile clinic operations, reducing administrative barriers. Industry collaboration on interoperability standards is also enhancing data fluidity across platforms, ensuring that patient records, imaging results, and prescription histories travel securely with the individual. These combined shifts are reshaping the contours of physician practice, forging a new framework for accessible, scalable care.

Analyzing the Wide-Ranging Impact of Recent U.S. Tariff Measures on Medical Devices Remote Monitoring and Telehealth Infrastructure in 2025

New U.S. tariffs announced in April 2025 impose a baseline 10% import tax on a broad range of goods, including critical medical equipment and digital health components, with elevated duties for products originating from specific trading partners. These measures have introduced pricing volatility and supply chain complexity for mobile physician practices that depend on unobstructed access to remote monitoring kits, wearable devices, and telehealth-enabled hardware.

Leading medical technology manufacturers such as Siemens Healthineers have reported truncated sales forecasts and delayed procurement by hospital administrators due to proposed duties as high as 50% on high-tech imaging equipment, including photon-counting CT scanners that support advanced diagnostics in mobile settings.

Industry trade associations including AdvaMed and the American Hospital Association warn that elevated duties on devices and remote monitoring kits will strain provider margins and may reduce patient access to advanced care, particularly for smaller clinics unable to absorb one-time pricing adjustments. This dynamic underscores the need for strategic sourcing and potential advocacy for medical device tariff exemptions to preserve both innovation and affordability in mobile healthcare delivery.

Insights Derived From Service Type End User and Technology Platform Segmentation Revealing Nuanced Demand Drivers and Care Delivery Models

The mobile physician practice market reveals distinct demand patterns when dissected by service type. Chronic disease management services are increasingly delivered through mobile units equipped with portable diagnostic tools, facilitating regular monitoring of conditions such as diabetes and hypertension. Preventive care programs leverage mobile capabilities to run community screening events, expanding early detection initiatives. Meanwhile, primary care offerings on wheels focus on routine checkups and vaccinations, complementing emergency department diversion efforts. Specialty care deployments, from dermatology to cardiology, utilize targeted mobile equipment to reach underserved areas. Urgent care responses rely on rapid-deployment mobile teams, enabling immediate treatment for minor injuries and acute illnesses without the overhead of traditional urgent care centers.

End user segmentation further highlights the versatility of mobile physician practice. Corporate clients engage mobile services to deliver on-site occupational health assessments and wellness programs, reducing employee downtime. Event services bring medical support directly to conferences, sporting events, and large gatherings, ensuring real-time care readiness. Individual patients benefit from home-based consultations and follow-up visits, particularly in rural or mobility-challenged populations, where convenience and continuity are critical. Long term care facilities contract mobile practitioners to conduct regular health assessments, minimizing resident transfers and enhancing in-place care.

Technology platform segmentation underscores the layered complexity of delivering mobile physician practice. EHR integration, encompassing interoperability and deeper EMR integration, ensures that patient records follow the caregiver seamlessly across locations. Mobile app scheduling streamlines appointment coordination and triage prioritization. Remote monitoring tools, from home monitoring kits to wearable devices, provide continuous data streams that inform proactive interventions. Telehealth integration, spanning audio, chat, and video consultations, extends the reach of clinicians, enabling immediate virtual follow-up and triage, even after on-site mobile visits. Together, these technological pillars support scalable and adaptive care models.

This comprehensive research report categorizes the Mobile Physician Practice market into clearly defined segments, providing a detailed analysis of emerging trends and precise revenue forecasts to support strategic decision-making.

- Service Type

- Technology Platform

- End User

Uncovering Regional Variations in Mobile Physician Practice Adoption Patterns and Infrastructure Readiness Across Key Global Markets

In the Americas, mobile physician practice has matured rapidly, driven by expansive rural geographies and urban underserved communities. Providers are integrating mobile units with telehealth platforms to address care deserts across Canada, the United States, Mexico, and Latin American markets. Mobile clinics support community health initiatives, and partnerships with public health departments facilitate vaccination drives and chronic disease screenings in remote areas.

Europe, the Middle East, and Africa present a diverse set of regulatory environments and infrastructure readiness. In Western Europe, established reimbursement frameworks for telemedicine complement well-developed transportation networks, enabling efficient mobile unit deployment. In contrast, emerging markets in the Middle East and Africa leverage mobile practice to overcome supply chain limitations and facility shortages. Public–private collaborations are essential, with NGOs and government agencies often sponsoring mobile medical caravans to serve refugee and rural populations where healthcare facilities are sparse.

The Asia-Pacific region showcases significant innovation in digital-first care models. High smartphone penetration and robust mobile networks in countries such as Japan, South Korea, and Australia facilitate seamless telehealth integration with on-the-ground mobile services. In Southeast Asia and parts of South Asia, mobile physician practice bridges gaps in regions with fragmented healthcare infrastructure. Providers are experimenting with pill dispensers integrated into mobile vans and leveraging local community health workers supported by remote physician oversight to maximize reach.

This comprehensive research report examines key regions that drive the evolution of the Mobile Physician Practice market, offering deep insights into regional trends, growth factors, and industry developments that are influencing market performance.

- Americas

- Europe, Middle East & Africa

- Asia-Pacific

Examining Leading Mobile Physician Practice Companies and Strategic Partnerships Driving Innovation and Market Expansion in Digital Healthcare Delivery

Leading companies in the mobile physician practice arena are defining strategic benchmarks through technology partnerships and service innovation. Telehealth pioneers are deepening integrations with home healthcare providers and remote monitoring vendors to create end-to-end patient management ecosystems. Some organizations are investing in modular mobile clinics that can be rapidly reconfigured for primary care, urgent care, or specialty services, optimizing capital utilization across diverse geographies.

Strategic alliances between digital health startups and established medical device manufacturers are also shaping market dynamics. These collaborations enable seamless deployment of advanced diagnostic tools within mobile units, while software platforms provide robust analytics and patient engagement interfaces. Companies that offer bundled solutions-combining hardware, software, and service delivery-are attracting attention from health systems seeking turnkey models to expand outreach.

Innovation extends beyond technology, as some market leaders adopt subscription-based service tiers for corporate clients and event organizers. This model ensures predictable revenue streams while delivering on-demand access to physician services. Furthermore, venture-backed entities are exploring AI-assisted triage capabilities within mobile workflows, enhancing efficiency and supporting clinicians with real-time decision support. The convergence of these strategies underscores a competitive landscape driven by agility and customer-centric offerings.

This comprehensive research report delivers an in-depth overview of the principal market players in the Mobile Physician Practice market, evaluating their market share, strategic initiatives, and competitive positioning to illuminate the factors shaping the competitive landscape.

- Amwell Medical Group, Inc.

- ChenMed, LLC

- DispatchHealth Holdings, Inc.

- Doctor On Demand, Inc.

- Heal, Inc.

- HealthTap, Inc.

- Landmark Health, LLC

- MDLIVE, Inc.

- MedZed, Inc.

- Oak Street Health, Inc.

- PlushCare, Inc.

- Ready Responders, Inc.

- Teladoc Health, Inc.

Actionable Recommendations for Industry Leaders to Capitalize on Growth Opportunities and Navigate Operational Challenges in Mobile Physician Practice

Providers seeking to thrive in the evolving mobile physician practice sector should prioritize investments in interoperable technology platforms that facilitate seamless data exchange across care settings. By aligning with industry standards and adopting scalable cloud-based solutions, organizations can minimize integration costs and accelerate service deployment across multiple locations.

Operational resilience depends on diversified supply chain strategies that address tariff-related risks and ensure timely access to critical equipment. Collaborating with domestic manufacturers or leveraging flexible procurement agreements can mitigate the impact of import duties on medical devices and remote monitoring tools. Additionally, engaging policymakers and industry associations in advocacy efforts may yield tariff exemptions for essential healthcare goods.

To enhance patient engagement, industry leaders should implement hybrid care models that blend in-person mobile visits with virtual follow-ups. Training clinicians on digital communication best practices and developing patient education materials will support adherence and satisfaction. Executives should also explore value-based partnerships with payers, demonstrating how mobile physician practice can improve outcomes and reduce total cost of care by preventing hospital readmissions and unnecessary emergency visits.

Detailing the Rigorous Research Methodology Employed to Ensure Robust Data Collection Analysis and Validation for Mobile Physician Practice Insights

This research employs a mixed-methods approach, combining secondary data analysis with primary interviews and qualitative field observations. Secondary sources include peer-reviewed journals, government publications, and industry reports to establish a contextual baseline and identify macro-level trends.

Primary research involved structured interviews with C-suite executives, clinical leaders, and technology partners across North America, Europe, the Middle East, Africa, and Asia-Pacific. These conversations yielded insights into operational challenges, technology adoption rates, and regulatory dynamics. Observational studies of mobile clinic deployments and telehealth operations supplemented interview data, providing real-world validation of best practices.

Quantitative surveys administered to mobile practice providers and end users captured service utilization patterns and technology preferences. Collected data underwent rigorous statistical analysis, with outliers and inconsistencies addressed through cross-validation. An iterative validation process included expert reviews and stakeholder feedback sessions, ensuring that findings accurately reflect current market conditions and inform actionable strategic guidance.

This section provides a structured overview of the report, outlining key chapters and topics covered for easy reference in our Mobile Physician Practice market comprehensive research report.

- Preface

- Research Methodology

- Executive Summary

- Market Overview

- Market Insights

- Cumulative Impact of United States Tariffs 2025

- Cumulative Impact of Artificial Intelligence 2025

- Mobile Physician Practice Market, by Service Type

- Mobile Physician Practice Market, by Technology Platform

- Mobile Physician Practice Market, by End User

- Mobile Physician Practice Market, by Region

- Mobile Physician Practice Market, by Group

- Mobile Physician Practice Market, by Country

- United States Mobile Physician Practice Market

- China Mobile Physician Practice Market

- Competitive Landscape

- List of Figures [Total: 15]

- List of Tables [Total: 1113 ]

Concluding Perspectives on the Future Trajectory of Mobile Physician Practice and Its Implications for Healthcare Delivery Models and Patient Outcomes

As healthcare systems worldwide grapple with rising demand and resource constraints, mobile physician practice emerges as a vital complement to traditional care models. Its agility in reaching diverse patient populations, coupled with digital integration, positions it as a scalable solution for preventive, chronic, and acute care alike. The confluence of technology, policy support, and shifting patient expectations heralds a new chapter in healthcare delivery.

Challenges remain, including regulatory heterogeneity, reimbursement complexities, and operational logistics. Nonetheless, the demonstrated successes of mobile and telehealth initiatives underscore the potential for broader adoption. Providers that balance innovation with strategic partnerships and advocacy will be best positioned to navigate evolving landscapes and deliver high-quality, cost-effective care.

Looking forward, the mobile physician practice model is set to expand through AI-driven workflows, advanced remote monitoring, and deeper ecosystem collaborations. Stakeholders across the continuum must collaborate to address interoperability, standardization, and equitable access, ensuring that the full promise of mobile care can be realized for all communities.

Engage With Ketan Rohom to Unlock Comprehensive Mobile Physician Practice Research Insights and Propel Strategic Decision-Making in Healthcare Organizations

For a deeper understanding of mobile physician practice trends and to discuss tailored solutions for your organization, reach out to Ketan Rohom, Associate Director, Sales & Marketing. Collaborating with Ketan will grant you exclusive access to comprehensive research insights, enhancing your strategic decision-making.

Secure your competitive edge by leveraging this in-depth market intelligence. Contact Ketan Rohom today to explore customization options, volume licensing, and early access provisions that align with your operational goals and drive sustainable growth in mobile healthcare delivery.

- How big is the Mobile Physician Practice Market?

- What is the Mobile Physician Practice Market growth?

- When do I get the report?

- In what format does this report get delivered to me?

- How long has 360iResearch been around?

- What if I have a question about your reports?

- Can I share this report with my team?

- Can I use your research in my presentation?