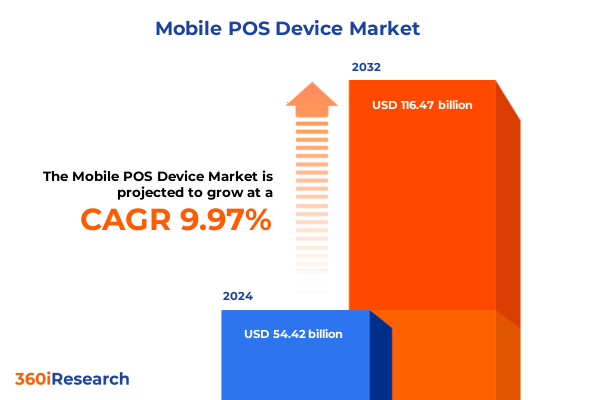

The Mobile POS Device Market size was estimated at USD 59.57 billion in 2025 and expected to reach USD 65.21 billion in 2026, at a CAGR of 10.05% to reach USD 116.47 billion by 2032.

Unveiling the Mobile POS Revolution Transforming Retail Payments and Operational Efficiency with Seamless Connectivity and Real-Time Data Insights

The mobile point-of-sale landscape has undergone an extraordinary evolution, transitioning from bulky terminals tethered to cash registers into agile, software-driven devices that facilitate seamless transactions anywhere commerce occurs. As digital payment preferences amplify, businesses have embraced mobile POS solutions to deliver frictionless customer experiences and unlock operational efficiencies. Over the last decade, mobile POS devices have advanced to incorporate cutting-edge connectivity options, robust encryption protocols, and intuitive interfaces that empower merchants, from small retailers to global enterprises.

Moreover, the convergence of hardware miniaturization and cloud-native architectures has accelerated deployment cycles, enabling stakeholders to integrate payment platforms with back-end analytics and inventory systems in real time. This integration has fostered accelerated checkout processes, improved fraud prevention, and richer customer engagement through loyalty program integration. Looking ahead, emerging technologies such as biometric authentication, edge computing, and artificial intelligence-powered analytics are poised to redefine the scope and scale of mobile POS capabilities, setting new benchmarks for adaptability, security, and user experience.

Navigating the Transformative Shifts Driving Mobile POS Adoption Fueled by Contactless Payment Trends and Emerging Connectivity Paradigms

The mobile POS industry is being reshaped by powerful market forces that reflect broader shifts in consumer behavior, regulatory landscapes, and technological innovation. Contactless payments have surged, driven by consumer demand for hygienic, touch-free checkouts and the ubiquity of NFC-enabled smartphones and wearables. As a result, hardware providers are prioritizing MST- and NFC-enabled contactless readers, investing heavily in secure element integration to ensure compliance with evolving EMVCo specifications.

Simultaneously, end users are demanding enhanced functionality beyond simple payment acceptance. Features such as integrated inventory management, customer relationship management, and modular accessories for on-the-go service are forging new value propositions. Connectivity standards themselves are evolving: 5G networks promise ultra-low latency and ubiquitous coverage, while Wi-Fi 6 (802.11ax) offers increased throughput in high-density retail environments. These developments are complemented by emerging software solutions that leverage cloud platforms and SDKs, enabling rapid customization and seamless upgrades. Together, these transformative shifts are redefining competitive parameters and setting the stage for a new era of mobile commerce resilience and agility.

Assessing the Cumulative Impact of 2025 United States Tariffs on Mobile POS Device Supply Chains and Cost Structures

In 2025, the United States government implemented a series of tariff measures encompassing a broad range of electronic components critical to mobile POS production. These measures were aimed at bolstering domestic manufacturing and addressing trade imbalances but have led to cascading effects throughout the global supply chain. Manufacturers now face elevated input costs for key hardware elements, including secure elements, touchscreens, and wireless modules, prompting reevaluations of sourcing strategies.

The tariff burden has been partially absorbed through leaner manufacturing practices and near-shoring initiatives, yet many vendors have had to adjust pricing models to maintain margin targets. This volatility in component costs has also spurred accelerated innovation in alternative materials and streamlined assembly processes. Meanwhile, channel partners and distributors have had to recalibrate expectations for lead times and revise inventory management protocols to buffer against supply disruptions. As the industry adapts to these regulatory shifts, stakeholders are emphasizing strategic supplier diversification and proactive compliance management to mitigate future tariff impacts.

Revealing Key Segmentation Insights Across Payment Types End Users Connectivity and Deployment Scenarios Driving Market Differentiation

A nuanced understanding of market segmentation reveals the diverse pathways through which mobile POS solutions are optimized for distinct environments. Payment type segmentation distinguishes contactless readers that leverage MST and NFC from EMV devices supporting Chip and PIN as well as Chip and Signature verification modes. Magnetic stripe readers and QR-code-enabled systems further complement this landscape, offering compatibility with legacy and smartphone-based payment methods alike.

End users are similarly varied, encompassing healthcare settings-from clinics and hospitals to pharmacy points of sale-where rapid, secure transactions are vital to patient throughput. Hospitality businesses deploy mobile POS in entertainment venues, hotel front desks, and full-service restaurants to streamline order taking and guest check-out. Retailers ranging from apparel boutiques and electronics outlets to grocery stores harness integrated POS devices for inventory visibility and promotional capabilities. Transportation services include public transit fare collection, ride-hailing platforms, and taxi operators that rely on mobile terminals for on-demand fare processing.

Connectivity options further refine device applicability. Bluetooth solutions, whether Classic or Low Energy, enable seamless pairing with tablets and smartphones for pop-up shops and off-site events. Cellular connectivity spanning 2G/3G networks to advanced 4G and 5G services ensures ubiquitous coverage for mobile merchants. Wi-Fi standards-including 802.11ac, ax, and n-address in-store environments that demand high-throughput and secure network segmentation.

Deployment modalities range from in-store countertop terminals to self-checkout kiosks, each optimized for high-volume environments or unattended transaction flows. On-the-go merchants utilize handheld POS terminals and bespoke mobile accessories for sale at festivals and food trucks. Meanwhile, self-service points-such as standalone kiosks and vending machines-employ integrated POS modules to maximize uptime and support contactless fare collection.

This comprehensive research report categorizes the Mobile POS Device market into clearly defined segments, providing a detailed analysis of emerging trends and precise revenue forecasts to support strategic decision-making.

- Payment Type

- Connectivity

- Deployment

- End User

Highlighting Regional Dynamics and Growth Drivers in the Americas Europe Middle East Africa and Asia-Pacific for Mobile POS Deployment

Regional markets exhibit distinctive dynamics influenced by economic maturity, infrastructure readiness, and regulatory frameworks. In the Americas, established retail and hospitality sectors demonstrate rapid uptake of contactless and QR-code payments, supported by extensive 4G/5G rollouts and robust point-of-sale ecosystems. North American merchants benefit from favorable interoperability standards and strong consumer trust in digital payments, driving demand for sophisticated feature sets and deep analytics integrations. Latin American markets, by contrast, are characterized by mobile-first strategies that leverage widespread smartphone penetration to leapfrog legacy infrastructure.

The Europe, Middle East & Africa region presents a tapestry of regulatory regimes and technological adoption rates. Western Europe continues to lead in EMV compliance and contactless maturity, underpinned by unified standards and progressive PSD2 regulations that foster open banking integrations. In the Middle East, digital transformation initiatives and government-backed fintech incubators have accelerated mobile POS deployment, particularly within hospitality and retail segments. African markets are witnessing grassroots innovation, where local POS providers integrate mobile money platforms with affordable hardware to address underbanked populations.

Asia-Pacific remains one of the most dynamic arenas, propelled by high smartphone penetration, digitally savvy consumers, and supportive government policies. Markets such as China and India are pioneering QR-code and super-app ecosystems, while Southeast Asian countries showcase rapid adoption of e-wallets and NFC payments. In-store implementations, on-the-go solutions, and self-service kiosks are all being deployed at scale, reflecting the region’s appetite for seamless omnichannel experiences and operational automation.

This comprehensive research report examines key regions that drive the evolution of the Mobile POS Device market, offering deep insights into regional trends, growth factors, and industry developments that are influencing market performance.

- Americas

- Europe, Middle East & Africa

- Asia-Pacific

Uncovering Strategic Moves and Innovation Portfolios of Leading Companies Showcasing Partnerships Product Launches and R&D Initiatives

Industry leaders have demonstrated varied approaches to securing their competitive positions within the mobile POS domain. Some have pursued strategic acquisitions to augment portfolio depth and extend geographic reach, while others focus on organic innovation through robust research and development investments. Collaboration with telecom operators and cloud-service providers has become a common strategy, enabling seamless device provisioning and management across global networks.

Leading hardware manufacturers differentiate through modular architectures that allow merchants to tailor accessories and software integrations to their specific operational needs. Meanwhile, software-centric companies emphasize open SDKs and API frameworks to facilitate rapid third-party application development. Partnerships between software vendors and fintech startups have given rise to value-added services-ranging from loyalty program management to embedded lending solutions-that further enrich the mobile POS value proposition.

Furthermore, several top-tier players have established regional innovation hubs to accelerate localization of features such as multi-currency acceptance, tax compliance, and language support. Joint ventures with financial institutions have also enabled the deployment of white-label POS solutions, expanding reach into underserved verticals such as healthcare and public transportation. Across the board, leadership in this space is defined by the ability to balance hardware reliability, software agility, and tailored service models.

This comprehensive research report delivers an in-depth overview of the principal market players in the Mobile POS Device market, evaluating their market share, strategic initiatives, and competitive positioning to illuminate the factors shaping the competitive landscape.

- Fiserv, Inc.

- Hewlett Packard Enterprise Development LP

- Ingenico

- NEC Corporation

- Oracle

- Panasonic Holdings Corporation

- PAX Technology

- Posiflex Technology, Inc.

- QVS Software

- SAMSUNG

- SPECTRA Technologies

- TOSHIBA CORPORATION

- Zebra Technologies Corp.

Crafting Actionable Recommendations for Industry Leaders to Optimize Mobile POS Strategies and Enhance Operational Resilience in Evolving Markets

Industry leaders should prioritize the development of unified hardware-software ecosystems that minimize integration friction and offer modular scalability. By embedding comprehensive SDKs and embracing microservices architectures, vendors can enable third-party developers to extend core capabilities with vertical-specific modules, enhancing both flexibility and speed to market. This approach will help organizations swiftly adapt to evolving consumer expectations and regulatory mandates.

Additionally, enterprises should invest in advanced analytics solutions that harness transaction data for actionable customer insights. By deploying real-time dashboards and predictive algorithms, merchants can optimize inventory levels, personalize marketing campaigns, and identify emerging operational bottlenecks. Such data-driven initiatives will drive incremental revenue opportunities and bolster long-term loyalty.

From a supply chain perspective, decision-makers must diversify component sourcing and pursue near-shoring partnerships to mitigate the impact of tariff volatility. Building strategic alliances with regional component manufacturers and contract assemblers can provide agility in managing cost fluctuations. Lastly, stakeholders should engage proactively with standards bodies and regulatory authorities to influence policy development, ensuring that future requirements align with practical deployment realities.

Illuminating the Comprehensive Research Methodology Harnessing Qualitative and Quantitative Approaches Ensuring Robust Mobile POS Market Insights

The research methodology underpinning this report combines rigorous primary and secondary research to ensure comprehensive coverage and depth of insight. Primary data collection entailed structured interviews with key executives, solution architects, and channel partners across multiple geographies. These interviews were augmented by targeted surveys that captured real-world adoption patterns, feature preferences, and deployment challenges from end-user organizations.

Secondary research involved in-depth analysis of industry publications, white papers from standards bodies, and regulatory filings. Proprietary databases provided historical context for tariff developments and patent activity tracking, while global news sources and technology blogs offered contemporaneous commentary on emerging trends. Data triangulation techniques were employed to validate insights, cross-referencing responses from primary interviews against secondary sources to ensure accuracy and reliability.

Furthermore, expert panel reviews were conducted to test preliminary findings and refine strategic frameworks. Analysts synthesized quantitative data with qualitative inputs to construct a multidimensional view of the mobile POS ecosystem. This robust approach has yielded a balanced perspective on technological, economic, and regulatory factors shaping market dynamics.

This section provides a structured overview of the report, outlining key chapters and topics covered for easy reference in our Mobile POS Device market comprehensive research report.

- Preface

- Research Methodology

- Executive Summary

- Market Overview

- Market Insights

- Cumulative Impact of United States Tariffs 2025

- Cumulative Impact of Artificial Intelligence 2025

- Mobile POS Device Market, by Payment Type

- Mobile POS Device Market, by Connectivity

- Mobile POS Device Market, by Deployment

- Mobile POS Device Market, by End User

- Mobile POS Device Market, by Region

- Mobile POS Device Market, by Group

- Mobile POS Device Market, by Country

- United States Mobile POS Device Market

- China Mobile POS Device Market

- Competitive Landscape

- List of Figures [Total: 16]

- List of Tables [Total: 2703 ]

Concluding Perspectives Emphasizing the Strategic Imperatives and Future Trajectories of Mobile POS Innovations Empowering Business Transformation

In conclusion, the mobile POS landscape is entering a pivotal phase marked by heightened connectivity options, escalating security standards, and evolving consumer expectations. Contactless and QR-code payments have transcended niche use cases to become foundational components of omnichannel commerce, while tariff pressures continue to compel stakeholders toward supply chain diversification and innovation.

Organizations that embrace integrated hardware-software platforms, leverage data analytics, and cultivate strategic partnerships will be best positioned to capture value in a rapidly shifting environment. Regional dynamics underscore the importance of localized strategies-from the mobile-first markets of Latin America to the QR-code dominance in Asia-Pacific and the regulatory sophistication of Europe, Middle East & Africa. Through a disciplined focus on modular architectures, open ecosystems, and proactive policy engagement, mobile POS solution providers can deliver the seamless, secure, and scalable experiences that modern businesses demand.

Ultimately, success in this arena will hinge on adaptive strategies that reconcile global trends with nuanced local requirements. Stakeholders who align technological innovation with operational agility will drive both customer satisfaction and sustainable growth.

Secure Your Comprehensive Mobile POS Market Research Report with Expert Guidance to Drive Strategic Growth and Outpace Competitive Challenges

Ready to elevate your business with unparalleled insights into the mobile POS ecosystem, engage directly with Ketan Rohom (Associate Director, Sales & Marketing) to secure the full market research report. Through this collaboration, your organization gains exclusive access to comprehensive analyses, in-depth segmentation breakdowns, and strategic frameworks tailored for immediate application. The report’s granular exploration of payment technology advancements, regulatory dynamics, and industry best practices will empower you to craft data-driven roadmaps, optimize vendor partnerships, and refine go-to-market strategies.

By reaching out to Ketan Rohom, you will benefit from personalized guidance on report utilization, including interactive consultations that align the findings with your strategic priorities. Accelerate your decision-making process, mitigate risk, and capitalize on emerging trends by acquiring actionable intelligence that competitive leaders rely upon. Don’t let shifting market forces and tariff uncertainties impede your progress. Connect with Ketan to obtain your copy today, and position your organization at the forefront of mobile POS innovation, ensuring sustained growth and resilience in an ever-evolving commerce landscape.

- How big is the Mobile POS Device Market?

- What is the Mobile POS Device Market growth?

- When do I get the report?

- In what format does this report get delivered to me?

- How long has 360iResearch been around?

- What if I have a question about your reports?

- Can I share this report with my team?

- Can I use your research in my presentation?