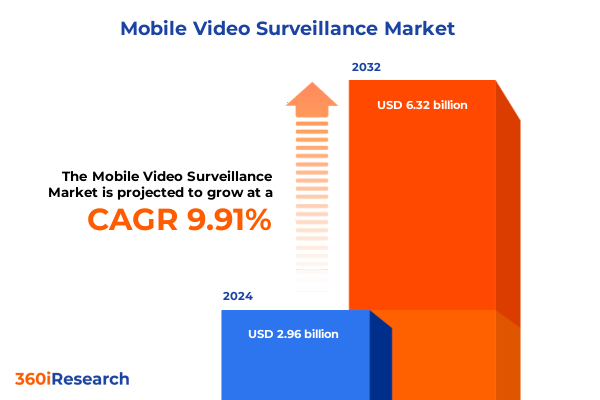

The Mobile Video Surveillance Market size was estimated at USD 3.26 billion in 2025 and expected to reach USD 3.55 billion in 2026, at a CAGR of 9.91% to reach USD 6.32 billion by 2032.

Unveiling the Critical Role of Mobile Video Surveillance in Securing Modern Environments and Empowering Stakeholders through Real-Time Insights

The mobile video surveillance market has evolved into a strategic cornerstone for organizations seeking real-time visibility and enhanced security across distributed environments. As smartphone proliferation, ubiquitous wireless connectivity, and advancements in video analytics converge, stakeholders are increasingly relying on mobile-enabled camera systems to deliver continuous monitoring, rapid incident response, and predictive insights. This executive summary delves into the fundamental drivers, structural shifts, and strategic imperatives shaping the modern mobile video surveillance landscape.

In today’s data-driven ecosystem, decision-makers in commercial, government, industrial, residential, and transportation sectors demand solutions that seamlessly integrate hardware, software, and services. Mobile video surveillance is no longer a standalone offering; it functions as an integrated platform underpinned by cloud software, on-premises video management systems, and edge analytics algorithms. This introduction sets the stage for an in-depth exploration of transformational trends, tariff-related headwinds, nuanced segmentations, regional dynamics, and vendor strategies that are guiding investments and innovations within the mobile video surveillance domain.

Identifying the Radical Transformations Driving Mobile Video Surveillance Adoption Across Hardware, Cloud, and AI-Driven Analytics Technologies

The mobile video surveillance landscape is witnessing transformative shifts driven by the convergence of edge computing, artificial intelligence, and 5G connectivity. Edge analytics has migrated processing closer to cameras, enabling ultra-low-latency event detection even in bandwidth-constrained areas, which in turn accelerates incident response and minimizes network traffic. Simultaneously, deep learning–based video analytics for facial recognition, object detection, and people counting are delivering unprecedented accuracy, automating threat identification without manual intervention.

Moreover, the rapid rollout of 5G infrastructure has unlocked new possibilities for wireless deployments, facilitating high-definition live monitoring and remote access straight from mobile applications. Service models have also evolved: consulting and installation services are now complemented by subscription-based maintenance and cloud software licensing, reflecting a shift toward recurring revenue. Underpinning these technological and business-model evolutions, strategic partnerships between networking equipment providers, cloud platform operators, and AI vendors are fostering integrated solutions that can scale horizontally across end users from hospitality facilities to smart city initiatives.

Analyzing the Ripple Effects of 2025 United States Tariff Policies on Mobile Video Surveillance Supply Chains, Cost Structures, and Market Dynamics

In 2025, the United States implemented incremental tariffs on imported video surveillance components-ranging from camera modules to storage arrays-prompting a ripple effect across the value chain. Hardware manufacturers dependent on international suppliers for bullet, PTZ, and dome camera optics have faced elevated input costs. As a result, many providers have reconfigured sourcing strategies, balancing domestic production with nearshoring initiatives to mitigate tariff impacts and ensure supply continuity.

This cost pressure has not only influenced price negotiations but also accelerated the migration toward software-centric service models. With hardware margins under strain, vendors are increasingly monetizing cloud software subscriptions and premium video analytics packages. In parallel, integrators and end users are reevaluating total cost of ownership, prioritizing systems optimized for on-premises processing or hybrid deployments to control recurring cloud expenses. Collectively, these dynamics underscore how tariff policies are reshaping strategic priorities, compelling stakeholders to innovate in procurement, design architectures, and commercial offerings.

Deep-Diving into Core Mobile Video Surveillance Market Segments Spanning Components, End Users, Deployment Modes, and Connectivity Paradigms

A nuanced understanding of mobile video surveillance market segments is crucial for tailoring product roadmaps and go-to-market strategies. When dissecting the market by component, one observes that hardware-spanning camera devices such as bullet, dome, PTZ, and turret models alongside networking equipment, recorders, and storage systems-serves as the foundational infrastructure. Network reliability depends on routers and switches, while digital video recorders and network video recorders handle the ingestion of continuous video streams. On the back end, NAS and SAN storage solutions are increasingly paired with cloud software for scalable archiving and retrieval, and video management systems orchestrate device interoperability.

Shifting our perspective to end users, verticals from hospitality and retail in the commercial arena to defense and smart city projects in the government sector are driving unique requirements. Industrial environments in manufacturing and oil and gas demand ruggedized installations, whereas multi-family and single-family residential deployments focus on ease of installation and user-friendly mobile access. Airports and railways prioritizing high-resolution continuous monitoring emphasize ultra-high-definition cameras and robust wireless connectivity. This diversification necessitates deployment-mode distinctions between cloud-centric architectures and on-premises implementations.

Connectivity paradigms-wired and wireless, including cellular and Wi-Fi networks-further influence system design, while camera type selection aligns with specific use cases. Resolution expectations range from standard definition for perimeter checks to high-definition and ultra-high-definition for forensic investigations. Applications extend beyond live monitoring and recording to encompass remote access via mobile apps or web interfaces, as well as advanced video analytics modules. Finally, sales channels leverage direct enterprise engagements, partnerships with distributors, and online platforms to reach a broad spectrum of end users. By harmonizing insights across these dimensions, market participants can pinpoint white-space opportunities and differentiate offerings effectively.

This comprehensive research report categorizes the Mobile Video Surveillance market into clearly defined segments, providing a detailed analysis of emerging trends and precise revenue forecasts to support strategic decision-making.

- Component

- End User

- Deployment Mode

- Connectivity

- Application

- Distribution Channel

Highlighting Regional Dynamics Shaping Mobile Video Surveillance Uptake Across Americas, Europe Middle East & Africa, and Asia-Pacific Territories

Regional dynamics are reshaping how mobile video surveillance solutions are adopted and adapted across global markets. In the Americas, emphasis on public safety and retail loss prevention has accelerated deployments of wireless-enabled turret and PTZ cameras integrated with advanced analytics. Regulatory frameworks around data privacy have also influenced cloud adoption rates, prompting a preference for hybrid models that combine on-premises edge processing with selective cloud storage.

Meanwhile, the Europe, Middle East & Africa region is characterized by heterogeneous infrastructure maturity. Western Europe’s smart city initiatives and stringent security mandates have spurred investments in ultra-high-definition video analytics and facial recognition systems, whereas emerging markets are prioritizing cost-effective dome and bullet camera solutions. In the Middle East, large-scale transportation projects in airports and rail are driving demand for robust network equipment and scalable management platforms.

In Asia-Pacific, rapid urbanization and government-led surveillance programs have resulted in high demand for recording devices and network video recorders optimized for massive data volumes. Regional players are forging partnerships to localize cloud software offerings, responding to data sovereignty laws and performance expectations. Collectively, these regional insights highlight how infrastructure maturity, regulatory environments, and end-user priorities converge to define differentiated adoption curves.

This comprehensive research report examines key regions that drive the evolution of the Mobile Video Surveillance market, offering deep insights into regional trends, growth factors, and industry developments that are influencing market performance.

- Americas

- Europe, Middle East & Africa

- Asia-Pacific

Examining the Strategic Positioning and Innovation Trajectories of Leading Mobile Video Surveillance Vendors and Emerging Market Players

Leading players in the mobile video surveillance market are advancing strategic initiatives that combine organic innovation with targeted alliances. Key vendors have expanded their portfolios to include end-to-end managed services, embedding consulting, installation, and maintenance capabilities into bundled offerings. At the same time, pure-play software specialists are enhancing video management systems and cloud platforms through modular analytics plugins, appealing to system integrators seeking flexible licensing models.

Emerging market entrants are capitalizing on niche gaps-such as specialized surveillance solutions for oil and gas or smart transportation corridors-to gain footholds by customizing both hardware and software stacks. Meanwhile, networking equipment providers are integrating edge compute modules directly into routers and switches, creating distributed processing hubs that reduce latency and minimize bandwidth usage. Collaborative ecosystems have flourished, with alliances between AI algorithm developers, hardware OEMs, and telecom operators driving the rapid deployment of 5G-enabled surveillance solutions.

This dynamic landscape underscores the importance of continuous research and development, as vendors race to differentiate through features like people counting algorithms, low-light imaging, and secure remote access. By analyzing patent filings, product launches, and partnership announcements in tandem, industry leaders can anticipate competitive moves and adapt their innovation roadmaps accordingly.

This comprehensive research report delivers an in-depth overview of the principal market players in the Mobile Video Surveillance market, evaluating their market share, strategic initiatives, and competitive positioning to illuminate the factors shaping the competitive landscape.

- Active Total Security Systems

- Actus Digital Inc.

- AVS Systeme AG

- Belixys Electronics

- Canon Inc.

- CP Plus International

- Dahua Technology USA Inc.

- Ecamsecure

- Ener-Tel Services I, LLC.

- ETA Transit Systems, Inc.

- EyeSite Surveillance, Inc.

- Hangzhou Hikvision Digital Technology Co., Ltd.

- Hanwha Vision

- Huawei Technologies Co., Ltd.

- Kooi Trading B.V.

- LivEye GmbH

- March Networks Corporation by Delta International Holding Limited

- Mobile Video Guard

- Motorola Solutions, Inc.

- Pro-Vigil, Inc.

- Radio Engineering Industries

- Robert Bosch GmbH

- Safe Fleet Acquisition Corp.

- Stealth Monitoring, Inc.

- Strongwatch

- Teledyne FLIR LLC

- Versitron, Inc.

- Vision Detection Systems

- Wanco, Inc.

- Wireless CCTV LLC

- Zhejiang Dahua Technology Co., Ltd.

- Zhejiang Uniview Technologies Co., Ltd.

Delivering Actionable Industry Recommendations Focused on Technology Integration, Ecosystem Partnerships, and Customer-Centric Deployment Strategies

Industry leaders should prioritize the integration of AI-driven analytics within edge compute devices to achieve real-time incident detection while minimizing network reliance. By embedding facial recognition and object detection capabilities at the camera level, organizations can reduce data backhaul costs and accelerate response times. Equally important is the development of hybrid deployment frameworks that combine on-premises VMS with cloud orchestration, offering both data sovereignty and scalable processing power.

Forging partnerships with telecom operators can unlock the full potential of 5G connectivity, enabling high-resolution remote monitoring for critical infrastructure and transportation hubs. Collaborative go-to-market strategies that align camera manufacturers, software developers, and managed service providers will streamline end-user procurement and deployment cycles. To address evolving privacy regulations, companies must embed compliance controls and encryption protocols throughout their solutions, fostering trust and reducing legal exposure.

Lastly, a customer-centric approach involving interactive mobile interfaces and customizable analytics dashboards will differentiate offerings in a crowded market. Industry players should invest in training programs and professional services to ensure seamless system adoption and ongoing support. These actionable steps will empower stakeholders to harness the full spectrum of mobile video surveillance capabilities, driving both operational efficiency and strategic value.

Outlining a Rigorous Research Methodology Combining Qualitative and Quantitative Approaches to Ensure Comprehensive Market Insights

This study employed a robust research methodology combining both qualitative and quantitative approaches to ensure comprehensive market insights. Primary research included in-depth interviews with system integrators, technology vendors, and end users across commercial, government, industrial, residential, and transportation segments. These conversations provided firsthand perspectives on procurement challenges, deployment preferences, and evolving feature demands.

Secondary research was conducted through analysis of publicly available corporate literature, industry white papers, and regulatory filings to capture technology roadmaps, merger and acquisition trends, and policy impacts-particularly relating to United States import tariffs enacted in 2025. Additionally, data triangulation techniques were applied, cross-validating survey responses with shipment records and installation statistics to enhance the accuracy of component- and region-specific insights.

To refine segmentation frameworks, the methodology integrated cluster analysis of deployment modes, connectivity options, and camera types, enabling the identification of nuanced sub-segments. Rigorous review sessions with subject-matter experts ensured the elimination of bias and validated key findings. This multi-layered approach guarantees that the conclusions and recommendations presented accurately reflect the complexities of the mobile video surveillance market.

This section provides a structured overview of the report, outlining key chapters and topics covered for easy reference in our Mobile Video Surveillance market comprehensive research report.

- Preface

- Research Methodology

- Executive Summary

- Market Overview

- Market Insights

- Cumulative Impact of United States Tariffs 2025

- Cumulative Impact of Artificial Intelligence 2025

- Mobile Video Surveillance Market, by Component

- Mobile Video Surveillance Market, by End User

- Mobile Video Surveillance Market, by Deployment Mode

- Mobile Video Surveillance Market, by Connectivity

- Mobile Video Surveillance Market, by Application

- Mobile Video Surveillance Market, by Distribution Channel

- Mobile Video Surveillance Market, by Region

- Mobile Video Surveillance Market, by Group

- Mobile Video Surveillance Market, by Country

- United States Mobile Video Surveillance Market

- China Mobile Video Surveillance Market

- Competitive Landscape

- List of Figures [Total: 18]

- List of Tables [Total: 3498 ]

Consolidating Key Findings to Illuminate the Strategic Imperatives and Future Prospects of Mobile Video Surveillance Markets Worldwide

The convergence of advanced hardware, cloud-enabled platforms, and intelligent analytics is redefining the mobile video surveillance sector, empowering organizations across diverse verticals to achieve heightened situational awareness and operational agility. Tariff-induced cost pressures have accelerated the shift toward software-led service models, while regional distinctions underscore the importance of tailored deployment strategies. Comprehensive segmentation analysis reveals white-space opportunities in specific component categories and end-user verticals, and leading vendors continue to refine their offerings through strategic collaborations and R&D investments.

As the market evolves, stakeholders must embrace an integrated approach-bridging edge and cloud, hardware and software, and security and privacy-to deliver scalable, resilient, and user-centric surveillance solutions. Moving forward, continuous adaptation to regulatory changes, technological breakthroughs, and shifting end-user expectations will be essential for sustained growth. This executive summary provides the strategic roadmap for stakeholders to navigate the complexities of the mobile video surveillance landscape and capitalize on emerging opportunities.

Connect with Ketan Rohom to Secure Your Comprehensive Market Research and Leverage Actionable Intelligence for Strategic Decision-Making

Secure comprehensive insights and empower your decision-making by collaborating directly with Ketan Rohom, Associate Director of Sales & Marketing at 360iResearch, who will guide you through the nuances of the mobile video surveillance landscape. By engaging with Ketan, you gain access to expert consultation that includes tailored data interpretations, deep dives into specific segments, and contextualized perspectives that align with your strategic objectives.

This partnership facilitates fast-tracked delivery of the full market research report, ensuring you have the most current intelligence at your fingertips. Ketan’s hands-on approach guarantees clarity on complex trends such as tariff impacts, regional dynamics, and emerging technologies. Reach out to Ketan Rohom to transform raw market data into actionable strategies that advance your competitive advantage and drive sustainable growth.

- How big is the Mobile Video Surveillance Market?

- What is the Mobile Video Surveillance Market growth?

- When do I get the report?

- In what format does this report get delivered to me?

- How long has 360iResearch been around?

- What if I have a question about your reports?

- Can I share this report with my team?

- Can I use your research in my presentation?