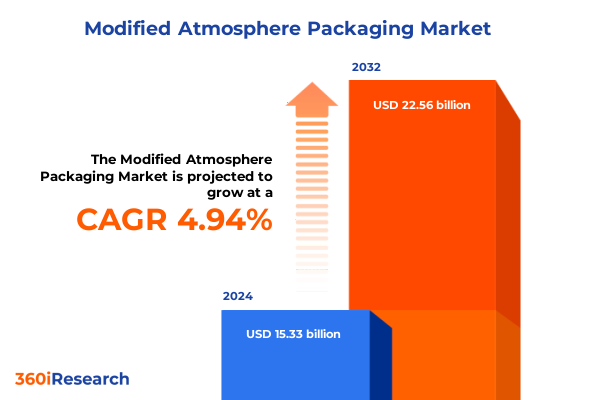

The Modified Atmosphere Packaging Market size was estimated at USD 16.10 billion in 2025 and expected to reach USD 16.82 billion in 2026, at a CAGR of 4.93% to reach USD 22.56 billion by 2032.

Unveiling the Lifeline of Perishable Goods Through Modified Atmosphere Packaging and Its Pivotal Role in Ensuring Freshness Across Global Supply Chains

Modified atmosphere packaging has emerged as a vital technology for preserving the freshness and safety of perishable goods by controlling the gas composition within sealed environments. By replacing or adjusting the proportions of oxygen, carbon dioxide, and nitrogen in packaging, this approach slows microbial growth and enzymatic reactions that lead to spoilage. As global supply chains lengthen and consumer demand for fresh, minimally processed items intensifies, the ability to extend shelf life without relying on chemical preservatives has positioned modified atmosphere packaging as an indispensable solution.

Key industry stakeholders, from producers of bakery products and dairy to meat processors and fresh produce distributors, rely on this technology to maintain product quality during transportation and storage. Its widespread adoption reflects the confluence of food safety regulations, sustainability ambitions, and consumer interest in high-quality, fresh offerings. Moreover, the integration of smart sensors and real-time monitoring is enabling brands to track environmental conditions throughout the cold chain, further enhancing transparency and reducing waste. As such, modified atmosphere packaging sits at the intersection of consumer preferences, regulatory frameworks, and technological innovation, cementing its role at the heart of modern food logistics.

Navigating the Convergence of Eco-Innovation, Smart Packaging, and Automation That Is Redefining Modified Atmosphere Packaging

In recent years, the landscape of modified atmosphere packaging has shifted dramatically under the influence of sustainability, digitization, and enhanced regulatory scrutiny. Eco-conscious consumers and stringent environmental mandates are driving manufacturers to replace conventional plastics with renewable or compostable barrier materials, while investing in multi-layer films engineered for high barrier performance with reduced environmental impact. Concurrently, brands are integrating intelligent packaging features-such as embedded sensors and wireless connectivity-to enable continuous monitoring of temperature, humidity, and atmospheric composition, thereby mitigating spoilage and ensuring compliance with evolving food safety standards.

The convergence of automation and artificial intelligence is further reshaping production lines. Automated filling, sealing, and inspection equipment equipped with machine learning algorithms now streamline operations, reduce labor costs, and enhance the consistency of gas flushing processes. Digital twins and data analytics platforms allow manufacturers to simulate packaging parameters, optimize throughput, and forecast maintenance needs, which in turn reduces downtime and energy consumption. Moreover, breakthroughs in nanocomposite coatings and biopolymer formulations are unlocking new possibilities for lightweight, high-performance films that balance cost, functionality, and recyclability. Together, these innovations are redefining what modified atmosphere packaging can achieve in terms of product protection, operational efficiency, and environmental stewardship.

Assessing How Recent U.S. Tariff Measures on Metals and Polymers Are Reshaping Supply Chains and Material Strategies in Packaging

The imposition and continuation of tariffs on packaging materials entering the United States have exerted notable pressure on input costs and supply chain dynamics for modified atmosphere packaging. Following the introduction of Section 232 duties on steel and aluminum, domestic producers and importers have grappled with higher prices for metal-based cans and rigid containers, prompting many stakeholders to explore alternative solutions. Simultaneously, safeguards on select polymer imports have elevated the cost of multilayer films and high-barrier laminates, driving pressure to renegotiate supplier contracts, localize manufacturing, or pass costs along the value chain.

In response, several packaging converters have accelerated investments in domestic extrusion and lamination capacity to mitigate exposure to cross-border levies. Others have pursued material reformulation, favoring mono-material structures that simplify recycling while leveraging co-extrusion techniques to retain barrier integrity. These adaptations have been accompanied by strategic alliances with resin producers to secure preferential pricing and by the diversification of sourcing to non-tariffed regions. Ultimately, the cumulative effect of these measures is a more resilient supply chain that balances cost containment with performance requirements, albeit with heightened complexity in material selection and logistical planning.

Decoding Material Choices and Packaging Approaches That Enable Tailored Atmosphere Control for Every Food Category

The modified atmosphere packaging arena encompasses a wide array of materials and formats tailored to diverse industry needs. Packaging solutions crafted from glass take the form of bottles and jars ideal for sauces and preserves, while metal options span aluminum and steel containers suited for canned goods. Corrugated board, folding box board, and solid bleached sulfate deliver structural strength in paper-and-paperboard applications, whereas plastics such as PE, PET, PP, PS, and PVC are extruded and formed into everything from films to rigid trays.

Across application segments, tailored approaches have emerged to serve bakery, dairy, fruits and vegetables, meat and seafood, and the multifaceted processed foods sector encompassing confections, ready meals, and snacks. Formats extend from rigid bottles, jars, and cans to flexible films and pouches-each engineered as barrier films, shrink wraps, or stretch wraps-and to lidding films and more robust trays and containers. Barrier performance ranges from single-layer films suited to less sensitive products to high-barrier coated or multi-layer assemblies that protect against oxygen and moisture ingress. Furthermore, technology choices span active systems employing CO₂ emitters and O₂ scavengers to passive methods leveraging gas flushing and injection, allowing fine-tuned control of internal atmospheres and fulfilling stringent shelf-life requirements.

This comprehensive research report categorizes the Modified Atmosphere Packaging market into clearly defined segments, providing a detailed analysis of emerging trends and precise revenue forecasts to support strategic decision-making.

- Material Type

- Packaging Type

- Barrier Type

- Technology Type

- Application Industry

Exploring How Regional Regulations, Consumer Preferences, and Infrastructure Shape Packaging Innovation Across the Globe

Regionally, distinct drivers and priorities shape the adoption and evolution of modified atmosphere packaging. In the Americas, consumer expectations for convenience and freshness spur demand for single-serve and extended-shelf-life products, while environmental policies in countries like Canada and the United States incentivize recyclable and compostable barrier solutions. Leading producers in North America are thus investing in advanced co-extrusion lines and intelligent packaging labs to support rapid innovation cycles.

In Europe, Middle Eastern, and African markets, regulatory frameworks such as the EU Packaging and Packaging Waste Regulation (PPWR) are accelerating the shift toward reusable and recyclable materials, with particular emphasis on mono-material structures that facilitate circularity. Sustainability mandates in these regions are also driving adoption of renewable biopolymers and the integration of technology for real-time compliance monitoring. Meanwhile, expanding cold chain infrastructure in Asia-Pacific is unlocking opportunities for MAP across emerging economies, where population growth and urbanization fuel rising demand for fresh produce, dairy, and processed foods. Investment in local production capacity and digital cold chain tracking is enhancing product integrity and reducing logistical losses across this diverse region.

This comprehensive research report examines key regions that drive the evolution of the Modified Atmosphere Packaging market, offering deep insights into regional trends, growth factors, and industry developments that are influencing market performance.

- Americas

- Europe, Middle East & Africa

- Asia-Pacific

Highlighting the Trailblazers Driving Sustainable Barrier Films, Intelligent Monitoring, and Circular Design in Packaging

A cadre of leading packaging innovators is advancing the boundaries of modified atmosphere solutions through strategic partnerships and technology development. Amcor has expanded its portfolio with mono-material high-barrier films designed for recyclability, while Sealed Air continues to integrate smart sensors and data analytics into its packaging lines to deliver condition-based monitoring. Berry Global emphasizes circular economy principles, forging alliances with resin producers to scale mechanically recycled content across film and tray applications.

European players such as Mondi and Coveris are focusing on biopolymer formulations and compostable barrier coatings that meet stringent environmental standards without sacrificing performance. In Asia-Pacific, regional champions are building localized extrusion and lamination facilities to cater to burgeoning markets for fresh produce and ready meals, and are piloting AI-driven packaging inspection systems to enhance throughput. Together, these companies are defining industry best practices by uniting sustainability, performance, and digitalization in innovative packaging platforms.

This comprehensive research report delivers an in-depth overview of the principal market players in the Modified Atmosphere Packaging market, evaluating their market share, strategic initiatives, and competitive positioning to illuminate the factors shaping the competitive landscape.

- Air Products and Chemicals, Inc.

- Amcor plc

- Berry Global, Inc.

- Constantia Flexibles Group GmbH

- Coveris Holdings S.A.

- CVP Systems Inc.

- GEA Group Aktiengesellschaft

- Harpak-Ulma Packaging LLC

- Ilapak International S.A.

- Klöckner Pentaplast GmbH

- Mondi plc

- Multisorb Technologies Inc.

- MULTIVAC Sepp Haggenmüller SE & Co. KG

- Packmech Engineers Pvt. Ltd.

- Point Five Packaging, LLC

- Robert Reiser & Co., Inc.

- Sealed Air Corporation

- StePac Ltd.

- Ulma Packaging S. Coop.

- Winpak Ltd.

Actionable Pathways for Packaging Executives to Merge Sustainability Goals with Operational Resilience and Technological Innovation

Industry leaders should prioritize investments in barrier technologies that balance performance with end-of-life considerations, deploying mono-material and compostable solutions where feasible. Concurrently, integrating smart packaging elements-sensors, connectivity, and data analytics-will provide actionable insights to reduce waste, optimize inventory, and ensure regulatory compliance across complex supply chains.

To mitigate external cost pressures stemming from tariffs or material shortages, companies are advised to diversify sourcing strategies, establish strategic resin partnerships, and invest in domestic production capabilities. Collaboration with equipment suppliers to adopt advanced extrusion and lamination systems will enhance agility and reduce lead times. Furthermore, cross-functional teams should leverage digital twin simulations and predictive maintenance frameworks to streamline operations and drive incremental efficiency gains. By embracing a holistic approach that weaves sustainability, technology, and supply chain resilience, packaging stakeholders can unlock new growth opportunities and fortify their market positions.

Integrating Primary Expert Interviews and Comprehensive Secondary Validation to Illuminate Packaging Technology Trends

This study employs a rigorous methodology combining primary research with comprehensive secondary analysis. In-depth interviews were conducted with material scientists, packaging engineers, supply chain executives, and regulatory experts to capture real-world perspectives on technological advancements and market drivers. Secondary sources including peer-reviewed journals, industry reports, regulatory filings, and patent databases were systematically reviewed to validate trends and benchmark best practices.

Quantitative data was obtained through a blend of trade association publications, customs databases, and equipment shipment records to map material flows and production capacities. Data triangulation techniques ensured consistency and accuracy, with insights cross-verified against public financial disclosures, sustainability reports, and technology roadmaps. Finally, proprietary market modeling tools were used to assess the implications of tariff scenarios, material innovation cycles, and regulatory evolutions, enabling a comprehensive and balanced analysis of the modified atmosphere packaging ecosystem.

This section provides a structured overview of the report, outlining key chapters and topics covered for easy reference in our Modified Atmosphere Packaging market comprehensive research report.

- Preface

- Research Methodology

- Executive Summary

- Market Overview

- Market Insights

- Cumulative Impact of United States Tariffs 2025

- Cumulative Impact of Artificial Intelligence 2025

- Modified Atmosphere Packaging Market, by Material Type

- Modified Atmosphere Packaging Market, by Packaging Type

- Modified Atmosphere Packaging Market, by Barrier Type

- Modified Atmosphere Packaging Market, by Technology Type

- Modified Atmosphere Packaging Market, by Application Industry

- Modified Atmosphere Packaging Market, by Region

- Modified Atmosphere Packaging Market, by Group

- Modified Atmosphere Packaging Market, by Country

- United States Modified Atmosphere Packaging Market

- China Modified Atmosphere Packaging Market

- Competitive Landscape

- List of Figures [Total: 17]

- List of Tables [Total: 2544 ]

Concluding Observations on How Innovation, Regulation, and Strategic Adaptation Are Shaping the Future of Perishable Goods Packaging

Modified atmosphere packaging stands at the confluence of consumer demand, regulatory imperatives, and technological progress. Its ability to extend shelf life, enhance safety, and reduce waste is resonating across industries-from fresh produce and dairy to meat and processed foods. As sustainability targets tighten and digital capabilities expand, the packaging sector must continue to innovate in barrier materials, smart sensor integration, and production automation.

The interplay of external factors such as tariffs, environmental regulations, and shifting supply chain paradigms underscores the need for adaptable strategies that align cost efficiency with performance excellence. Stakeholders capable of weaving sustainability, agility, and intelligence into their packaging operations will not only meet evolving market needs but also gain a competitive edge. In this dynamic environment, proactive collaboration, continuous innovation, and informed decision-making will distinguish industry leaders from followers, charting a path toward a more sustainable and efficient future for perishable goods logistics.

Unlock Comprehensive Market Intelligence on Modified Atmosphere Packaging by Engaging Directly with Our Sales and Marketing Associate

For further exploration of the modified atmosphere packaging market, connect with Ketan Rohom to secure your comprehensive report and gain strategic insights tailored to your organization’s growth objectives.

Reach out today and take the first step toward optimizing your packaging operations, unlocking new revenue streams, and sustaining competitive advantage in the dynamic perishable goods landscape.

- How big is the Modified Atmosphere Packaging Market?

- What is the Modified Atmosphere Packaging Market growth?

- When do I get the report?

- In what format does this report get delivered to me?

- How long has 360iResearch been around?

- What if I have a question about your reports?

- Can I share this report with my team?

- Can I use your research in my presentation?