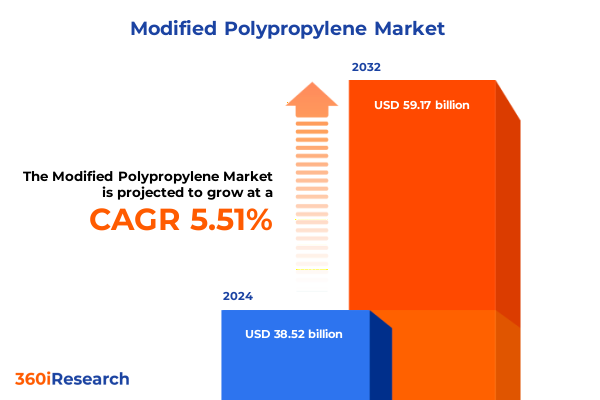

The Modified Polypropylene Market size was estimated at USD 40.60 billion in 2025 and expected to reach USD 42.80 billion in 2026, at a CAGR of 5.52% to reach USD 59.17 billion by 2032.

Shifting Paradigms in Modified Polypropylene Markets as Industries Embrace Advanced Polymers and Sustainability Strategies

The modified polypropylene industry stands at a pivotal moment as the convergence of technological innovation, sustainability mandates, and evolving end-use requirements reshapes the global landscape. In the automotive sector, the push for weight reduction and emission compliance has led manufacturers to integrate glass fiber-reinforced polypropylene compounds into battery housings and structural components, yielding weight savings of up to 22% while maintaining performance standards. Meanwhile, in packaging, mono-material solutions leveraging advanced compounding technologies have achieved recyclability rates exceeding 98%, exemplified by leading consumer goods producers adopting polypropylene packaging in place of multi-layer PET structures. These dynamics underscore the material’s unparalleled versatility and its capacity to meet stringent regulatory and customer demands across sectors.

Beyond performance enhancements, the modified polypropylene market is experiencing a surge in tailored solutions driven by breakthroughs in polymer chemistry. Manufacturers are deploying novel copolymerization and grafting techniques to engineer materials with enhanced UV stability, flame resistance, and chemical inertness, enabling use in premium electrical housings and medical device components. At the same time, the emergence of polyolefin elastomers as impact modifiers is facilitating compliance with forthcoming EU vehicle recycling mandates, which require a higher content of recycled plastics in end-of-life vehicles. Together, these factors position modified polypropylene as a strategic enabler for industries seeking high-performance, cost-effective, and sustainable polymer solutions.

Revolutionary Technological, Regulatory, and Sustainability Forces Redefining the Modified Polypropylene Landscape for the Next Generation

The modified polypropylene arena is witnessing seismic shifts as sustainability imperatives, regulatory landscapes, and digital transformation coalesce to define new competitive benchmarks. Manufacturers are doubling down on eco-friendly production pathways, integrating post-consumer recycled polypropylene into their compounding processes to align with tightening environmental regulations and consumer expectations. This strategic pivot is further reinforced by catalysts that enable high-efficiency recycling, achieving up to 95% material recovery from end-of-life products, thereby unlocking circularity potential in packaging, automotive, and consumer goods applications. As a result, market participants are reorienting their R&D investments to develop PCR-enhanced formulations that do not compromise on mechanical or aesthetic properties.

Parallel to the sustainability revolution, the automotive lightweighting imperative is accelerating adoption of high-performance modified polypropylene grades. With electric vehicle production surging, automakers increasingly rely on tailored polypropylene copolymers to meet structural, acoustic, and thermal management specifications. In Europe, regulatory mandates on EOL vehicle recycling, scheduled to take effect from 2030, are compelling OEMs to source compatibilizers and impact modifiers to ensure recycled content meets OEM tolerances. Moreover, digitalization across the supply chain - from predictive maintenance in extrusion lines to AI-driven process optimization - is enhancing manufacturing agility, reducing downtime, and facilitating rapid scale-up of customized resin formulations. This synergy of sustainability, regulation, and digital innovation is redefining competitive dynamics and establishing a new paradigm for growth in the modified polypropylene sector.

Assessing the Comprehensive Effects of the 2025 U.S. Tariff Revamp on Supply Chains, Cost Structures, and Competitive Dynamics in Polypropylene

The cumulative impact of U.S. tariff measures enacted in early 2025 has introduced multifaceted challenges and strategic adjustments in the modified polypropylene supply chain. On March 3, 2025, the executive revision of Section 301 tariffs raised additional duties on Chinese exports from 10% to 20%, eliminating the de minimis exemption and mandating full duty application on all shipments of HTS 9903.01.20‐classified goods. This adjustment effectively elevated the average tariff rate on polyolefins to approximately 26.5%, creating immediate cost headwinds for resin importers and downstream compounders. The abrupt tariff increase disrupted established sourcing models, prompting buyers to reassess procurement strategies and accelerate diversification of supply beyond China.

In concert with heightened import duties on Chinese materials, the broader chemical ecosystem has felt the reverberations of additional levies across shipping, feedstock, and intermediate inputs. Analysts report that these measures could drive underlying chemical prices up by an estimated 33-37%, while freight costs for key feedstocks like monoethylene glycol and ethanol may climb by as much as 228%. As a result, resin producers face margin pressures that necessitate either absorbable cost containment or strategic price adjustments for end users. Simultaneously, the tariff landscape has spurred negotiations for supply contracts with North American and Middle Eastern petrochemical producers, as market actors seek to mitigate volatility and secure longer‐term supply agreements. The confluence of these tariff dynamics underscores the need for agility in trade policy navigation and proactive risk management for all stakeholders in the modified polypropylene value chain.

Deep Dive into Segmentation Insights Revealing How Applications, Product Types, Processing Methods, and Additives Shape Market Opportunities

A nuanced understanding of segmentation reveals how application domains drive differentiated demand for modified polypropylene, tailoring resin selection to performance and regulatory requirements. In the automotive sector, modifications range from highly reinforced exterior fascia to acoustic‐dampening interior components and under-the-hood parts requiring enhanced thermal and chemical resistance. Construction applications utilize polypropylene modifications to improve weathering performance in pipes and fittings, bolster structural profiles, and deliver durable roofing membranes that withstand UV exposure and temperature fluctuations. Consumer goods manufacturers leverage modified polypropylene’s clarity and processability for appliances and sporting goods, while electronics producers embed specialized formulations within housings and insulation materials to meet electrical safety and flame‐retardant standards. The packaging industry taps into the polymer’s versatility across bottles, films, both shrink and stretch variants, flexible pouches, and rigid containers, achieving barrier performance and recyclability targets without sacrificing cycle times or aesthetic qualities.

Complementing application‐driven segmentation, product type, processing methods, and additive profiles further refine market positioning. Block copolymers, including both A-B and A-B-A configurations, enable balanced combinations of stiffness and impact resistance, whereas homopolymers serve basic molding operations with cost efficiency. Impact copolymers, notably terpolymers, deliver superior toughness in film extrusion and injection molding processes, while random copolymers like ethylene propylene random copolymer excel in applications demanding clarity and flexibility. Processing routes such as extrusion blow molding, encompassing both extrusion and injection variations, film and profile extrusion, injection molding, and thermoforming each align with specific geometry, throughput, and material performance criteria. Finally, additive packages ranging from antioxidants and lubricants to flame retardants, UV stabilizers, and colorants-available as liquid concentrates or masterbatch-provide further fine-tuning of mechanical, thermal, and aesthetic properties to satisfy end-use requirements.

This comprehensive research report categorizes the Modified Polypropylene market into clearly defined segments, providing a detailed analysis of emerging trends and precise revenue forecasts to support strategic decision-making.

- Product Type

- Processing Method

- Additive

- Application

Uncovering Regional Dynamics Driving Demand for Modified Polypropylene across the Americas, Europe Middle East Africa, and Asia-Pacific Markets

Regional market dynamics for modified polypropylene underscore shifting epicenters of demand and investment as end-use industries evolve across geographies. In North America, demand is anchored by robust automotive and packaging production, fueled by nearshoring trends and heightened focus on domestic supply resilience. Market participants are navigating a transition toward higher recycled content, leveraging advanced recycling capacities in Texas and Louisiana, where Baytown and Baton Rouge facilities have expanded to collectively process over 500 million pounds of end-of-life plastics annually. Concurrently, Latin American markets are witnessing a surge in packaging and construction applications, driven by urbanization and retail expansion throughout the region.

Across Europe, the Middle East, and Africa, regulatory frameworks on recyclability and circular economy targets are catalyzing demand for bio-based and PCR-enhanced polypropylene formulations. European automakers are increasingly specifying modified polypropylene compounds that incorporate up to 30% recycled content to comply with upcoming EOL vehicle recycling mandates. In the Middle East and Africa, infrastructure growth is boosting consumption in building and construction segments, where weather-resistant roofing membranes and durable pipe systems rely on polymer enhancements to extend service life under harsh climatic conditions. Meanwhile, Asia-Pacific continues to dominate global polypropylene consumption at over 58% of volume, driven by China’s aggressive EV production goals and substantial packaging output, compared to North America’s 22% share. This regional mosaic of drivers highlights the criticality of tailoring strategies to localized regulatory, industrial, and consumer imperatives.

This comprehensive research report examines key regions that drive the evolution of the Modified Polypropylene market, offering deep insights into regional trends, growth factors, and industry developments that are influencing market performance.

- Americas

- Europe, Middle East & Africa

- Asia-Pacific

Illuminating Competitive Landscapes by Profiling Leading Innovators, Strategic Initiatives, and Emerging Collaborations in the Modified Polypropylene Sector

The competitive ecosystem in modified polypropylene is characterized by a mix of global petrochemical majors and nimble specialty compounders each vying to deliver differentiated value propositions. Leading players in automotive and packaging markets include BASF, Covestro, and LyondellBasell, whose recent investments in high-performance copolymer R&D have fortified their positions in lightweighting and sustainability solutions. Meanwhile, ExxonMobil’s Signature Polymers brand is gaining traction across nonwovens, hygiene, and medical segments, showcasing Exxtend™ advanced recycling and Vistamaxx™ performance technologies that enable higher recycled content without compromising material integrity. In parallel, strategic alliances with OEMs and film converters are driving collaboration on application-specific formulations, from shrink films with optimized sealant layers to rigid packaging with enhanced barrier properties.

Beyond the established leaders, emerging suppliers and regional compounders are carving out niches through agile product development and localized production footprints. Investments in polymer modification lines across Southeast Asia and the Middle East are expanding capacity for specialty grades, while joint ventures between petrochemical incumbents and local players are accelerating market entry and ensuring supply chain continuity. Notably, Chevron Phillips’ partnerships in India and SABIC’s pipeline expansions in Saudi Arabia exemplify the trend toward integrated, multi-regional strategies that balance global scale with regional responsiveness. The evolving competitive landscape underscores the imperative for continuous innovation, strategic partnerships, and robust go-to-market models to secure leadership in the modified polypropylene arena.

This comprehensive research report delivers an in-depth overview of the principal market players in the Modified Polypropylene market, evaluating their market share, strategic initiatives, and competitive positioning to illuminate the factors shaping the competitive landscape.

- Arkema S.A.

- Borealis AG

- Braskem S.A.

- China Petroleum & Chemical Corporation

- China XD Plastics Company Limited

- Covestro AG

- Dow Inc.

- Exxon Mobil Corporation

- Formosa Plastics Corporation

- INEOS Group Holdings S.A.

- Jiangyin Excen Broaden Polymer Co., Ltd.

- Kingfa Sci. & Tech. Co., Ltd.

- LG Chem Ltd.

- LyondellBasell Industries N.V.

- PetroChina Company Limited

- PolyPacific Pty Ltd

- Saudi Basic Industries Corporation

- TotalEnergies SE

Actionable Roadmap for Industry Leaders to Navigate Market Complexities, Capitalize on Innovation, and Achieve Sustainable Growth in Polypropylene

To navigate the complexities of the modern modified polypropylene market, industry leaders must pursue a multifaceted strategy that balances innovation, sustainability, and supply chain resilience. First, prioritizing investment in advanced recycling technologies and PCR integration will not only address regulatory mandates but also unlock cost efficiencies as feedstock premiums continue to pressure margins. Establishing partnerships with mechanical and chemical recyclers, alongside the implementation of closed-loop collection systems, can further enhance material traceability and ensure consistent quality of recycled resin streams.

Second, strengthening supply chain diversification is essential. Diversification beyond traditional sourcing geographies into the Middle East and North America will mitigate tariff risks and logistical disruptions, while strategic alliances with regional compounders can facilitate agile response to localized demand spikes. Third, accelerating R&D on high-performance copolymers and impact modifiers will differentiate product portfolios, offering tailored solutions that meet evolving OEM specifications and consumer preferences. Collaboration with end-use customers on application-driven innovation, supported by digital simulation and rapid prototyping, will streamline development cycles and reduce time-to-market.

Finally, embedding digital analytics across manufacturing and commercial functions will optimize operations and enable data-driven decision making. From predictive maintenance in extrusion lines to AI-driven demand forecasting, digital tools can enhance yield, reduce downtime, and align production with market signals. By integrating sustainability, diversification, innovation, and digitalization, leaders can craft a resilient roadmap that secures competitive advantage and drives sustainable growth in the modified polypropylene sector.

Transparent Research Methodology Emphasizing Rigorous Primary and Secondary Research, Data Triangulation, and Analytical Frameworks Underpinning the Findings

The research underpinning this report follows a transparent, robust methodology designed to ensure accuracy, relevance, and replicability of insights. Data collection commenced with an extensive review of secondary sources, including industry publications, regulatory filings, technical journals, and corporate disclosures, to map the global polypropylene value chain and identify prevailing trends. This foundation was complemented by primary research involving in-depth interviews with senior executives, polymer scientists, supply chain managers, and independent consultants, facilitating qualitative validation of quantitative observations and uncovering nuanced sector dynamics.

Quantitative analysis employed both top-down and bottom-up approaches to cross-verify data consistency across end-use segments, regional markets, and product classifications. Our triangulation framework integrated supply-side metrics such as production capacities and trade flows with demand-side indicators including application adoption rates and regulatory thresholds. Analytical tools, including Porter's Five Forces and PESTEL assessments, provided structured lenses to evaluate competitive intensity, regulatory impacts, and macroeconomic drivers. Throughout, data integrity was maintained via iterative validation cycles, ensuring that the final deliverables reflect both the depth and breadth of the modified polypropylene landscape.

This section provides a structured overview of the report, outlining key chapters and topics covered for easy reference in our Modified Polypropylene market comprehensive research report.

- Preface

- Research Methodology

- Executive Summary

- Market Overview

- Market Insights

- Cumulative Impact of United States Tariffs 2025

- Cumulative Impact of Artificial Intelligence 2025

- Modified Polypropylene Market, by Product Type

- Modified Polypropylene Market, by Processing Method

- Modified Polypropylene Market, by Additive

- Modified Polypropylene Market, by Application

- Modified Polypropylene Market, by Region

- Modified Polypropylene Market, by Group

- Modified Polypropylene Market, by Country

- United States Modified Polypropylene Market

- China Modified Polypropylene Market

- Competitive Landscape

- List of Figures [Total: 16]

- List of Tables [Total: 1908 ]

Synthesizing Strategic Conclusions Highlighting Market Evolution, Innovation Drivers, Imperative for Collaborative Breakthroughs in Modified Polypropylene

The modified polypropylene market has evolved into a crucible of innovation, sustainability, and strategic dynamism, reflecting the demands of modern industries and regulatory frameworks. High-performance material demand, particularly in automotive and electrical applications, has driven technologists to advance copolymerization techniques, delivering property enhancements of up to 40% in key performance metrics. Concurrently, the sustainability imperative has accelerated adoption of bio-based and recycled formulations, with notable R&D breakthroughs in catalytic degradation and mechanical recycling that support circular economy objectives.

Regional variances-from Asia-Pacific’s preeminence in volume consumption to Europe’s stringent recyclability mandates and North America’s nearshoring momentum-underscore the importance of adaptable strategies. The tariff environment in 2025 has highlighted trade-off considerations between cost, resilience, and compliance, compelling stakeholders to diversify supply and deepen partnerships. Moving forward, success will hinge on the ability to integrate digital capabilities across product development and manufacturing, harness advanced materials science to unlock new performance horizons, and embed sustainability across the value chain. As market participants embrace these imperatives, modified polypropylene will continue to serve as a cornerstone material enabling safer, lighter, and more sustainable products across a spectrum of industries.

Take the Next Step Toward Market Leadership in Modified Polypropylene by Engaging with Ketan Rohom for the Definitive Research Report Purchase

Are you ready to elevate your strategic decision-making with the most comprehensive and up-to-date insights on the modified polypropylene market? Reach out to Ketan Rohom, Associate Director of Sales & Marketing at 360iResearch, to secure your copy of the definitive research report that will empower your organization to stay ahead of the competition and capitalize on emerging opportunities. Our tailored analysis, coupled with expert guidance from Ketan Rohom, ensures that you receive the actionable intelligence needed to navigate market complexities with confidence. Engage directly with Ketan Rohom to discuss how this report aligns with your specific objectives and to finalize your purchase today

- How big is the Modified Polypropylene Market?

- What is the Modified Polypropylene Market growth?

- When do I get the report?

- In what format does this report get delivered to me?

- How long has 360iResearch been around?

- What if I have a question about your reports?

- Can I share this report with my team?

- Can I use your research in my presentation?