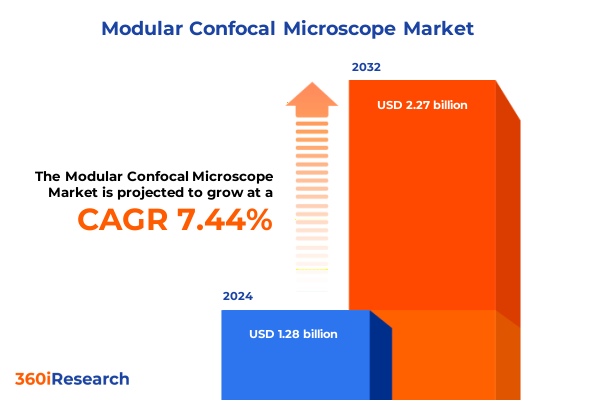

The Modular Confocal Microscope Market size was estimated at USD 1.36 billion in 2025 and expected to reach USD 1.46 billion in 2026, at a CAGR of 7.62% to reach USD 2.27 billion by 2032.

Introducing the Era of Modular Confocal Microscopes Unveiling the Next Wave of Customizable High-Resolution Imaging Platforms

Confocal microscopy has transformed biomedical and materials research by enabling non-invasive, cellular-level visualization of complex structures in real time. By rejecting out-of-focus light through a precisely aligned pinhole, modern confocal systems provide optical sectioning that rivals histological analysis while preserving specimen integrity. This capability has proven indispensable in fields ranging from ophthalmology to oncology, illuminating cellular processes with unprecedented clarity and facilitating breakthroughs in diagnostics and therapeutics. Moreover, confocal laser scanning modalities have become the preferred tool for studying dynamic phenomena in vivo, from neuronal signaling to tissue remodeling, thanks to their high-speed scanning and live-cell compatibility.

Navigating the Rapid Technological Revolutions Shaping Modular Confocal Microscopy through Digital Miniaturization Optical Advancements and AI-Driven Automation

Recent years have witnessed a convergence of digital miniaturization, photonic innovation, and intelligent automation reshaping modular confocal microscopes. Compact processing modules now integrate advanced GPUs and FPGAs for real-time 3D reconstruction and quantitative analysis, dramatically shrinking bench footprints without compromising performance. These systems leverage state-of-the-art detectors and high-power lasers to deliver high-contrast, multi-color imaging across a broad spectral range, while modular software frameworks enable seamless upgrades to emerging analytical tools and algorithms.

Assessing the Cumulative Impact of United States Trade Tariffs in 2025 on the Modular Confocal Microscope Supply Chain and Costs

The cumulative effect of United States trade policies in 2025 has introduced multiple layers of tariffs impacting the supply chain for modular confocal microscopes. Under Section 301, tariffs on specific technology inputs such as polysilicon and wafers rose to 50 percent as of January 1, 2025, while duties on certain tungsten components increased to 25 percent, reflecting a statutory review targeting critical tech sectors. These elevated duties have driven up procurement costs for semiconductor-based detectors and optical filters, necessitating strategic inventory planning and cost mitigation measures.

Unlocking Strategic Opportunities through In-Depth Segmentation Insights across Product Types Applications End Users and Components

A granular look at product-type segmentation reveals that laser scanning confocal modules dominate most research settings, driven by their versatility in implementing galvanometer and resonant scanning schemes. Galvanometer-based units deliver high-resolution imaging ideal for detailed structural studies, whereas resonant scanning modules enable high-speed, real-time observation of dynamic cellular events without sacrificing spatial fidelity. Point scanning alternatives, segmented into multifocal and single-point architectures, serve niche applications requiring ultra-sensitive detection or simplified system integration. Meanwhile, spinning disk configurations-offering multi-spinning disk and specialized Yokogawa disk variants-balance throughput and phototoxicity concerns for large-scale live-cell assays, making them a critical option for high-content screening platforms.

This comprehensive research report categorizes the Modular Confocal Microscope market into clearly defined segments, providing a detailed analysis of emerging trends and precise revenue forecasts to support strategic decision-making.

- Product Type

- Component

- Application

- End User

Gaining a Competitive Edge through Comprehensive Regional Insights across Americas Europe Middle East Africa and Asia-Pacific

Application-wise, modular confocal systems continue to underpin breakthroughs in cell biology, providing insights into intracellular trafficking, membrane dynamics, and organelle interactions at sub-cellular resolution. Developmental biology benefits from the ability to capture embryonic morphogenesis in three dimensions, while drug discovery workflows leverage high-throughput imaging to accelerate target validation and phenotypic screening. Neuroscience applications exploit fast scanning modalities to map synaptic networks and calcium signaling in real time, and pathology labs integrate confocal modules into digital pathology pipelines to enhance diagnostic accuracy through precise optical sectioning.

This comprehensive research report examines key regions that drive the evolution of the Modular Confocal Microscope market, offering deep insights into regional trends, growth factors, and industry developments that are influencing market performance.

- Americas

- Europe, Middle East & Africa

- Asia-Pacific

Illuminating Key Industry Players Driving Innovation Strategic Partnerships and Competitive Differentiation in Modular Confocal Microscopy

Key industry players are forging the path forward through innovative platform architectures and strategic collaborations. ZEISS, with its LSM 980 platform and Airyscan 2 detector, offers multiplex super-resolution imaging combining 32-element area detection with joint deconvolution to achieve spatial resolution down to 90 nanometers, all while maintaining high light efficiency for delicate live samples. Nikon’s latest AX and AX R series elevate throughput with 8K×8K pixel density, a 25mm field of view, and integrated AI-driven acquisition and analysis tools that simplify multi-modal experiments and future expansion. Leica’s TCS SP8 platform underscores modularity with upgradeable scanning modules-ranging from super-resolution and super-sensitivity options to multiphoton and coherent anti-Stokes Raman scattering capabilities-enabling researchers to tailor their confocal systems to evolving experimental demands. Olympus rounds out the landscape with its FV3000 systems, integrating TruSpectral volume phase hologram detection and hybrid galvanometer-resonant scanning units to deliver bright, multi-color imaging and rapid acquisition speeds suited for complex live-cell and super-resolution assays.

This comprehensive research report delivers an in-depth overview of the principal market players in the Modular Confocal Microscope market, evaluating their market share, strategic initiatives, and competitive positioning to illuminate the factors shaping the competitive landscape.

- Bruker Corporation

- Carl Zeiss AG

- Hamamatsu Photonics K.K.

- ISS, Inc.

- Leica Microsystems GmbH

- Nikon Corporation

- Olympus Corporation

- Oxford Instruments plc

- PerkinElmer, Inc.

- Thorlabs, Inc.

- Vivanto Solutions s.r.o.

- Yokogawa Electric Corporation

Formulating Actionable Recommendations to Propel Growth Foster Collaboration and Enhance Innovation in Modular Confocal Microscopy Systems

Industry leaders should consider adopting modular frameworks that decouple hardware investments from software evolution, enabling incremental upgrades as new modules become available. Prioritizing open interfaces and standardized communication protocols will foster interoperability across components sourced from different vendors, reducing integration costs and accelerating time to imaging. Strategic alliances with software innovators can embed AI-driven analytics directly into acquisition workflows, automating tasks such as focus tracking, artifact detection, and multi-dimensional reconstruction. Emphasizing sustainability initiatives-through energy-efficient laser modules, recyclable optics, and service-based upgrade pathways-will align product roadmaps with institutional environmental goals and extend system lifecycles. Investing in comprehensive training programs and digital support platforms will empower end users to fully leverage advanced features, minimizing downtime and driving return on investment.

Detailing the Rigorous Research Methodology Employed to Ensure Data Integrity Analytical Robustness and Market Insight Accuracy

This report’s insights derive from a rigorous, multi-pronged research methodology combining primary and secondary sources. Experts in optical engineering, cellular biology, and biotechnology were interviewed to validate technology adoption trends and application requirements. A comprehensive review of government publications, patent filings, and regulatory notices informed the analysis of trade policies, funding landscapes, and standards compliance. Quantitative data were augmented by qualitative insights, using triangulation to reconcile divergent viewpoints and assess market readiness for emerging innovations. Each segment underwent iterative validation through advisory board consultations, ensuring analytical robustness and the reliability of strategic recommendations.

This section provides a structured overview of the report, outlining key chapters and topics covered for easy reference in our Modular Confocal Microscope market comprehensive research report.

- Preface

- Research Methodology

- Executive Summary

- Market Overview

- Market Insights

- Cumulative Impact of United States Tariffs 2025

- Cumulative Impact of Artificial Intelligence 2025

- Modular Confocal Microscope Market, by Product Type

- Modular Confocal Microscope Market, by Component

- Modular Confocal Microscope Market, by Application

- Modular Confocal Microscope Market, by End User

- Modular Confocal Microscope Market, by Region

- Modular Confocal Microscope Market, by Group

- Modular Confocal Microscope Market, by Country

- United States Modular Confocal Microscope Market

- China Modular Confocal Microscope Market

- Competitive Landscape

- List of Figures [Total: 16]

- List of Tables [Total: 1749 ]

Concluding Reflections on the Transformative Potential and Strategic Imperatives Shaping the Future of Modular Confocal Microscopy

Modular confocal microscopy stands at the nexus of optical precision, digital intelligence, and experimental flexibility. The convergence of miniaturized hardware, advanced detectors, and AI-embedded software positions these systems as indispensable tools for tackling the most complex biological questions and industrial quality challenges. Stakeholders across academia, healthcare, and manufacturing sectors must embrace modular architectures to remain agile in the face of regulatory shifts, evolving application demands, and intensifying competition. By leveraging the insights and recommendations outlined herein, organizations can chart a strategic course toward sustained innovation and market leadership.

Engage with Associate Director of Sales Marketing Ketan Rohom Today to Secure Your Modular Confocal Microscope Market Research Report

To secure comprehensive insights into the modular confocal microscope landscape, reach out to Ketan Rohom, Associate Director of Sales & Marketing at 360iResearch. Engage in a personalized discussion to explore how this report can inform your strategic decisions, support procurement planning, and uncover untapped growth opportunities. Schedule a dedicated briefing to delve into the data, segmentation dynamics, and competitive intelligence tailored to your unique needs. Act now to leverage this detailed market intelligence, positioning your organization at the forefront of innovation and ensuring a decisive advantage in an evolving imaging landscape.

- How big is the Modular Confocal Microscope Market?

- What is the Modular Confocal Microscope Market growth?

- When do I get the report?

- In what format does this report get delivered to me?

- How long has 360iResearch been around?

- What if I have a question about your reports?

- Can I share this report with my team?

- Can I use your research in my presentation?