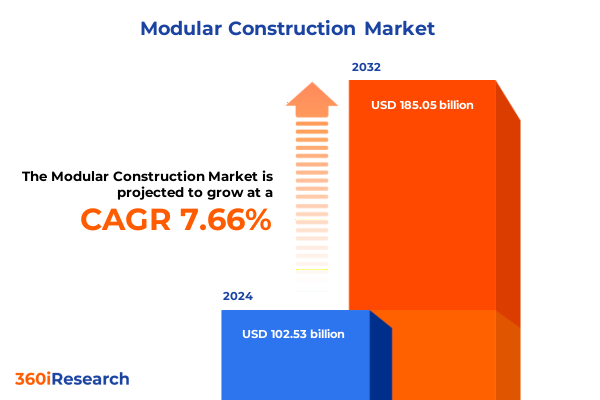

The Modular Construction Market size was estimated at USD 110.06 billion in 2025 and expected to reach USD 118.20 billion in 2026, at a CAGR of 7.70% to reach USD 185.05 billion by 2032.

Harnessing the Power of Modular Construction to Revolutionize Building Timelines and Drive Sustainable Growth Across Industrial Commercial and Residential Sectors

The landscape of construction is undergoing a profound transformation as modular methodologies shift from niche applications to mainstream deployment. By leveraging offsite prefabrication, developers and contractors are achieving unprecedented efficiencies in both time and cost, all while maintaining high standards for quality and safety. This transition is being driven by converging forces: evolving customer expectations for faster project delivery, regulatory incentives promoting sustainability, and the integration of advanced technologies such as digital twins and robotics. Consequently, modular construction is emerging as a strategic imperative for stakeholders seeking to de-risk projects and accelerate returns on investment.

Furthermore, the industry’s emphasis on lean manufacturing principles is reshaping supply chain dynamics. Fabrication facilities are increasingly adopting just-in-time processes, real-time tracking, and automated quality controls, resulting in tighter alignment between design and production. This integration reduces on-site labor demands and minimizes waste, bolstering sustainability credentials while addressing chronic workforce shortages. As a result, project owners are witnessing enhanced predictability across budgets and schedules, marking a departure from the volatility associated with conventional stick-built construction.

Uncovering the Pivotal Technological Regulatory and Market Forces Reshaping the Global Modular Construction Landscape in the Contemporary Era

Modular construction’s ascendancy is underpinned by a series of transformative shifts that are recalibrating the competitive landscape. Chief among these is the rise of digital integration: building information modeling platforms are now seamlessly connected to factory floor operations, enabling a continuous feedback loop between design, engineering, and manufacturing. This convergence ensures that design modifications propagate instantaneously across all project stakeholders, mitigating rework risks and optimizing resource allocation.

In tandem, regulatory frameworks are evolving to support offsite methodologies. Incentivized by carbon reduction mandates and net-zero targets, governments are streamlining permitting processes for modular components and offering tax credits for projects that incorporate prefabrication. Meanwhile, private-sector clients, from educational institutions to hospitality operators, are valuing modular’s repeatability and consistency as tools for brand standardization and accelerated rollouts.

Additionally, the entry of nontraditional players-from niche technology startups to large manufacturing conglomerates-has injected fresh capital and R&D capabilities into the space. Collaborative alliances between engineering firms and automation specialists are advancing modular system complexity, enabling multi-story configurations and bespoke façade treatments previously thought impractical. These factors collectively signal a maturation of the modular ecosystem, in which speed, precision, and sustainability converge to form the industry’s new baseline.

Analyzing the Ripple Effects of 2025 US Tariff Adjustments on Import Dynamics Supply Chains and Cost Structures in Modular Construction Ecosystem

The cumulative impact of the United States’ 2025 tariff adjustments has reverberated across the modular construction supply chain, influencing material costs, sourcing strategies, and end-market pricing. Tariffs imposed on imported steel, for instance, have prompted fabricators to negotiate longer-term contracts with domestic mills, while simultaneously seeking alternative materials such as engineered timber and advanced plastics to hedge against pricing volatility. As a result, manufacturers are recalibrating their bill of materials and, in some cases, redesigning module components to optimize weight-to-strength ratios under fluctuating cost structures.

Moreover, the heightened duties on steel and certain alloys have accelerated the adoption of domestic manufacturing partnerships. Fabrication facilities are expanding capacity closer to project sites to reduce cross-border shipping expenses and mitigate exposure to further policy shifts. In parallel, firms are investing in material innovation, exploring hybrid composites that blend recycled inputs with performance polymers. These strategic responses are not only cost-driven but also address growing demand for circular economy practices.

In addition, the tariff landscape has altered the competitive calculus for international suppliers. Companies that previously relied on exporting standardized modules to the US market are now refocusing efforts toward less tariff-sensitive regions, thereby intensifying competition in Asia-Pacific and certain Latin American markets. This geographic pivot underscores the need for US-based modular providers to reinforce local supply chains and continually refine cost-efficiency levers to maintain market share in a shifting trade environment.

Gleaning Actionable Insights from Diverse Market Segmentation Dimensions to Illuminate Type Material Module and Application Dynamics in Modular Construction

Examining the market through the lens of type reveals distinct adoption patterns between permanent, relocatable, and temporary structures. Permanent installations are gaining ground in high-rise applications and civic infrastructure, driven by their long-term return profiles and integration with urban planning initiatives. Relocatable modules, in contrast, are favored for evolving needs such as remote workspaces or disaster relief housing, where rapid deployment and reconfiguration are paramount. Meanwhile, temporary solutions are addressing short-term project requirements at construction sites and event venues, offering cost-effective, time-bound alternatives that align with shifting demand scenarios.

Material-based analysis uncovers the growing traction of concrete modules in heavy-duty applications, where durability and fire-resistance are critical. Plastic composites, offering lightweight construction and ease of cleaning, are emerging in hygienic environments such as healthcare settings. Steel remains indispensable for high-strength, multi-story assemblies, albeit with continuous design optimizations to offset material price fluctuations. Wood modules are experiencing a resurgence, particularly in residential projects, fueled by biophilic design trends and carbon sequestration benefits.

When considering module configuration, four-sided modules are prevalent in standardized room units, enabling rapid stacking and installation. Mixed modules and floor cassettes, which integrate floors, ceilings, and partition walls, cater to large-scale residential and hospitality projects by consolidating multiple trades into a single assembly. Open-sided modules accommodate facilities that require on-site fit-out flexibility, such as retail environments, while partially open-sided modules strike a balance between factory completion and in-field customization.

Application segmentation highlights the broad spectrum of modular construction. In commercial sectors, corporate offices leverage repeatable layouts to maintain brand consistency, while educational buildings benefit from reduced campus disruption. Healthcare facilities prioritize infection control and rapid expansion of clinical spaces. Hotels and restaurants use modules to expedite openings and refresh interiors swiftly, and retail stores adopt them for pop-up experiences and urban infill opportunities. Industrial clients, from logistics hubs to manufacturing plants, value the scalability and precision of modular assemblies. Residential developers are integrating prefabricated units into multi-family housing and single-family neighborhoods, accelerating delivery timelines and enhancing sustainability profiles.

This comprehensive research report categorizes the Modular Construction market into clearly defined segments, providing a detailed analysis of emerging trends and precise revenue forecasts to support strategic decision-making.

- Type

- Material

- Module

- Application

Exploring Regional Nuances and Emerging Opportunities Across the Americas EMEA and Asia-Pacific Markets in the Modular Construction Domain

Regional analysis reveals that the Americas continue to lead in modular construction adoption, underpinned by robust infrastructure programs and a mature network of fabricators and logistics providers. North America, in particular, benefits from strong regulatory support and a diverse client base spanning commercial, residential, and industrial sectors. Latin America is witnessing growing interest in modular methodologies for affordable housing and healthcare clinics, fueled by both private investment and multilateral development funding.

In Europe, the Middle East, and Africa, regulatory alignment around sustainability goals is driving modular uptake. Western European markets are leveraging prefabrication to meet stringent energy efficiency standards, while the Middle East is utilizing modular systems in large-scale hospitality and tourism developments to accelerate project timelines. Africa, although in earlier stages of modular adoption, is exploring offsite solutions for disaster relief and remote infrastructure, often in collaboration with international NGOs and development agencies.

Asia-Pacific stands out for its rapid urbanization and government-led prefabrication initiatives. China’s emphasis on smart city projects has propelled large-scale modular factories, and Japan continues to pioneer advanced wood-based modules in earthquake-resilient applications. Southeast Asian economies are following suit, integrating modular systems into commercial high-rises and mass housing projects, driven by both cost-containment objectives and labor constraints. Australia and New Zealand are also adopting modular approaches to address remote site logistics and workforce shortages in resource-driven regions.

This comprehensive research report examines key regions that drive the evolution of the Modular Construction market, offering deep insights into regional trends, growth factors, and industry developments that are influencing market performance.

- Americas

- Europe, Middle East & Africa

- Asia-Pacific

Profiling Leading Modular Construction Innovators Highlighting Strategic Initiatives Collaborations and Competitive Differentiators Driving Industry Leadership

Leading companies in the modular construction arena are distinguishing themselves through strategic investments in technology and vertical integration. Some manufacturers have developed proprietary design platforms that streamline customization, enabling clients to configure modules in real time through interactive digital interfaces. Others are building vertically integrated supply chains, acquiring raw material facilities to insulate against volatility and ensure a consistent quality standard from steel billets to final assembly.

Collaborations are also reshaping market dynamics. Joint ventures between global construction firms and robotics specialists are automating critical processes such as welding and assembly, reducing cycle times and enhancing precision. Partnerships with logistics providers are optimizing transportation routes, minimizing handling, and ensuring modules arrive at sites in sequence with installation schedules.

Sustainability is a core differentiator for top-tier companies. Initiatives include closed-loop recycling programs that recover fabrication offcuts, renewable energy integration within factory operations, and cradle-to-cradle design ethos, ensuring modules can be relocated or repurposed at end of life. As a result, leading players are not only competing on price and speed but also on environmental impact, aligning their corporate strategies with broader ESG commitments.

This comprehensive research report delivers an in-depth overview of the principal market players in the Modular Construction market, evaluating their market share, strategic initiatives, and competitive positioning to illuminate the factors shaping the competitive landscape.

- Alta-Fab Structures Ltd.

- ATCO Ltd.

- Balfour Beatty plc

- BAM Construction Limited

- Bouygues Construction

- CIMC Group

- Clayton Homes, Inc.

- Dubox by AN AMANA GROUP COMPANY

- Dutco Group of Companies.

- Etex Group

- Fleetwood Corporation Limited

- GMC Solutions

- Guerdon, LLC

- H+H UK Limited

- Hickok Cole

- HOMAG Group AG

- KLEUSBERG GmbH & Co. KG

- KOMA MODULAR s. r. o.

- Kwikspace

- Laing O’Rourke

- Lendlease Corporation Limited

- Modulaire Group

- Modular Building Systems, LLC

- Modular Concepts, Inc.

- Modular Genius

- Modulex Modular Buildings Plc

- Portakabin Group

- Pressmach Infrastructure Private Limited

- Red Sea International

- Skanska AB

- Vinci S.A.

- Volumetric Building Companies LLC

- Wernick Group

- WILLSCOT MOBILE MINI HOLDINGS CORP

- Zekelman Industries

Implementing Strategic Roadmaps for Industry Leaders to Capitalize on Modular Construction Trends Enhance Operational Agility and Foster Sustainable Growth Trajectories

To capitalize on current momentum, industry leaders should first prioritize digital transformation by integrating advanced design-to-manufacturing platforms that bridge BIM with factory execution systems. This will enhance visibility across the value chain and reduce the risk of misalignment between design intent and production output. In parallel, investing in modular design standards will streamline customization, enabling faster client approvals and reducing engineering overhead.

Next, organizations must strengthen domestic supply chains by forging long-term agreements with material suppliers and exploring alternative feedstocks to safeguard against tariff and currency fluctuations. Strategic facility placement closer to target markets will minimize transportation costs and support just-in-time delivery models.

Sustainability initiatives should be elevated beyond compliance to serve as market differentiators. Companies can implement circular economy practices, such as remanufacturing and repurposing modules, while transparently communicating lifecycle impacts to stakeholders. Additionally, developing talent pipelines through partnerships with technical institutes and vocational programs will address workforce gaps and foster a culture of continuous improvement.

Finally, establishing collaborative consortiums with peers, technology providers, and research institutions will accelerate innovation in areas such as robotics, advanced materials, and digital twins. By pooling resources and sharing best practices, industry leaders can collectively overcome common challenges and set new benchmarks for performance and environmental stewardship.

Detailing a Rigorous Multi-Stage Research Framework Integrating Primary Interviews Secondary Data Analysis and Expert Validation to Ensure Data Integrity

The research methodology combines a multi-stage approach to ensure rigorous data integrity and actionable insights. In the first phase, comprehensive secondary research was conducted, reviewing industry publications, regulatory filings, and technology briefs to establish foundational context and identify emerging trends. This was complemented by a detailed analysis of patent activity and capital investments to gauge innovation trajectories and funding priorities.

Primary research followed, encompassing structured interviews with a cross-section of stakeholders, including project developers, factory managers, material suppliers, and end-users. These interviews provided qualitative insights into adoption barriers, cost drivers, and operational best practices. Quantitative surveys were deployed to capture standardized data on project timelines, material preferences, and module configurations, ensuring statistical relevance across diverse geographies and applications.

Data synthesis involved triangulating primary and secondary inputs, supported by expert validation sessions. Industry advisors and technology specialists reviewed preliminary findings to refine assumptions and address potential blind spots. The final deliverable includes interactive data visualizations and scenario analyses that enable stakeholders to explore various market drivers and outcomes under different regulatory and economic conditions.

This section provides a structured overview of the report, outlining key chapters and topics covered for easy reference in our Modular Construction market comprehensive research report.

- Preface

- Research Methodology

- Executive Summary

- Market Overview

- Market Insights

- Cumulative Impact of United States Tariffs 2025

- Cumulative Impact of Artificial Intelligence 2025

- Modular Construction Market, by Type

- Modular Construction Market, by Material

- Modular Construction Market, by Module

- Modular Construction Market, by Application

- Modular Construction Market, by Region

- Modular Construction Market, by Group

- Modular Construction Market, by Country

- United States Modular Construction Market

- China Modular Construction Market

- Competitive Landscape

- List of Figures [Total: 16]

- List of Tables [Total: 954 ]

Synthesizing Core Findings to Reinforce the Strategic Imperatives and Future Outlook of Modular Construction for Decision Makers and Stakeholders Worldwide

This executive summary distills the most critical findings shaping the modular construction landscape. From the accelerating shift toward offsite fabrication and advanced digital integration to the nuanced impacts of recent tariff policies, the insights presented herein underscore the strategic imperatives for market participants. Segmentation analysis reveals where demand is most pronounced, whether by permanent or relocatable structures, material choices, module configurations, or end-use applications. Regional perspectives highlight both mature and emerging markets, while company profiles illustrate the competitive strategies driving leadership.

The evidence is clear: modular construction is no longer an adjunct to traditional methods but a cornerstone of future-oriented building practices. By embracing the outlined recommendations-spanning digital transformation, supply chain resilience, sustainability, and collaborative innovation-stakeholders can position themselves at the forefront of this evolution. As decision makers refine their strategies, the data and analysis contained in the full report will serve as an indispensable guide for navigating the complexities and capitalizing on the opportunities within the modular construction domain.

Reach Out to Ketan Rohom to Secure the Full Modular Construction Market Research Report and Unlock Critical Insights for Strategic Decision Making Today

We encourage you to engage with Ketan Rohom, the Associate Director of Sales & Marketing, to gain immediate access to the comprehensive market research report on modular construction. His expertise will guide you through the report’s in-depth analysis, ensuring you identify the strategic insights most relevant to your organization’s objectives. By partnering with him, you can secure executive summaries, detailed segmentation breakdowns, and proprietary data visualizations that will empower your decision-making processes. Reach out today to transform your understanding of modular construction’s opportunities and secure the competitive edge needed for tomorrow’s building challenges.

- How big is the Modular Construction Market?

- What is the Modular Construction Market growth?

- When do I get the report?

- In what format does this report get delivered to me?

- How long has 360iResearch been around?

- What if I have a question about your reports?

- Can I share this report with my team?

- Can I use your research in my presentation?