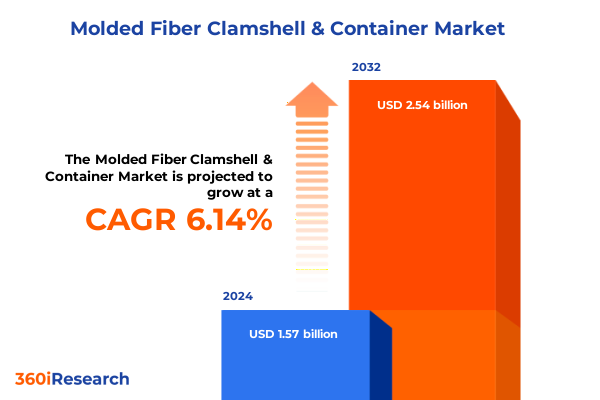

The Molded Fiber Clamshell & Container Market size was estimated at USD 1.66 billion in 2025 and expected to reach USD 1.75 billion in 2026, at a CAGR of 6.27% to reach USD 2.54 billion by 2032.

Unveiling the Strategic Significance of Molded Fiber Clamshells and Containers in Shaping the Future of Eco-Conscious Packaging Solutions

The world of packaging has entered a pivotal era in which molded fiber clamshells and containers have transcended their traditional roles to become cornerstones of sustainable supply chains. Rising environmental consciousness, stringent regulatory mandates, and dynamic consumer preferences have coalesced to elevate molded fiber solutions from niche alternatives to mainstream necessities. As a result, businesses across diverse sectors are reevaluating their packaging strategies to align with broader corporate sustainability goals and circular economy principles. This report presents an incisive executive summary that unpacks the critical factors influencing demand for molded fiber clamshells and containers, offering stakeholders a clear roadmap for navigating this rapidly evolving landscape.

Drawing upon comprehensive secondary research and industry expertise, our analysis explores the transformational shifts reshaping the molded fiber packaging domain. From the meteoric rise of e-commerce to innovations in material science, each element contributes to a powerful narrative of growth and adaptation. Through this introduction, readers will gain an elevated understanding of the strategic significance of molded fiber solutions, setting the stage for deeper insights into market drivers, segmentation, regional dynamics, and competitive strategies.

Exploring the Critical Industry Transformations and Technological Advances Propelling Widespread Adoption of Molded Fiber Clamshells and Containers

Molded fiber packaging has undergone a profound metamorphosis driven by sustainability imperatives and technological breakthroughs. Organizations worldwide are rapidly adopting eco-friendly alternatives as regulations to curb single-use plastics tighten and consumer scrutiny intensifies. Governments in major markets have introduced bans on conventional plastic disposables, compelling brands to pivot toward biodegradable and recyclable materials. In this environment, molded fiber clamshells and containers have emerged as preferred solutions, combining renewable feedstocks with end-of-life compostability to meet stringent environmental standards. As such, the industry is witnessing an unprecedented shift toward circularity, with partners across the value chain investing heavily in closed-loop recycling and life cycle assessments to validate environmental claims.

Simultaneously, the exponential growth of e-commerce is reinforcing demand for robust, protective packaging that minimizes transit damage while supporting sustainability narratives. Molded fiber solutions address both functional and environmental requirements, offering shock-absorption properties that rival plastic alternatives and enhancing unboxing experiences for digitally native consumers. Technological advancements in automated thermoforming and precision molding further enable high-volume production with consistent quality, reducing operational costs and accelerating time-to-market. Looking ahead, continued innovation in raw material blends-such as agricultural waste fibers and advanced pulp formulations-will expand application horizons, from premium electronics cushioning to multipurpose foodservice containers.

Analyzing the Far-Reaching Implications of United States Tariff Policies on Molded Fiber Clamshell and Container Supply Chains in 2025

The introduction of new U.S. tariffs in early 2025 has exerted profound pressure on raw material costs and supply chain dynamics for molded fiber manufacturers. In February, a 25% duty on imports from Canada and Mexico, coupled with an additional 10% levy on Chinese-sourced pulp and paper goods, disrupted cross-border pulp flows and elevated input prices for U.S. producers. While a temporary 30-day pause on tariffs for North American materials provided short-term relief, the broader uncertainty has prompted companies to reassess sourcing strategies and inventory policies. The American Forest & Paper Association has highlighted the risk of longer-term disruptions to established mill networks, noting that critical fiber inputs from Canada underpin optimal production efficiencies in many U.S. facilities.

Further compounding these challenges, a subsequent 50% tariff targeting Brazilian eucalyptus kraft pulp-responsible for over 80% of U.S. premium-grade pulp imports-has upped the stakes for manufacturers reliant on high-performance fiber grades. This layer of duties threatens to redirect Brazilian volumes to Asia and Europe, potentially creating global supply imbalances and intensifying competition for alternative sources. As companies navigate escalating landed costs and logistical complexity, many are exploring domestic pulp partnerships, investing in fiber substitution research, or accelerating automation initiatives to offset margin pressures and maintain reliable production capacities.

Unpacking Multifaceted Segmentation Perspectives That Illuminate Diverse Applications and Distribution Channels in Molded Fiber Packaging

Insights into molded fiber packaging reveal a layered segmentation landscape that illuminates diverse end-use scenarios and distribution strategies. When one considers application dynamics, molded fiber solutions span the spectrum from e-commerce packaging-where lightweight protective cushioning is paramount-to industrial packaging formats designed for parts protection and logistics efficiency, with food packaging further differentiated into beverages, cold food, hot food, and fresh produce segments. Parallel to this, distribution channels weave a complex tapestry of consumer interactions; specialty stores and supermarkets anchor traditional retail outlets, while direct-to-consumer websites and multi-seller e-commerce platforms enable brands to engage digital audiences with sustainable unboxing experiences.

Material innovation also lends itself to critical differentiation, as manufacturers balance the use of recycled pulp-bolstering circularity-with virgin pulp grades that deliver high mechanical strength and consistency. Finally, product distinctions between clamshells and containers shape form-factor decisions across industries, from single-serve meal packaging to industrial component housing. By synthesizing these segmentation dimensions, stakeholders can strategically tailor their portfolios, optimizing performance metrics and environmental impact across diverse market niches.

This comprehensive research report categorizes the Molded Fiber Clamshell & Container market into clearly defined segments, providing a detailed analysis of emerging trends and precise revenue forecasts to support strategic decision-making.

- Product Type

- Material Type

- Application

- Distribution Channel

Charting Regional Dynamics and Growth Drivers Across the Americas, Europe Middle East Africa, and Asia Pacific Molded Fiber Markets

Regional variances play a defining role in shaping market trajectories and innovation pathways for molded fiber packaging. Across the Americas, robust environmental legislation alongside a burgeoning e-commerce ecosystem is driving adoption, with North America at the forefront of regulatory enforcement and consumer sustainability awareness. Conversely, Latin American markets are experiencing nascent demand growth fueled by investment in recycling infrastructure and the pursuit of cost-effective alternatives to imported plastics.

In Europe, Middle East and Africa, stringent EU directives targeting single-use plastics and aggressive circular economy targets have galvanized manufacturers and converters to accelerate the transition to molded fiber. The Middle East is witnessing pilot initiatives in hospitality and foodservice sectors, while select African nations prioritize frugal innovations that leverage agricultural residues for pulp production. Meanwhile, the Asia Pacific region stands out as the fastest-growing market, propelled by rapid urbanization, expanding disposable incomes, and the maturation of regional pulp and paper supply chains. Governments in key APAC economies are enacting incentives for sustainable packaging, while domestic producers scale capacity to meet both local and export demand, underscoring the region’s dual role as a dynamic consumer base and an emerging supply hub.

This comprehensive research report examines key regions that drive the evolution of the Molded Fiber Clamshell & Container market, offering deep insights into regional trends, growth factors, and industry developments that are influencing market performance.

- Americas

- Europe, Middle East & Africa

- Asia-Pacific

Highlighting Strategic Moves and Innovations from Leading Players Shaping the Molded Fiber Clamshell and Container Landscape

Leading corporations in the molded fiber clamshell and container sphere are deploying multifaceted strategies to solidify market positions and drive sustainable innovation. Huhtamaki has spearheaded new compostable fiber blends and advanced barrier coatings, launching an eco-enhanced product line in January 2024 that showcases moisture-resistant performance while maintaining end-of-life compostability. Pactiv, responding to escalating demand, announced capacity expansion at its Texas facility, aligning production volumes with evolving foodservice requirements. Similarly, UFP Technologies has invested in automated molding systems that deliver precision and throughput gains, while Stora Enso has deepened partnerships across the retail food ecosystem to co-develop custom packaging solutions.

Across this competitive landscape, mid-tier and specialty players are carving niche positions through localized service models, rapid prototyping capabilities, and targeted sustainability certifications. These concerted moves highlight a broader industry imperative: to balance operational efficiency with environmental stewardship, all while responding to regulatory shifts and consumer expectations. As competition intensifies, strategic alliances and innovation roadmaps will increasingly determine which firms emerge as market leaders in the molded fiber segment.

This comprehensive research report delivers an in-depth overview of the principal market players in the Molded Fiber Clamshell & Container market, evaluating their market share, strategic initiatives, and competitive positioning to illuminate the factors shaping the competitive landscape.

- Better Earth LLC

- DS Smith PLC

- Eco-pliant Products Inc.

- Eco-Products, Inc.

- Environmental Packaging Public Company Limited

- EnviroPAK Corporation

- Eurasia United Equipment Group Co., Ltd.

- Good Start Packaging

- Green Paper Products

- Henry Molded Products Inc.

- Huhtamäki Oyj

- International Paper Company

- KINYI Technology Limited

- MFT-CKF, Inc.

- Omni-Pac Group

- OrCon Industries

- Pacific Pulp Molding, Inc.

- Pactiv Evergreen Inc.

- PrimeWare

- Protopak Engineering Corporation

- Sabert Corporation

- Sonoco Products Company

- Tekni-Plex, Inc.

- WestRock Company

Actionable Strategies for Packaging Industry Leaders to Capitalize on Emerging Molded Fiber Clamshell and Container Opportunities

Industry leaders should proactively integrate several strategic initiatives to stay ahead in the molded fiber packaging arena. First, establishing flexible raw material sourcing partnerships is critical to mitigate disruptions from tariff fluctuations and supply chain volatility. Collaborative programs with pulp suppliers can enable preferential access to stable fiber grades and facilitate joint sustainability projects that enhance circularity credentials.

Furthermore, investing in advanced manufacturing technologies-such as robotics, AI-driven quality controls, and high-precision molding-will drive operational efficiencies and reduce per-unit costs. Equally important is the co-development of application-specific designs that meet stringent sectoral requirements, from barrier coatings for wet foods to shock-absorbing modules for protected shipping of high-value electronics. Finally, forging strategic alliances with brands and regulators can accelerate pilot initiatives and certification approvals, positioning companies as preferred partners for early adopters seeking credible eco-packaging solutions. By executing these measures, organizations can safeguard margins, capture emerging opportunities, and fortify their leadership in the molded fiber market.

Detailing Rigorous and Holistic Research Methodology Underpinning the Molded Fiber Clamshell and Container Market Analysis

Our research methodology combines rigorous primary and secondary research to ensure robust and unbiased insights into the molded fiber clamshell and container market. We initiated a comprehensive review of industry databases, trade publications, and regulatory repositories to map prevailing trends, legislative frameworks, and competitive dynamics. This secondary research was supplemented by in-depth interviews with senior executives and technical experts across the supply chain, encompassing pulp suppliers, converters, equipment manufacturers, and end-users.

Quantitative analyses were conducted using cost-input models and scenario assessments to evaluate the impact of tariff changes and material innovations. Qualitative insights were validated through peer benchmarking and triangulation of multiple data sources, ensuring credibility and relevance. Finally, iterative consultations with subject-matter advisors and regional analysts refined our findings, delivering actionable intelligence that aligns with both global standards and local market nuances.

This section provides a structured overview of the report, outlining key chapters and topics covered for easy reference in our Molded Fiber Clamshell & Container market comprehensive research report.

- Preface

- Research Methodology

- Executive Summary

- Market Overview

- Market Insights

- Cumulative Impact of United States Tariffs 2025

- Cumulative Impact of Artificial Intelligence 2025

- Molded Fiber Clamshell & Container Market, by Product Type

- Molded Fiber Clamshell & Container Market, by Material Type

- Molded Fiber Clamshell & Container Market, by Application

- Molded Fiber Clamshell & Container Market, by Distribution Channel

- Molded Fiber Clamshell & Container Market, by Region

- Molded Fiber Clamshell & Container Market, by Group

- Molded Fiber Clamshell & Container Market, by Country

- United States Molded Fiber Clamshell & Container Market

- China Molded Fiber Clamshell & Container Market

- Competitive Landscape

- List of Figures [Total: 16]

- List of Tables [Total: 1272 ]

Synthesizing Key Findings to Illuminate the Future Trajectory of Molded Fiber Clamshell and Container Packaging Market

This executive summary has synthesized the pivotal forces shaping the molded fiber clamshell and container market, from transformative regulatory and consumer trends to the operational challenges introduced by evolving tariff regimes. We have elucidated how segmentation dynamics enable tailored solutions across applications, distribution channels, and material choices, while highlighting regional idiosyncrasies that influence demand and supply structures.

Leading companies continue to differentiate through targeted innovation and collaborative partnerships, reinforcing the competitive intensity of this sustainable packaging domain. As global markets pivot toward eco-conscious practices, the molded fiber segment stands poised for enduring relevance, propelled by its material credentials and functional versatility. By leveraging the insights outlined herein, stakeholders can formulate informed strategies that reconcile growth ambitions with sustainability imperatives, ensuring long-term success in a rapidly evolving industry.

Connect with Ketan Rohom to Secure Comprehensive Market Intelligence and Drive Strategic Decision-Making in Molded Fiber Packaging

We invite you to engage with Ketan Rohom, Associate Director of Sales and Marketing, to gain direct access to our in-depth market research report on molded fiber clamshells and containers. Leveraging his expertise, Ketan can provide personalized insights tailored to your organization’s strategic objectives, ensuring you harness the full potential of this sustainable packaging sector. By partnering with our team, you will receive comprehensive intelligence, including detailed analyses of technological advancements, competitive positioning, and regional dynamics. Reach out to Ketan today to discuss how our research can empower your decision-making processes, optimize your supply chain strategies, and drive innovation in molded fiber packaging. Elevate your market understanding and secure a competitive advantage by contacting Ketan Rohom and unlocking actionable intelligence that will shape your growth trajectory in this rapidly evolving industry

- How big is the Molded Fiber Clamshell & Container Market?

- What is the Molded Fiber Clamshell & Container Market growth?

- When do I get the report?

- In what format does this report get delivered to me?

- How long has 360iResearch been around?

- What if I have a question about your reports?

- Can I share this report with my team?

- Can I use your research in my presentation?