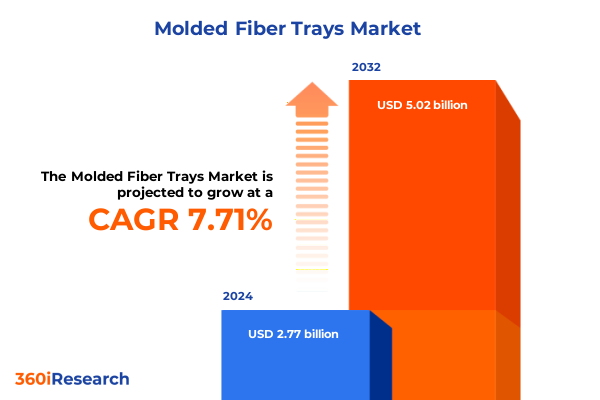

The Molded Fiber Trays Market size was estimated at USD 2.94 billion in 2025 and expected to reach USD 3.14 billion in 2026, at a CAGR of 7.90% to reach USD 5.02 billion by 2032.

Navigating the Growing Importance of Molded Fiber Trays at the Intersection of Environmental Consciousness and Operational Efficiency in Modern Supply Chains

The evolving landscape of packaging has placed molded fiber trays at the forefront of sustainability and operational efficiency discussions within supply chains around the globe. Fueled by growing environmental consciousness, these trays have emerged as a credible alternative to conventional plastics, balancing the need to protect delicate goods with the imperative to reduce ecological footprints. Stakeholders across industries are recognizing that molded fiber trays not only deliver robust product protection but also resonate with consumers who prioritize recyclability and renewable sourcing. As sustainability commitments intensify-from corporate pledges to regulatory mandates-the role of molded fiber trays is rising, setting new standards for what modern packaging solutions should achieve.

Beyond environmental benefits, molded fiber trays align with broader operational goals, such as waste reduction and cost control. Their design flexibility allows for tailored support of diverse product geometries, which streamlines packing efficiency and minimizes material overuse. Moreover, adoption of these trays contributes to circular supply chain initiatives, enabling manufacturers and distributors to capture value through recycling infrastructures. As the packaging sector confronts mounting pressures-from tightening regulations on single-use plastics to public demand for eco-friendly packaging-molded fiber trays are poised to become essential tools for companies aiming to satisfy multiple objectives simultaneously. This introduction sets the stage for an in-depth exploration of the transformative forces and strategic considerations shaping the molded fiber tray market.

Identifying the Transformative Shifts Reshaping the Molded Fiber Tray Landscape through Technological Advances and Regulatory Pressures

The molded fiber tray market is undergoing significant transformation driven by advances in technology, evolving consumer behavior, and tightening regulatory frameworks. Innovations in compression molding, hybrid molding, and thermoforming have elevated production speeds and improved consistency, while new material formulations leverage both recycled and virgin pulp to balance performance with environmental credentials. These process enhancements not only enable more intricate tray geometries but also reduce energy consumption and waste during manufacturing, reflecting a broader push toward leaner, greener operations.

Concurrently, consumers are demanding packaging that aligns with their values, prompting brands to seek differentiated solutions that underscore their sustainability commitments. Digital tools such as lifecycle analysis software have become indispensable, equipping decision-makers with quantitative metrics to compare molded fiber trays against legacy materials. This analytical rigor supports strategic procurement that integrates environmental impact alongside price and performance. Regulatory developments further accelerate change: extended producer responsibility schemes and bans on certain single-use plastics are prompting companies to reevaluate their packaging portfolios. In response, packaging providers and converters are collaborating with raw material suppliers to refine pulp blends, enabling trays to meet stringent compostability and recyclability requirements.

These converging forces-technological progress, consumer preferences, and policy imperatives-are reshaping the competitive landscape for molded fiber trays. Companies that anticipate and adapt to these shifts will secure first-mover advantages, while those that lag risk being eclipsed by better-equipped rivals. The following sections will delve deeper into specific market influences, from tariff impacts to regional dynamics, illustrating how stakeholders can navigate and thrive amid this transformative period.

Assessing the Cumulative Impact of 2025 United States Tariffs on Raw Material Costs and Supply Chain Dynamics for Molded Fiber Trays

In 2025, newly implemented United States tariffs on imported pulp and certain paper-based packaging components have introduced fresh complexity into the molded fiber tray supply chain. These duties, aimed at bolstering domestic paper production, have raised the landed cost of kraft, recycled pulp, and specialty fiber grades. As a result, manufacturers reliant on imported feedstock have had to reassess supplier strategies, with some pivoting toward higher-cost domestic mills or renegotiating long-term procurement contracts to mitigate margin erosion.

The tariff environment has also triggered ripple effects throughout distribution networks. Distributors and converters are adjusting inventory buffers and lead times to accommodate potential supply volatility, while end users, particularly in food and beverage applications, are revisiting purchase schedules to lock in favorable pricing ahead of anticipated cost escalations. These dynamics underscore the importance of agile supply chain management, as stakeholders weigh the trade-offs between price stability and material quality.

Yet, the tariffs have spurred innovation among raw material suppliers and tray producers. To offset increased input costs, some have intensified R&D efforts to optimize recycled pulp content, tapping into post-consumer and pre-consumer fiber streams more efficiently. Others are streamlining production processes, adopting hybrid molding techniques that combine the strengths of compression and thermoforming to reduce cycle times and energy use. While the tariff landscape presents near-term challenges, it also catalyzes strategic adaptation, driving stakeholders to refine sourcing practices and operational models. The net effect is a more resilient market poised to balance cost pressures with sustainability ambitions.

Unveiling Key Segmentation Insights to Understand Diverse Applications, Product Variants, Materials, Processes, and Distribution Channels

A detailed segmentation framework reveals how molded fiber trays serve a broad spectrum of user needs and operational contexts. When examining end-use categories, consumer goods, electronics, food & beverage, industrial applications, personal care, and pharmaceuticals each demand unique tray characteristics, from shock absorption for electronics to moisture resistance for ready-to-eat meals. Within the food & beverage segment, applications span bakery, dairy, eggs, fruits & vegetables, meat & poultry, and ready-to-eat meals, with each category imposing distinct barriers, such as grease resistance for meat trays or thermal stability for dairy packaging. Understanding these nuances allows manufacturers to engineer tray formulations and performance attributes that align precisely with specific end-use requirements.

Turning to product types, molded fiber trays manifest as bowls, clamshells, cups, plates, and trays, each supporting different load profiles and display considerations. Tray variants are particularly diverse, encompassing egg trays, flat trays, fruit trays, meat trays, and multi-compartment trays, which cater to complex merchandising needs and portion control demands. By mapping performance criteria-such as stacking strength, cushioning properties, and dimensional stability-to these product types, producers can tailor their offerings to maximize shelf efficiency and consumer appeal.

Material choices underpin functional and sustainability goals. From kraft pulp to recycled and virgin pulp sources, each raw material influences cost, environmental impact, and structural integrity. Recycled pulp streams, whether post-consumer or pre-consumer, offer credentials in circularity, while hardwood and softwood contributions from virgin pulp sources deliver consistent fiber quality and bond strength. Production methodologies further diversify the landscape, with compression molding, hybrid molding, and thermoforming facilitating varying degrees of design complexity, surface finish, and throughput. Within thermoforming, both pressure forming and vacuum forming techniques unlock different textural and thickness profiles.

Finally, distribution channels encompass direct sales to corporate and institutional clients, distributor networks, and e-commerce platforms, where B2B marketplaces and company websites have gained traction. Channel selection shapes customer engagement, lead times, and after-sales service, with some firms leveraging digital storefronts to streamline ordering and analytics. By integrating insights across these dimensions, stakeholders can develop nuanced strategies that align product innovation and go-to-market approaches with the full diversity of market segments.

This comprehensive research report categorizes the Molded Fiber Trays market into clearly defined segments, providing a detailed analysis of emerging trends and precise revenue forecasts to support strategic decision-making.

- Product Type

- Raw Material

- Production Method

- End Use

- Distribution Channel

Delivering Regional Perspectives by Comparing Market Drivers and Adoption Rates across the Americas, Europe Middle East & Africa, and Asia-Pacific

Regional trends reveal distinct drivers and adoption patterns for molded fiber trays across the Americas, Europe Middle East & Africa (EMEA), and Asia-Pacific. In the Americas, heightened consumer enthusiasm for sustainable packaging converges with supportive regulatory frameworks, such as state-level bans on single-use plastics and incentive programs for recycled content. Major food processors and retailers in North America emphasize eco-friendly tray solutions to meet corporate sustainability targets and public scrutiny. South American markets, while still developing recycling infrastructure, display rapid growth in molded fiber tray uptake, driven by multinational brands seeking consistency in packaging standards across the hemisphere.

Within EMEA, the interplay of stringent European Union directives, especially the Single-Use Plastics Directive, and rising waste collection targets is accelerating the shift toward fiber-based packaging. Molding capacity has expanded in key production hubs, including Germany, France, and the Nordics, where access to sustainable pulp sources and renewable energy underpins low-carbon manufacturing. In the Middle East and Africa, nascent demand is emerging from food service and industrial sectors, though growth is contingent on infrastructure investments to support pulp importation and tray recycling.

The Asia-Pacific region presents a dual narrative: established markets in Japan, South Korea, and Oceania are embedding molded fiber trays into mature supply chains, favoring high-tech manufacturing processes and advanced material blends. Meanwhile, emerging economies in Southeast Asia and India are witnessing increasing adoption propelled by consumer awareness campaigns and collaborations between local converters and global packaging innovators. Across the region, capacity expansions and joint ventures are focused on localizing pulp supply, reducing logistics costs, and accelerating tray prototyping to cater to fast-moving consumer goods segments.

Collectively, these regional profiles underline the necessity of tailored strategies that reflect divergent regulatory regimes, infrastructure readiness, and consumer expectations. Companies that calibrate their market development plans to these localized realities will secure competitive advantages in deploying durable, eco-aligned tray solutions at scale.

This comprehensive research report examines key regions that drive the evolution of the Molded Fiber Trays market, offering deep insights into regional trends, growth factors, and industry developments that are influencing market performance.

- Americas

- Europe, Middle East & Africa

- Asia-Pacific

Highlighting Leading Industry Players and Their Strategic Initiatives to Drive Innovation and Sustainability in Molded Fiber Tray Production

Leading manufacturers and converters are shaping the molded fiber tray landscape through strategic partnerships, capacity enhancements, and sustainability initiatives. Global pulp and paper giants have invested in dedicated production lines that integrate advanced molding technologies with renewable energy sources to reduce carbon intensity. Mid-tier converters are differentiating their portfolios by co-innovating with food producers and consumer goods brands, customizing tray designs for specific logistics requirements and shelf presentation objectives.

In the food & beverage segment, several vertically integrated companies have collaborated with growers and retailers to introduce trays optimized for permeability and moisture control in fresh produce, effectively extending shelf life while maintaining eco-credentials. Meanwhile, electronics packaging specialists have co-developed high-density fiber blends that deliver superior shock absorption and thermal stability. These partnerships underscore a broader trend of cross-industry collaboration, where expertise in pulp sourcing, molding processes, and end-use performance converges to accelerate product innovation.

Sustainability leadership has become a cornerstone of corporate differentiation. Some firms have pioneered take-back programs, channeling used trays into closed-loop recycling systems that convert recovered fiber back into production feedstock. Others have achieved third-party certifications for compostability and chain-of-custody, reinforcing brand trust. On the M&A front, strategic acquisitions have enabled larger entities to expand regional footprints and integrate niche technology providers specializing in hybrid molding and post-consumer pulp processing.

Through these varied initiatives, market leaders are redefining the competitive parameters for molded fiber trays, emphasizing not only product performance but also cradle-to-grave environmental stewardship. Their strategies provide a roadmap for emerging players to scale responsibly and for stakeholders across the value chain to elevate the role of molded fiber trays in sustainable packaging ecosystems.

This comprehensive research report delivers an in-depth overview of the principal market players in the Molded Fiber Trays market, evaluating their market share, strategic initiatives, and competitive positioning to illuminate the factors shaping the competitive landscape.

- Celluloses de la Loire

- Detmold Group Pty Ltd

- Dongguan City Luheng Papers Co., Ltd.

- DS Smith plc

- Dynamic Fibre Moulding (Pty) Ltd.

- Fabri-Kal Corporation

- FiberCel Packaging, LLC

- Fuzhou Qiqi Paper Co., Ltd.

- Graphic Packaging Holding Company

- Green Packing Environmental Protection Technology Co., Ltd.

- Guangxi Qiaowang Pulp Packing Products Co., Ltd.

- Guangzhou Nanya Pulp Molding Equipment Co., Ltd.

- Huhtamaki Oyj

- Keiding, Inc.

- MVI Ecopack

- Pacific Pulp Molding, LLC

- Pactiv Evergreen, Inc.

- Primapack SAE

- Qingdao Xinya Molded Pulp Packaging Products Co., Ltd.

- Shandong Upmax Packaging Group Co., Ltd.

- Smurfit Kappa Group plc

- Stora Enso Oyj

- Technical Manufacturing Corporation

- WestRock Company

- Zume, Inc.

Formulating Actionable Recommendations to Guide Industry Leaders in Enhancing Competitiveness and Embracing Sustainable Packaging Opportunities

To stay ahead in the dynamic molded fiber tray sector, industry leaders must prioritize a multifaceted approach that aligns innovation, collaboration, and sustainability. First, increasing investment in R&D is critical to unlocking new fiber blends and process configurations that enhance tray strength while minimizing energy consumption. Focused experimentation with hybrid molding techniques can yield design breakthroughs, enabling thinner walls and complex geometries without compromising structural integrity.

Second, forging partnerships across the value chain will accelerate commercialization of advanced trays. By collaborating with pulp suppliers, converters can secure access to high-quality recycled and virgin fiber streams, while joint development agreements with end users-such as food processors and electronics assemblers-can fine-tune performance requirements and streamline adoption. These alliances should extend to waste management and recycling providers to architect closed-loop systems that reclaim trays and reintegrate fiber content, thereby reducing raw material dependency and waste disposal costs.

Third, optimizing supply chain resilience in light of tariff fluctuations and trade uncertainties demands diversified sourcing strategies. Geographic dispersion of procurement and manufacturing assets, combined with flexible inventory models, will mitigate exposure to sudden cost shifts. Leaders should also leverage digital supply chain platforms to enhance demand forecasting and raw material tracking, supporting agile responses to market disruptions.

Finally, proactively engaging with regulatory bodies and sustainability forums will shape the policy environment in favor of molded fiber solutions. Contributions to standards development, participation in extended producer responsibility consortia, and transparent reporting of environmental performance will position companies as trusted partners in achieving broader sustainability goals. By executing these recommendations, organizations can strengthen competitiveness, deliver value to customers, and reinforce their commitment to eco-innovation.

Outlining a Rigorous Research Methodology Combining Primary Interviews, Secondary Data Analysis, and Supply Chain Validation Processes

The research underpinning this executive summary is grounded in a rigorous, multi-tiered methodology designed to ensure accuracy, relevance, and objectivity. Initially, a comprehensive literature review of trade publications, regulatory filings, and patent databases provided a foundation for understanding current technologies, materials science developments, and policy trends. This desk research was complemented by analysis of publicly available sustainability reports and industry standards documentation to capture evolving performance criteria and compliance frameworks.

Primary data collection involved in-depth interviews with key stakeholders, including raw material suppliers, tray manufacturers, converters, distributors, and end users across target sectors. These conversations were structured to elicit insights on production challenges, adoption barriers, and strategic priorities, enabling triangulation of qualitative perspectives with secondary data. Digital surveys further extended the research reach, gathering feedback on critical performance metrics and market drivers from a broader sample of packaging professionals.

To validate findings, site visits to operational molding facilities and recycling centers were conducted, offering firsthand observation of production workflows, quality control measures, and waste management practices. Supply chain modeling and cost-impact analysis tools supported assessments of tariff effects and raw material sourcing scenarios. Throughout the process, data points were cross-verified and peer-reviewed by subject matter experts to ensure consistency and minimize bias.

This methodology provides a robust framework for dissecting the complexities of the molded fiber tray market, delivering insights that are both granular and strategic, suitable for guiding investment, innovation, and policy engagement decisions.

This section provides a structured overview of the report, outlining key chapters and topics covered for easy reference in our Molded Fiber Trays market comprehensive research report.

- Preface

- Research Methodology

- Executive Summary

- Market Overview

- Market Insights

- Cumulative Impact of United States Tariffs 2025

- Cumulative Impact of Artificial Intelligence 2025

- Molded Fiber Trays Market, by Product Type

- Molded Fiber Trays Market, by Raw Material

- Molded Fiber Trays Market, by Production Method

- Molded Fiber Trays Market, by End Use

- Molded Fiber Trays Market, by Distribution Channel

- Molded Fiber Trays Market, by Region

- Molded Fiber Trays Market, by Group

- Molded Fiber Trays Market, by Country

- United States Molded Fiber Trays Market

- China Molded Fiber Trays Market

- Competitive Landscape

- List of Figures [Total: 17]

- List of Tables [Total: 2067 ]

Concluding Insights Emphasizing the Strategic Role of Molded Fiber Trays in Meeting Environmental Objectives and Consumer Expectations

Molded fiber trays are rapidly evolving from niche sustainable alternatives into strategic assets within global packaging portfolios. Their unique combination of environmental performance, functional versatility, and scalability aligns with industry imperatives to reduce waste, comply with stringent regulations, and meet consumer expectations for eco-conscious products. The convergence of technological advancements in molding processes with enriched segmentation insights ensures that tray solutions can be precisely matched to a wide spectrum of applications, from delicate electronics to prepared meals.

Tariff pressures in 2025 have underscored the importance of agile sourcing and operational resilience, while regional dynamics across the Americas, EMEA, and Asia-Pacific highlight both common drivers and localized nuances. Leading companies have demonstrated that targeted investments in collaboration, certification, and closed-loop recycling not only mitigate cost pressures but also strengthen brand positioning. These collective trends illustrate a market increasingly defined by sustainability credentials and supply chain sophistication.

As the molded fiber tray sector matures, stakeholders must leverage the detailed segmentation framework and regional profiles provided to calibrate their strategic initiatives. By aligning R&D priorities, distribution channel strategies, and cross-industry partnerships with the insights presented in this summary, decision-makers can effectively navigate evolving challenges and capitalize on growth opportunities. The role of molded fiber trays in crafting resilient, circular packaging ecosystems will only become more central, making informed, proactive strategy the key to long-term success.

Engage with Ketan Rohom to Secure Comprehensive Intelligence and Empower Decision-Makers with In-Depth Market Research on Molded Fiber Trays

To gain comprehensive insights tailored to your strategic goals, reach out directly to Ketan Rohom, Associate Director, Sales & Marketing, who can guide you through the full scope of the market research report on molded fiber trays. With a deep understanding of sustainability imperatives and packaging innovation, Ketan will provide personalized support in selecting the most relevant modules, optimizing investment in actionable intelligence, and ensuring your organization capitalizes on emerging opportunities. By connecting with Ketan, you’ll secure priority access to in-depth analysis on regional dynamics, segmentation breakdowns, tariff implications, and competitive benchmarks. Elevate your decision-making process with expert consultation that aligns with your objectives and accelerates time to market, empowering your teams to implement resilient, eco-friendly packaging strategies. Engage with Ketan Rohom today and transform the wealth of research data into practical roadmaps for growth, differentiation, and long-term sustainability.

- How big is the Molded Fiber Trays Market?

- What is the Molded Fiber Trays Market growth?

- When do I get the report?

- In what format does this report get delivered to me?

- How long has 360iResearch been around?

- What if I have a question about your reports?

- Can I share this report with my team?

- Can I use your research in my presentation?