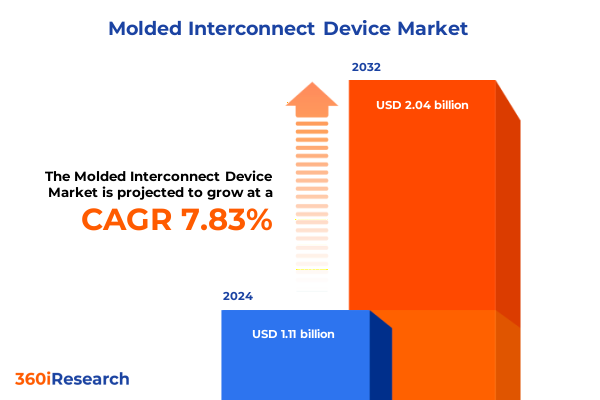

The Molded Interconnect Device Market size was estimated at USD 1.19 billion in 2025 and expected to reach USD 1.28 billion in 2026, at a CAGR of 7.93% to reach USD 2.04 billion by 2032.

Shaping the Path Forward for Molded Interconnect Devices as Convergence of Miniaturization and Smart Manufacturing Accelerates Industry Transformation

The molded interconnect device sector stands at the confluence of mechanical engineering and advanced electronics, forging a new paradigm in circuit integration that is redefining design possibilities across multiple verticals. As miniaturization pressures intensify and demand for lightweight, high-performance assemblies grows, these hybrid structures are transitioning from niche applications to mainstream adoption. This shift is driven by the imperative to embed intelligence directly into plastic substrates, streamlining assembly processes and enabling unprecedented functional density without inflating production complexity.

Against this backdrop, the industry is witnessing accelerated investments in advanced materials science and precision molding techniques that ensure reliability and scalability at high volumes. Leading designers and manufacturers are exploring novel polymer formulations and additive processes to enhance thermal stability and electrical performance. By embedding conductive traces within three-dimensional forms, molded interconnect devices are opening a new frontier for product architects seeking to optimize form factors without sacrificing electronic sophistication. This introduction sets the stage for a deeper exploration of the transformative forces reshaping this dynamic market segment.

How Technological Breakthroughs and Industry 4.0 Adoption Are Rewriting the Landscape of Molded Interconnect Device Applications Worldwide

Technological innovation and digital transformation are intersecting in ways that are fundamentally altering the trajectory of molded interconnect device development. Smart manufacturing platforms, infused with real-time process monitoring and predictive analytics, are enabling unprecedented repeatability and yield improvements. Concurrently, advancements in direct imaging technologies are refining trace resolution, while photolithographic processes are pushing the envelope on feature density and reliability. Together, these breakthroughs are converging to support increasingly complex three-dimensional circuitry that was previously unachievable.

Simultaneously, heightened collaboration between OEMs and specialized material suppliers is fostering co-development efforts that accelerate time to market. These strategic partnerships are geared toward customizing substrate chemistries and optimizing cure cycles to meet exacting performance thresholds. Furthermore, as additive manufacturing techniques gain maturity, they are serving as rapid prototyping enablers, compressing development cycles and fostering iterative design validation. Consequently, organizations are navigating a landscape where agility and cross-disciplinary integration define competitive advantage, as the ecosystem evolves from isolated innovation pockets to a more cohesive network of technology enablers.

Assessing the Far-Reaching Consequences of 2025 United States Tariff Policies on Global Supply Chains and Production Economics of Molded Interconnect Devices

In 2025, the extension and expansion of United States tariff regulations on electronic components have introduced new complexities into the supply chain calculus for molded interconnect devices. Suppliers reliant on imported polymers, catalysts, and specialty metals are recalibrating sourcing strategies in response to increased duties, which are influencing material selection and cost structures. In turn, manufacturers are compelled to evaluate domestic versus offshore production trade-offs, weighing the benefits of nearshoring against the pressures of higher input expenses.

These regulatory shifts are also prompting strategic realignments among global players, as tier-one automotive and aerospace contractors seek to mitigate exposure by diversifying their supplier base. Innovative firms are investing in dual-sourcing frameworks and material substitution research to navigate the evolving tariff landscape. Moreover, the ripple effects extend into logistics networks, with freight forwarders adapting to new routes and customs protocols to optimize lead times. The cumulative impact of these 2025 tariff changes underscores the importance of resilience and flexibility in both procurement and manufacturing planning, as organizations strive to maintain continuity without eroding profit margins.

Unveiling Critical Insights from Segmentation Analyses Highlighting Varied Needs Across Industries Product Types Layers Technologies and Applications of MIDs

Analysis based on end user industries reveals unique demand patterns in aerospace & defense, automotive, consumer electronics, industrial, and medical sectors. In aerospace & defense, the emphasis on weight reduction and high-reliability performance has driven adoption of multi-layer, rigid-flex devices that can withstand demanding environmental stresses. Within automotive applications, manufacturers are prioritizing heat dissipation and signal integrity, leveraging direct imaging techniques on single-layer substrates for advanced driver-assistance systems and in-cabin connectivity. Consumer electronics continue to push the boundaries of miniaturization, relying on flexible configurations to integrate display and sensor modules directly into housing structures. Industrial automation environments are increasingly utilizing photolithographic processes for robust, high-density circuitry that can endure vibration and temperature fluctuations. Meanwhile, medical device designers are applying both single-layer and multi-layer rigid-flex solutions to facilitate sterilizable, compact assemblies for monitoring and diagnostic equipment.

When examining product types, flexible substrates excel in applications where conformality and motion tolerance are paramount, while rigid and rigid-flex alternatives offer structural stability for hybrid use cases. Layer count differentiation further informs design decisions, with multi-layer constructs enabling greater routing complexity and single-layer boards offering cost and assembly advantages. Direct imaging approaches are selected for their ability to produce precise conductive paths without significant tooling lead times, whereas photolithographic techniques remain essential for high-volume production of intricate pattern geometries. Across applications including EMI shielding, heat dissipation, miniaturization, and weight reduction, segmentation based on end-use and performance criteria is guiding targeted innovation efforts. Sales channel dynamics also play a critical role: OEM partnerships foster collaborative product development, and aftermarket channels drive rapid prototyping and customization services. This integrated segmentation perspective illuminates how diverse requirements and technology enablers intersect to steer the evolution of molded interconnect device offerings.

This comprehensive research report categorizes the Molded Interconnect Device market into clearly defined segments, providing a detailed analysis of emerging trends and precise revenue forecasts to support strategic decision-making.

- Product Type

- Layer Count

- Technology

- End User Industry

- Application

- Sales Channel

Decoding Regional Dynamics Revealing Distinct Drivers Opportunities and Challenges for Molded Interconnect Devices Across Americas EMEA and Asia-Pacific

Regional variation exerts a profound influence on the molded interconnect device market, as local manufacturing strengths, regulatory regimes, and end-industry concentrations shape demand trajectories. In the Americas, a robust automotive sector combined with a growing pipeline of aerospace modernization initiatives is fueling investments in advanced integration techniques. North American suppliers are capitalizing on skilled labor pools and proximity to key OEMs, while Latin American production hubs are emerging as cost-competitive alternatives for certain polymer-based services.

In Europe, the Middle East & Africa, stringent regulatory standards and a legacy of precision manufacturing have established a strong foothold for high-reliability applications, particularly within defense and medical segments. Collaborative clusters across Germany, the United Kingdom, and France are driving material innovation, while Middle Eastern investments in electronics infrastructure are creating new opportunities for local and regional partnerships.

Across Asia-Pacific, the convergence of expansive consumer electronics manufacturing platforms and government-driven incentives for advanced materials research has positioned the region at the forefront of flexible and rigid-flex adoption. China, South Korea, and Japan remain pivotal in pushing throughput and yield enhancements, while Southeast Asian nations are garnering attention for niche capabilities in direct imaging and prototyping services. This regional tapestry underscores how local ecosystems, policy frameworks, and industrial priorities coalesce to define differentiated opportunity sets for molded interconnect device providers worldwide.

This comprehensive research report examines key regions that drive the evolution of the Molded Interconnect Device market, offering deep insights into regional trends, growth factors, and industry developments that are influencing market performance.

- Americas

- Europe, Middle East & Africa

- Asia-Pacific

Profiling Leading Innovators and Strategic Collaborators Shaping the Molded Interconnect Devices Market with Cutting-Edge Technologies and Partnership Models

A constellation of established players and agile newcomers is shaping the competitive environment for molded interconnect devices. Global connectors and cable specialists have extended their portfolios, integrating in-house molding capabilities to offer turnkey solutions that span design, prototyping, and volume manufacturing. These incumbents are leveraging long-standing relationships with automotive and aerospace OEMs to cross-sell advanced MID applications.

At the same time, focused material innovators are collaborating with precision injection molders to co-develop proprietary substrate formulations that deliver improved thermal conductivity and mechanical resilience. These partnerships are accelerating the commercialization of next-generation devices that support higher data rates and more stringent environmental tolerances. Meanwhile, emerging technology-driven startups are introducing software-led process controls and machine learning algorithms to optimize trace deposition and reduce scrap rates. Collectively, these companies are forging a landscape where vertical integration, strategic alliances, and digital enablement converge to drive differentiation and capture value across the MID ecosystem.

This comprehensive research report delivers an in-depth overview of the principal market players in the Molded Interconnect Device market, evaluating their market share, strategic initiatives, and competitive positioning to illuminate the factors shaping the competitive landscape.

- Aptiv PLC

- Cicor Technologies Ltd

- Ficosa International S.A.

- Hella GmbH & Co. KGaA

- Hitachi Chemical Co., Ltd.

- Jenoptik AG

- Kyocera Corporation

- LPKF Laser & Electronics AG

- Molex LLC

- Murata Manufacturing Co., Ltd.

- Panasonic Corporation

- RTP Company

- Schaeffler Technologies AG & Co. KG

- TE Connectivity Ltd.

- Würth Elektronik eiSos GmbH & Co. KG

Actionable Strategic Initiatives for Industry Leaders to Capitalize on Emerging Trends and Navigate Regulatory and Technological Complexities in MIDs

Industry leaders seeking to harness the full potential of molded interconnect devices should prioritize establishing cross-functional teams that integrate electrical design, polymer chemistry, and manufacturing engineering expertise. By embedding these disciplines early in the product development cycle, organizations can mitigate downstream integration bottlenecks and accelerate time to market. Furthermore, cultivating partnerships with specialized material suppliers enables iterative testing of novel substrate blends, empowering teams to fine-tune thermal and electrical properties in alignment with application-specific requirements.

In parallel, executives should evaluate the implementation of digital twins and advanced analytics within molding operations to achieve real-time visibility into process performance. Such investments not only enhance yield and throughput but also provide the data foundation for predictive maintenance programs. On the supply chain front, proactive tariff impact assessments and dual-sourcing strategies can safeguard against regulatory volatility. Finally, fostering open innovation forums with key customers and research institutions can uncover adjacent applications and co-innovation pathways, ensuring that molded interconnect device offerings remain at the vanguard of emerging technological demands.

Rigorous Research Methodology Underpinning Comprehensive Market Intelligence Combining Primary Engagements Secondary Analyses and Advanced Data Synthesis Techniques

This analysis integrates a multi-tiered research framework combining direct expert engagements, proprietary secondary data synthesis, and advanced qualitative analysis techniques. Primary insights were derived from in-depth interviews with design engineers, materials scientists, and supply chain executives across leading end-user industries, ensuring coverage of both strategic imperatives and operational challenges. Secondary sources encompassed peer-reviewed journals, trade publications, and patent filings, facilitating trend validation and technology assessment.

Quantitative validation was achieved through structured surveys targeting procurement and engineering functions within OEMs and contract manufacturers, designed to triangulate subjective perspectives with observed adoption patterns. Furthermore, rigorous cross-verification protocols were applied to reconcile divergent viewpoints and eliminate bias. The research methodology also incorporated scenario-based stress testing to evaluate supply chain resilience under variable tariff and regulatory environments, as well as sensitivity analysis to identify critical parameters influencing material selection and process performance. This comprehensive approach underpins the robustness of the findings and the relevance of the actionable insights provided.

This section provides a structured overview of the report, outlining key chapters and topics covered for easy reference in our Molded Interconnect Device market comprehensive research report.

- Preface

- Research Methodology

- Executive Summary

- Market Overview

- Market Insights

- Cumulative Impact of United States Tariffs 2025

- Cumulative Impact of Artificial Intelligence 2025

- Molded Interconnect Device Market, by Product Type

- Molded Interconnect Device Market, by Layer Count

- Molded Interconnect Device Market, by Technology

- Molded Interconnect Device Market, by End User Industry

- Molded Interconnect Device Market, by Application

- Molded Interconnect Device Market, by Sales Channel

- Molded Interconnect Device Market, by Region

- Molded Interconnect Device Market, by Group

- Molded Interconnect Device Market, by Country

- United States Molded Interconnect Device Market

- China Molded Interconnect Device Market

- Competitive Landscape

- List of Figures [Total: 18]

- List of Tables [Total: 1113 ]

Concluding Perspectives Synthesizing Key Findings Insights and Implications to Guide Stakeholders in the Evolving Molded Interconnect Device Ecosystem

In synthesizing the key findings, it is evident that molded interconnect devices are on the cusp of widespread integration across high-value industries, driven by imperatives for miniaturization, thermal management, and functional consolidation. Technological progress in imaging and photolithography, coupled with digital manufacturing practices, is catalyzing design innovation and production efficiency. At the same time, evolving tariff landscapes are introducing new considerations for supply chain agility and cost optimization.

Segment-specific insights underscore the need for tailored material and process strategies, whether catering to the stringent reliability demands of aerospace applications or the rapid innovation cycles of consumer electronics. Regionally, differentiated manufacturing capabilities and regulatory contexts create a mosaic of opportunities that require localized go-to-market approaches. Competitive dynamics reveal that success will hinge on the ability to forge strategic partnerships, invest in process digitalization, and proactively address regulatory shifts. Altogether, these conclusions serve as a strategic compass for stakeholders aiming to navigate the evolving molded interconnect device ecosystem with confidence and precision.

Engage Directly with Leadership to Unlock Comprehensive Molded Interconnect Device Market Insights and Propel Strategic Decision Making Today

To delve deeper into the strategic opportunities and practical applications emerging within the Molded Interconnect Device domain, reach out to Ketan Rohom, Associate Director of Sales & Marketing, for guidance on securing a comprehensive research report tailored to your organization’s needs. His expertise can help align your innovation roadmap with the most critical trends and supply chain considerations shaping today’s competitive landscape. Don’t miss the opportunity to leverage in-depth analysis, expert interviews, and actionable recommendations to inform your next strategic move in this rapidly evolving market.

- How big is the Molded Interconnect Device Market?

- What is the Molded Interconnect Device Market growth?

- When do I get the report?

- In what format does this report get delivered to me?

- How long has 360iResearch been around?

- What if I have a question about your reports?

- Can I share this report with my team?

- Can I use your research in my presentation?