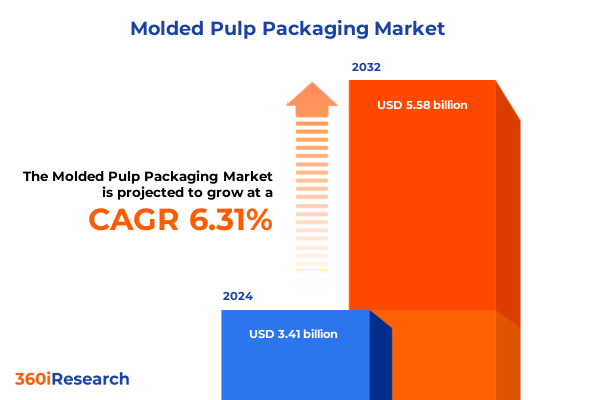

The Molded Pulp Packaging Market size was estimated at USD 3.56 billion in 2025 and expected to reach USD 3.71 billion in 2026, at a CAGR of 6.63% to reach USD 5.58 billion by 2032.

Discover How Molded Pulp Packaging Is Revolutionizing Sustainable Packaging Strategies to Address Environmental Goals and Consumer Expectations

Molded pulp packaging stands at the intersection of environmental stewardship and functional design, emerging as a vital solution for industries seeking to reduce their ecological footprint. As companies and consumers alike intensify their focus on circular economy principles, molded pulp products have transcended basic protective uses to become a hallmark of eco-conscious differentiation. Using fibers derived from recycled or virgin pulp, manufacturers craft biodegradable bowls, trays, cups, and clamshells that meet rigorous performance standards while minimizing waste. Consequently, this sustainable packaging format is gaining traction across sectors as diverse as food service, electronics, healthcare, and consumer goods.

In recent years, stringent regulations targeting single-use plastics have accelerated adoption of molded pulp alternatives, driving innovation in molding processes and fiber formulations. Advances in dry molding, wet molding, and thermoformed techniques have enhanced product durability and complexity, enabling seamless integration into automated filling and sealing lines. Moreover, leading consumer brands are leveraging molded pulp packaging to communicate environmental commitments and align with evolving corporate social responsibility mandates. As sustainability transitions from a niche concern to a mainstream imperative, molded pulp solutions will play an increasingly prominent role in shaping packaging portfolios and brand narratives.

Examining the Key Sustainability, Regulatory, and Technological Shifts Propelling Molded Pulp Packaging to the Forefront of Modern Packaging

The molded pulp packaging landscape has undergone transformative shifts driven by sustainability commitments and technological breakthroughs. Heightened consumer awareness regarding plastic pollution has prompted legislative initiatives worldwide to restrict non-recyclable materials, catalyzing the pursuit of biodegradable packaging formats. Consequently, research into fiber blends, barrier coatings, and hybrid structures has surged, resulting in innovative clamshell designs for food service, precision-molded trays for electronics, and hygienic solutions for medical applications.

Simultaneously, digitalization is redefining manufacturing processes. Automation and real-time process monitoring have optimized cycle times and reduced waste, allowing manufacturers to respond swiftly to custom design requirements and fluctuating demand. Thermoforming and wet molding techniques have matured, offering enhanced resolution in intricate shapes and increased resistance to moisture. Partnerships between packaging producers and machinery suppliers have further accelerated development of integrated production lines, ensuring scalability and consistency in quality. Altogether, these trends underscore a packaging sector in transition where sustainability, efficiency, and adaptability converge.

Assessing the Far-Reaching Consequences of New U.S. Tariff Measures on Molded Pulp Packaging Supply Chains, Costs, and Market Dynamics

U.S. trade policy in 2025 has introduced a baseline 10% tariff on all imported goods, effective April 5, 2025, establishing a uniform cost floor across supply chains. In parallel, a series of reciprocal tariffs were implemented on select countries with significant trade deficits, including China, the European Union, Vietnam, Japan, South Korea, India, Taiwan, and Thailand. While these individualized rates briefly escalated-reaching as high as 125% for certain Chinese imports-they were later reverted to the baseline 10% for a ninety-day period, illustrating the volatility of tariff structures and the challenges of compliance in a dynamic policy environment.

Beyond this baseline framework, the Administration imposed a 25% tariff on all imports from Canada and Mexico under national security authorities, with a temporary pause applied to non-energy goods after preliminary negotiations. Concurrently, an additional 10% tariff on Chinese goods was enacted on February 4, intensifying cost pressures on raw material imports. Industry stakeholders voiced concerns that these measures threaten the complex, cross-border supply chains that underpin pulp and paper manufacturing in the U.S.

For the molded pulp packaging segment, tariffs on bleached hardwood pulp from major suppliers such as Brazil have introduced new uncertainties. Suzano SA highlighted that transport disruptions and elevated duties have already contributed to a 20% year-over-year decline in U.S.-bound Brazilian pulp exports in April, threatening the steady flow of fiber essential for food service containers, egg trays, and electronics packaging.

Looking ahead, these tariff measures are expected to reshape sourcing strategies and inventory management. Manufacturers are evaluating regional supply alternatives, bolstering domestic production capacities, and establishing strategic stockpiles to guard against future policy shifts. In doing so, the industry aims to achieve a balance between cost stability and supply chain resilience, leveraging innovation in material sourcing and process optimization to mitigate the impacts of trade volatility.

Uncovering Multifaceted Segmentation Dynamics in Molded Pulp Packaging Including Products, End Uses, Materials, Processes, and Distribution Channels

Segmentation analysis of the molded pulp packaging market reveals a tapestry of product applications and material choices driving tailored solutions. The product type spectrum extends from simple bowls to sophisticated clamshells, cups, and trays, each demanding unique design considerations; clamshell variants address electronics protection, food service presentation, and sterile medical packaging, while tray formats accommodate beverage holders, egg cartons, and fruit and vegetable transport. Segmentation by end use further highlights the versatility of molded pulp offerings, as consumer goods applications branch into home care and personal care, electronics require precision shock absorption, food service channels span full service restaurants to institutional catering and quick service outlets, and healthcare demands hygienic and compliant packaging.

Material type segmentation underscores the critical balance between sustainability and performance. Recycled pulp leads the drive toward circular resource use, while virgin pulp provides consistency and strength for high-barrier requirements. Processing methods introduce additional differentiation: dry molded techniques enable intricate detail and rapid cycle times, thermoformed solutions deliver rigidity and moisture resistance, and wet molded approaches offer cost efficiency for large-volume, less complex shapes. Finally, distribution channels range from direct sales that foster close customer collaboration to distributor networks that ensure broad geographic reach and logistical support. Together, these segmentation layers form a dynamic matrix guiding strategic product development and go-to-market decision making.

This comprehensive research report categorizes the Molded Pulp Packaging market into clearly defined segments, providing a detailed analysis of emerging trends and precise revenue forecasts to support strategic decision-making.

- Product Type

- Material Type

- Manufacturing Process

- End Use

- Distribution Channel

Mapping Regional Growth Drivers and Challenges for Molded Pulp Packaging Across the Americas, Europe Middle East & Africa, and Asia-Pacific

Regional markets for molded pulp packaging each exhibit distinct drivers that shape growth trajectories. In the Americas, strong demand from food service giants and rapid expansion of e-commerce fulfillments have fueled adoption of sustainable trays, clamshells, and protective inserts. Investments in domestic molding capacity and supportive government incentives for circular materials underscore the region’s momentum. Conversely, the Europe, Middle East & Africa region grapples with a complex regulatory landscape where stringent single-use plastic bans and packaging waste directives are driving manufacturers toward locally produced molded pulp alternatives, with particular emphasis on recycled fiber solutions and lightweight designs tailored to logistic networks.

Meanwhile, the Asia-Pacific market stands out for its robust manufacturing base and surging consumer markets. Rapid urbanization, expanding quick service restaurant networks, and rising disposable incomes have spurred demand for molded pulp packaging in food delivery and retail applications. Regional players are investing in production scale-up and advanced wet molding technologies to meet volume requirements, while cross-border trade agreements and tariff considerations continue to influence sourcing models. Across these regions, tailored approaches to material sourcing, process selection, and regulatory compliance dictate the competitive landscape and dictate strategic investment priorities.

This comprehensive research report examines key regions that drive the evolution of the Molded Pulp Packaging market, offering deep insights into regional trends, growth factors, and industry developments that are influencing market performance.

- Americas

- Europe, Middle East & Africa

- Asia-Pacific

Profiling Industry Leaders and Innovative Players Driving Advancements in Molded Pulp Packaging Through Strategic Initiatives and Collaborations

Major corporations and emerging innovators alike are shaping the molded pulp packaging industry through targeted strategies and technological leadership. Global leaders have leveraged scale and research and development investments to deliver sustainable portfolios across multiple sectors. They collaborate closely with multinational brands in food service and consumer goods to co-design premium pulp structures that meet precise performance and aesthetic requirements. At the same time, agile regional players capitalize on local market insights and flexible manufacturing footprints to offer customized runs for niche applications, including medical-grade clamshells and heavy-duty electronics trays.

Strategic partnerships and acquisitions are reshaping the competitive environment. Industry frontrunners are securing integrated supply chains by investing in fiber mills and digital molding lines, while startups bring forth novel pulp blends and barrier coatings that enhance moisture resistance and thermal insulation. This confluence of scale, specialization, and innovation fosters a dynamic ecosystem where emerging wastes to raw materials initiatives and automation breakthroughs accelerate time-to-market. Collectively, these companies are driving down costs, elevating quality standards, and redefining sustainability benchmarks for molded pulp packaging.

This comprehensive research report delivers an in-depth overview of the principal market players in the Molded Pulp Packaging market, evaluating their market share, strategic initiatives, and competitive positioning to illuminate the factors shaping the competitive landscape.

- Better Earth LLC

- DS Smith PLC

- Eco-pliant Products Inc.

- Eco-Products, Inc.

- Environmental Packaging Public Company Limited

- EnviroPAK Corporation

- Eurasia United Equipment Group Co., Ltd.

- Good Start Packaging

- Green Paper Products

- Henry Molded Products Inc.

- Huhtamäki Oyj

- International Paper Company

- KINYI Technology Limited

- MFT-CKF, Inc.

- Omni-Pac Group

- OrCon Industries

- Pacific Pulp Molding, Inc.

- Pactiv Evergreen Inc.

- PrimeWare

- Protopak Engineering Corporation

- Sabert Corporation

- Sonoco Products Company

- Tekni-Plex, Inc.

- WestRock Company

Strategic Actions Industry Leaders Can Implement to Capitalize on Sustainability Trends, Mitigate Trade Risks, and Enhance Competitive Positioning

To thrive in this evolving environment, industry leaders should prioritize a series of strategic actions. Establishing resilient supply chains through dual sourcing of recycled and virgin pulp will help mitigate tariff and raw material price fluctuations. Investing in advanced digital molding technologies will enhance production flexibility, allowing rapid switching between formats such as trays, cups, and clamshells without extensive downtime. Furthermore, deepening collaborative partnerships with food service operators, electronics manufacturers, and healthcare providers will enable co-creation of application-specific solutions that meet stringent performance and regulatory demands.

Simultaneously, companies must double down on sustainability by increasing the share of recycled inputs and pursuing certifications that validate compostability and recyclability. Developing closed-loop programs with end customers can generate feedstock for new pulp production while strengthening brand alignment with environmental priorities. Finally, monitoring geopolitical developments and engaging with trade associations will be essential to anticipate policy shifts, advocate for industry-friendly regulations, and adapt proactively. Adopting these integrated strategies will position industry leaders to capitalize on growth opportunities and maintain competitive advantage in the fast-shifting molded pulp packaging market.

Detailing Rigorous Research Approaches and Analytical Frameworks Underpinning the Comprehensive Study of the Molded Pulp Packaging Market

This research is grounded in a rigorous methodology that synthesizes primary and secondary data through a structured, multi-stage approach. Initially, an exhaustive review of industry publications, government regulations, corporate disclosures, and trade association reports provided a foundational understanding of market drivers, regulatory frameworks, and technological innovations. Secondary inputs were then validated through in-depth interviews with key stakeholders, including packaging engineers, procurement leaders, regulatory experts, and sustainability officers, ensuring practical perspectives on emerging trends and operational realities.

Quantitative analyses employed both top-down and bottom-up techniques to segment the market across product types, end uses, material inputs, manufacturing processes, and distribution channels. Cross-verification of data points from financial statements, import/export customs databases, and industry surveys strengthened the accuracy of insights. Finally, comprehensive expert workshops facilitated scenario analysis, stress-testing potential tariff impacts and regional growth trajectories. This methodological rigor ensures the reliability of findings and supports informed decision making for industry participants.

This section provides a structured overview of the report, outlining key chapters and topics covered for easy reference in our Molded Pulp Packaging market comprehensive research report.

- Preface

- Research Methodology

- Executive Summary

- Market Overview

- Market Insights

- Cumulative Impact of United States Tariffs 2025

- Cumulative Impact of Artificial Intelligence 2025

- Molded Pulp Packaging Market, by Product Type

- Molded Pulp Packaging Market, by Material Type

- Molded Pulp Packaging Market, by Manufacturing Process

- Molded Pulp Packaging Market, by End Use

- Molded Pulp Packaging Market, by Distribution Channel

- Molded Pulp Packaging Market, by Region

- Molded Pulp Packaging Market, by Group

- Molded Pulp Packaging Market, by Country

- United States Molded Pulp Packaging Market

- China Molded Pulp Packaging Market

- Competitive Landscape

- List of Figures [Total: 17]

- List of Tables [Total: 1590 ]

Synthesis of Critical Findings Demonstrating How Molded Pulp Packaging Trends Are Shaping Future Industry Trajectories and Stakeholder Decisions

The accelerated shift toward sustainable packaging, bolstered by regulatory mandates and consumer preferences, has elevated molded pulp solutions as a mainstream alternative to conventional materials. Innovations in manufacturing processes and fiber technologies have expanded application scopes from protective trays in electronics to hygienic clamshells in healthcare. Meanwhile, evolving U.S. trade policies and global tariff adjustments have introduced supply chain complexities that underscore the importance of agile sourcing and production flexibility. Regional dynamics-from the Americas’ e-commerce boom to EMEA’s regulatory rigor and Asia-Pacific’s manufacturing scale-remain critical factors influencing market trajectories.

Collectively, these insights paint a compelling picture of an industry at the cusp of transformation, where sustainability imperatives and technological advancements converge. Stakeholders who harness the detailed segmentation intelligence, regional nuances, and strategic recommendations outlined in this study will be well-positioned to navigate uncertainties and capture emerging opportunities. By aligning innovation initiatives with resilient supply chain designs, companies can secure a competitive advantage and drive the next wave of growth in molded pulp packaging.

Connect with Ketan Rohom to Secure Your Comprehensive Molded Pulp Packaging Market Report and Empower Your Strategic Planning Initiatives

Elevate your decision-making capabilities by securing the detailed market research report on molded pulp packaging directly from our Associate Director, Sales & Marketing. By engaging with Ketan Rohom, you will gain access to comprehensive analyses that span sustainability trends, tariff impacts, regional growth dynamics, and competitive landscapes. This report delivers critical insights designed to inform strategic investments, optimize supply chain resilience, and capture emerging market opportunities. Reach out to Ketan Rohom to arrange a personalized briefing, obtain a tailored proposal, and unlock exclusive data sets that will empower your organization’s strategic planning and drive measurable business outcomes.

- How big is the Molded Pulp Packaging Market?

- What is the Molded Pulp Packaging Market growth?

- When do I get the report?

- In what format does this report get delivered to me?

- How long has 360iResearch been around?

- What if I have a question about your reports?

- Can I share this report with my team?

- Can I use your research in my presentation?