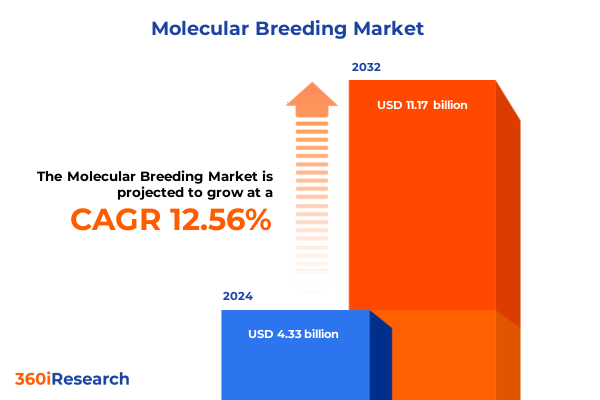

The Molecular Breeding Market size was estimated at USD 4.87 billion in 2025 and expected to reach USD 5.45 billion in 2026, at a CAGR of 12.59% to reach USD 11.17 billion by 2032.

Emerging molecular breeding breakthroughs are reshaping agricultural practices to accelerate crop improvement and ensure global food security

The evolution of molecular breeding represents a pivotal chapter in modern agriculture, where technological sophistication converges with the pressing imperative of feeding a growing world population. Over the past decade, breakthroughs in genomic tools have enabled researchers to decipher complex trait architectures and accelerate the pace of varietal development. This section explores how innovations such as marker-assisted selection, genomic selection and emerging gene editing platforms are coalescing to redefine crop improvement.

As these methodologies mature, they are increasingly deployed to target complex traits that were once resistant to conventional breeding, including tolerance to abiotic stressors like drought and salinity. A convergence of high-throughput sequencing, precision phenotyping and machine learning-driven predictive models has forged a seamless pipeline from trait discovery to field deployment. Consequently, breeding cycles that previously required years can now be completed in a fraction of the time, catalyzing a new era of responsiveness to environmental and market demands.

Moreover, public and private sector collaborations are proliferating, fostering the exchange of germplasm, data and proprietary technologies. This collaborative ethos has expanded the horizons of molecular breeding beyond traditional staple crops, empowering initiatives in specialty fruits, vegetables and under-utilized pulses. By situating these advances within the broader context of sustainability and resilience, stakeholders are charting a course toward agricultural systems that can thrive amid climate volatility and shifting consumer preferences.

Rapid integration of genomic selection, gene editing and high-throughput phenotyping is redefining the molecular breeding landscape with unprecedented efficiency

The landscape of molecular breeding has undergone transformative shifts driven by the integration of next-generation sequencing, CRISPR-based gene editing and automated phenotyping platforms. Genomic selection, once limited by cost and computational constraints, is now scaled across breeding programs to predict performance outcomes with remarkable accuracy. At the same time, CRISPR technologies have transitioned from proof of concept to field applications, enabling precise editing of key regulatory genes without introducing foreign DNA.

Simultaneously, advanced phenotyping infrastructures equipped with imaging sensors, hyperspectral cameras and robotics have unlocked the capacity to quantify complex traits at scale. These platforms deliver multidimensional data on plant growth, physiological responses and developmental dynamics, which feed into machine learning algorithms to refine selection criteria. This synergy between data generation and analytic rigor is dismantling bottlenecks that have historically slowed varietal release timelines.

In parallel, cloud-based bioinformatics ecosystems are facilitating real-time collaboration among geographically dispersed research teams. Secure data repositories, integrated visualization tools and modular analytical pipelines are democratizing access to high-value genomic insights. As a result, the molecular breeding ecosystem is shifting from siloed projects to interconnected networks focused on cross-institutional innovation, further compressing the time from discovery to deployment.

Cumulative impact of escalating US agricultural tariffs is reshaping molecular breeding supply chains, driving cost pressures and strategic sourcing

In 2025, cumulative US tariff measures on imported seeds, reagents and laboratory equipment have introduced significant cost pressures across molecular breeding workflows. Tariffs affecting primary consumables such as DNA extraction kits and specialized reagents have elevated input expenses, prompting laboratories to renegotiate supplier contracts and explore alternate sourcing channels. This cost inflation has particularly impacted large-scale genotyping initiatives that rely on high-volumes of consumables.

On the equipment front, duties imposed on imported microarray scanners, PCR systems and next-generation sequencers have led breeders to extend depreciation cycles and prioritize in-country service agreements to mitigate capital expenditures. As a direct consequence, some programs have deferred expansion of phenotyping facilities, while others have accelerated adoption of in-house instrument manufacturing partnerships to circumvent tariff barriers.

The strategic ripple effects are also evident in the procurement of digital platforms. Software licenses for bioinformatics tools and data analysis suites have seen negotiated renewals tied to bundled service contracts, enabling end users to lock in predictable pricing despite the external tariff environment. These adaptations underscore the resilience of the molecular breeding sector in maintaining continuity of research operations while navigating an increasingly complex trade landscape.

In-depth segmentation analysis reveals crop specific molecular breeding demands, diverse product channel dynamics and end user application priorities

Delineating the molecular breeding market by crop type reveals that staple cereals continue to command the largest share of research efforts, driven by global food security imperatives. Yet, the expansion into fruits and vegetables is gaining momentum, as consumer demand for nutritional quality and novel varieties intensifies. Oilseeds remain a critical focus for biofuel and industrial feedstock applications, while pulses are emerging as prioritized targets for improved protein content and climate resilience.

When viewed through the lens of product type, the ecosystem extends from fundamental consumables-including kits designed for DNA and RNA preparation and reagents formulated for high-precision assays-to sophisticated instruments such as microarray scanners, polymerase chain reaction systems and high-throughput sequencers. Complementing these are service offerings that span both genotyping and phenotyping, supported by software solutions ranging from specialized bioinformatics tools to comprehensive data analysis platforms.

End users encompass a diverse spectrum of biotechnology firms focused on commercial trait development, public and private research institutions advancing foundational breeding science, and seed companies intent on translating molecular insights into superior commercial hybrids and varieties. Across applications, the technology is deployed to enhance disease resistance by identifying and stacking resistance genes, to improve stress tolerance by targeting drought and salinity adaptation pathways, and to drive yield enhancement through the dissection and selection of yield-related quantitative trait loci.

This comprehensive research report categorizes the Molecular Breeding market into clearly defined segments, providing a detailed analysis of emerging trends and precise revenue forecasts to support strategic decision-making.

- Crop Type

- Product Type

- End User

- Application

Regional disparities underscore Americas leadership, Europe Middle East & Africa collaborative innovation hubs and Asia-Pacific tailored molecular breeding adoption pathways

Regional dynamics in molecular breeding underscore a leadership position for the Americas, where robust investment in genomic infrastructure and advanced breeding platforms is concentrated in North and South America. The United States and Brazil, in particular, have established integrated research networks that leverage private-public partnerships and cutting-edge phenotyping facilities, fueling high-throughput breeding pipelines and early commercial launches.

In Europe, Middle East & Africa, a collaborative environment driven by pan-European research consortia and precision agriculture initiatives has fostered innovation hubs across France, Germany and the Netherlands, while emerging programs in the Middle East and Africa target region-specific challenges such as heat stress and salinity tolerance. These efforts are supported by regulatory frameworks that balance innovation incentives with oversight of gene editing applications.

The Asia-Pacific region is characterized by rapid adoption of molecular breeding techniques to address both staple crop productivity and the diversification of horticultural portfolios. Major programs in China, India and Australia are integrating high-density genotyping platforms with advanced phenomics, often in collaboration with international technology providers, to accelerate the delivery of improved varieties suited to local agroecological zones.

This comprehensive research report examines key regions that drive the evolution of the Molecular Breeding market, offering deep insights into regional trends, growth factors, and industry developments that are influencing market performance.

- Americas

- Europe, Middle East & Africa

- Asia-Pacific

Leading molecular breeding providers forge strategic alliances, expand technology portfolios and integrate service models to drive competitive differentiation

Leading providers in the molecular breeding arena are engaging in strategic alliances with technology innovators, academic institutions and agribusiness partners to broaden their service portfolios. Several key players have expanded their capabilities through acquisitions of specialty bioinformatics startups, integrating powerful analytics tools that enhance data interpretation and decision support.

Concurrently, tier-one agri-biotech firms are investing in next-generation sequencing platforms and phenotyping centers to establish vertically integrated breeding pipelines, ensuring end-to-end control over sample preparation, data generation and trait validation. These companies are also forging contracts with service labs to offer turnkey genotyping and phenotyping packages, catering to research institutions and seed developers seeking rapid, scalable solutions.

Moreover, collaborations between instrument manufacturers and bioinformatics software vendors are yielding bundled offerings that simplify deployment for end users. By delivering combined hardware-software ecosystems with embedded analytics workflows, these partnerships reduce implementation barriers and accelerate time to actionable insights, reinforcing platform loyalty among research stakeholders.

This comprehensive research report delivers an in-depth overview of the principal market players in the Molecular Breeding market, evaluating their market share, strategic initiatives, and competitive positioning to illuminate the factors shaping the competitive landscape.

- Agilent Technologies, Inc.

- BASF SE

- Bayer AG

- Charles River Laboratories International Inc.

- Cibus

- Corteva Agriscience

- CRISPR Therapeutics AG

- DanBred P/S

- Eurofins Scientific SE

- GenScript Biotech Corporation

- GRA&GREEN Inc.

- Heritable Agriculture

- HORIZON DISCOVERY GROUP PLC

- Illumina, Inc.

- Inari

- Intertek Group plc

- Keygene N.V.

- LemnaTec GmbH

- LGC Limited

- Merck KGaA

- Mol Breeding

- SGS S.A.

- Syngenta AG

- Thermo Fisher Scientific Inc.

- VNR Seeds

Industry leaders must prioritize investment in cutting-edge genomic platforms, foster cross sector collaborations and align with regulatory frameworks

To maintain momentum in molecular breeding, industry leaders should prioritize capital allocation toward cutting-edge genomic platforms that deliver speed and precision. By investing in high-density genotyping and CRISPR editing infrastructure, organizations can shorten development cycles and gain first-mover advantages in trait release.

Furthermore, fostering cross sector collaborations-linking academic research, biotechnology firms and seed enterprises-will be essential to share risk, pool resources and leverage complementary expertise. These partnerships can catalyze the co-development of trait pipelines and facilitate the translation of academic breakthroughs into commercial products.

Simultaneously, aligning R&D strategies with evolving regulatory frameworks will mitigate approval delays and ensure compliance with global gene editing guidelines. Proactive engagement with policy bodies and transparent data sharing can smooth the path for novel breeding technologies and safeguard stakeholder confidence throughout the commercialization process.

Comprehensive methodology leveraging expert interviews, secondary data analysis and advanced models underpins molecular breeding insights

Our analysis is grounded in a rigorous methodology that synthesizes primary insights from interviews with leading molecular breeders, technology providers and regulatory experts. This primary research was complemented by comprehensive secondary analysis of peer-reviewed literature, patent filings and industry white papers to validate emerging trends and innovation trajectories.

Advanced data models were employed to integrate multidimensional data streams, including sequence datasets, phenotypic measurements and regulatory policy developments. These models facilitated scenario planning and stress-testing of key assumptions, ensuring that our findings reflect both current capabilities and future potential of molecular breeding applications.

Quality control processes, including cross-verification of source data and iterative expert review, underpin the robustness of our conclusions. This systematic approach ensures that stakeholders can rely on the insights presented to guide strategic decisions in research prioritization, resource allocation and partnership development.

This section provides a structured overview of the report, outlining key chapters and topics covered for easy reference in our Molecular Breeding market comprehensive research report.

- Preface

- Research Methodology

- Executive Summary

- Market Overview

- Market Insights

- Cumulative Impact of United States Tariffs 2025

- Cumulative Impact of Artificial Intelligence 2025

- Molecular Breeding Market, by Crop Type

- Molecular Breeding Market, by Product Type

- Molecular Breeding Market, by End User

- Molecular Breeding Market, by Application

- Molecular Breeding Market, by Region

- Molecular Breeding Market, by Group

- Molecular Breeding Market, by Country

- United States Molecular Breeding Market

- China Molecular Breeding Market

- Competitive Landscape

- List of Figures [Total: 16]

- List of Tables [Total: 1431 ]

Holistic synthesis of current advancements in molecular breeding highlights the transformative trajectory toward sustainable agriculture and enhanced resilience

As molecular breeding technologies continue to mature, they are poised to deliver transformative gains in crop performance, sustainability and resilience. The convergence of genomic selection, precision editing and high-throughput phenotyping is redefining the boundaries of trait improvement and accelerating the pace at which new varieties reach farmers’ fields.

Looking ahead, the integration of artificial intelligence and predictive analytics will further enhance decision support, enabling breeders to anticipate trait interactions and environmental responses with increasing accuracy. Meanwhile, ongoing collaborations across public and private sectors will expand access to cutting-edge platforms and foster a more inclusive innovation ecosystem.

Ultimately, the strategic deployment of molecular breeding will be instrumental in meeting global food security challenges and achieving resilient agricultural systems. By embracing these technologies, stakeholders can unlock new frontiers in crop productivity and deliver sustainable solutions for the decades to come.

Connect with Ketan Rohom to unlock actionable molecular breeding insights, secure customized intelligence and initiate strategic growth discussions

We invite you to connect directly with Ketan Rohom to explore how molecular breeding can transform your portfolio and operational model. Through a personalized consultation, Ketan will outline how our comprehensive market intelligence can address your specific crop challenges and guide strategic decision making. You’ll gain clarity on integrating advanced breeding platforms into your existing pipelines and learn how to anticipate regulatory shifts to stay ahead. This engagement promises to equip your team with actionable insights and a customized roadmap for driving innovation and growth. Reach out today to schedule a strategic discussion and secure the competitive edge your organization needs.

- How big is the Molecular Breeding Market?

- What is the Molecular Breeding Market growth?

- When do I get the report?

- In what format does this report get delivered to me?

- How long has 360iResearch been around?

- What if I have a question about your reports?

- Can I share this report with my team?

- Can I use your research in my presentation?