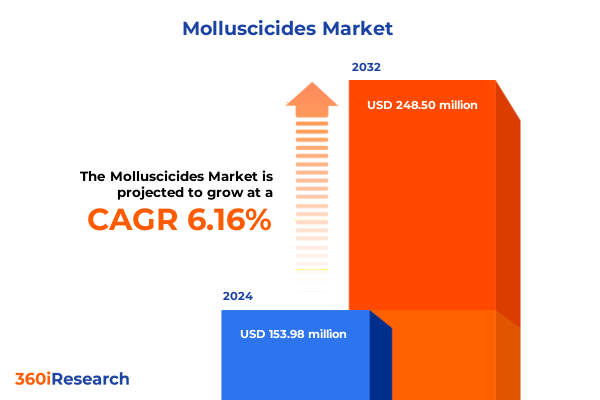

The Molluscicides Market size was estimated at USD 163.00 million in 2025 and expected to reach USD 172.70 million in 2026, at a CAGR of 6.20% to reach USD 248.50 million by 2032.

Understanding the Essential Role of Molluscicides in Protecting Crops and Ecosystems from Snail and Slug Infestations Worldwide

Molluscicides are specialized chemical or biological agents designed to control populations of snails and slugs that pose significant threats to agricultural productivity, horticulture, and ecosystem balance. With pests capable of causing substantial crop losses and damaging ornamental landscapes, the need for effective molluscicide solutions has never been more critical. These products play a vital role in integrated pest management strategies, helping growers and land managers minimize yield reductions while preserving environmental safety.

In recent years, the importance of molluscicides has expanded beyond traditional agriculture into turf management, public parks, and industrial facilities where slug- and snail-related damage can disrupt operations and incur high remediation costs. The shift toward sustainability and reduced chemical footprints has driven innovation in molluscicide chemistries and application methods. As regulatory bodies tighten restrictions on persistent and non-selective compounds, the industry is responding with research-backed formulations that balance efficacy with environmental stewardship.

Given the growing emphasis on digital agriculture, precision application, and regulatory compliance, stakeholders must remain informed about the evolving molluscicide landscape. This executive summary synthesizes the essential context, market drivers, and emerging trends that define this critical sector, establishing a foundation for strategic decision-making across diverse end-use scenarios.

Exploring Recent Technological, Regulatory, and Sustainability-Driven Transformations Shaping the Future of Molluscicide Applications

The molluscicide sector is undergoing transformative shifts driven by advancements in chemistry, regulatory reforms, and a collective push toward sustainability. Innovative active ingredient combinations now deliver targeted control with reduced off-target impact, while next-generation formulations-such as biodegradable pellets-ensure efficient release profiles that align with environmental safety goals. Moreover, digital dosing technologies and application equipment are enhancing precision, reducing waste, and lowering treatment costs by synchronizing molluscicide deployment with real-time pest pressure data.

Concurrently, regulatory landscapes in key markets have evolved, with authorities imposing stricter thresholds for environmental contaminants and residue levels. This has accelerated the phase-out of legacy metaldehyde products in some regions and spurred the adoption of ferric phosphate and other lower-toxicity alternatives. Stakeholders are increasingly leveraging integrated pest management protocols that combine physical barriers, cultural practices, and selective chemistries to meet compliance requirements while maintaining operational efficacy.

Sustainability imperatives are also reshaping end-user preferences and procurement strategies. Agricultural producers and landscape managers are placing greater emphasis on products certified for reduced environmental risk and compatibility with biological controls. As a result, manufacturers are investing in research collaborations that explore novel modes of action, bio-based ingredients, and formulation technologies that optimize molluscicidal performance without compromising ecosystem health. These converging trends signal a new era of more responsible, effective, and data-driven slug and snail control.

Analyzing the Comprehensive Impact of 2025 United States Tariff Measures on Molluscicide Supply Chains and Cost Structures

The introduction of new tariff measures by the United States in 2025 has had a pronounced effect on the global molluscicide supply chain. Tariffs levied on key raw materials and imported finished products from major exporters disrupted traditional procurement routes, compelling manufacturers to reassess sourcing models. As import costs rose, some producers accelerated investments in domestic manufacturing capabilities and alternative supply agreements, thereby reducing reliance on higher-cost foreign suppliers.

These tariff changes have not only elevated landed costs for raw active ingredients such as metaldehyde but also impacted ancillary inputs including emulsifiers and pellet binders sourced from overseas. Consequently, companies have been negotiating longer-term contracts, engaging in supplier diversification strategies, and exploring backward integration to safeguard against future trade uncertainties. Furthermore, larger manufacturers have leveraged economies of scale to absorb part of the cost increases, maintaining market competitiveness while smaller players navigate margin pressures more cautiously.

As trade realignment continues, the industry has witnessed an uptick in bilateral partnerships and regional supply hubs that mitigate the impact of US tariffs. Greater collaboration between North American producers and suppliers in Latin America and domestic chemical distributors has facilitated more resilient networks. Going forward, businesses will need to monitor geopolitical developments, tariff sunset provisions, and potential retaliatory measures to maintain supply continuity and cost stability in an increasingly complex trade environment.

Uncovering Critical Segmentation Insights Across Active Ingredients, Physical Forms, End Users, Modes of Action, and Distribution Channels in the Sector

A closer examination of active ingredient types reveals that formulations based on ferric phosphate have gained traction due to favorable toxicity profiles and broad regulatory acceptance. Metaldehyde remains popular for its rapid knockdown effects, while combinations of metaldehyde with synergistic additives seek to optimize efficacy and reduce per-unit dosages. These ingredient distinctions influence product positioning and end-user selection, with sustainability-focused applications often favoring iron-based alternatives.

Physical form segmentation underscores distinct use cases for granular feed, dust applications, liquid concentrates, and pelletized formulations. Dust products are valued for spot treatments in confined areas, whereas granules suit broadcast treatments across field crops. Emulsifiable concentrates and solution-based liquids provide versatility for tank-mix programs, and pellet formats-whether biodegradable or standard-offer controlled release benefits, particularly in high-moisture or turf management settings.

End-user diversity spans large-scale commercial agriculture operations prioritizing crop protection through high-volume applications to government agencies implementing barrier treatments in public green spaces. Industrial users, including food-processing facilities and wastewater installations, require reliable barrier controls, while residential customers rely on home-garden and lawn care products that balance convenience with pet- and child-safety considerations.

Mode-of-action distinctions play a critical role in strategic application planning. Contact-based molluscicides deliver immediate impact upon pest interaction, fumigant approaches are leveraged for enclosed or greenhouse environments, and systemic agents are integrated into plant defense systems for residual protection. By aligning mode-of-action choices with pest behavior and environmental parameters, users can optimize control while mitigating resistance development.

Distribution channels have likewise evolved to accommodate shifting buyer preferences. Traditional agrochemical dealers, garden centers, and supermarket chains remain vital for localized supply, offering technical support and rapid fulfillment. However, online platforms-from specialized e-commerce sites to manufacturer websites-are capturing growing market share through direct-to-consumer models, expanded product assortments, and subscription services that enhance reorder predictability.

This comprehensive research report categorizes the Molluscicides market into clearly defined segments, providing a detailed analysis of emerging trends and precise revenue forecasts to support strategic decision-making.

- Active Ingredient Type

- Formulation Type

- Mode Of Action

- Application

- Distribution Channel

Delving into Regional Variations Influencing Molluscicide Adoption and Regulations Across Americas, Europe Middle East & Africa, and Asia Pacific Markets

In the Americas, robust agricultural infrastructure and well-established distribution networks underpin strong demand for molluscicides that address both field-crop and turf applications. Regulatory frameworks in the United States, Canada, and Brazil are increasingly harmonized around residue tolerances and environmental safety thresholds, encouraging the adoption of lower-toxicity iron-based products and integrated pest management protocols. Meanwhile, the region’s domestic production of key intermediates helps buffer supply-chain shocks and reduces reliance on imports.

Europe, the Middle East, and Africa present a tapestry of regulatory and market conditions. The European Union’s stringent restrictions on metaldehyde formulations have catalyzed a shift toward alternative chemistries approved under the Biocidal Products Regulation. In the Middle East, arid climates and irrigation-dependent agriculture drive demand for formulations that maintain efficacy under extreme conditions, while Africa’s emerging markets exhibit growing interest in cost-effective and locally produced solutions supported by public-sector pest-control initiatives.

Asia-Pacific markets are characterized by rapid growth, fueled by intensified crop production, expanding horticulture sectors, and evolving regulatory frameworks. China remains a major producer of active ingredients, but domestic policy changes are leading to tighter environmental permitting and higher standards for product registration. Australia and New Zealand have championed stewardship programs that emphasize responsible use, training, and petition-driven monitoring, setting benchmarks for neighboring markets. Across the region, the convergence of logistical investments and digital agriculture technologies is facilitating broader access to advanced molluscicide products and technical support.

This comprehensive research report examines key regions that drive the evolution of the Molluscicides market, offering deep insights into regional trends, growth factors, and industry developments that are influencing market performance.

- Americas

- Europe, Middle East & Africa

- Asia-Pacific

Identifying Strategic Movements and Competitive Dynamics Among Leading Molluscicide Manufacturers Driving Innovation and Market Positioning

Leading chemical companies have intensified efforts to differentiate their molluscicide portfolios through formulation innovation, strategic acquisitions, and collaborative research. International conglomerates are leveraging global R&D networks to advance novel active ingredients, while regional specialists are carving out niches with environmentally friendly pellet and liquid formulations designed for precision agriculture and turf management.

Partnerships between agrochemical firms and agricultural technology providers have accelerated the integration of digital monitoring tools with molluscicide application platforms. This has facilitated data-driven application schedules that optimize timing and dosage, enhance efficacy, and reduce chemical runoff. At the same time, forward-looking companies are establishing sustainability benchmarks for supply-chain transparency, ensuring raw-material traceability and third-party certification for eco-friendly ingredients.

Corporate strategies are increasingly centered on capturing synergies between biological control research and chemical molluscicides. By combining selective chemistries with naturally derived antagonists, companies aim to offer integrated solutions that mitigate resistance risks and align with organic standards. This dual-track approach fosters long-term customer loyalty and creates a resilient product pipeline adaptable to shifting regulatory landscapes.

As competition intensifies, companies are also differentiating through service-oriented offerings such as bespoke application consulting, training modules for end users, and specialized technical support for niche applications like greenhouse fumigation and industrial slug control. These value-added services strengthen customer relationships and reinforce corporate reputations as thought leaders in molluscicidal innovation.

This comprehensive research report delivers an in-depth overview of the principal market players in the Molluscicides market, evaluating their market share, strategic initiatives, and competitive positioning to illuminate the factors shaping the competitive landscape.

- ADAMA Agricultural Solutions Limited

- Agchem Manufacturing Corporation

- AMVAC Chemical Corporation

- Arxada AG

- BASF SE

- Bayer AG

- Certis Biologicals, Inc.

- De Sangosse Ltd

- Doff Portland Ltd

- DoMyOwn, LLC

- INDUSTRIALCHIMICA S.R.L.

- Lonza Group AG

- Nufarm Limited

- PI Industries Limited

- Syngenta AG

- UPL Ltd

- VAPCO

- W. Neudorff GmbH KG

- Westland Horticulture Limited

- Zagro Asia Limited

Formulating Actionable Strategic Recommendations to Enhance Market Penetration, Regulatory Compliance, and Sustainability in Molluscicide Operations

Companies seeking to enhance market presence should prioritize the development of hybrid formulations that merge high-efficacy active ingredients with environmentally benign carriers to meet evolving regulatory and consumer demands. By investing in pilot programs that validate product performance under diverse climatic conditions, manufacturers can bolster product credibility and accelerate adoption across multiple end-user segments.

Regulatory engagement is another critical focus area. Proactive collaboration with government agencies on residue trials, environmental impact assessments, and stewardship programs can expedite product approvals and reinforce brand trust. Establishing transparent communication channels and participating in standard-setting committees will help companies anticipate regulatory shifts and adapt formulations in advance.

To optimize distribution, firms should leverage digital commerce platforms alongside traditional channels. Developing user-friendly online portals with detailed application guides, dosage calculators, and sample ordering can enhance customer convenience and reduce time to treatment. Simultaneously, reinforcing relationships with agrochemical distributors, garden centers, and supermarkets through targeted training and co-marketing initiatives will sustain offline relevance.

Finally, investing in cross-industry partnerships-such as collaborations with agritech startups, biological control innovators, and environmental NGOs-can foster integrated management approaches that resonate with sustainability-focused customers. By aligning product development roadmaps with industry-wide stewardship pledges and certification standards, companies will be better positioned to secure long-term growth.

Detailing Robust Research Methodologies and Analytical Approaches Underpinning the Comprehensive Molluscicide Market Assessment and Insights

Our analysis draws upon a multilayered research framework integrating both primary and secondary data sources. Primary research included in-depth interviews with pest-management specialists, agronomists, regulatory officials, and end-user representatives to capture firsthand perspectives on efficacy preferences, application challenges, and emerging demand drivers.

Secondary research encompassed a systematic review of regulatory filings, patent databases, environmental impact studies, and industry publications to map evolving approval pathways, proprietary formulation technologies, and competitor strategies. Data triangulation was employed to cross-verify insights derived from diverse sources, ensuring both accuracy and robustness in our market assessment.

Quantitative analysis involved the compilation of historical shipment logs, trade statistics, and sales data from multiple regions, enabling the identification of distribution dynamics and end-user consumption patterns. Concurrently, qualitative thematic analysis of stakeholder interviews illuminated nuanced attitudes toward new mode-of-action chemistries, digital application platforms, and sustainability benchmarks.

Further, competitive intelligence initiatives included benchmarking of leading product portfolios, patent activity mapping, and strategic partnership tracking. This comprehensive methodology provides a transparent audit trail for our insights and allows stakeholders to gauge the reliability of our findings and the applicability of strategic recommendations to their specific contexts.

This section provides a structured overview of the report, outlining key chapters and topics covered for easy reference in our Molluscicides market comprehensive research report.

- Preface

- Research Methodology

- Executive Summary

- Market Overview

- Market Insights

- Cumulative Impact of United States Tariffs 2025

- Cumulative Impact of Artificial Intelligence 2025

- Molluscicides Market, by Active Ingredient Type

- Molluscicides Market, by Formulation Type

- Molluscicides Market, by Mode Of Action

- Molluscicides Market, by Application

- Molluscicides Market, by Distribution Channel

- Molluscicides Market, by Region

- Molluscicides Market, by Group

- Molluscicides Market, by Country

- United States Molluscicides Market

- China Molluscicides Market

- Competitive Landscape

- List of Figures [Total: 17]

- List of Tables [Total: 2544 ]

Synthesizing Key Findings and Strategic Implications to Guide Stakeholders in Navigating the Evolving Global Molluscicide Landscape Effectively

This executive summary has synthesized the latest developments in molluscicide formulations, regulatory trends, supply-chain dynamics, segmentation intricacies, regional variations, and competitive strategies. Together, these insights illuminate a rapidly evolving landscape where innovation, sustainability, and trade considerations intersect to shape market opportunities and challenges.

Stakeholders must remain vigilant to regulatory shifts that incentivize lower-toxicity active ingredients and integrated pest management solutions. At the same time, the ramifications of trade policies underscore the importance of supply-chain diversification and domestic production investments to safeguard operational resilience.

Ultimately, the path forward in the molluscicide sector is defined by strategic agility, collaborative innovation, and a steadfast commitment to environmental stewardship. Organizations that align product development with market segmentation nuances, leverage digital application technologies, and forge strong partnerships will be best positioned to capitalize on emerging opportunities and navigate the complexities of global molluscicide demand.

Engage with Associate Director Ketan Rohom to Unlock In-Depth Insights and Secure Your Comprehensive Molluscicide Market Intelligence Report Today

If you’re ready to deepen your understanding of molluscicide dynamics and gain a competitive edge in this specialized market, reach out to Associate Director Ketan Rohom. He can guide you through the extensive research methodology, highlight strategic insights tailored to your region and application, and outline how this comprehensive report can support your decision-making processes. By engaging with Ketan, you’ll secure access to a wealth of actionable intelligence that addresses cutting-edge formulations, regulatory landscapes, and distribution strategies, empowering your organization to navigate challenges and seize the most promising growth opportunities.

- How big is the Molluscicides Market?

- What is the Molluscicides Market growth?

- When do I get the report?

- In what format does this report get delivered to me?

- How long has 360iResearch been around?

- What if I have a question about your reports?

- Can I share this report with my team?

- Can I use your research in my presentation?