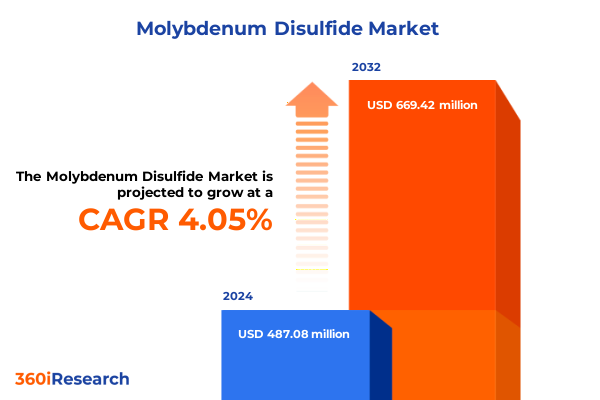

The Molybdenum Disulfide Market size was estimated at USD 506.88 million in 2025 and expected to reach USD 525.31 million in 2026, at a CAGR of 4.05% to reach USD 669.42 million by 2032.

Exploring the Fundamental Role of Molybdenum Disulfide as a Multifunctional Material in Emerging Technological Applications

Molybdenum disulfide has emerged as an indispensable material across a wide spectrum of industrial and technological sectors, distinguished by its unique combination of lubricity, thermal stability, and semiconducting properties. In recent years, the confluence of advanced manufacturing techniques and heightened performance requirements has driven the material beyond its traditional role as a dry lubricant into high-growth areas such as next-generation electronics, energy storage, and catalysis. This report serves as an introduction to the critical factors defining the material’s evolving value proposition and outlines the foundational characteristics that underpin its expanding adoption.

At the heart of this transformation lies molybdenum disulfide’s layered crystalline structure, which provides exceptional friction-reducing capabilities while offering avenues for nanoscale engineering. Consequently, manufacturers are exploring novel form factors-from bulk flake to nano-engineered powders-tailored to demanding applications ranging from hydrogen production catalysts to solid-state battery electrodes. As the industry adapts to stringent performance and environmental standards, the versatility of molybdenum disulfide has positioned it as a strategic enabler of innovation.

Through this executive summary, readers will gain a high-level understanding of the market dynamics, pivotal trends, and key considerations shaping the future trajectory of molybdenum disulfide. By framing the material’s core strengths and emerging applications, this section establishes the context for the in-depth analysis that follows, guiding stakeholders in assessing strategic imperatives and investment priorities.

Identifying Paradigm-Shifting Trends That Are Accelerating Transformation Across the Molybdenum Disulfide Market Landscape

The landscape for molybdenum disulfide is undergoing a series of transformative shifts driven by accelerated R&D investments, strategic partnerships, and the pursuit of sustainability. In electronics, the drive toward two-dimensional semiconductors and flexible devices has elevated the material’s role from a niche lubricant to an active transistor channel, thanks to its tunable bandgap and excellent charge carrier mobility. Simultaneously, the energy sector is leveraging its catalytic properties to enhance hydrogen evolution reactions and solid-state battery performance, underscoring a broader trend toward green energy solutions.

Industry collaborations are further compressing product development cycles, as chemical processing companies join forces with advanced materials specialists to co-develop premium-grade catalysts that deliver higher conversion efficiencies and longer operational lifetimes. In parallel, the automotive sector’s rapid adoption of electric vehicles has created a surge in demand for high-purity powders engineered for next-generation battery anodes, illustrating the material’s expanding utility across diverse end markets.

Amid these advancements, a clear emphasis has emerged on process innovation and eco-friendly production methods. Manufacturers are scaling up low-carbon synthesis routes and recycling initiatives to mitigate environmental impact, thereby responding to both regulatory pressures and corporate sustainability goals. As each of these shifts converges, stakeholders must navigate a more complex ecosystem where technical differentiation and supply chain resilience define competitive advantage.

Analyzing How Recent United States Tariffs Have Reshaped the Global Molybdenum Disulfide Supply Chain and Cost Structures

The introduction of new United States tariffs in early 2025 has had a cumulative effect on the molybdenum disulfide supply chain, driving strategic realignments and cost optimization measures. With additional duties imposed on key raw material imports, downstream manufacturers have faced heightened input costs, prompting many to renegotiate supplier contracts and explore domestic feedstock sources. This shift has not only elevated the premium on local production capabilities but has also accelerated joint ventures aimed at securing stable, tariff-free supply channels.

Concurrent with tariff-induced cost pressures, companies have intensified their focus on end-to-end supply chain transparency. Traceability initiatives now extend from mining operations through advanced processing facilities to final assembly plants, ensuring adherence to both trade regulations and corporate governance standards. Furthermore, rerouted logistics networks have emerged as firms diversify their sourcing hubs, reducing reliance on any single geographic region and enhancing resilience against future trade policy fluctuations.

These cumulative impacts have underscored the need for agile procurement strategies, as businesses balance the trade-offs between cost, quality, and regulatory compliance. By fostering closer collaboration with government agencies and forging strategic partnerships across the value chain, stakeholders are adapting to a more protectionist landscape without sacrificing innovation or product performance.

Unveiling Critical Market Segmentation Insights by Grade Form End-User Industry and Application for Strategic Positioning

Market segmentation in the molybdenum disulfide space reveals critical distinctions shaping competitive positioning and investment priorities. When considering grade, industrial and technical variants of bulk material cater to traditional lubrication and composite reinforcement needs, whereas premium and standard catalyst grades support high-efficiency chemical synthesis and energy conversion applications. In the electronics arena, semiconductor and ultra-high purity grades are meticulously engineered for device fabrication, underscoring the importance of stringent quality control.

Form factor further influences performance and end-use feasibility. Bulk flake material, whether in its native or exfoliated form, offers ideal characteristics for coatings and solid lubricants, while nanoplate and spherical nanoparticle configurations enhance catalytic activity and electrode kinetics. Meanwhile, micron and nano powders deliver optimized surface area-to-volume ratios, facilitating rapid ionic transport in battery systems and fine dispersion in industrial formulations.

Delving into end-user industries, commercial and defense aerospace applications demand materials that withstand extreme environments, whereas passenger and commercial vehicle segments seek cost-effective solutions for electric powertrain components. In chemical processing, additive manufacturing blends with catalyst manufacturing to drive innovation in bespoke reactor designs and emission control systems. Electronics end users, spanning consumer gadgets to industrial instrumentation, leverage molybdenum disulfide’s electronic properties to unlock next-generation functionalities.

Application-driven segmentation provides further granularity, differentiating lithium ion and solid state battery materials by their electrochemical performance requirements. Chemical synthesis versus petrochemical catalysts highlights the dual role of this compound in both green hydrogen and traditional refining processes. Semiconductor versus wearable electronics underscores the leap from high-reliability microchips to flexible display technologies, while automotive and industrial lubricant additives illustrate the broad spectrum of friction management needs.

This comprehensive research report categorizes the Molybdenum Disulfide market into clearly defined segments, providing a detailed analysis of emerging trends and precise revenue forecasts to support strategic decision-making.

- Grade

- Form

- End-User Industry

- Application

Decoding Key Regional Dynamics in Americas Europe Middle East Africa and Asia-Pacific Driving Molybdenum Disulfide Demand

Regional dynamics play a defining role in shaping molybdenum disulfide demand as industries worldwide pursue localized advantages. In the Americas, strong growth in electric vehicles and aerospace manufacturing has propelled investment in high-purity powders and advanced catalyst formulations. Leading producers in North America are leveraging tight integration between mining, refining, and end-use fabrication to shorten lead times and reduce tariff exposure, fostering a robust domestic ecosystem.

Across Europe, the Middle East and Africa, stringent environmental regulations and ambitious decarbonization targets have driven uptake of green hydrogen catalysts and sustainable lubricants. Collaborative frameworks among government bodies, research institutions, and private enterprises have accelerated pilot deployments of clean energy projects, thereby underpinning demand for molybdenum disulfide derivatives tailored to emission control and renewable energy technologies.

The Asia-Pacific region continues to be the largest consumer, fueled by rapid industrialization, electronics manufacturing hubs, and expansive lithium ion battery supply chains. China, South Korea, and Japan have intensified efforts to develop proprietary processing techniques, resulting in a competitive landscape dominated by vertically integrated players. Simultaneously, Southeast Asian nations are emerging as alternative sourcing centers, attracted by favorable trade agreements and growing internal consumption.

This comprehensive research report examines key regions that drive the evolution of the Molybdenum Disulfide market, offering deep insights into regional trends, growth factors, and industry developments that are influencing market performance.

- Americas

- Europe, Middle East & Africa

- Asia-Pacific

Profiling Leading Industry Stakeholders and Their Strategic Initiatives in the Competitive Molybdenum Disulfide Ecosystem

Leading organizations in the molybdenum disulfide market are distinguished by their integrated capabilities and innovation-driven portfolios. Major chemical companies have established high-volume manufacturing facilities for industrial and technical grade bulk products, then advanced into specialty catalyst segments through strategic acquisitions. Conversely, specialty materials firms focus on ultra-high purity grades and bespoke form factors, leveraging proprietary exfoliation processes and nano-engineering techniques to meet stringent electronics industry standards.

A number of emerging players have carved out niches in the battery materials space, collaborating closely with cell manufacturers to optimize electrochemical performance in both lithium ion and solid state configurations. These collaborations often include shared R&D platforms, co-located pilot plants, and joint intellectual property agreements that accelerate time to market for next-generation energy storage solutions.

In parallel, partnerships between materials suppliers and OEMs in the aerospace and automotive sectors underscore a growing trend toward co-development models. By embedding technical teams within customer operations, companies can rapidly iterate on material specifications and validate performance in real-world conditions. This level of integration not only strengthens customer relationships but also drives continuous innovation across the value chain.

This comprehensive research report delivers an in-depth overview of the principal market players in the Molybdenum Disulfide market, evaluating their market share, strategic initiatives, and competitive positioning to illuminate the factors shaping the competitive landscape.

- 2Dsemiconductors USA

- ACS Material

- American Elements

- China Molybdenum Co., Ltd.

- Freeport‑McMoRan Inc.

- Fuchs Petrolub SE

- H.C. Starck Tungsten Powders

- Jinduicheng Molybdenum Group Mining Corporation

- Luoyang Tongrun Nano Technology Co., Ltd.

- Merck KGaA

- Nanografi Nano Technology

- OKS Spezialschmierstoffe GmbH

- Structure Probe, Inc.

- Sumico Lubricant Co., Ltd.

- VCI & Lubricants LLC

Delivering Actionable Strategic Recommendations to Guide Industry Leaders in Capitalizing on Molybdenum Disulfide Market Opportunities

To capitalize on the expanding applications and evolving market demands for molybdenum disulfide, industry leaders should prioritize targeted investment in high-value product grades and advanced manufacturing capabilities. By expanding in-house synthesis capacity for premium catalyst and semiconductor grades, organizations can secure differentiated revenue streams and deepen technical expertise. Moreover, diversifying supply chains through strategic alliances with mining and refining partners will mitigate geopolitical and tariff-related risks.

Embracing digitalization across the value chain will further enhance operational agility. Deploying advanced analytics and digital twins in process development can accelerate optimization of exfoliation techniques and quality control workflows, thereby reducing production costs and improving yield consistency. Simultaneously, forging cross-industry consortia focused on sustainable production methods will address regulatory pressures and strengthen brand reputation among environmentally conscious end users.

Lastly, cultivating collaborative research partnerships with leading universities and national laboratories will provide access to cutting-edge developments in two-dimensional materials and catalysis. By sponsoring joint research initiatives and co-authoring technical publications, firms can shape emerging industry standards, attract top-tier talent, and maintain a leadership position as the molybdenum disulfide market enters its next phase of growth.

Detailing Rigorous Research Methodology Combining Primary Expert Insights and Robust Secondary Data Sources for Market Analysis

This analysis employs a comprehensive research methodology designed to ensure data integrity and actionable insights. Primary information was gathered through in-depth interviews with C-level executives, materials scientists, and procurement specialists across the molybdenum disulfide value chain, providing qualitative context on market drivers and strategic priorities. In parallel, quantitative data was sourced from publicly available government and industry filings, trade databases, and technical whitepapers to verify production, consumption, and trade dynamics.

Triangulation techniques were applied to reconcile divergences between company disclosures, third-party analytics, and expert opinions, thereby strengthening the robustness of key findings. Additionally, the study incorporates a bottom-up approach for segment-specific analysis, aligning granular production and application data to real-world end-user demand patterns. Scenario planning exercises were also conducted to assess the potential impact of evolving trade policies and sustainability regulations on supply chain resilience.

Quality assurance protocols included iterative validation with subject matter experts, cross-referencing data points with independent market trackers, and peer reviews by senior research analysts. This rigorous framework ensures that the conclusions and recommendations presented herein accurately reflect prevailing market realities and emerging trends in the molybdenum disulfide ecosystem.

This section provides a structured overview of the report, outlining key chapters and topics covered for easy reference in our Molybdenum Disulfide market comprehensive research report.

- Preface

- Research Methodology

- Executive Summary

- Market Overview

- Market Insights

- Cumulative Impact of United States Tariffs 2025

- Cumulative Impact of Artificial Intelligence 2025

- Molybdenum Disulfide Market, by Grade

- Molybdenum Disulfide Market, by Form

- Molybdenum Disulfide Market, by End-User Industry

- Molybdenum Disulfide Market, by Application

- Molybdenum Disulfide Market, by Region

- Molybdenum Disulfide Market, by Group

- Molybdenum Disulfide Market, by Country

- United States Molybdenum Disulfide Market

- China Molybdenum Disulfide Market

- Competitive Landscape

- List of Figures [Total: 16]

- List of Tables [Total: 3021 ]

Synthesizing Core Findings to Highlight the Pivotal Role of Molybdenum Disulfide in Advancing High-Performance Applications

The collective insights presented in this summary underscore the instrumental role of molybdenum disulfide in advancing critical applications across lubrication, catalysis, energy storage, and electronics. As transformative trends-ranging from two-dimensional semiconductor integration to sustainable synthesis methods-gain momentum, stakeholders are compelled to recalibrate strategies that align with evolving technological requirements and regulatory landscapes.

The compounded influence of new trade policies and regional dynamics has elevated the importance of supply chain adaptability, prompting organizations to diversify sourcing, enhance traceability, and pursue localized production. At the same time, segmentation analysis highlights the value of differentiated product offerings, tailored to the distinct performance needs of each end-user segment.

By integrating strategic partnerships, digital process optimization, and collaborative research initiatives, market participants can unlock the full potential of molybdenum disulfide. This report provides a foundational blueprint for decision-makers seeking to harness the material’s unique properties and capitalize on high-growth opportunities, ultimately shaping a resilient and innovation-driven market landscape.

Seize Your Competitive Edge Today by Accessing Comprehensive Molybdenum Disulfide Market Intelligence with Personalized Support

To secure timely access to the most comprehensive and actionable molybdenum disulfide market research report, please reach out to Ketan Rohom, Associate Director of Sales & Marketing. His expertise and personalized service will help you navigate complex data, tailor solutions to your organizational needs, and accelerate strategic decision-making. Engage directly to explore custom research options, gain exclusive insights on segment-specific opportunities, and ensure your enterprise remains at the forefront of technological innovation by leveraging the full depth of analysis contained within this authoritative study. Begin your consultation today and chart a course toward sustainable competitive advantage.

- How big is the Molybdenum Disulfide Market?

- What is the Molybdenum Disulfide Market growth?

- When do I get the report?

- In what format does this report get delivered to me?

- How long has 360iResearch been around?

- What if I have a question about your reports?

- Can I share this report with my team?

- Can I use your research in my presentation?