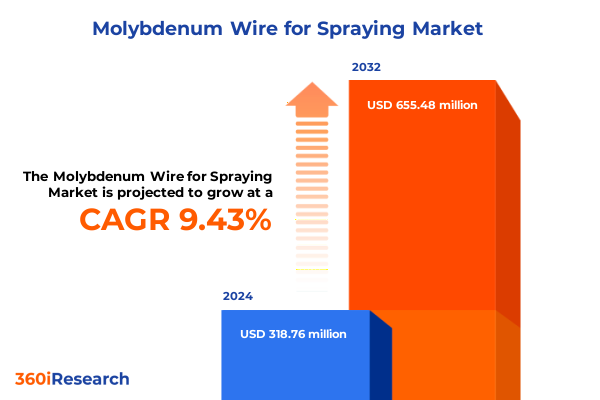

The Molybdenum Wire for Spraying Market size was estimated at USD 344.58 million in 2025 and expected to reach USD 377.79 million in 2026, at a CAGR of 9.62% to reach USD 655.48 million by 2032.

Introducing the Critical Role and Innovation Trajectory of Molybdenum Wire in Metal Spraying Technologies and Advanced Surface Engineering

The realm of surface engineering has witnessed a remarkable ascension of molybdenum wire as a pivotal feedstock in metal spraying processes. Molybdenum wire’s combination of exceptional high-temperature stability, mechanical strength, and corrosion resistance underpins applications that demand robust protective and wear-resistant coatings. Its ability to form dense, adherent layers under varying thermal spraying conditions has galvanized its adoption across sectors where enhanced component longevity and performance optimization are imperative.

This executive summary distills critical insights into the molybdenum wire for spraying domain, elucidating the technological undercurrents, regulatory environment, and market segmentation that define current dynamics. It navigates the trajectory of transformative shifts such as the migration towards high-velocity and laser-assisted processes, evaluates the repercussions of recent United States tariff implementations on cost structures and supply chains, and delves into granular segmentation perspectives that unveil nuanced performance and distribution patterns.

Readers will gain a panoramic yet precise overview of regional market behaviors spanning the Americas, Europe Middle East & Africa, and Asia-Pacific, alongside a strategic understanding of leading corporate players driving innovation. By weaving together these components, this summary equips decision-makers with the clarity needed to formulate strategic imperatives, optimize operational resilience, and harness emerging growth corridors in the evolving landscape of molybdenum wire spraying technologies.

Mapping the Transformative Technological Shifts and Operational Paradigm Changes That Are Reshaping the Molybdenum Wire Spraying Market Globally

Over the last decade, the landscape of metal spraying has been reshaped by a series of technological innovations that have elevated both performance and efficiency. Traditional flame and plasma spraying techniques, once the mainstay of the industry, are gradually yielding ground to cold spraying and high-velocity oxy fuel (HVOF) systems, which impart coatings with superior density, bond strength, and microstructural integrity. The integration of laser cladding has further augmented precision, enabling engineers to tailor surface properties at the micro scale and achieve distinct functional gradients.

Simultaneously, the convergence of digital process control and real-time monitoring has introduced unprecedented consistency across spraying operations. Industry 4.0-era platforms now allow for closed-loop feedback, predictive maintenance, and comprehensive traceability, streamlining throughput while mitigating defects. These digital enhancements complement the inherent advantages of molybdenum wire, such as its thermal stability and erosion resistance, by ensuring that each coating deposit adheres to stringent tolerances.

Moreover, mounting emphasis on sustainability has driven a pivot toward energy-efficient spraying modalities and recyclable feedstock solutions. Advances in powder recovery systems and wire feed refinements are enabling spray shops to curtail material waste and reduce their carbon footprint. This evolution in process and policy is creating fertile ground for molybdenum wire innovations, setting the stage for a new era of high-performance surface engineering.

Assessing the Comprehensive Impact of 2025 United States Tariff Policies on Supply Chains Cost Structures and Competitiveness in Molybdenum Wire Spraying

In 2025, the United States enacted revised import tariffs on molybdenum wire, adjusting duty rates for major exporting regions and reshaping global supply chain economics. The newly applied levies have introduced additional cost burdens on imported wire, prompting service providers and manufacturers to reassess sourcing strategies. Many firms are accelerating investments in domestic alloy production to offset punitive duties, while others are negotiating long-term contracts with key suppliers in tariff-exempt jurisdictions.

The immediate impact has manifested in elevated input costs that cascade through processing operations. Thermal spraying service shops have responded by recalibrating contract terms, adopting pass-through pricing mechanisms, and prioritizing orders based on strategic end-use applications. Industries with slim profit margins, such as automotive component suppliers, have expressed particular concern, as tighter budgets limit their ability to absorb added expenses without compromising competitive pricing.

Longer term, these tariff measures are driving a wave of strategic realignment. Companies with established in-house coating capabilities are doubling down on vertical integration, seeking to secure raw material flows and stabilize cost structures. Additionally, alternative coating solutions and hybrid approaches are gaining traction as stakeholders aim to diversify risk and maintain operational flexibility. Through this convergence of policy and practice, the tariff environment of 2025 is redefining the competitive contours of molybdenum wire spraying across the United States and its trading partners.

Unveiling Critical Segmentation Insights to Illuminate Application Uses Material Types Purity Grades and Distribution Channels in the Molybdenum Wire Market

A multifaceted segmentation framework offers a window into where growth prospects lie and which niches demand attention. Application-based distinctions reveal that cold spraying and high-velocity oxy fuel spraying are rapidly outpacing conventional flame techniques, driven by end users’ desire for coatings exhibiting minimal porosity and maximal bond strength. Laser cladding is carving out a specialized corridor, prized for its ability to generate bespoke surface architectures, while plasma spraying remains a reliable choice for bulk coatings that require moderate thermal input.

End-use industry analysis underscores the prominent role of aerospace, where commercial aircraft, defense platforms, and spacecraft benefit from molybdenum wire’s ability to endure extreme thermal cycles and erosion. The automotive sector, spanning both commercial and passenger vehicles, is likewise a robust contributor, leveraging wire-based coatings for turbocharger components and exhaust systems. Electronics, energy and power, and oil and gas industries follow closely, each capitalizing on molybdenum’s corrosion resistance and electrical conductivity in demanding operational contexts.

Beyond application and industry, product type segmentation highlights flux cored wire versus solid wire offerings, with flux cored variants gaining momentum for complex component geometries. Material grade considerations-in purity thresholds above 99.5%, 99.9%, and 99.95%-are influencing high-precision deployments, particularly in aerospace and electronics. Sales channels, ranging from direct sales and distributor networks to online platforms, reflect evolving procurement preferences and underscore the importance of digital engagement in driving end-user adoption.

This comprehensive research report categorizes the Molybdenum Wire for Spraying market into clearly defined segments, providing a detailed analysis of emerging trends and precise revenue forecasts to support strategic decision-making.

- Type

- Material Grade

- Application

- End Use Industry

- Sales Channel

Distilling Key Regional Dynamics from The Americas to Europe Middle East Africa and Asia Pacific Driving Divergent Trends in Molybdenum Wire Spraying Demand

Regional perspectives illuminate stark contrasts in demand drivers and adoption curves. In the Americas, the convergence of a mature aerospace cluster and expanding energy infrastructure has amplified the need for robust thermal spray coatings. Service centers across the United States and Canada are forging strategic partnerships with domestic wire producers to mitigate tariff-related cost escalations and secure just-in-time delivery windows.

Within Europe, Middle East & Africa, European OEMs in the automotive and industrial equipment sectors continue to prioritize low-emission processes, fostering growth in cold spraying and laser cladding. Meanwhile, oil-rich nations in the Middle East are investing heavily in downstream processing capabilities, and African markets show nascent interest in advanced surface treatments for mining equipment, foreshadowing future expansion.

Asia-Pacific stands out for its rapid industrialization and electronics manufacturing prowess in economies such as China, South Korea, and Japan. Rising power generation projects and a burgeoning semiconductor sector are intensifying demand for molybdenum wire sprays that enhance conductivity and thermal management. This region’s dynamic regulatory environment and aggressive infrastructure initiatives are creating both opportunities and competitive pressures for domestic and international suppliers alike.

This comprehensive research report examines key regions that drive the evolution of the Molybdenum Wire for Spraying market, offering deep insights into regional trends, growth factors, and industry developments that are influencing market performance.

- Americas

- Europe, Middle East & Africa

- Asia-Pacific

Highlighting the Strategic Positions and Innovations of Leading Industry Players Shaping the Future of Molybdenum Wire for Spraying Applications

Industry leaders are staking out competitive positions through strategic investments, joint ventures, and continuous innovation in material science. Major diversified metal suppliers have enhanced their production footprints to integrate upstream alloy manufacturing with downstream wire drawing, delivering a seamless value chain that secures quality control and cost efficiencies. These vertically integrated models confer resilience in the face of fluctuating raw material prices and evolving trade policies.

Specialized enterprises are carving out niches by focusing on ultra-high purity grades and sophisticated coating processes. Through targeted research and development, they have optimized wire metallurgy to achieve microstructural uniformity and controlled grain size, which translates into superior coating performance under thermal fatigue and corrosive environments. Collaboration with academic institutions and national laboratories has accelerated this R&D pipeline, enabling early adoption of next-generation spraying technologies.

Meanwhile, a cadre of agile mid-tier players is leveraging digital commerce platforms and distributor alliances to extend their market reach. These firms are emphasizing customer service models that bundle technical support, training, and post-sale maintenance, reinforcing client loyalty. As competitive intensity increases, strategic M&A activity is expected to further consolidate capabilities and foster the next wave of market consolidation.

This comprehensive research report delivers an in-depth overview of the principal market players in the Molybdenum Wire for Spraying market, evaluating their market share, strategic initiatives, and competitive positioning to illuminate the factors shaping the competitive landscape.

- Advanced Refractory Metals

- ALB Materials Inc.

- Allegheny Technologies Incorporated

- Alleima AB

- Beijing Sunstone Tungsten Molybdenum Co., Ltd.

- China Molybdenum Co., Ltd.

- Filwel Products India Pvt Ltd.

- Flame Spray Technologies

- Heeger Materials Inc.

- Jinduicheng Molybdenum Company Limited

- Khodal Steel

- Kobe Steel, Ltd.

- Mersen S.A.

- Metallisation Ltd.

- Plansee SE

- Praxair Surface Technologies

- Sandvik Materials Technology AB

- WL Allotech Co., Ltd.

- Xiamen Honglu Tungsten Molybdenum Co., Ltd.

- Xiamen Tungsten Co., Ltd.

- Zhejiang Huahai Technology Co., Ltd.

Delivering Actionable Strategic Imperatives to Navigate Technological Evolution Geopolitical Tariffs and Market Volatility in the Molybdenum Wire Spraying Sector

To navigate market complexity and secure a durable competitive edge, industry leaders should prioritize supply-chain diversification by establishing multi-source procurement frameworks. Cultivating relationships with both domestic and tariff-exempt offshore wire manufacturers will mitigate risk exposure from abrupt policy shifts and logistical disruptions.

Strengthening in-house production capabilities through targeted capital expenditures can yield significant cost savings and quality improvements. Investments in high-precision drawing equipment and automated quality inspection systems will be critical to meeting stringent purity thresholds and dimensional tolerances, especially for high-performance aerospace and electronics applications.

Embracing advanced spraying modalities, including laser cladding and cold spraying, can unlock new performance frontiers. Organizations should pilot hybrid coating solutions to assess the feasibility of combining multiple processes for enhanced functionality. Concurrently, forging alliances with technology innovators and research institutions will expedite the development of next-generation wire alloys and process controls.

Finally, implementing a dynamic pricing model that reflects real-time input cost fluctuations will strengthen margin resilience. Coupled with proactive tariff monitoring and scenario planning, these measures will empower stakeholders to adapt strategically to evolving geopolitical landscapes.

Detailing a Triangulated Research Methodology Leveraging Primary Industry Engagement Secondary Data Sources and Analytical Validation for Market Credibility

The foundation of this analysis rests upon a rigorous, triangulated research methodology designed to ensure comprehensive market understanding and data integrity. Primary data collection encompassed direct engagement with metallurgical experts, coating service providers, and OEM equipment manufacturers through structured interviews and virtual roundtables. These dialogues elucidated first-hand operational challenges, technology adoption patterns, and procurement behaviors.

Secondary research involved a systematic review of trade publications, technical journals, patent registries, and regulatory filings. This archival exploration provided historical context for tariff changes, tracked innovation milestones in wire metallurgy, and mapped competitive movements across geographic regions. Cross-referencing multiple sources facilitated the validation of emerging trends and guarded against single-source bias.

Quantitative data inputs were synthesized through statistical modeling and regression analysis to detect correlations between tariff adjustments, application uptake rates, and regional demand fluctuations. A dedicated steering committee convened periodically to vet preliminary findings, ensuring that qualitative insights aligned with quantitative outputs. This iterative validation process underpins the credibility of the report’s conclusions and recommendations.

This section provides a structured overview of the report, outlining key chapters and topics covered for easy reference in our Molybdenum Wire for Spraying market comprehensive research report.

- Preface

- Research Methodology

- Executive Summary

- Market Overview

- Market Insights

- Cumulative Impact of United States Tariffs 2025

- Cumulative Impact of Artificial Intelligence 2025

- Molybdenum Wire for Spraying Market, by Type

- Molybdenum Wire for Spraying Market, by Material Grade

- Molybdenum Wire for Spraying Market, by Application

- Molybdenum Wire for Spraying Market, by End Use Industry

- Molybdenum Wire for Spraying Market, by Sales Channel

- Molybdenum Wire for Spraying Market, by Region

- Molybdenum Wire for Spraying Market, by Group

- Molybdenum Wire for Spraying Market, by Country

- United States Molybdenum Wire for Spraying Market

- China Molybdenum Wire for Spraying Market

- Competitive Landscape

- List of Figures [Total: 17]

- List of Tables [Total: 1272 ]

Synthesizing Core Findings and Strategic Takeaways to Inform Stakeholder Decisions and Future Directions in the Evolving Molybdenum Wire Spraying Landscape

The convergence of advanced spraying technologies and shifting policy frameworks has elevated the strategic importance of molybdenum wire in surface engineering. Cold spraying and HVOF systems are redefining quality benchmarks, while laser cladding and digital integration are unlocking precision capabilities that were once aspirational. These technological trajectories are complemented by structural adjustments prompted by tariff interventions, which are reshaping supply chains and cost dynamics in real time.

Segmentation analysis reveals targeted niches where performance specifications command premium valuations: aerospace applications demanding ultra-high purity grades, automotive components requiring erosion-resistant layers, and electronics sectors leveraging conductivity improvements. Regional contrasts underscore the necessity for localized strategies, whether it be securing domestic supply in the Americas, aligning with sustainability mandates in Europe Middle East & Africa, or capitalizing on infrastructure expansion in Asia-Pacific.

Leading industry players are responding through vertical integration, research alliances, and digital channel expansion, setting a blueprint for resilient growth. By converging these insights into a cohesive strategic framework, stakeholders can anticipate market shifts, optimize resource allocation, and maintain a trajectory of innovation. The path forward lies in harmonizing technological adoption with adaptive business models that accommodate both geopolitical fluctuations and the relentless pace of surface engineering advancements.

Engage with Ketan Rohom to Secure the Definitive Market Research Report on Molybdenum Wire for Spraying and Propel Your Strategic Growth Initiatives

To gain a comprehensive and forward-looking perspective on molybdenum wire for spraying, reach out to Ketan Rohom, Associate Director of Sales & Marketing, to secure the definitive market research report. Engaging with Ketan Rohom will grant you access to an in-depth analysis of emerging technology trends, tariff impacts, regional dynamics, and competitive strategies that are shaping this specialized segment. This report is designed to empower your organization with actionable intelligence, enabling you to optimize supply chains, refine product portfolios, and capitalize on high-value growth opportunities.

Connect with Ketan Rohom today to explore tailored licensing options, receive a detailed sample of the report, and discuss how these insights can be seamlessly integrated into your strategic planning. By leveraging this research, you will be equipped to navigate market volatility, respond proactively to geopolitical changes, and strengthen your position in the rapidly evolving realm of advanced surface engineering.

- How big is the Molybdenum Wire for Spraying Market?

- What is the Molybdenum Wire for Spraying Market growth?

- When do I get the report?

- In what format does this report get delivered to me?

- How long has 360iResearch been around?

- What if I have a question about your reports?

- Can I share this report with my team?

- Can I use your research in my presentation?