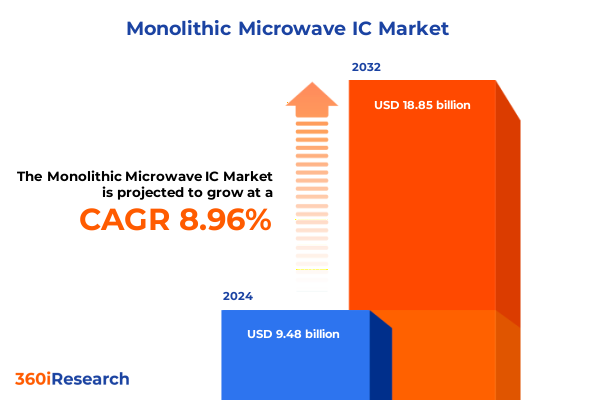

The Monolithic Microwave IC Market size was estimated at USD 10.29 billion in 2025 and expected to reach USD 11.18 billion in 2026, at a CAGR of 9.02% to reach USD 18.85 billion by 2032.

Setting the Stage for Monolithic Microwave Integrated Circuits Amid Rapid Technological Adoption and Transformative Industry Demands Driving Innovation

Monolithic Microwave Integrated Circuits (MMICs) have emerged as foundational building blocks for modern high-frequency applications, combining multiple radio-frequency functions on a single semiconductor chip. These sophisticated devices enable compact, efficient signal processing in sectors ranging from telecommunications and aerospace to automotive radar and defense systems. As global data demands escalate, MMICs provide critical support for next-generation wireless networks, satellite communications, and advanced sensor platforms, underscoring their role in enabling higher bandwidths and improved energy efficiency across diverse use cases.

Against this backdrop, the pace of innovation in MMIC technology is accelerating. The deployment of 5G networks has intensified the need for components that operate reliably at millimeter-wave frequencies, while early investments in 6G research promise even higher performance requirements in the coming decade. Moreover, the growing adoption of electric and autonomous vehicles leverages MMIC-based radar sensing for collision avoidance and adaptive cruise control, reflecting how automotive electrification trends are reinforcing MMIC demand. Concurrently, defense budgets worldwide continue to prioritize advanced radar, electronic warfare, and satellite communications capabilities, offering robust opportunities for MMIC vendors to deliver high-power, high-reliability solutions.

Material and architecture selection lie at the heart of MMIC differentiation. Gallium nitride (GaN) substrates are gaining traction for high-power and high-temperature applications due to superior thermal conductivity and power-density attributes, while gallium arsenide (GaAs) remains prevalent for low-noise front-end functions. Likewise, indium phosphide (InP) and silicon germanium (SiGe) technologies each contribute unique advantages in noise performance and integration capability. These material shifts, coupled with advancements in heterojunction bipolar transistors (HBTs), high electron mobility transistors (HEMTs), and emerging metamorphic HEMTs, are driving the miniaturization and integration of MMIC functions in a single package, streamlining system footprints and reducing overall cost of ownership.

Unprecedented Shifts in Monolithic Microwave IC Landscape Fueled by 5G Rollouts GaN Material Advances and Integrated Circuit Miniaturization Trends

The MMIC landscape is undergoing transformative shifts driven by both technological breakthroughs and evolving end-user requirements. The mass deployment of 5G base stations and the parallel emergence of fixed wireless access have pushed MMIC designers to optimize circuits for millimeter-wave bands, particularly the Ka- and Ku-bands, in order to deliver multi-gigabit throughput over shorter link distances. This shift towards higher-frequency operation has accelerated the development of compact power amplifiers, low-noise amplifiers, and integrated front-end modules that maintain efficiency and linearity at unprecedented radio frequencies.

Simultaneously, the sustained momentum behind GaN technology has reshaped design priorities. GaN-on-SiC processes now facilitate MMICs that withstand elevated voltages and temperatures, enabling higher power-added efficiencies and greater output density for radar and high-capacity communication systems. These capabilities translate into systems that require fewer discrete components, thereby reducing board space and enhancing thermal management. Moreover, the maturation of SiGe and InP technologies is fostering hybrid integration of analog and digital functions, allowing for faster signal conversion and noise suppression vital to emerging aerospace and satellite payload designs.

Moreover, the convergence of miniaturization trends and multifunction integration is prompting the introduction of metamorphic HEMT architectures that coalesce switching, amplification, and phase-shifting functions on a single MMIC. By embedding passive components and digital control elements within the same process flow, manufacturers are charting a path towards system-on-chip solutions that align with the compact form factors demanded by next-generation unmanned aerial vehicles and portable defense communication nodes.

Assessing the Cumulative Impact of 2025 United States Tariffs on Monolithic Microwave IC Supply Chains Pricing and Strategic Sourcing Decisions

In 2025, the United States increased tariffs on semiconductor imports from 25 percent to 50 percent, a policy move intended to bolster domestic manufacturing through the CHIPS Act but which also reverberated across specialized markets such as monolithic microwave integrated circuits. These tariffs encompass raw semiconductor substrates and packaged IC components, including gallium arsenide and gallium nitride wafers that are critical to MMIC production. As a result, raw material costs for GaN and InP substrates rose significantly, compelling MMIC suppliers to reassess cost structures and pricing strategies.

The heightened duty rates exacerbated existing supply chain vulnerabilities. Many MMIC assembly and test operations are concentrated in Asia-Pacific regions that rely on Chinese-sourced substrates, creating a cascading effect of increased logistics expenses and lead time variability. End users in telecommunications and consumer electronics have encountered elevated procurement costs, while defense contractors have urged regulatory carve-outs to preserve the continuity of secure communications and radar programs. Economists warn that sustained high tariffs could undermine U.S. economic growth by dampening competitiveness and inflating prices for a broad spectrum of downstream industries reliant on semiconductors.

In response, industry participants have pursued several strategic adaptations. First, supply chain diversification initiatives are underway to identify alternative substrate suppliers in Japan, South Korea, and Europe. Second, companies are accelerating domestic capacity expansion by leveraging CHIPS Act incentives and Department of Defense-funded development programs to establish trusted foundry processes for GaN MMICs. Finally, design innovations aimed at enhancing per-wafer yield and increasing integration density are helping offset tariff-induced cost pressures through improved manufacturing economics and reduced part counts per system.

Uncovering Core Segmentation Insights Revealing Component Material Technology Frequency Band and End User Dynamics in Microwave IC Markets

A granular examination of the MMIC market reveals distinct dynamics across component, material, technology, frequency band, and end-user dimensions. Within the component domain, power amplifiers continue to account for the largest volume due to their central role in signal transmission for 5G infrastructure, satellite uplinks, and radar systems. Yet attenuators and phase shifters are experiencing accelerated demand as beamforming and phased array designs become essential for high-resolution imaging and dynamic spectrum management in both defense and commercial applications. Mixer circuits and transceiver modules have likewise grown in prominence, reflecting the trend toward integrated front-end solutions that combine receive and transmit paths in a single footprint.

Material segmentation further underscores the ascendancy of gallium nitride, which now leads in high-power, high-frequency implementations, especially where thermal resilience is critical. Gallium arsenide retains a vital niche for low-noise amplifiers in receiver chains, while silicon germanium is increasingly leveraged for cost-sensitive consumer devices that require moderate RF performance. Indium phosphide’s unique electron mobility makes it the choice for ultra-low noise and high-frequency applications such as millimeter-wave satellite links and electronic warfare modules.

From a technology standpoint, high electron mobility transistors based on GaN structures dominate for wideband power applications, whereas heterojunction bipolar transistors maintain strong relevance for medium-power, low-gain stages. Metamorphic HEMTs are emerging as versatile platforms for multifunction integration, combining high-frequency switching, amplification, and control logic. Metal-semiconductor field-effect transistors fill targeted roles in cost-optimized signal routing and switching arrays.

Frequency band segmentation highlights continued investments in C-band for 5G and Ku-band for satellite broadband, with L- and S-bands serving terrestrial radar and telemetry functions. X-band remains indispensable for naval and ground-based radar, whereas emerging K- and Ka-band use cases in automotive radar and high-capacity backhaul promise new growth vectors. End-user analysis demonstrates that telecommunications networks remain the largest demand driver, followed by defense and aerospace, with consumer electronics and automotive radar applications contributing increasingly to overall market momentum.

This comprehensive research report categorizes the Monolithic Microwave IC market into clearly defined segments, providing a detailed analysis of emerging trends and precise revenue forecasts to support strategic decision-making.

- Component

- Material

- Technology

- Frequency Band

- End User

Examining Regional Dynamics Across Americas Europe Middle East Africa and Asia-Pacific to Decode Varied Growth Patterns in Microwave IC Demand

Regional market dynamics exhibit clear contrasts shaped by industrial policies, infrastructure investments, and technology priorities. The Americas region benefits from robust defense procurement budgets and ambitious 5G network deployments, underpinned by government incentives such as the CHIPS Act that accelerate domestic MMIC fabrication capacity. In North America, a confluence of private investment and public-sector funding is fostering the establishment of trusted foundries and advanced packaging facilities to reduce dependency on foreign supply chains.

In Europe, Middle East & Africa, national initiatives to advance indigenous semiconductor ecosystems are gaining traction, with coordinated programs in Germany, France, and the Middle East emphasizing local chip production and strategic collaborations. These programs not only aim to secure supply for aerospace and defense applications but also address civilian telecommunications and industrial IoT requirements. Collaborative research centers and cross-border partnerships are accelerating the transfer of GaN and SiGe MMIC technologies into regional manufacturing pipelines.

Asia-Pacific remains the largest regional market, driven by leading semiconductor producers in China, South Korea, Taiwan, and Japan. These countries are investing heavily in next-generation wireless infrastructure, satellite communications, and automotive electronics, creating a formidable ecosystem for MMIC development and adoption. Governments across the region are also providing incentives for domestic research on wide-bandgap semiconductors and supporting high-volume wafer fabrication plants, reinforcing Asia-Pacific’s pivotal role in the global MMIC supply chain.

This comprehensive research report examines key regions that drive the evolution of the Monolithic Microwave IC market, offering deep insights into regional trends, growth factors, and industry developments that are influencing market performance.

- Americas

- Europe, Middle East & Africa

- Asia-Pacific

Profiling Leading Monolithic Microwave IC Innovators Highlighting Competitive Strategies Partnerships and Technological Differentiators

Several leading companies are defining the competitive landscape of the MMIC market through differentiated technology portfolios, strategic partnerships, and targeted investments. Qorvo has expanded its GaN-on-SiC amplifier offerings, as evidenced by its QPA1314 13.75–14.5 GHz Satcom amplifier, which achieves 30 percent power-added efficiency and 20 W linear output through a mature 0.15 µm GaN process. Additionally, Qorvo’s acquisition of Anokiwave has bolstered its active electronically scanned array capabilities, enabling highly integrated beamformer ICs tailored for 5G massive MIMO and phased array radar systems.

MACOM has been selected to lead a Department of Defense–funded GaN-on-SiC process development project under the CHIPS Act, positioning it at the forefront of domestic MMIC production for defense and telecom applications. The company’s showcase at IMS 2025 highlighted a range of GaN and GaAs solutions, including X-band front-end modules and Ka-band power amplifiers, underscoring its deep foundry expertise and end-to-end design support services.

Skyworks Solutions and Analog Devices continue to strengthen their RF front-end product lines through strategic acquisitions and alliance formations, focusing on multichip modules that integrate filters, switches, and amplifiers. NXP Semiconductors and Infineon have also made inroads into MMICs by aligning with automotive radar standardization efforts and developing high-reliability HEMT devices tailored for advanced driver assistance systems. Collectively, these firms are navigating the tariff environment, leveraging R&D centers and foundry collaborations to maintain technology leadership and supply-chain resilience.

This comprehensive research report delivers an in-depth overview of the principal market players in the Monolithic Microwave IC market, evaluating their market share, strategic initiatives, and competitive positioning to illuminate the factors shaping the competitive landscape.

- Analog Devices, Inc.

- Infineon Technologies AG

- MACOM Technology Solutions Inc.

- MicroWave Technology, Inc.

- Mini-Circuits by Scientific Components Corporation

- Northrop Grumman Corporation

- NXP Semiconductors N.V.

- Qorvo Inc.

- Semiconductor Components Industries, LLC

- Skyworks Solutions, Inc.

- Texas Instruments Incorporated

- Toshiba Corporation

- United Monolithic Semiconductors Group

- VECTRAWAVE S.A.

- WIN Semiconductors Corp.

- Wolfspeed, Inc.

Actionable Recommendations to Empower Industry Leaders in Monolithic Microwave IC Space Through Strategic Innovation Vertical Integration and Diversification

Industry leaders should prioritize strategic investments in wide-bandgap materials and advanced transistor architectures to sustain performance advantages in high-frequency, high-power applications. By increasing R&D allocations for GaN and metamorphic HEMT process enhancements, organizations can achieve superior efficiency and reliability, mitigating the impact of elevated substrate costs. Furthermore, vertical integration of select design and assembly activities will enhance quality control and shorten time to market.

To navigate ongoing tariff pressures, companies must diversify their supply chains by qualifying multiple substrate and foundry partners across geographies. Engaging in public-private collaborations and leveraging government incentives under the CHIPS Act can facilitate nearshoring initiatives and establish trusted manufacturing lines, thereby reducing cost exposure and ensuring business continuity. Moreover, forging strategic alliances with material suppliers and equipment vendors will foster joint innovation roadmaps that align process capabilities with emerging system requirements.

Finally, enterprises should adopt a customer-centric approach to solution development, combining software-enabled calibration and digital predistortion techniques with modular hardware platforms. This will enable rapid customization for defense, telecommunications, and automotive applications. By integrating field programmable elements and diagnostic telemetry within MMIC designs, companies can deliver adaptive performance, predictive maintenance features, and enhanced system-level diagnostics that meet the exacting needs of next-generation network operators and mission-critical end users.

Robust Research Methodology Combining Primary Interviews Secondary Data Analysis and Rigorous Quality Control to Ensure Insight Integrity

This research incorporates a robust methodology combining primary and secondary data collection to ensure comprehensive and reliable insights. Primary research involved in-depth discussions with MMIC design engineers, foundry operations managers, and procurement executives from leading semiconductor firms. Expert interviews were complemented by structured surveys targeting end users in telecommunications, aerospace, automotive radar, and defense procurement agencies.

Secondary research comprised a thorough review of publicly available technical literature, company press releases, and government policy documents related to semiconductor tariffs and the CHIPS Act. Proprietary databases and industry conference proceedings were analyzed to validate technological adoption trends and track product roadmaps. All quantitative inputs were triangulated across multiple data sources to confirm consistency and minimize bias.

Quality control measures included cross-verification of interviewer transcripts, expert panel reviews of draft findings, and iterative refinements based on stakeholder feedback. This multi-layered approach ensures that the conclusions and recommendations presented herein are grounded in current market realities and technological trajectories while maintaining analytical rigor and transparency.

This section provides a structured overview of the report, outlining key chapters and topics covered for easy reference in our Monolithic Microwave IC market comprehensive research report.

- Preface

- Research Methodology

- Executive Summary

- Market Overview

- Market Insights

- Cumulative Impact of United States Tariffs 2025

- Cumulative Impact of Artificial Intelligence 2025

- Monolithic Microwave IC Market, by Component

- Monolithic Microwave IC Market, by Material

- Monolithic Microwave IC Market, by Technology

- Monolithic Microwave IC Market, by Frequency Band

- Monolithic Microwave IC Market, by End User

- Monolithic Microwave IC Market, by Region

- Monolithic Microwave IC Market, by Group

- Monolithic Microwave IC Market, by Country

- United States Monolithic Microwave IC Market

- China Monolithic Microwave IC Market

- Competitive Landscape

- List of Figures [Total: 17]

- List of Tables [Total: 954 ]

Concluding Perspectives on the Future Trajectory of Monolithic Microwave Integrated Circuits Emphasizing Innovation Agility and Market Resilience

The monolithic microwave IC market stands at a pivotal juncture, shaped by transformative shifts in materials, technologies, and geopolitical factors. The convergence of GaN ascendancy, high-frequency network rollouts, and evolving defense requirements underscores the imperative for agility and innovation. Firms that capitalize on advanced transistor architectures and integrated system solutions will be best positioned to address the diverse demands of telecommunications, automotive, and aerospace sectors.

Meanwhile, tariff-induced cost pressures have accelerated strategic realignments of supply chains and reinvigorated domestic manufacturing initiatives. Companies that proactively diversify sourcing, leverage public-sector incentives, and enhance per-wafer yields through process improvements will emerge more resilient in the face of global trade uncertainties. Ultimately, sustained competitive advantage will arise from the seamless integration of hardware, software, and services within MMIC platforms, delivering adaptive performance and system-level intelligence.

By embracing collaborative innovation models, fostering strategic partnerships across the value chain, and aligning roadmaps with emerging 6G and autonomous system requirements, industry participants can chart a path toward sustained growth. This collective pursuit of technological excellence and operational resilience will define the future trajectory of monolithic microwave ICs, ensuring they remain indispensable enablers of next-generation communication and sensing ecosystems.

Engage with Ketan Rohom Associate Director Sales Marketing to Acquire Your Comprehensive Monolithic Microwave IC Market Research Report Today

To explore this comprehensive analysis in depth and secure your own copy of the Monolithic Microwave IC Market Research Report, reach out directly to Ketan Rohom, Associate Director of Sales & Marketing. Ketan will guide you through the report’s extensive insights, tailored data, and strategic perspectives to empower your decision-making. Engage now to leverage expert research, actionable intelligence, and exclusive market intelligence, ensuring your organization stays ahead in the rapidly evolving monolithic microwave IC landscape. Your next-generation growth opportunities begin with a conversation-contact Ketan today to purchase the definitive market report.

- How big is the Monolithic Microwave IC Market?

- What is the Monolithic Microwave IC Market growth?

- When do I get the report?

- In what format does this report get delivered to me?

- How long has 360iResearch been around?

- What if I have a question about your reports?

- Can I share this report with my team?

- Can I use your research in my presentation?