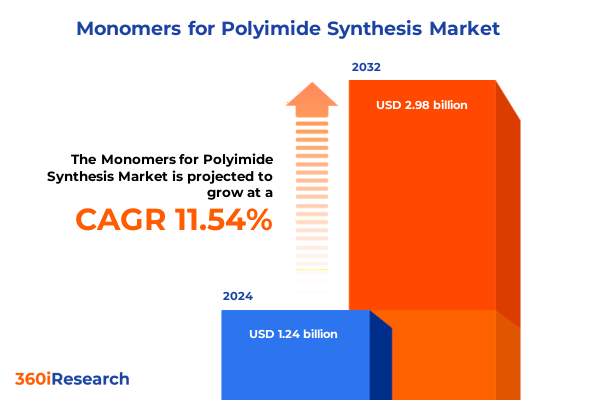

The Monomers for Polyimide Synthesis Market size was estimated at USD 1.35 billion in 2025 and expected to reach USD 1.52 billion in 2026, at a CAGR of 11.90% to reach USD 2.98 billion by 2032.

Discovering the Critical Role of Diamine and Dianhydride Monomers in Shaping High-Performance Polyimide Materials Across Diverse Industries

Polyimide chemistry stands at the forefront of advanced materials science, with monomers such as diamines and dianhydrides forming the foundational pillars. These high-performance polymers derive their exceptional thermal and mechanical properties through the precise condensation of specific monomer combinations, an approach that has evolved since the pioneering work of DuPont in the 1950s. Understanding the molecular intricacies and synthesis pathways of these monomers is essential for scientists and engineers seeking to tailor polyimide properties for critical applications in aerospace, electronics, and automotive sectors. Consequently, an informed exploration of monomer behavior under various processing conditions lays the groundwork for innovations in film coatings, composite matrices, and flexible electronics.

Embracing Innovation and Sustainability: Bio-Based Feedstocks, Digitalization, and Advanced Manufacturing Transform the Polyimide Monomer Landscape

The polyimide monomer landscape has undergone a profound transformation, driven in part by sustainability imperatives and the maturation of Industry 4.0 technologies. In the realm of green chemistry, researchers are synthesizing diamine monomers from renewable feedstocks such as cashew nut shell liquid and citric acid, achieving bio-based triphenylamine variants that retain thermal robustness and film-forming excellence. Simultaneously, the industry has embraced digitalization, integrating real-time IoT monitoring, predictive maintenance, and advanced analytics across chemical plants to optimize reaction yields, reduce variability, and accelerate scale-up processes.

These combined shifts have not only enhanced process reliability but also opened avenues for mass customization and closed-loop manufacturing. By deploying digital twins and AI-driven quality controls, companies can simulate novel imidization pathways and identify optimal reaction conditions before committing resources to pilot runs. This synergy between sustainable monomer chemistry and digital operational excellence marks a new era in polyimide synthesis, fostering faster innovation cycles and reinforcing supply chain resilience.

Navigating the Complex Impact of U.S. Tariff Policies on Monomer Supply Chains and Competitive Dynamics in Polyimide Synthesis

Recent U.S. trade policy adjustments have introduced critical considerations for polyimide monomer supply chains. The continuation of Section 301 tariffs on chemical imports from China has been upheld by a U.S. appeals court, maintaining duties on commodity chemicals and plastics and placing 2025 IEEPA-related tariffs into effect while litigation proceeds. Additionally, the U.S. Trade Representative increased rates on polysilicon and certain chemical intermediates under Section 301, with new duties reaching 50 percent on January 1, 2025 for targeted product categories. These measures have elevated raw material costs and introduced complexity into sourcing strategies.

As a result, leading manufacturers are accelerating efforts to diversify procurement, shifting volumes to non-Chinese suppliers in South Korea, Japan, and Europe, and exploring domestic production expansions. Concurrently, stakeholders are engaging with policymakers to secure exclusion requests and ensure continuity of specialized monomer flows. Together, these responses reflect a dynamic adaptation to evolving tariff frameworks, underscoring the importance of agile supply chain models in safeguarding polyimide production and maintaining downstream manufacturing competitiveness.

Leveraging Monomer Types, Application Needs, Physical Forms, and Imidization Technologies to Unlock Comprehensive Segmentation Insights

In dissecting the market through the lens of monomer type, the segmentation spans diamines and dianhydrides, each branching into aliphatic and aromatic variants. Aliphatic diamines like hexamethylene diamine confer flexibility, while aromatic counterparts such as m-phenylenediamine and p-phenylenediamine impart superior thermal stability and mechanical strength. On the dianhydride side, an aliphatic subset offers enhanced toughness, whereas aromatic dianhydrides deliver exceptional heat resistance. From this foundational perspective, applications further refine the picture: insulation coatings and structural components in aerospace and defense demand high-temperature endurance, whereas electronic packaging, including CPU substrates and flexible PCBs, necessitate low dielectric constants and precise dimensional control.

Considering the physical form factor, liquid monomer options support solution processing for fine patterning in microelectronics, while solid powders cater to high-purity, solvent-free production routes. Finally, the imidization technology-whether chemical or thermal-impacts cycle times, solvent usage, and film uniformity, enabling manufacturers to align process selection with product requirements. Together, these segmentation dimensions illustrate a market defined not only by chemical diversity but also by tailored application and production strategies.

This comprehensive research report categorizes the Monomers for Polyimide Synthesis market into clearly defined segments, providing a detailed analysis of emerging trends and precise revenue forecasts to support strategic decision-making.

- Monomer Type

- Form

- Technology

- Application

Uncovering Regional Dynamics: How Americas, EMEA, and Asia-Pacific Regions Drive Innovation and Growth in Polyimide Monomer Markets

The Americas region remains at the nexus of innovation and production for polyimide monomers, with significant R&D hubs in the United States driving development of next-generation diamine and dianhydride feedstocks. North America’s emphasis on nearshoring has catalyzed new domestic capacity expansions and fortified collaborations between chemical producers and OEMs. In Latin America, smaller specialty producers are forming alliances to service regional electronics manufacturers, positioning the Americas as both a testing ground for sustainable practices and a growing end-market demand center.

In Europe, Middle East & Africa, stringent REACH regulations and energy cost volatility shape the monomer landscape. European producers have invested heavily in renewable energy integration and the substitution of substances of very high concern, adapting ingredient portfolios to meet evolving compliance thresholds. Meanwhile, Middle Eastern feedstock refiners leverage abundant hydrocarbon resources to develop high-purity dianhydride intermediates, exporting to global polyimide manufacturers. African markets, though nascent, are exploring strategic partnerships to introduce localized production of high-performance monomers, targeting infrastructure and defense applications.

Asia-Pacific leads in manufacturing scale, with China, Japan, and South Korea operating expansive facilities for both traditional and bio-based monomers. Japanese and Korean suppliers focus on ultra-high-purity products for semiconductor packaging, while Chinese producers drive cost-competitive volumes, often integrating downstream imidization processes. Across the region, government support for advanced electronics and aerospace sectors underpins continued capacity growth and technology commercialization efforts.

This comprehensive research report examines key regions that drive the evolution of the Monomers for Polyimide Synthesis market, offering deep insights into regional trends, growth factors, and industry developments that are influencing market performance.

- Americas

- Europe, Middle East & Africa

- Asia-Pacific

Profiling Key Industry Players and Their Strategic Initiatives Driving Innovation and Competitive Advantage in Polyimide Monomer Production

Industry leaders are rapidly advancing monomer innovation through strategic investments, partnerships, and capacity expansions. Evonik Industries, for instance, distinguishes itself with vertically integrated production from monomer synthesis to specialty formulations, pioneering bio-based imide chemistries and additive manufacturing powders for high-temperature insulation. DuPont retains its technology leadership by enhancing ultra-high-purity Kapton® films and Vespel® components, extending applications from aerospace satellites to next-generation semiconductor packaging. Toray Industries combines carbon fiber composites with polyimide expertise, delivering lightweight structural adhesives and space-grade liners for aerospace missions.

Kaneka Corporation and Ube Industries have intensified R&D on colorless, transparent polyimide films and automotive-grade foams, capitalizing on growing demand for foldable displays and under-hood components. Meanwhile, strategic joint ventures such as HD MicroSystems blend DuPont and Hitachi capabilities to drive sub-5 μm patterning technologies for advanced microelectronics. Across this competitive landscape, leading players differentiate through sustainability initiatives, digital factory deployments, and targeted collaborations with device manufacturers, ensuring agile responses to evolving performance specifications.

This comprehensive research report delivers an in-depth overview of the principal market players in the Monomers for Polyimide Synthesis market, evaluating their market share, strategic initiatives, and competitive positioning to illuminate the factors shaping the competitive landscape.

- Asahi Kasei Corporation

- E.I. du Pont de Nemours and Company

- Evonik Industries AG

- HiPolyking Corporation

- Honghu Shuangma New Material Technology Co., Ltd.

- Jiangsu Ever Galaxy Chemical Co., Ltd.

- Kaneka Corporation

- Kolon Industries, Inc.

- LHD Group Deutschland

- Mitsubishi Gas Chemical Company, Inc.

- Mitsui Chemicals, Inc.

- Qinyang Tianyi Chemical Co., Ltd.

- Shanghai Guchuang New Chemical Materials Co., Ltd.

- Shifeng Technology Co., Ltd.

- Showa Denko K.K.

- SKC Kolon PI Co., Ltd.

- Solvay S.A.

- Toray Industries, Inc.

- UBE Industries, Ltd.

- Yantai Xianhua Technology Group

Strategic Roadmap for Industry Leaders to Enhance Resilience, Adoption of Green Chemistry, and Supply Chain Diversification in Polyimide Monomer Markets

Industry leaders looking to fortify their positions in polyimide monomers should prioritize a multifaceted strategy that integrates supply chain diversification, green chemistry, and digital frameworks. First, establishing dual-source agreements across geographic regions can mitigate tariff-induced disruptions and capacity bottlenecks, while also leveraging nearshore and onshore production partnerships. Next, accelerating investment in bio-sourced diamines and dianhydrides not only addresses sustainability mandates but also opens registration pathways in regulated markets such as the European Union.

Adopting advanced digital tools, including digital twins for reaction simulation and AI-based predictive maintenance, can sharpen operational efficiencies and reduce scale-up risks. Concurrently, proactive engagement with regulatory bodies to negotiate tariff exclusions and secure favorable classification under trade programs will safeguard monomer flows. Finally, nurturing collaborative innovation ecosystems-with academic institutions, pilot plant consortia, and end-use customers-will accelerate commercialization of high-value, specialized monomers tailored to emerging applications, from electric vehicle insulation to flexible electronics.

Detailing a Robust, Multiphase Research Framework Integrating Qualitative Expertise and Quantitative Data for Comprehensive Monomer Market Analysis

The research underpinning this analysis employed a rigorous, multiphase methodology blending primary and secondary data collection. Secondary research included detailed reviews of scientific literature, patent filings, and regulatory publications to map monomer chemistries and process technologies, ensuring alignment with the latest academic and industry developments. Complementing this, primary interviews were conducted with polymer scientists, supply chain experts, and procurement leads across key regions, providing frontline insights into operational challenges and strategic priorities.

Quantitative datasets were sourced from customs databases, industry associations, and corporate disclosures to validate trade flows and capacity metrics. These figures were cross-referenced with proprietary capacity utilization models. To ensure objectivity, findings were triangulated through expert panel reviews, integrating perspectives from material science academics, process engineers, and end-use market specialists. Throughout the process, data integrity protocols, including anomaly detection and peer verification, were applied to maintain the highest standards of accuracy and transparency.

This section provides a structured overview of the report, outlining key chapters and topics covered for easy reference in our Monomers for Polyimide Synthesis market comprehensive research report.

- Preface

- Research Methodology

- Executive Summary

- Market Overview

- Market Insights

- Cumulative Impact of United States Tariffs 2025

- Cumulative Impact of Artificial Intelligence 2025

- Monomers for Polyimide Synthesis Market, by Monomer Type

- Monomers for Polyimide Synthesis Market, by Form

- Monomers for Polyimide Synthesis Market, by Technology

- Monomers for Polyimide Synthesis Market, by Application

- Monomers for Polyimide Synthesis Market, by Region

- Monomers for Polyimide Synthesis Market, by Group

- Monomers for Polyimide Synthesis Market, by Country

- United States Monomers for Polyimide Synthesis Market

- China Monomers for Polyimide Synthesis Market

- Competitive Landscape

- List of Figures [Total: 16]

- List of Tables [Total: 1749 ]

Synthesizing Core Insights and Forward-Looking Perspectives on Monomer Trends Shaping the Future of the Polyimide Industry

In summary, the monomer segment for polyimide synthesis is undergoing dynamic shifts driven by sustainability goals, digital transformation, and evolving trade regulations. Bio-based diamine and dianhydride pathways have transitioned from niche academic pursuits to commercially viable alternatives, supported by advances in green chemistry and renewable feedstock extraction. Meanwhile, digital innovations are redefining process optimization, enabling predictive insights and lean manufacturing across polyimide supply chains.

Concurrently, U.S. tariff measures have prompted strategic realignments in global sourcing and underscored the necessity of agile procurement models. Regional landscapes each exhibit distinct drivers: North America emphasizes domestic innovation, EMEA navigates regulatory compliance, and Asia-Pacific leverages scale for cost efficiency and R&D excellence. Leading companies are capitalizing on these trends through targeted investments and collaborative ecosystems. Looking ahead, stakeholders who masterfully integrate sustainability, digital capabilities, and regulatory engagement will be best positioned to capture emerging opportunities in high-performance polyimide applications.

Secure Your Competitive Edge Today by Engaging With Our Senior Sales Leader for Customized Polyimide Monomer Market Research and Insights

To explore in-depth market intelligence and strategic opportunities within the polyimide monomer landscape, reach out to Ketan Rohom, Associate Director of Sales & Marketing. Ketan brings extensive expertise in high-performance polymers and a deep understanding of emerging trends, enabling you to access tailored insights that drive innovation and competitive advantage. Engage directly with Ketan to discuss how this comprehensive report can inform your product development strategies, optimize your supply chain, and identify growth prospects in both traditional and bio-based monomer segments. Secure your copy today and empower your team with the actionable intelligence needed to navigate evolving regulations, technological advancements, and shifting global supply dynamics. Begin a conversation with Ketan to customize your research package and unlock the full potential of the polyimide monomer market.

- How big is the Monomers for Polyimide Synthesis Market?

- What is the Monomers for Polyimide Synthesis Market growth?

- When do I get the report?

- In what format does this report get delivered to me?

- How long has 360iResearch been around?

- What if I have a question about your reports?

- Can I share this report with my team?

- Can I use your research in my presentation?