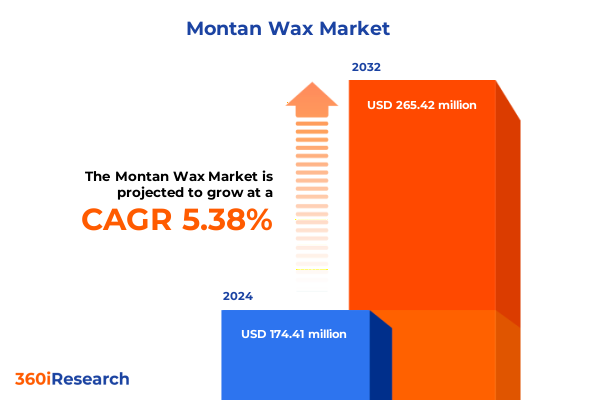

The Montan Wax Market size was estimated at USD 183.02 million in 2025 and expected to reach USD 192.36 million in 2026, at a CAGR of 5.45% to reach USD 265.42 million by 2032.

Delving into the Strategic Importance of Montan Wax in Advanced Applications and Identifying the Fundamental Market Drivers Shaping Industry Evolution

Montan wax occupies a pivotal position within advanced industrial applications, serving as an indispensable performance enhancer across disciplines such as coatings, adhesives, and electrical insulation. Its unique chemical profile, derived from lignite deposits, delivers unparalleled hardness, thermal stability, and compatibility with diverse polymer matrices. These attributes have elevated its prominence in sectors demanding high-performance additives and have driven continuous product innovation over recent decades.

Transitioning from traditional commodity status, Montan wax now underpins the development of next-generation materials engineered for stringent environmental and technical specifications. Advancements in modification techniques, including esterification and hydrogenation, have broadened its application horizon, while intensified sustainability imperatives are reshaping feedstock selection and processing pathways. As regulatory bodies worldwide introduce more rigorous purity and emissions standards, manufacturers are compelled to refine production methodologies and explore eco-conscious alternatives.

Consequently, market participants face a dual mandate: to harness the proven benefits of Montan wax in high-value formulations, and to align with evolving regulatory and sustainability benchmarks. This report introduces a holistic framework for evaluating the current industry ecosystem, highlighting the macroeconomic drivers, technological disruptions, and policy dynamics that collectively determine the trajectory of Montan wax demand and supply.

Unveiling Sustainability Imperatives and Digital Innovations That Are Reshaping the Montan Wax Value Chain and Customer Experience

The Montan wax sector is experiencing a paradigm shift driven by the convergence of sustainability imperatives, digital transformation, and evolving customer expectations. In recent years, producers have accelerated efforts to develop bio-based and recycled feedstocks, aiming to reduce carbon footprints and minimize environmental impact. This pivot is not merely a response to regulatory pressures but also reflects a growing demand for greener additives within end-use industries that prioritize circularity and lifecycle accountability.

Simultaneously, the rise of smart manufacturing has redefined production efficiency and quality assurance protocols. Advanced process controls, real-time analytics, and digital twins enable manufacturers to optimize yield, reduce waste, and ensure consistent product specifications. These technologies have also facilitated more agile response mechanisms to supply chain disruptions, allowing stakeholders to adapt swiftly to raw material shortages and shifting trade conditions.

Moreover, end-users are increasingly seeking tailored wax solutions that enhance performance without compromising ecological credentials. This demand has spurred collaborative innovation between wax producers, polymer formulators, and additive developers. As a result, the market landscape is evolving from a traditional supplier–buyer dynamic toward an integrated ecosystem where co-development and knowledge sharing drive competitive advantage.

Assessing the Complex Consequences of Recent United States Tariff Enhancements on Montan Wax Supply Chains and Cost Structures

In 2025, the United States implemented additional tariff layers on specialty wax imports, targeting several commodity codes under the broader wax and chemical additives regime. These measures were introduced as part of a comprehensive effort to protect domestic manufacturing and reduce import dependency on strategic raw materials. The cumulative effect has been a notable escalation in landed costs for key Montan wax variants, prompting supply chain stakeholders to re-evaluate sourcing strategies.

Importers reliant on traditional procurement pipelines have experienced margin compression as tariff-induced premiums erode cost advantages. Some manufacturers have responded by shifting purchases to tariff-exempt jurisdictions, while others have negotiated risk-sharing arrangements with domestic suppliers. This redirection has created competitive tensions between new entrants from emerging supply regions and established producers in North America and Europe.

Furthermore, the tariff environment has catalyzed investments in nearshoring and onshore production capacities. Several market leaders have announced plans to expand local refining and modification facilities, seeking to insulate operations from future trade volatility. Over time, these strategic moves are expected to recalibrate global trade flows and foster a more resilient Montan wax ecosystem, albeit at the cost of higher capital expenditures and extended project lead times.

Illuminating the Multifaceted Landscape of Montan Wax Applications and Performance by Type Form Grade Application and Industry

A granular examination of the Montan wax landscape across multiple segmentation criteria yields nuanced insights into usage patterns and performance differentiation. When evaluating the market by type, natural and modified varieties each showcase distinct strengths. Modified formulations, including esterified, hydrogenated and oxidized waxes, command interest for their superior thermal resistance and adhesion properties, whereas natural grades continue to satisfy applications prioritizing minimal processing.

Considering the importance of physical form, flakes remain the incumbent choice for high-purity industrial applications, while granules and powder formats are gaining traction due to streamlined handling, dosing accuracy and compatibility with automated feed systems. This evolution in form factors is reshaping supply chain logistics, reducing waste and facilitating just-in-time inventory management for end-users.

Grade distinctions also reveal critical performance considerations. Refined grades offer enhanced color and odor control that align with stringent quality specifications, whereas technical grades address less demanding applications where cost-effectiveness prevails. These differences underscore the importance of aligning grade selection with end-use requirements to optimize both functionality and total cost of ownership.

This complex segmentation extends into application domains, where Montan wax’s role in adhesives and coatings leads growth, supported by emerging uses in electrical insulation, foundry binders, printing inks, polishes and rubber processing. End-user industries such as automotive, construction, electronics, metal manufacturing, printing and rubber & plastics demonstrate varied demand trajectories, influenced by sector-specific performance criteria and regulatory landscapes. Distribution channels also play a pivotal role, as offline direct sales and distributor networks continue to serve established clients, while online platforms enable smaller players to access niche wax grades with greater agility.

This comprehensive research report categorizes the Montan Wax market into clearly defined segments, providing a detailed analysis of emerging trends and precise revenue forecasts to support strategic decision-making.

- Type

- Form

- Grade

- Application

- End User Industry

- Distribution Channel

Mapping Regional Demand Drivers and Regulatory Influences That Determine Distinct Trajectories for Montan Wax Use Across Global Markets

Regional dynamics exert significant influence on Montan wax consumption patterns, driven by differences in industrial maturity, regulatory frameworks and raw material endowments. Within the Americas, legacy markets in North America maintain robust demand for high-performance formulations used in automotive, aerospace and industrial coatings, whereas Latin American producers are focusing on building downstream processing capabilities to capture more value locally.

In Europe, Middle East & Africa, stringent environmental regulations and advanced manufacturing hubs in Western Europe have accelerated adoption of eco-optimized waxes, while emerging economies across Eastern Europe and the Gulf Cooperation Council are gradually expanding capacity to serve construction, packaging and electrical infrastructure projects. Regulatory alignment with the European Chemicals Agency’s REACH standards remains a critical factor shaping product development and market entry strategies.

Asia-Pacific continues to lead in volume terms, fueled by rapid industrialization, growing automotive production and extensive foundry operations. China’s dominance as both a Montan wax producer and consumer has prompted ongoing investments in capacity expansion, whereas India’s developing chemical processing sector is projected to drive incremental growth in demand for both natural and modified wax grades. Meanwhile, Southeast Asian economies are emerging as competitive players through strategic trade partnerships and targeted policy incentives for specialty chemicals.

This comprehensive research report examines key regions that drive the evolution of the Montan Wax market, offering deep insights into regional trends, growth factors, and industry developments that are influencing market performance.

- Americas

- Europe, Middle East & Africa

- Asia-Pacific

Examining How Leading Companies in the Montan Wax Sector Leverage Innovation Partnerships and Strategic Alliances to Drive Competitive Advantage

The competitive landscape of the Montan wax market is characterized by a blend of established players and specialized innovators. Leading chemical conglomerates differentiate their portfolios through advanced modification techniques and integrated value chain capabilities, leveraging proprietary technology platforms to deliver tailored wax solutions. These initiatives are complemented by mid-sized enterprises that focus on niche segments, offering highly refined grades or bespoke formulations to meet exacting performance specifications.

Strategic partnerships and joint ventures are increasingly prominent, enabling companies to access new geographies and diversify raw material sources. Several producers have forged alliances with lignite mining firms and downstream converters to secure feedstock supply and enhance sustainability credentials. Concurrently, targeted acquisitions of regional specialists are reshaping competitive dynamics, as global players seek to consolidate market share and streamline distribution networks.

Innovation remains a cornerstone of differentiation, with research and development initiatives prioritizing bio-based feedstocks, improved process yield and multifunctional additive performance. Through these efforts, key companies are positioning themselves to address evolving regulatory mandates, customer-driven sustainability goals and the technical demands of emerging end-use applications.

This comprehensive research report delivers an in-depth overview of the principal market players in the Montan Wax market, evaluating their market share, strategic initiatives, and competitive positioning to illuminate the factors shaping the competitive landscape.

- Carmel Industries

- Clariant Ltd.

- Dhariwal Corp Limited

- Excel International

- First Source Worldwide LLC

- LUMITOS AG

- Mayur Dyes & Chemicals Corporation

- Nanjing Tianshi New Material Technologies Co., Ltd.

- Poth Hille & Co Ltd.

- ROMONTA GmbH

- S. KATO & CO.

- Stevenson Seeley Inc.

- TER HELL & Co. GmbH

- VÖLPKER SPEZIALPRODUKTE GMBH

- Yunphos (Xundian) phosphorus & Electricity Co., Ltd.

Strategic Pathways for Enhancing Supply Chain Resilience and Driving Product Innovation Amidst Regulatory and Market Pressures

Industry leaders must adopt proactive strategies to navigate the intersecting challenges of regulatory change, tariff-induced cost pressures and shifting customer expectations. First, enhancing supply chain resilience through diversified sourcing is imperative; by establishing relationships with alternative feedstock suppliers and pursuing nearshore processing opportunities, organizations can mitigate disruption risks and stabilize input costs.

Additionally, investing in advanced manufacturing technologies will enable producers to optimize resource utilization, reduce environmental impact and maintain product consistency. Embracing digital tools such as real-time analytics, predictive maintenance and process simulation can further improve operational agility and support continuous improvement initiatives.

In parallel, developing value-added, performance-oriented wax formulations that align with sustainability benchmarks will differentiate offerings in competitive tender processes. Collaborating closely with end-use customers to co-create solutions will reinforce customer loyalty and unlock premium pricing potential. Finally, engaging with policymakers to shape pragmatic regulatory frameworks can help balance environmental objectives with industrial competitiveness, ensuring that Montan wax continues to fulfill critical application needs.

Applying a Multi-Source Research Framework Combining Expert Interviews Empirical Data Analysis and Scenario Testing to Ensure Holistic Market Insights

This study employs a rigorous research methodology that integrates primary and secondary data streams to construct a reliable and balanced view of the Montan wax market. The primary research component encompasses in-depth interviews with C-level executives, product development specialists and procurement leaders within key end-user industries. These engagements provide qualitative insights into application-specific requirements, sourcing challenges and innovation priorities.

Complementing this, secondary research includes a structured review of publicly available regulatory filings, patent databases, trade association reports and industry journals. Data triangulation techniques are applied throughout to reconcile discrepancies and validate trends across multiple sources. Quantitative analysis leverages shipment data, customs statistics and capacity utilization figures to contextualize qualitative findings and ensure empirical robustness.

Finally, expert workshops with technical consultants and sustainability advisors are convened to stress-test emerging scenarios, exploring the implications of policy shifts, technology breakthroughs and supply chain evolutions. This comprehensive approach ensures that the report delivers actionable insights grounded in both empirical evidence and strategic foresight.

This section provides a structured overview of the report, outlining key chapters and topics covered for easy reference in our Montan Wax market comprehensive research report.

- Preface

- Research Methodology

- Executive Summary

- Market Overview

- Market Insights

- Cumulative Impact of United States Tariffs 2025

- Cumulative Impact of Artificial Intelligence 2025

- Montan Wax Market, by Type

- Montan Wax Market, by Form

- Montan Wax Market, by Grade

- Montan Wax Market, by Application

- Montan Wax Market, by End User Industry

- Montan Wax Market, by Distribution Channel

- Montan Wax Market, by Region

- Montan Wax Market, by Group

- Montan Wax Market, by Country

- United States Montan Wax Market

- China Montan Wax Market

- Competitive Landscape

- List of Figures [Total: 18]

- List of Tables [Total: 1431 ]

Synthesizing Critical Insights on Montan Wax Dynamics to Illuminate Strategic Imperatives for Future-Proofing Business Models and Growth

The Montan wax market stands at an inflection point, where the interplay of technological innovation, regulatory evolution and trade policy shifts is redefining competitive dynamics. Stakeholders must balance the enduring performance benefits of traditional wax formulations with the imperative for sustainable, future-ready alternatives. Navigating the complexities of tariff structures and supply chain realignment will require strategic foresight, operational agility and collaborative partnerships across the value chain.

By understanding nuanced segmentation patterns, regional demand drivers and the competitive positioning of leading companies, decision makers can identify high-potential opportunities and mitigate exposure to adverse market developments. Embracing advanced manufacturing and digitalization, while maintaining a steadfast commitment to regulatory compliance and environmental stewardship, will be critical to capturing long-term value.

As the market continues to evolve, organizations that proactively adapt their sourcing strategies, invest in product innovation and engage constructively with policy stakeholders will be best positioned to thrive. This executive summary offers a roadmap for navigating the next phase of Montan wax industry transformation and underscores the importance of strategic action to harness emerging opportunities.

Empower Strategic Growth by Connecting with Ketan Rohom for Exclusive Montan Wax Market Intelligence and Bespoke Analytical Support

Engaging with the nuanced layers of market intelligence is essential for securing a competitive edge and driving strategic initiatives. To gain a comprehensive understanding of the evolving Montan wax landscape and capitalize on emerging opportunities, we invite decision makers to access the full in-depth market research report. By collaborating with Ketan Rohom, Associate Director of Sales & Marketing, you will receive tailored insights, customized data packages, and ongoing support to navigate complex regulatory frameworks, supply chain challenges, and innovation pathways. Reach out directly to Ketan Rohom to discuss licensing options, exclusive data access, and bespoke consulting services that align with your organization’s growth objectives. Empower your leadership team with actionable intelligence that transforms uncertainty into strategic advantage and accelerates value creation across the entire Montan wax value chain.

- How big is the Montan Wax Market?

- What is the Montan Wax Market growth?

- When do I get the report?

- In what format does this report get delivered to me?

- How long has 360iResearch been around?

- What if I have a question about your reports?

- Can I share this report with my team?

- Can I use your research in my presentation?